All business owners as well as companies should know the benefit of preparing a financial statement of a company at the end of a financial year. If that’s been a problem for you, then you’re in the right place. This post will help you acquire every information you’d need to prepare the financial statement of a company. We’ll also at some of the best financial statement templates, formats and samples of successful companies out there-PDFs inclusive

FINANCIAL STATEMENT OF A COMPANY

The financial statement of a company basically shows you where your money is, how it came, and where it went.

Businesses always have to deal with taking financial risks and in turn, making financial decisions daily. As business owners, on the other hand, you can hardly make any informed decisions without the help of financial statements for each fiscal year at hand. So, in other words, every business-oriented individual would need to have a fundamental knowledge of how to prepare and read a company’s financial statement at some point . You don’t necessarily need to be an accountant to be able to understand the financial statement of a company. Once you have a few basic starts of accounting you will be able to read and take out points from a financial statement of any company.

This, however, starts with familiarizing yourself with the different parts of a financial statement.

There are 4 major financial statements of a company parts and they include:

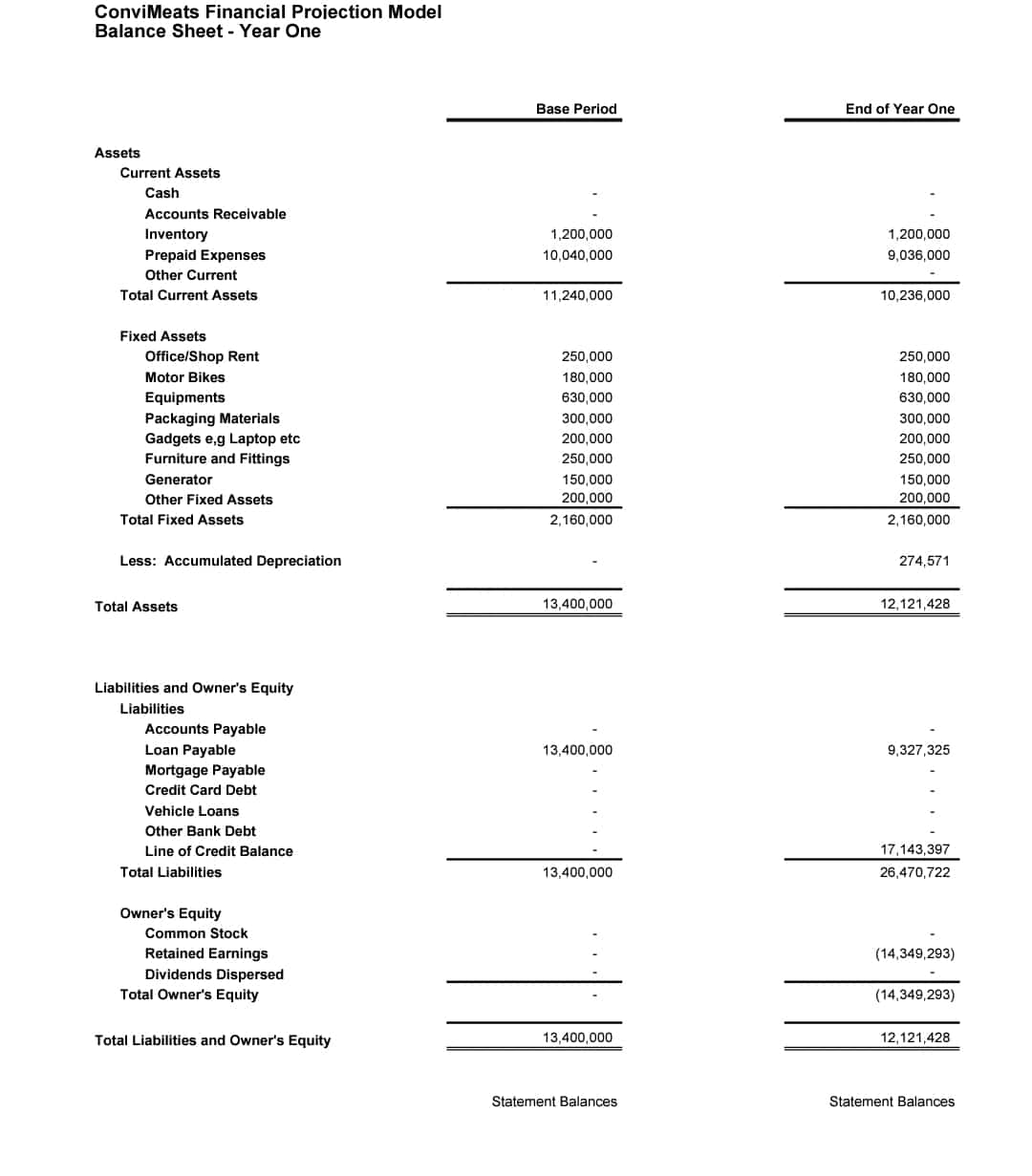

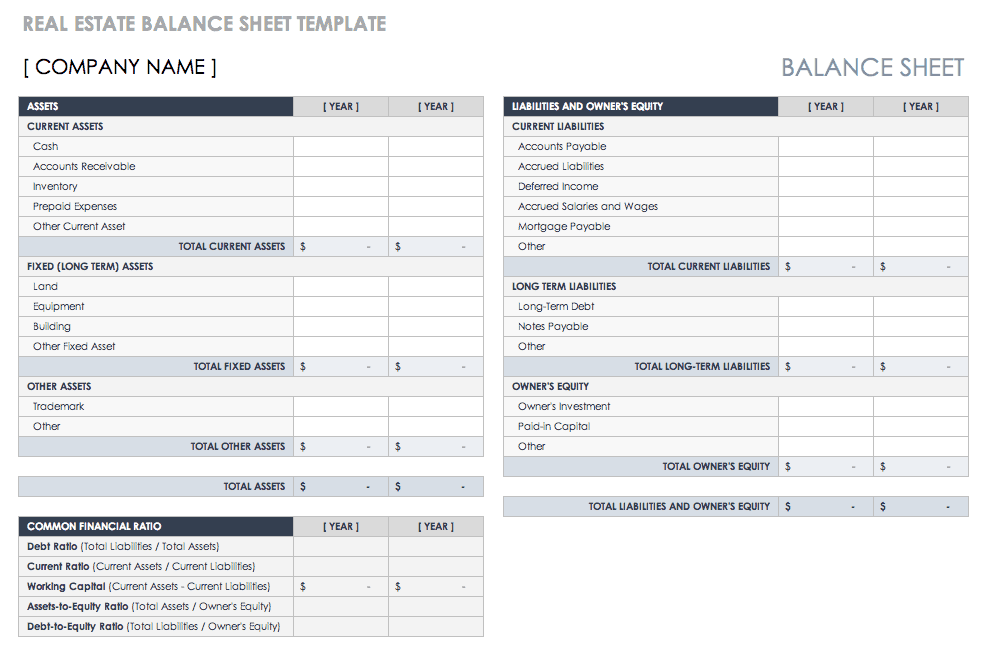

#1. BALANCE SHEET

This part of a company’s financial statement basically shows what the company owes as well as what it owes at a particular point in time. This means the balance sheet shows the company’s assets, liabilities, and shareholder’s equity too.

ASSET

Assets are items a company owns that have values. Some of these assets include inventory, plant, trucks, equipment. Although all these things are physical properties, assets may also includes items that can’t be touched but still have a value such as trademarks and patents. An example of this can be investment or cash.

In the balance sheet asset are listed according to how quickly they are converted to cash. This brings us to the various types of asset which include:

CURRENT ASSET: This is the type of asset a company is required to sell within one year. A good example of this asset is a company’s inventory.

NON-CURRENT ASSET: A direct opposite of the current asset, these are items of a company that will take longer than a year to sell as well as not expected to be converted to cash inl the space of one year. Examples of this kind are fixed assets which include: furniture and trucks. Fixed assets are those items used in the running of a business but are not for sale.

