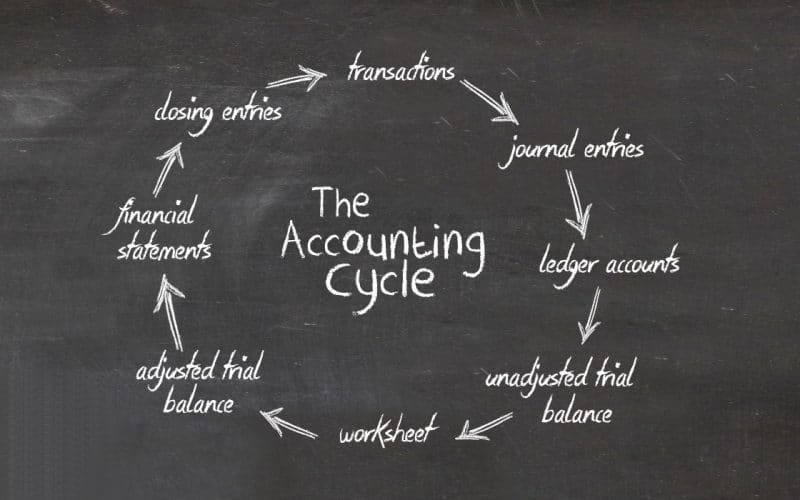

You basically get firsthand knowledge of a company’s finances by learning the relevant accounting processes and terminology. The eight steps of the accounting cycle process are discussed in this article, as well as how they differ from a budget cycle.

What is the Accounting Cycle, and how does it work?

The accounting cycle is the comprehensive process of documenting and processing all of a company’s financial transactions, ranging from when they occur to when they appear on financial statements and then finally to the close of accounts. One of a bookkeeper’s key responsibilities is to keep track of the entire accounting cycle from beginning to end. In other words, as long as a company is in business, the cycle repeats itself every fiscal year.

Over the course of a whole accounting cycle, all accounts, journal entries, T accounts, debits and credits, and adjusting entries are major components.

The Difficulty in Balancing

The accounting cycle’s goal is to ensure that all monies entering and leaving a business are properly accounted for. This is why balancing is so important.

However, errors in recording entries are common. This often results in an inaccurate trial balance which you would need to modify to reflect the debits and credits. The following are the most prevalent causes of an account imbalance:

- Forgetting to complete a transaction

- Making a mistake when posting a transaction to the wrong account

- Choosing to record a transaction as a debit rather than a credit, or vice versa

- Postings that are identical

- Incorrect posting of the sum

How the Accounting Cycle Works

The accounting cycle is a collection of procedures that ensures that financial statements are accurate and consistent. Mathematical errors have been reduced thanks to computerized accounting systems and a consistent accounting cycle process. Most accounting software today fully automates the accounting cycle, resulting in reduced human effort and the errors that come with manual processing.

But even with software, manual processing is the baseline for automation. So, let’s go through these steps one after the other

#1. Identify & Compile Transactions

Compile all of the data you have on every transaction that occurred within the time period. Ideally, you or your bookkeeper should be doing this throughout the month rather than waiting until the end of the month to scramble for receipts.

It’s, however important to remember that the timing of when you record income and costs is determined by the type of accounting you use. If you use cash accounting, you’ll want to keep track of every time money changed hands throughout the period. Financial transactions are only recognized when they are incurred if you use accrual accounting.

#2. Record Transactions

Recording a transaction entails writing the transaction down in the required notebooks Or journals. The term “bookkeeping” comes from these journals, or “books.” Each transaction should be documented as a credit and a debit in separate journals, according to double-entry accounting.

The rest will now happen more or less automatically as long as you classify the transaction in your accounting software.

#3. Publish to the General Ledger

The general ledger is another relic from the past. A master list of all transactions was kept in the general ledger. This would be the item to save if a fire broke out in your back office. You would add a transaction to the general ledger after entering it in the proper journals.

The general ledger now exists in the background of the accounting cycle, thanks to the wonders of the internet and automation. It’s gone from being a tangible book to being a part of the cloud, and accountants don’t have to touch it anymore.

#4. Calculate Unadjusted Trial Balance

The first three steps of the accounting cycle can (and should) be completed at any time during the financial year. After the period is concluded and all transactions have been identified, documented, and reported to the general ledger, the next step is to calculate the unadjusted trial balance.

Creating an unadjusted trial balance is similar to double-checking your work. And because each transaction is recorded as both a debit and a credit, the purpose of this step is to make sure your overall debit and credit balances are equal. If not, something was overlooked or categorized incorrectly.

Oftentimes, it’s common to find oddities at this point. It can be thrown off by invoices that you expected to be paid but weren’t. Furthermore, payments that you expected (but did not receive) from your vendors can also cause problems.

