You’re buying a Texas mansion! Good idea. Texas has basically everything. Real estate investors can choose from many cities in Texas, the second-largest state in size and population. Texas real estate investments are now almost a no-brainer, though. More people have moved here since 2010 than to Florida or California combined. Regardless, buying a property in this location doesn’t require a Texas-sized budget. In fact, in the first quarter of 2022, nearly half of Texas homes sold were between $200,000 and $399,000, which is inexpensive for a state like Texas that is drawing so many new residents. To help you get started on the path to buying a new property in Texas, we’ve compiled all the essential information you’ll need to start.

Is it Good to Buy Property in Texas?

Putting money into Texas property is basically a smart move. Texas has several positive attributes, including a rapidly expanding population, a thriving economy, and beneficial tax and legal frameworks for landowners. Furthermore, there are a number of stunning marketplaces to select from, each offering substantial business opportunities. That being said,

Can a Non-resident Buy a House in Texas?

Definitely! The state of Texas does not restrict the purchase of real estate to locals but does allow purchases by foreign nationals. Foreigners or not, Texas is a fantastic place to invest in real estate. The real estate market in Texas is available for everyone to buy or sell a property.

With a few exclusions, non-U.S. citizens have the same access to purchasing U.S. real estate as citizens. Don’t pass up this chance to make what could be a life-changing investment in Texas real estate. Read on to learn all there is to know about buying a property in the Lone Star State.

What is the Process of Buying a Property in Texas?

Because of its year-round mild temperatures and abundance of diverse landscapes, many people are drawn to Texas as a desirable place to settle down. Texas is not like the rest of the United States, where summer lasts all year long and winter is a distant memory; rather, it is one of the few places in the country where you may truly experience all four seasons. If you’re someone who enjoys each of the four seasons, Texas is the place for you to be.

A wide range of human feelings can be evoked by Texas’s climate. Moving to Texas requires careful consideration of the state’s climate. Section of the state is tropical in the south, while the western part is arid and mountainous. Wetlands and bayous can be found in the state’s eastern region, and the north is home to numerous agricultural areas.

Buying a home or investment property in Texas follows the same general steps as in any other state. Hence, these are the fundamentals:

#1. Save For A Down Payment

Don’t panic if coming up with a down payment seems unattainable; you might be able to get some help. If you’re a first-time real estate investor, you might be eligible for one of the several programs created to make the transition easier. For instance, Austin, Texas, provides up to $40,000 in down payment as well as closing cost assistance to anyone whose income is lower than a specific limit. Low-income borrowers can now buy a home thanks to programs in Corpus Christi, Dallas, and Houston. Along with saving money for your down payment, don’t forget to take into account these aid programs.

#2. Get a Mortgage Preapproval

You should hold a preapproval document in your hands before you start browsing for real estate. Obtaining preapproval demonstrates both your seriousness about your quest and the seriousness of the lender in considering you for a loan. Even while there is no assurance that your loan application will be legally granted, it lets a seller know that a lender has reviewed your finances and is satisfied with what it found.

#3. Locate the Ideal Financing

Despite the fact that you are buying a property in Texas, you are not required to obtain financing from a company with a location there. With an entirely online application, several Texas mortgage lenders can assist you in obtaining finance. If you prefer getting help with your application in person, there are several lenders who have physical locations. To save money both now and over the life of the loan, make sure to compare offers from several lenders to discover one with a deal that combines low fees and cheap rates.

There are also businesses that will assist you in making a cash offer even if you don’t truly have that much money in your bank account. All three companies, Ribbon, Knock, and Opendoor, have financing options that can help you compete with all-cash purchasers. It might make a big impact, especially if you’re buying and selling a property at the same time.

#4. Find a Texas Real Estate Agent

In a seller’s market, being a buyer may be stressful and frustrating. Having the appropriate real estate agent on your team can help. Realtors work hard to match your wants and budget with properties, and they frequently are aware of the launch dates of new homes.

#6. Start Searching for Your Dream Home

From the comfort of your couch, you can begin your home search. Visit some house showings and ask your real estate agent to arrange private viewings should any listings catch your eye. Going in with a positive mindset will help you find a property you can later customize to your own preferences, even though you might have a list of everything you want in a home. An antiquated kitchen, for instance, should not be a deal-breaker; rather, use it as an opportunity to personalize your culinary haven with new finishes as well as appliances that better fit your preferences.

#7. Make a Proposal

Your agent will assist you in creating a competitive offer if you locate a location that you think might be your future home. He or she will have an idea of how quickly homes are selling and how many are selling for more than they were originally listed for. Homes in Houston, for instance, that are in high demand frequently sell for 4% more than the asking price.

#8. Get a House Appraisal and Inspection.