LIABILITIES

This can be said to be the opposite of assets since liabilities are simply what a company owes another. It can appear in various forms such as obligations to provide service or even goods to customers in the future, and environmental cleanup cost. Other examples include taxes owned, rent for the use of a building, loan from a bank to launch a new product, and payroll owing to employees.

Liabilities can either be current or long-term. They are listed based on their expiring dates because current liabilities are obligations expected to be paid off within one year. While long-term liabilities are obligations owed by a company that can be tolerated for more than one year for payment.

This part in a financial statement called the shareholder’s equity is also known as the capital or net worth. It is the fund left if a company would sell all its assets to pay off its liabilities. The remaining fund belongs to the shareholder or owners of the company as the case may be. Most times companies distribute earnings instead of holding on to them. The distributions are dividends.

The balance sheet is an essential part of the financial statement of a company that specializes in showing a clear shot of the assets, liabilities, and share holder’s equity at the end of the financial year.

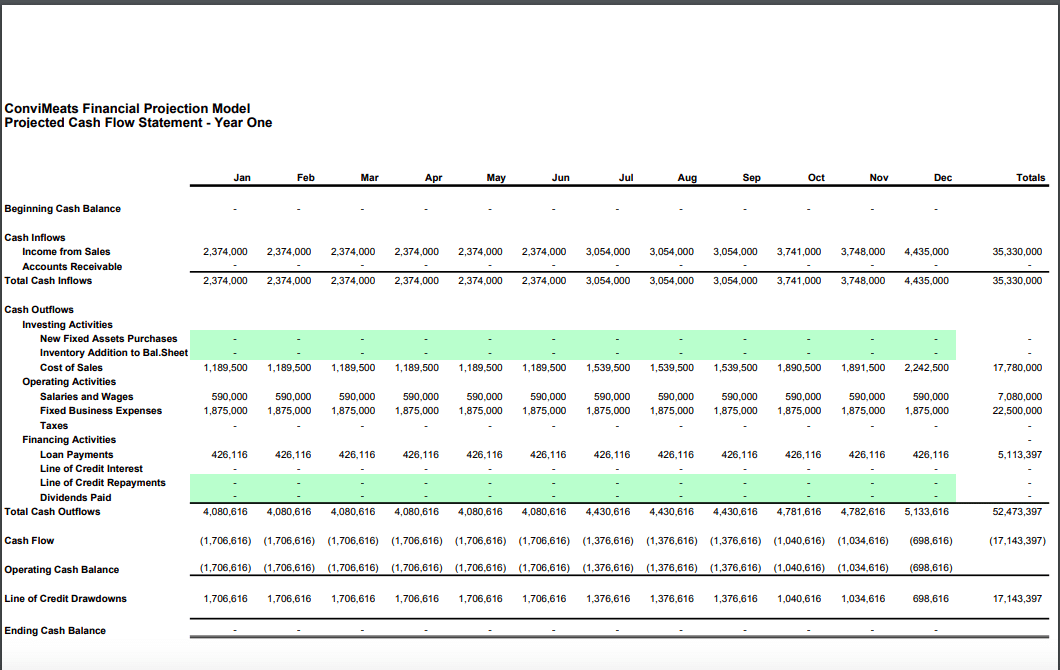

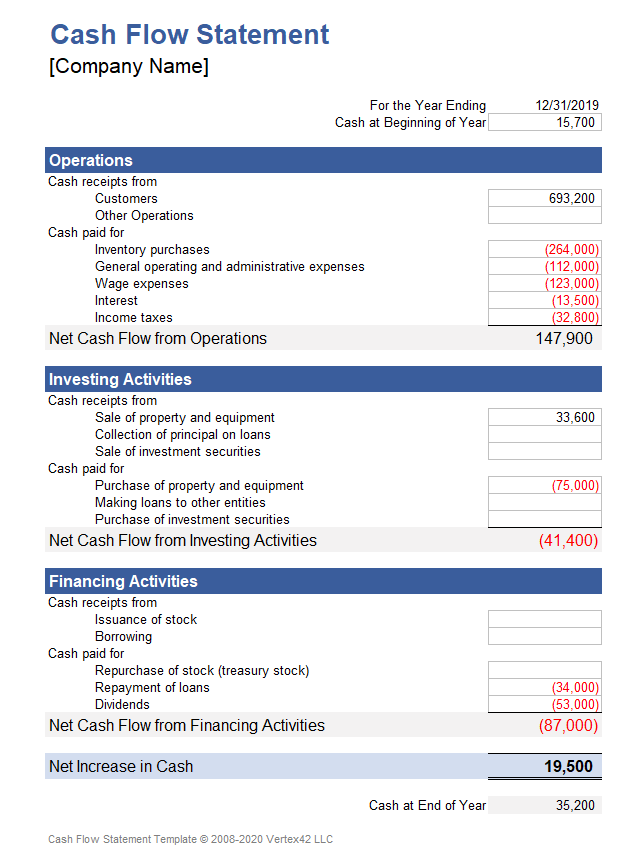

#2. CASH FLOW STATEMENTS

The inflow and outflows of cash in a company are records in the cash flow statement of a company. The cash flows reveals whether or not a company generated cash at the end of a financial year. Companies need cash at hand to purchase assets and as well as pay for its expenses

The aim of cash flow statements is to show the net increase or decrease at the end of a financial year. This is why this statement shows changes over time instead of the absolute dollar amount at a particular period.

For the purpose of a better review, cash flow statements are divided into 3 different activities and they are:

OPERATING ACTIVITIES

This part of the statement analyses the company’s net income, as well as adjust for any cash that was used by other operating assets and liabilities. It also adjusts net income for items that are non-cash like adding back depreciation costs.

Most companies in this section reconcile the overall net income to the actual income cash the company used in operating for the financial year.

FINANCIAL ACTIVITIES

Financial activities of a company include: paying back a loan and cash generated by selling stocks or bonds. The financial activity sector of the cash flow statement is the financial statement of a company. That shows the cash flow from all financial doings of the company.

INVESTING ACTIVITIES

Purchase of long-term assets like plant, equipment, and investment securities are the details of the investing activities of a cash flow financial statement. For instance, if a company decides to sell off some of thier investments, the results from the sales will show in the investing activity of a cash flow financial statement because it provided cash.

