Introducing options trading into all types of investment strategies has quickly grown in popularity among individual investors. For beginners, the major question that will arise is why traders would wish to sell options rather than to buy them. However, the selling of options confuses many investors because of the obligations, risks, and payoffs involved. They are different from those of the standard long option. Here will see the strategies of selling put options explained with examples and how to calculate using the put options calculator.

Selling a put option allows an investor to potentially own the underlying security at a future date and a much more favorable price. In other words, the sale of put options allows market players to gain bullish exposure, with the added benefit of potentially owning the underlying security at a future date and a price below the current market price. Selling a put option can also be called writing a put option.

How Does a Put Option Work?

A put option gives you the right, but not the obligation, to sell a stock at a particular price (known as the strike price) at a specific time, at the option’s expiration. As a result, the put buyer pays the seller a sum of money called a premium. In contrast with stocks, which can exist indefinitely, an option will expire at expiration and then be settled, with some value remaining or completely worthless.

Therefore, put options are in the money when the stock price is below the strike price at expiration. The put owner may exercise the option, thereby selling the stock at the strike price. Otherwise, the owner can sell the put option to another buyer at fair market value.

A put owner makes a profit when the premium paid is lower than the difference between the strike price and stock price. Imagine a trader buying a put option for $0.70 with a strike price of $35 and the stock is $20 at expiration. The option is worths $15 and the trader has made a profit of $4.10.

If the stock price is higher than the strike price at expiration, the put is out of the money and expires worthless. So, the put seller keeps any premium received for the option.

Why Sell a Put Options?

In options trading, you can be a buyer or a seller. Here are the advantages of selling puts.

- The payoff for put sellers is definitely the reverse of those for buyers.

- Sellers expect the stock to stay flat or rise above the strike price, thus making the put worthless.

Considering the same example as before, imagine that stock WXY is trading at $40 per share. You can decide to sell a put on the stock with a $40 strike price for $3 with an expiration in six months. Hence, one contract gives you $300, or (100 shares * 1 contract * $3).

Read also: SHORT CALL: A best easy guide to master short call strategy

Merits of Buying Puts

Subsequently, the profit for the put seller will be exactly the inverse of that for the put buyer.

- So for a stock price above $40 per share, the option expires worthless. As a result, the put seller keeps the full value of the premium, $300.

- Between $37 and $40, the put is in the money. The put seller gains some of the premia, but not the full amount.

- When it gets below $37, the put seller begins to lose money beyond the $300 premium.

The merits of selling put are that you receive cash earlier and may not ever have to buy the stock at the strike price. So if the stock rises above the strike by expiration, you’ll make money. However, you won’t be able to multiply your money as you would by buying puts. As a put seller, your gain is capped at the premium you get upfront.

Selling a put seems like a low-risk proposition and sure it is. However, if the stock really rises so high, then you’ll be on the hook to buy it at the much higher strike price. You’ll also need the money in your brokerage account to do that. Most investors keep enough cash, or at least enough margin capacity, in their account to cover the cost of the stock. That is if the stock is put to them.

For example, if the stock fell from $40 to $20, a put options seller would have a net loss of $1,700. It can also be the $2,000 value of the option minus the $300 premium he will get. If done prudently, selling puts can be an effective strategy to generate cash, especially on stocks that you won’t mind owning if they fell.

Selling Put Options Example Using Commodities

Put options can be used for commodities as well as stocks. Commodities are tangible things like gold, oil, and other agricultural products, including wheat, corn, and pork bellies. In contrast to stocks, commodities aren’t bought and sold outright. You know, no one purchases and takes ownership of a “pork belly.”

Instead, commodities are rather bought as futures contracts. These contracts are hazardous because they can expose you to limitless losses. Unlike stocks, you can’t buy just one ounce of silver. A single silver contract is worth 100 ounces of silver. If the silver loses $1 an ounce the day after you bought your contract, you’ve just lost $100. Since the contract is in the future, you could lose hundreds to thousands of dollars by the time the contract comes through.

We use put options in commodities trading because they are a lower-risk way to get into these highly risky commodities futures contracts. In commodities, a put option gives you the option to sell a futures contract on the underlying commodity. If you buy a put option, your risk is limited to the price you pay for the put option (premium) in addition to any commissions and fees. Despite the reduction of the risks, most traders don’t exercise the put option. Instead, they close it before it expires. They just use it as insurance to hedge their losses.

Read Also: PUT OPTIONS: How to trade put options in simple steps

PUT OPTION SELLER

The profit scenario is the opposite for the put option seller because the maximum profit they can achieve is equal to the premium received. The potential losses are limitless to the point where the stock reaches zero.

The breakeven price for the put seller is $20. Anything below that will see them suffer losses on a one-to-one basis. So, if the stock falls to $14, the put seller would lose $6 per contract or $600 totally.

The profit calculation above is only at expiration. The calculation for interim profits is much more complex to predict and is best done with options software such as Interactive Brokers Risk Navigator or Option Net Explorer.