Congrats if your offer is approved! But hold out on that. You must still ensure that it is a wise investment. A house inspection is your best line of defense. These usually cost a few hundred dollars, but they are very worthwhile: An expert house inspector is trained to identify issues with plumbing, roofing, electrical wiring, and other systems. The lender for your loan will also need an appraisal. It guarantees that the house is worth the money you intend to spend on it.

#9. Sign the Purchase Agreement and Obtain a Title Report.

Signing the contract is the last action in the house purchase process. This document will contain all the information about your acquisition, such as the price, the closing date, any repairs that will be required, and who will be accountable for which fees.

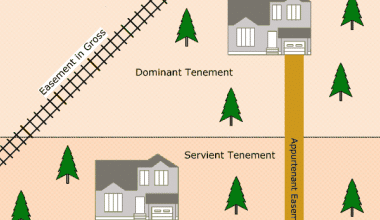

At this time, you ought to order a title report as well. Any outstanding liens or encumbrances on the property will be shown in this report. Before you buy a house, you should be aware of this since you would not like to be held liable for someone else’s mortgage.

#10. Complete a Final inspection of Your New Texas Home and Finalize the Deal

Your lender has provided you with a closing disclosure, the appraisal is finished, and the inspection results look good. It’s then time to perform one more walkthrough to make sure the seller has taken all of their possessions and that the house is prepared for your arrival. If you’re happy with the state of the property, move on to the closing.

Closings occasionally have a ceremonial air. You will be in a room with a few other people, including lawyers, lenders, agents, and frequently a notary, as you sign numerous pieces of paper and hand over numerous cheques. Your task is done once you’ve collected all those private autographs. In Texas, your house is formally yours.

Is Moving to Texas Worth it?

Texas is a hidden gem for young professionals because of its high quality of life and low cost of living. Zillow reports that the average rent in Texas is around $1,500, while the median property price is around $190,000. The sheer size of Texas means that there is an abundance of space for new development.

What City in Texas is the Cheapest to Live in?

The index found that Brownsville-Harlingen has the lowest cost of living in all of Texas. Brownsville-Harlingen had a 37% lower cost of living than Dallas-Fort Worth-Arlington. As of the year 2020, the population of the Brownsville-Harlingen metro region, the southernmost in Texas, was 421,017.

How Much Do You Have to Put Down on Property in Texas?

20%

For conventional financing of land, a 20% down payment is the norm. The length of time that you can fix your interest rate is variable (between 1 and 20 years). The mortgage interest rate for raw land will be different from the rate for a finished home.

How Much are Closing Costs in Texas?

What Do Closing Costs Typically Cost in Texas? Purchasers should expect to pay between 2% and 6% of the purchase price in closing charges in the Lone Star State. In most cases, the seller will pay between 6-10% of the purchase price (including real estate agent commissions).

What Credit Score is Needed to Buy a House in Texas?

620

In Texas, you need a credit score of at least 620 to qualify for a conventional loan, but there are still plenty of financing opportunities available to you if your score is lower than that. Keep in mind that mortgage companies evaluate more than just your credit history when deciding whether or not to provide you with a loan.

Conclusion

People from all over the world are making the move to Texas to take advantage of the state’s rich cultural offerings and wide range of housing alternatives in both rural and urban settings. The competition for purchasing the ideal property is likely to be fierce; but, there is something for everyone in Texas; all you need is some time, energy, and the assistance of a real estate professional to locate the perfect place to call home.

You can choose between a modest house or a mansion, depending on your budget. Now, all you need to do is check your money carefully and get everything in order before making a purchase.

Homebuying necessities including a down payment, mortgage program, and qualification standards must be kept in mind as well. So, your budget should account for all of these considerations.

Buying Property in Texas FAQs

What should I know about buying a home in Texas?

Texas home sales have increased dramatically in recent years, so you aren’t alone in your quest to purchase a new residence in the Lone Star State. Some areas, like Austin and Dallas, are incredibly competitive, with ordinary properties selling for much more than their list prices. You should be prepared to submit an offer immediately and to compete with numerous potential buyers, depending on the market you’re trying to break into.

What should I know before purchasing a home in Texas?

Sales of homes in Texas have been on the rise, so you aren’t alone in your desire to do so. Some places, like Austin and Dallas, have a lot of competition, and the average house sells for a lot more than what it was listed for. Depending on where you want to buy, you may need to be prepared to submit an offer immediately and compete with numerous other bids.

Related Articles

- How to buy a house in Texas

- How to get a business license in Texas: Step-by-Step Guide

- Minimum Wage in Texas: What is the Minimum Wage in Texas 2022

- TOP COMPANIES IN TEXAS IN 2022