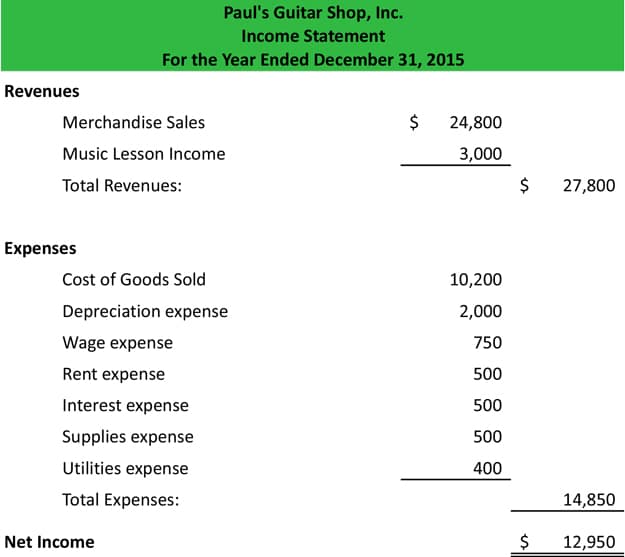

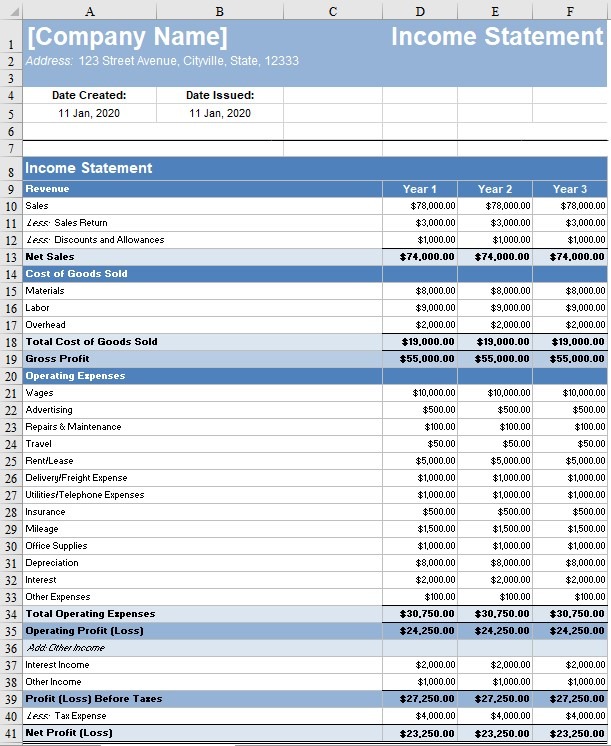

#3. INCOME STATEMENTS

This financial statement shows the revenue a company acquires over a specific period of time (often a year or some part of a year). Expenses connecting to earning the revenue are also in notes in this statement. This might seem more like a financial goal for the business but in a more detailed manner.

The statement also treats the company’s net earnings or loss as well as earnings per share. The essence of this calculation is to tell you how much a shareholder in a company would receive if the net income were to be shared at the end of an accounting year. (Although companies never share all their net income instead they reinvest them).

Starting off this statement, the top line contains the total amount of money brought in for the sales of goods and services called the gross revenue. This is because the removal of expenses is yet to be done. Therefore gross starting is not even refining.Removing allowances and returns from the company’s gross revenue, you arrive at its net revenue.

Read Also: Complete business plan guide with financial templates

Moving down the line in creating our income statement the next content should be the cost of sales. The function of the cost sales like its name simply shows the cost of money the company spends. On producing goods and services which they use for the financial year.

The next action to observe is to deduct the cost of sales from the net revenue to get gross profit. Remember gross means not refine or certain because deducts are yet on some expenses.

Operating Expenses

Let’s talk about operating expenses in this section. This is the kind of expenses that go towards supporting the company’s activities for the financial year. These expenses are different from the cost of sales because sales costs can link straight to the production of goods and services sold in the company. Examples of these operating expenses are the salaries of the administrative persons, marketing expenses and also the cost on researching new products. Remember operating expenses can not link directly to the production of goods and services.

However, while the cost of using assets during the financial period is a fiction of the original cost of the asset, the income of operations is what you will arrive at when all operating expenses is deducted from the gross profit.

Read Also: Corporate Finance: Secret Expert Guide for successful businesses (+free courses)

Interest Income and Expenses

Companies should be able to account for interest income and interest expenses. Interest income is money a company gets as a result of keeping their money in an income-bearing savings account. Interest expenses, on the other hand, are the money a company pays as a result of the money the company borrows.

But while some income statements account for the interest income and the interest expenses separately, others account for both. In any case, the interest income and interest expenses we will be subtracted or added to arrive at operating profit before heading to the income tax.

FINANCIAL STATEMENT RATIO AND CALCULATIONS

Terms like current ratio and operating margin also PE ratio may sound unfamiliar to you. You are already wondering what they mean. Plus they don’t even appear on the financial statements.

Well, let’s quickly treat ratios which some investors use in calculating information on financial statement. Basically, it is used in evaluating a company’s account even though choice of ratio might vary from one company to another.

For better understanding of the vary rule, if a company has a debit-to-equity ratio of 2 to 1 then it simply implies that the company is taking on debt twice the rate the owners are investing on the business.

OPERATING MARGIN

I often express this as a percentage which shows the percentage profit for each dollar put in sales.

Operating margin =income from operations and net revenue.

We can find both the operating income and the net revenue in the operating margin financial statement. This is because its work is to compare both.

Divide the company’s income by its operations to arrive at the company’s operating margin just before the interest and income expenses come in.

INVENTORY TURNOVER RATIO

Inventory turnover ratio=average inventory for the period and cost of sales.

For example, if a company is stated as 2 to 1, it clears that the company’s inventory turned over twice in the accounting period.

So in calculating the average inventory balance, look at the inventory numbers lists on the balance sheet carry the lists of the number on the balance sheet for the period then add them to the balance that lists for the previous period and divide by two.

