How difficult can it be to sign a check? The good news is that it’s easy. However, it’s entirely a different ballgame when it comes to ensuring that the check is properly endorsed (with the signature), especially during a mobile deposit. Why is that? Well, for starters it reduces any delays in money transfers to your small business’s mobile bank account and protects you from fraud.

More often than not, handling checks is the same as physically holding their cash equivalent (with a few more details). This is because when you sign over a check to the bank, you’re literally authorizing them to turn that check into cash. Eventually, you get the equivalent, either by hand or as a deposit into your bank account.

For the most part, endorsing a check with your signature is a security precaution. It assists the bank in verifying the correct recipient and completing the transaction. The ensuing paragraphs contain basic information you should know about endorsing a check for a mobile deposit and the new rules that apply in this process.

Basic Guidelines for Endorsing a Check

While endorsing a check appears to be a simple process, there are a few things to keep in mind before signing it. Here are some short pointers:

Double-check your signature

During endorsements, it’s important to double-check if the name on the front of the check matches the name you sign on the back. So if the check is made payable to “Ms. Harret,” but the name is spelled correctly as “Ms. Harriet,” sign the back of the check with the incorrect spelling first, then the correct spelling below.

Look for the “Endorse Here” section

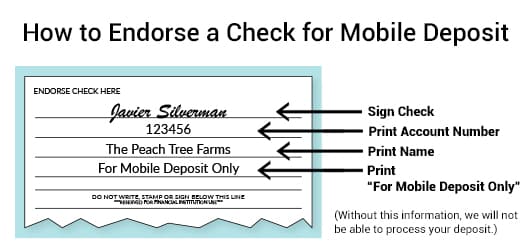

The endorsement area is often a 1.5-inch line on the back of the check that is followed by a notice that reads “Endorse Here” or “Endorse Check Here.” Make every effort to keep your signature on the line and other relevant details which must be in the endorsement area while endorsing a check for mobile deposit.

Understand the bank’s policies

Depending on the financial institution, procedures for endorsing a check often differ. Knowing your bank’s precise guidelines will help you ensure that you are correctly endorsing the check.

How to Endorse a Check For Mobile Deposit (Tips)

Depositing a check is easy and straightforward with today’s technology. Mobile deposits are simpler than ever before with tons of mobile digital banks in our present day. Although for different mobile digital banks, the procedures differ. Below, however, are generic pointers to make endorsing checks for mobile deposits go as smoothly as possible.

Wait to sign/endorse the check

It’s important to hold off on endorsing the check until you’re ready to deposit it for security reasons. When a check is endorsed, it becomes negotiable, meaning it can be cashed or deposited by anybody, even though they are not the payee.

Include the phrase “For Mobile Deposit Only”

It is recommended that you include the term “for mobile deposit only” in the endorsement field if you are endorsing a check for a mobile deposit. Some banks (like Bank of America) insist on it, and checks without it will be returned with a message that says “deposit was rejected due to restrictive endorsement.”

Ensure you Double-check it

When done correctly, using a mobile app to deposit a check makes the process faster and simpler. However, a faulty endorsement can result in complications or even fraud. So, ensure that there are no mistakes by double-checking.

Follow instructions

When depositing a check with a mobile device, make sure you strictly adhere to instructions from the app. Although these are usually straightforward, applications are constantly evolving and improving which gives room for little changes here and there.

For most mobile digital banking apps, all you need to do is take a simple photo of both the front and back of it. Your pending deposit will appear in your account right away!

Types of Endorsements

There are three different forms of endorsements, each with its own set of rules for depositing the check. It’s crucial to know which type of endorsement to use on the back of a check before signing it to ensure you’ve included all of the necessary details.

Blank Endorsements

When the back of a check is signed without any additional conditions, it is called a blank endorsement. Basically, anyone (even if their names are not written on the check) can deposit a blank endorsement check. This approach is better used when the check will be deposited immediately, such as when using a mobile banking app.

Endorsement with Restrictions

A restrictive endorsement guarantees that a check is deposited into a particular account. This includes adding a limitation to the endorsement area, such as “for deposit only” or “for mobile deposit only”. Consequently, it reduces the chances of money being stolen if the check is lost. In fact, some financial institutions now demand that this information be written on checks before they come in.

Special Endorsement

A payee can only make a check payable to someone else with a “special” endorsement. Ms. Harriet, for example, might make the check payable to Mr. John by writing “Pay to the order of Mr. John” in the endorsement section on the back of the check. Because of the possibility of forgery associated with special endorsement, banks are encouraged not to cash these checks unless the payee is present. However, when you deposit a special endorsement check using a mobile banking app, the bank is able to verify the payment and secure your account from fraud.

Who Signs a Check?

It can be difficult to determine who should sign the back of the check in certain situations. However, just like every other check, the person who receives the check must also endorse it.

Endorsing a Check on behalf of a Group of People

It’s crucial to look for the words “and” or “or” in the pay-to line on the front of a check that’s written to multiple people when endorsing it. Both parties must sign the check if it is made out to “Ms. and Mr. John.” If the check is made payable to “Ms. or Mr. John,” any party may sign it. When endorsing the back of a check, the signature must fit the spelling on the front of the check on the pay-to side, much like it does when endorsing a check written to one individual.

If the check was written out to you, but you’d like to sign it over to someone else, you can also do so. However, handing over a check to someone has its own set of rules that you should learn about.

Endorsing a Commercial Check

Endorsing a check written out to your small company differs just marginally from endorsing a check written out to you. When a check is made payable to your company, the name of your company should be endorsed on the back of the check. Your name, location, and any additional restrictions should all be included when endorsing a business check for a mobile deposit.