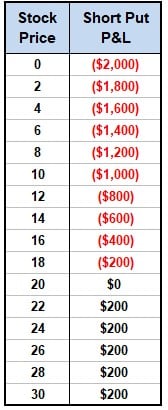

Excel Profit, Sell Put Option Calculator

These calculations are all quite plain. However, if you want to visualize this in excel alongside the payoff graph, you can download the handy sell put options calculator below. You can also use the calculator for most of the major options strategies.

- The first step is to download the sell put options calculator here.

- So for a put buyer use the Long Put tab and the put seller should use the Short Put tab.

- So you simply enter the strike price, the number of contracts (position), and the premium.

- According to the stock price, you will likely have to adjust the values in Centre and Increment.

- The sell put options calculator will complete the calculations.

What is the Maximum Loss that can be Incurred while Selling a Put?

When selling or writing a put, the maximum loss is equal to the strike price less the premium obtained. Here’s an easy example. Assume the stock of Company XYZ is trading at $50, and you sell three-month options with a strike price of $40 for a $5.00 premium. Assume you sold ten put options, each of which covers 100 shares, and you received $5,000 in options premium ($5.00 x 100 shares x ten contracts).

Just before the options expire, it is revealed that Company XYZ committed huge fraud and is pushed into bankruptcy, causing the shares to lose all value and trade near nothing. The put buyer will execute the option to “put” or sell the shares of Company XYZ at the strike price of $40, which means you will be obliged to acquire these worthless shares at $40 apiece, for a total investment of $40,000. However, because you paid $5,000 in option premium upfront, your net loss is $35,000 ($40,000 minus $5,000).

Is it Better to Buy a Call Option or Write a Put Option?

It all comes down to your risk tolerance and knowledge of available possibilities. Buying a call is a straightforward strategy with a maximum loss limited to the call premium paid and a theoretically infinite maximum gain. In contrast, writing a put restricts your maximum gain to the put premium received, while your potential loss is substantially bigger (and is equal to the put strike price less the premium received). Investors with a lesser risk tolerance may opt to buy calls, whereas more experienced traders with a higher risk tolerance may prefer to write puts.

Is it a Good Idea to Write Put Options in Volatile Markets?

Because volatility is a major predictor of the option price, write puts with prudence in tumultuous markets. You may receive larger premiums as a result of increased volatility, but if volatility continues to rise, the price of your put may rise, resulting in a loss if you choose to close out the position. Writing puts in such a market environment may still be a reasonable strategy if you believe the volatility rise is transient and expect it to trend lower.

What is the purpose of selling Put Options?

The purpose of selling put options is to generate income. By selling put options, the seller collects a premium, which acts as a source of income, as long as the stock price stays above the strike price.

What is the difference between selling a Call Option and selling a Put Option?

Selling a call option involves granting the buyer the right to buy the underlying stock at a predetermined price, while selling a put option involves granting the buyer the right to sell the underlying stock at a predetermined price.

What is the risk involved in selling Put Options?

The risk involved in selling put options is that the seller is obligated to buy the underlying stock at the strike price if the stock price falls below the strike price. This can result in significant losses for the seller if the stock price drops significantly.

How does the premium collected from selling Put Options affect the risk involved?

The premium collected from selling put options reduces the risk involved in the trade, as it acts as a buffer against losses. However, the premium collected is limited and may not fully cover potential losses if the stock price drops significantly.

How does the strike price chosen affect the risk involved in selling Put Options?

The strike price chosen affects the risk involved in selling put options, as a lower strike price results in a higher premium but also increases the likelihood of having to buy the stock at a lower price. A higher strike price results in a lower premium but also decreases the likelihood of having to buy the stock at a lower price.

What is the most important factor to consider when selling Put Options?

The most important factor to consider when selling put options is the stock price and its potential movement, as this will determine whether the option will be exercised or expire worthless. Other factors to consider include the strike price, the premium collected, and the expiration date of the option.

Summary

From the examples, we can see that profits and losses on put options vary depending on whether you are the buyer or seller of the option. The option buyers have limited risk and unlimited gain potential (until the stock reaches zero). In contrast, the opposite is true for put sellers.

Profits and losses at expiration can easily be calculated using the handy excel calculator tool available for download above. However, calculating the interim profits is more complex. It requires advanced software such as Option Net Explorer.

Sell Put Options FAQ’s

Why would you sell a put option?

In other words, selling put options allows market participants to get bullish exposure while also potentially owning the underlying securities at a later period and at a lower price than the current market price.

Is selling put options Safe?

However, as many put-selling tutorials will tell you, selling puts is “risky” since the negative risk outweighs the profit possibility. During these 3.5 months, the highest rate of return on put premiums is 5%. If you keep doing that, your returns will be capped at 5% or 18% annually.

Can you sell a put option at any time?

When the stock price is less than the strike price at expiration, the put option is in the money. The put owner has the opportunity to exercise it by selling the shares at the strike price. Alternatively, the owner can sell the put option to another bidder at fair market value before it expires.

Why sell a put instead of buy a call?

Purchasing a call results in an immediate loss with the possibility for future gain, with risk limited to the option’s premium. Selling a put, on the other hand, provides an instant profit/inflow with the potential for future loss and no risk cap.