Remember the inventory balance for the previous is the beginning balance for the current period is the ending balance because balance sheets are snapshots in time.

On the other hand, in calculating the inventory turnover ratio, divide the company’s cost of sales by the average inventory for the period. The result is your inventory turnover ratio.

PE RATIO

Let’s use an instance to explaining this. Assuming a company is earning $2 per share while selling the company stock at $20 per share. Then the company’s PE ratio is 10 to 1 which means 10 times its earning on selling its stock.

In order to arrive at a company’s PE ratio you need to divide the company’s stock price by its earnings per share. PE ratio basically compares a company’s common stock price with its earnings per share.

WHAT ARE THE MOST IMPORANT PARTS OF A FINANCIAL STATEMENT

People tend to always ask which parts of the financial statement of a company is the best or most important. To me all are important and as well as play their separate roles.

BALANCE SHEET

The balance sheet is important because it is relative to the income statement to produce the amount of investment you need to support the sales and also profits which are on the income statement.

There are a tons of analysts who gauge the efficiency of a company through its balance sheet.

A thorough analysis of the balance sheet could also offer quick views. This is because to balance assets, assets must be in turn equal to liabilities plus equity. Analysts see the subtraction of assets from liabilities as the book value of a firm.

Looking at the long-term assets analysts determines how effectively companies have managed its receivables in the short term.

INCOME STATEMENT

This is often regarded as the most important for several financial statement users since it shows the power of a business to generate profit. However, the income statement should not be in use by itself as the information will be misleading. It does not show the amount of assets and liabilities you need to generate a profit. Also its results don’t equate to the cash flow raised by the business.

Generally the income statement provides information on the revenue a company earns as well as the expenses involved in its operating activities. It also provides more details on the holistic activities of a company. The direct, indirect, and capital expenses a company incurs are also parts of the income statement.

Basically, transparency is the central work of the income statement especially in dealing with the company’s operating services.

CASH FLOW STATEMENT

This statement reports all cash inflows and outflows of the financial accounting period with the summarization of the available cash at hand. Overall liquidity of cash transaction of the company is visible also in the cash flow statement.

The two sectors of the cash flow statement (investing and financing) are close with the work of capital planning for the firm which also interconnects with the liabilities and equity on the balance sheet.

FORMAT OF THE FINANCIAL STATEMENT OF A COMPANY

Some of the formats of the financial statement of a company to consider include:

BASIC INCOME STATEMENT

For this format of a company’s financial statement, revenues are first then expenses follow. The net income of the company is gotten by subtracting the expenses from the revenue, making it a simple version of an income statement used by most service providers.

INCOME STATEMENT FOR MANUFACTURING

The first line in this format of a company’s financial statement is reserved for gross income or revenue only. After which removing the cost of goods manufactured or sold follows. Its gross income amount is the result.

List of company expenses are embedded in the second part of the financial income statement in this format.

BALANCE SHEET

It is important to note that the total assets must equal to the total liabilities and shareholders’ equity. As discussed above the balance sheet reflects the assets, liabilities and share holders equity in the company.

The first line of the balance sheet financial statement format should cover all assets including investments, cash, real estate, other company holdings, and equipment. The following line covers information like the liabilities of the company including any loans or accounts payable. Finally, the share holder’s equity should state the difference between the total assets and total liabilities.

NB: The above explains balance sheet account for small companies which is enough to cover up the financial statement. For a larger company it might not be possible as it requires a breakdown of assets and liabilities to their forms which include current and long-term assets and liabilities.

CASH FLOW STATEMENT

A lot of companies handle their accounting on an accrual basis which means they will be able to recognize the income a contract receives. The recognition starts when you execute the contract and not necessarily when the cash comes in.

The cash flow statement format of a company’s financial statement is only valid when you receive cash. It aids investors to determine if the company is facing difficulty managing its cash flow. This format basically starts with the cash flow activities ranging from its operations to investments.

Significantly each category shows incoming and outgoing cash from the company.