Endorsing a Check for Someone Else’s Benefit

The phrase “for the benefit of another” (FBO) is used in the payee line of a check made out to an agency or custodian. The first payee must sign and approve the check. If the pay-to line reads “Ms. Brenda FBO Mr. John,” it means, Ms. Brenda will be the first to endorse the check back, followed by Mr. John.

Other Things to Keep in Mind

If the notion of mobile check deposits appeals to you, the following are other variables that come with it.

#1. Your Bank May Impose a Deposit Limit

Banks will usually set a restriction on the amount of money you can deposit using your mobile phone. These can be daily or monthly limits, depending on the bank. Your bank will determine the limit, or maximum amount, that you are permitted to deposit for a certain time period. This figure could be anywhere from a few thousand dollars to well over $100,000.

The justification behind these deposit limits is explained by Urjit Patel, executive vice president of consumer banking at Axiom Bank:

“Mobile check deposit limits are designed to prevent the danger of counterfeit checks being placed.” If you need to deposit checks that are larger than your bank’s predetermined restrictions, you can do so at a branch or at an ATM.”

#2. Even if You Obtain a Confirmation, Your Bank May Return a Deposit

The fact that you deposited a check using your smartphone does not guarantee that the check will not bounce.

“A bank can return a check deposited using a mobile app in the same way it can return a check deposited in a branch,” Ben Premo, founder of True Fees, explains. “It usually occurs when the person sending the check does not have sufficient funds in their account.”

It’s worth noting, though, that this will have an impact on your mobile deposits. You might get a confirmation when you deposit a check. However, even after receiving the confirmation, the bank has the authority to refund the deposit.

#3. Mobile-Deposited Funds Can Be Put On Hold by Your Bank

Your bank, just like a traditional check, might put a hold on the funds you deposit with your smartphone. Simply depositing your check too late in the day is a common cause of the “delayed availability of money.” If you miss the check deposit cutoff time, you may have to wait an additional business day for the check to clear and access your cash.

#4. The Photographs From the Check Are Not Saved on Your Phone

It could feel strange when you’re ready to deposit a check on your phone. After all, you may be wondering who will get access to this private information. Make sure that no images are saved on your phone. Bank apps, on the other hand, “keep the deposit data, including photographs, on a protected web-based server, thereby preserving the customer and the security of their financial information,” according to Patel.

#5. Your Phone Can Assist You in Capturing the Perfect Shot

Getting the hang of taking the proper photo for a mobile deposit might be difficult. Fortunately, banking apps are available to assist you. Once you have the check in the correct place, the app will take a picture.

“I think the most significant feature supplied is the automatic snapshot feature that takes the photo automatically when you have the photo box firmly delineated around the check,” says Bill Samuel, owner of Blue Ladder Development and a frequent depositor of mobile checks.

It’s advisable to have a darker background behind your check to boost the photo’s quality. It should be easy to shoot the front and back of your endorsed check once you’ve lined up the check with your camera.

#6. You Must Still Sign the Check

Make sure you endorse the check before you start taking images for mobile deposit. This implies you’ll have to sign the check’s back side. You should also check the “mobile deposit” box while making mobile deposits. Alternatively, you may just add “for mobile deposit only” beneath your signature. This will make the deposit procedure go more smoothly and ensure that the money is deposited into your account rightly.

#7. Keep the Paper Check In Your Possession

Although the check should be snapped in under a minute, you should keep the physical check for a few days to ensure that the cash is successfully deposited into your account. A hard copy of your cheque should be kept for five days, according to Wells Fargo. It’s tempting to throw the check into the shredder right away. This is because it could create issues if the bank has a query about the deposit.

“Hold on to the check until you see it clear and move from pending to approved on your online account,” says Micheal Foguth, founder of Foguth Financial Group. In fact, most banks prefer that you keep the check for at least a few days in case the deposit goes wrong.

What Do You Write on the Back of a Check for Mobile Deposit?

Sign the back of the check and write “for mobile deposit only”. Select the Front of Check and Back of Check buttons on your smartphone to take images of the front and back of the check.

What Happens if You Endorse a Check Wrong?

Cross out the error, and then initial it. Instead of erasing the error, you should attempt to draw a line through it. Once this is complete, you can endorse the check as usual. Ensure that you can still read your signature.

How do I endorse a check to mobile Deposit 2023?

The following are steps to endorse a check for mobile deposit in 2023;

- Make sure your signature is correct

- Look for the area that says “Endorse Here.”

- Verify the bank’s policies.

- “For Mobile Deposit Only” should be included

- Make sure you double-check everything.

- Follow the directions

How do you endorse the back of a check?

Simply turn the check over and sign your name on the back to endorse it. The back of most checks has an area for your endorsement. There are a couple of blank lines and an “x” where you should sign your name.

What Is an Example of a Special Endorsement?

For instance, if Ms. Smith wants the check to be made out to Mr. Smith, she would write “Pay to the order of Mr. Smith” in the endorsement area on the back of the check.

Do I Need to Endorse the Back of a Check?

For a check to be valid for a deposit, it must be signed on the back. So, always write your name in the blank space next to the X right before you bring it to the Bank. Note: You can make a deposit at a Bank location, at an ATM, or through our mobile app.

In Conclusion

Taking advantage of your bank’s mobile check deposit tool can save you a lot of time by allowing to do tasks like make transactions and view bills online instead of going to the bank. This may, however, take some getting used to.

However, contact a bank representative if you have any queries concerning your specific circumstances as it relates to mobile deposits. They’ll be able to tell you whether or not your account has any mobile check deposit restrictions and how to endorse the checks rightly.