It is often impossible to fully understand the financial condition of a business with just a fraction of the financial statement. In other words, using just the balance sheet or the income statement will only give you a partial view of the company’s state. Combining both statements, on the other hand, gives you a better view and understanding. But more importantly, you’d also need to be able to differentiate between them. This post was designed to accomplish just that; to help you understand the relationship and differences between a balance sheet and an income statement (Balance sheet vs Income Statement).

What Goes on a Balance Sheet vs Income Statement?

Different accounting measures relating to a business’s financial status are reported on the income statement and the balance sheet. Understanding the aim of each report will help you better grasp how they differ from one another.

What is a Balance Sheet?

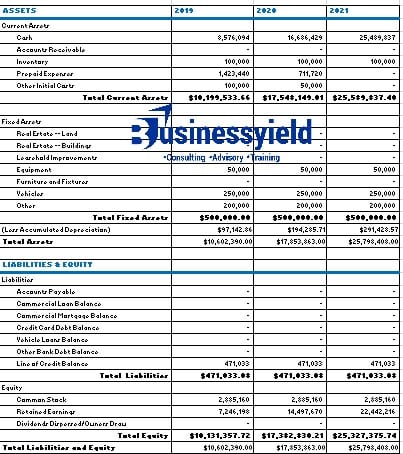

The balance sheet shows what your company has and what it owes. It is often used by creditors and investors to analyze the financial health of your firm. Consider your balance sheet to be a direct picture or reflection of your company. It depicts the financial situation of your organization as of a given date.

Basically, your company’s balance sheet covers three of the five account types; assets, liabilities, and equity. A general accounting formula comes via the balance sheet format as;

Liabilities + Equity Equals Assets

Assets include cash, accounts receivable, inventory, machinery, and real estate that your company owns. Intangible assets, or items of worth that can’t be touched or felt also fall under this category.

Current and long-term assets are the two types of assets. Current assets, such as merchandise, may be converted into cash quickly, whereas long-term assets, such as property, are something you intend to hold on to for a long time.

On the other hand, your company’s debts, such as accounts payable and notes payable, are referred to as liabilities. Liabilities, like assets, are could either be current or long-term categories. Current liabilities must be paid within the following year, while long-term liabilities must be paid over a longer period of time.

Equity is the amount of money you and your investors have invested in the company. When the sum of equity and liabilities equals, or balances with, your assets, then you have constructed an appropriate balance sheet.

The balance sheet proves that Assets = Liabilities + Equity, which is a basic accounting equation.

While the balance sheet is a useful analytical tool for creditors and investors, it doesn’t give you a whole picture of your company’s worth. Here are some of its limitations;

#1. Individual assets on your balance sheet rarely increase in value

Assets must be recorded at their purchase price, and most long-term assets must be depreciated. Assets are not elevated to market value from their historical worth or book value.

#2. The balance sheet represents your company’s assets and liabilities as of a specific date, but it might alter on a daily basis, just like your personal bank account.

Consider what would happen if your balance sheet was prepared shortly after you paid off a large debt and before you delivered a large order to a customer. You have a temporary cash shortage, but you can’t always explain it on the balance sheet.

#3. The income of your business is not shown on the balance sheet

Because not all organizations develop by purchasing new assets, it’s more difficult to detect growth on a balance sheet. Increased income, for example, is one way for service businesses to indicate growth. (Tramadol)

What Goes on a Balance Sheet?

A balance sheet shows the assets, liabilities, and equity of a company at a certain point in time. A balance sheet comes in two sections: assets on one side and liabilities and equity on the other. Both sides must be balanced, which means they must be on an equal footing. It includes the following line items in its report:

- Current Assets: Accounts receivable, inventory, and prepaid expenses are examples of current assets that will be converted to cash within a year.

- Long-term Assets: Land, buildings, and equipment are examples of long-term assets that will not be converted to cash within a year.

- Current Liabilities: These are debts due in the next 12 months, such as rent, electricity, taxes, and payroll.

- Long-Term Liabilities include long-term corporate loans and liabilities owed to pension funds.

- Shareholders Equity refers to a company’s net assets, which include money generated by the company as well as donated capital.

On a given date, the balance sheet shows you what your company has and what it owes to others. It provides a snapshot of the company’s overall value.

What is an Income Statement?

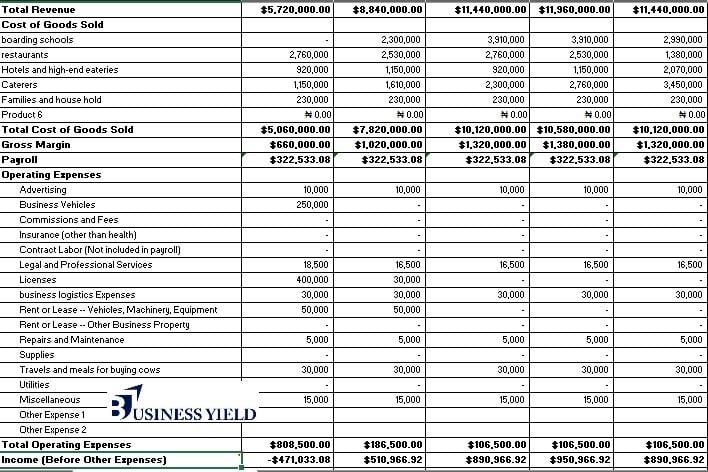

An income statement, also known as a profit and loss statement, shows your company’s earnings over a period of time. Revenue and expense accounts are the two types of accounts on the income statement.