An unadjusted trial balance, on the other hand, simply displays all of your debits and credits in a table. If they don’t add up to the same number, utilize this table to start looking into why.

#5. Adjust Journal Entries

This step merely remedies any anomalies that came up in the previous stage. To begin with, you must determine why the debits and credits are out of sync. You then create entries in your journal to correct them.

#6. Create a New Trial Balance

Following the journal entries, use an adjusted trial balance to double-check your work one last time. Your unadjusted trial balance, adjusted entries, and adjusted balances are all shown in this table. It’s the last step before preparing financial statements, so make sure everything is correct.

#7. Financial Statements to Create

The financial statements are the most important deliverable you’ll get from the accounting cycle. The income statement and balance sheet are exact records of the happenings in your company during the previous accounting cycle.

They’re crucial records for anyone outside your company who has to compare them to others (investors, lenders, etc. ), but they’re also quite useful for business owners.

But besides having these financial documents, it’s also important that you know how to read and comprehend them. It can help you keep track of your company’s finances and plan for future expansion.

#8. Fill in the blanks with your closing entries.

Making closing entries and preparing your business for the next accounting cycle are the final steps in the accounting cycle. This entails converting transitory accounts such as income and expenses into permanent accounts such as retained earnings.

Once you’ve completed this final step, you can restart the process.

Technology and the Accounting Cycle

We’ve explained how technological advancements have relegated some portions of the accounting cycle to the background. To put it another way, while those activities are still occurring to some extent, computerized accounting has rendered them less relevant to accountants and business owners who do not need to take direct action to complete them.

The accounting cycle would look a little different today if we looked at it through the eyes of an accountant. The general ledger, for example, no longer exists in its original form, so there’s no need to post transactions to it.

The concept of altering trial balances is now in its simplest form as well. Accounting software can help uncover deviations and prompt users to help reconcile them without producing explicit trial balances, albeit the procedure is mostly the same.

However, the accounting cycle illustrates the laws and practices that all firms must follow in order to have correct figures, thus it’s critical to understand all steps, including those that take place behind the scenes.

But regardless, the steps in the accounting cycle are becoming much less manual and significantly faster as technology and accounting continue to combine.

The Accounting Cycle’s Start and End Dates

An accounting period begins and ends with the accounting cycle. Accounting periods vary and are dependent on a variety of criteria; nevertheless, the annual term is the most prevalent.

Furthermore, financial statements, which are mandatory according to regulation also come at the end of the year. As a result, their accounting cycle revolves around reporting deadlines.

Budget Cycle vs. Accounting Cycle

The accounting cycle differs from the budget cycle in terms of timing and concentration. The budget cycle evaluates a firm’s goals and aspirations in order to anticipate future transactions, whereas the Accounting cycle collects and summarizes past company transactions.

Another way to distinguish these terms is to think of the accounting cycle as a process that allows a company to share its financial documents with external stakeholders, whereas the budget cycle is a process used internally by company officials to determine the costs associated with future company activities.

Lastly, the accounting cycle aids in the production of data for external consumers, whereas the budget cycle is mostly utilized for internal management.

What Are the 5 Accounting Cycles?

The accounting cycle is defined by the following steps:

- financial transactions,

- journal entries

- posting to the ledger,

- trial balance period,

- reporting period with financial reporting and auditing.

What Are the 10 Steps in the Accounting Cycle?

The Order of the Ten Steps in the Accounting Cycle

- Analyze Transactions.

- Journalize Transactions.

- Transactions should be posted.

- Create an Unadjusted Trial Balance

- Create Adjusting Entries.

- Prepare the Adjusted Trial Balance

- Create the Financial Statements.

- Make your closing entries.

What Are Four Accounting Cycles?

- Identify and analyze transactions.

- Record transactions in a journal.

- Post journal information to a ledger.

- Prepare an unadjusted trial balance are the first four steps in the accounting cycle. We begin by presenting the steps and their corresponding

What Is Ledger Balance?

A ledger balance is the balance of a checking account at the beginning of a given day. After all credits, withdrawals, and interest from a given day’s activities have been factored in, ledger balances are determined at the conclusion of each business day. A ledger balance is not the same as an accessible balance.

What Are the 4 Types of Accounting?

- Public accounting.

- Government accounting.

- Corporate accounting.

- Forensic accounting.

- TRIAL BALANCE: What is Trial Balance & How Does it Work?

- ACCOUNTING PROCESS: Understanding the 8 Steps in the Accounting Cycle

- ACCOUNTS PAYABLE PROCESS: How to Manage the Process Effectively

- PUBLIC ACCOUNTING FIRMS: The Ultimate List in 2023

- PeachTree Accounting Software Overview and Guide 2023 (Updated!)