SAMPLES FOR THE FINANCIAL STATEMENT OF A COMPANY

Samples for the financial statement of a company are major guides to aid you to create a well detailed financial statement for your company. As we have already discussed, preparing a financial statement requires some elements to complete. These samples of a company’s financial statement will reveal those elements. Preparing a financial statement with a sample? you should be careful not to copy in details of the sample company to your companies statement. One danger in the samples for the financial statement of a company.

But then if all the elements were missing in creating a financial statement. These three shouldn’t be missing in the financial statement of a company. After a rundown on this sample for the financial statement of a company, you would know it’s important to you.

These samples for the financial statement of a company accounts include cash flow statements, income statements, and balance sheets. Samples for the financial statement of a company are visible below accordingly.

The three main samples for the financial statement of a company are what have been shown above. You can use those samples for the financial statement of a company to create your own financial statement.

TEMPLATES FOR FINANCIAL STATEMENT OF A COMPANY

Templates of a financial statement of a company is now our discuss here. Companies that seek to attain their profit and loss margin at the end of each financial year should be able to provide a detailed financial statement at the end of each accounting year. Templates are a guide that provides a compressed way for you to go about your financial statement writing.

Below are a few examples of templates for the financial statement of a company for clearer and easy production of your companies’ financial statement.

Templates for the financial statement of a company including balance sheet, cash flow, income statement. Are all available very in detail in this post below.

However, we should pay extra attention to preparing financial statements of our company so we don’t go about mixing up these contents of the financial statement for another. Templates of the most important parts of the financial statement of a company which is the cash flow, income statement, and balance sheet are shown below for guidance purposes.

Templates of the financial statement of a company are just basic sights to enable you to prepare your financial statement of a company. With the aid of the templates of the financial statement of a company above you can see how others try to prepare theirs and get started with yours.

We are not in any way afflicted with the templates of the financial statements of a company provided.

How do you get a financial statement of a company?

On the firm’s website, under Investor Relations, where Securities and Exchange Commission (SEC) and other corporate reports are frequently held, you can find financial information.

Who prepares financial statements?

Directors draft financial statements and audit committees ensure the accuracy of the data. The annual report is subjected to several procedures in addition to the audit of the financial statements by auditors.

Can I prepare my own financial statements?

However, you might be able to create your own financial statements with the aid of computer software. Sometimes a third party, such a banker, would demand that financial statements be made by a professional accountant or certified public accountant if you need to prepare them for them.

What are the 3 main financial statements called?

Financial statements that must be provided are the income statement, balance sheet, and statement of cash flows. These three statements can be used by traders as educational tools to assess a company’s financial health and to quickly determine its underlying value.

Which financial statement is prepared first?

First, an income statement—also known as a statement of earnings or an operations statement—is created. It outlines revenues and costs and determines the company’s net income or loss over a specified time period.

Is the CEO responsible for financial statements?

Although the jobs that CEOs and CFOs play are distinct and equally vital, they might be perplexing to those outside the business sector.

Can you make financial statements in Excel?

Open a new spreadsheet after logging into Microsoft Excel Online. Make a Transactions page and note the financial statement’s underlying assumptions. Organize monthly transactions into a Profit and Loss statement. Fill up the categories for the Profits and Losses with the transactions using the SUMIFS formula.

PDFS FOR THE FINANCIAL STATEMENT OF A COMPANY

PDFS for the financial statement of a company is always recommended in a better understanding of the financial statement of a company. These PDFS for the financial statement of a company to aid your research are listed below. Click on them for easy access to PDFS for the financial statement of a company.

Introduction to the Financial statement for business entities

Financial statements new ground PDFS for the financial statement of a company

The Financial statements PDFS for the financial statement of a company

Read the PDFS for the financial statement of a company provided for a wider knowledge of the financial statement of a company. You can decide to search for more PDFS for the financial statement of a company as well as compare PDFS for the financial statement of a company too.

CONCLUSION

The financial statement of the company is the end result of that company’s financial dealings and activities at the end or quarterly, as preferred, of each accounting year. For a business or company to be responsible for its financial dealings and grow as a business, keeping records of its financial statements will be the only solution to landing such results.