Basically, there are different types of income statements, but they all follow the same formula:

Net income = Revenue – Expenses.

In either a single or multi-step format, a classic income statement shows revenue, expenses, and net income.

Read Also: MULTI-STEP INCOME STATEMENT: Examples, Format & How-to Guide

The income statement’s multi-step format distinguishes between business operations and other activities such as investing. This more thorough format allows readers to see your company’s genuine health without any influence from your investments.

Unlike the single-step income statement, the multi-step income statement estimates gross profit.

Read Also: Single Step Income Statement: Definition, Examples, Comparisons &Format

When you see gross profit, which is the difference between sales and the cost of goods sold, you’re looking at a multi-step income statement.

Furthermore, the operating income is the most valuable line on a multi-step income statement. It’s simple to observe how your business is doing apart from investing because the format clearly indicates running expenses.

Meanwhile, the income statement alone doesn’t also provide a complete picture of a company’s health. In the scenario above, there is a net operational loss, but there is no opportunity to explain the cause.

The income statement makes no mention of a company’s debt. Although revenue may appear to be strong, you should consider the health of the company if it has a looming debt payment or little cash.

What Goes on an Income Statement?

The following line items appear on an income statement:

- Sales: This is the revenue a company gains from selling its goods and services.

- Cost of Goods Sold: It includes company labor and material costs.

- Gross profit: This is the difference between sales and the cost of products sold.

- General and Administrative Expenses: Generally includes Rent, utilities, wages, other operational expenses.

- Earnings Before Taxes: This is your company’s profits/ incomes before taxes.

- Net Income: The resultant profit or loss by subtracting entire income from total costs.

The income statement’s main purpose is to display a company’s net income for a certain reporting period. The business reports a profit if the net income is positive. If it’s a negative number, the company is losing money.

How Do You Prepare a Balance Sheet vs Income Statement?

The financial accounts of a company are all linked so report some of the same data, but for different purposes. Because parts of your financial statements rely on information from other statements, there is a specific order in which you should prepare them. The sequence is;

- Income Statement

- Balance Sheet

- Cash Flow Statement

Basically, the net income must be calculated in order to produce a balance sheet. Net income, which is the final computation on the income statement, shows how much profit or loss the company made during the reporting period. Upon completion of your income statement, computation on your balance sheet with the net income figure commences.

Net income is recorded in the retained earnings line item on the balance sheet. The amount of equity a company reports on its balance sheet is influenced by net income.

Differences and Relationship between Balance Sheet and Income Statement

With the pieces of information above, it should be clear already what the difference and relationship between balance sheet and income statement are. However, we’ll still have to go over them.

Relationship between the Income Statement and Balance Sheet

The income statement and balance sheet have inextricable links in double-entry accounting. For every transaction record in a company, double-entry accounting requires two separate entries. (Xanax) The income statement has one of these entries, and the balance sheet has the other.

Furthermore, the assets and liabilities on the balance sheet are modified every time a sale or expense is recorded, affecting the income statement. In other words, when a company makes a sale, its assets increase, and its liabilities drop. When a company reports an expense, on the other hand, it reduces its assets and increases its liabilities. The income statement and balance sheet are thus inextricably linked.

What is the difference between a balance sheet and an income statement?

- Both the balance sheet and the income statement are financial statements that convey the story of a company’s history. The balance sheet is similar to a snapshot of your bank and student loan accounts on a certain day. The shot does not alter if you get paid the next day or if your student loan is forgiven.

- A balance sheet depicts a single point in time, while an income statement depicts a company’s success over a period of time, typically a quarter or year. The income statement is similar to a report card for your child: You’re looking at your child’s final grades, but they reflect his or her effort throughout the year.

- Balance sheet accounts (assets, liabilities, and equity) and income statement accounts (revenue and expenses) are the two forms of accounts.

- While the balance sheet and income statement accounts do not overlap, net income shows on the balance sheet as part of retained earnings, which is an equity account.

- Income statement accounts, unlike balance sheet accounts, are reset in the accounting cycle, with revenue and expense accounts “closed” to zero at the end of the year so your organization may start afresh the next year. All income and expense account balances are reset to zero throughout the closing process.

Which Is More Important Income Statement or Balance Sheet?

Both balance sheets and income statements are of equal importance. It is almost impossible to prepare one without information/data from the other as they are different but integral aspects of preparing a financial statement.

Is Income Statement Part of Balance Sheet?

Basically, the net income must be calculated in order to produce a balance sheet. Net income, which is the final computation on the income statement, shows how much profit or loss the company made during the reporting period. Upon completion of your income statement, computation on your balance sheet with the net income figure commences.

What Comes First Balance Sheet or Income Statement?

The financial accounts of a company are all linked so report some of the same data, but for different purposes. Because parts of your financial statements rely on information from other statements, there is a specific order in which you should prepare them. The sequence is;

- Income Statement

- Balance Sheet

- Cash Flow Statement

What Is the Purpose of Balance Sheet and Income Statement?

The primary purpose of a balance sheet and income statement is to inform management about their company’s performance and whether they need to take remedial action. These financial statements reveal the game’s score after all of the work is completed.

What Are the Difference Between the Balance Sheet and Income Statement?

The balance sheet details assets, liabilities, and shareholders’ equity, whereas the income statement details revenues and expenses that result in a profit or loss. The income statement also includes any tax expenses, while the balance sheet includes any tax liabilities that remain unpaid.