After their widespread introduction in the early 2000s, the growth of exchange-traded funds (ETFs) was remarkable, and they continue to grow in number and popularity. The emergence of the investment vehicle has been beneficial to investors, as new low-cost opportunities for nearly every asset class in the market are now available. However, investors must now sift through over 5,000 ETFs that are currently available globally, which can be a daunting task for the weekend investor.

The purpose of this article is to help you understand the fundamentals of ETFs dividend stock and provide insight into how you can build an all-ETF portfolio in 2023.

Benefits of an ETF Portfolio

ETFs are baskets of individual securities, much like mutual funds but with two key differences. First, ETFs can be freely traded like stocks, while mutual fund transactions don’t occur until the market closes. Second, expense ratios tend to be lower than those of mutual funds because many ETFs are passively managed vehicles tied to an underlying index or market sector Read our article on Market Economy: Features, Examples, Advantages & Disadvantages. Mutual funds, on the other hand, are more often actively managed. Because actively managed funds don’t commonly beat the performance of indexes, ETFs arguably make a better alternative to actively-managed, higher-cost mutual funds.

The top reason for choosing an ETF overstock is instant diversification. For example, purchasing an ETF that tracks a financial services index gives you ownership in a basket of financial stocks versus a single company. As the old cliché goes, you do not want to put all your eggs into one basket. An ETF can guard against volatility (up to a certain point) if certain stocks within the ETF fall. The elimination of company-specific risk is the most appealing feature for most ETF investors.

Another advantage of ETFs is that they can provide a portfolio with exposure to alternative asset classes such as commodities, currencies, and real estate.

Selecting the Best ETF Portfolio

There are several considerations to consider when deciding which ETFs are ideally suited for your portfolio.

First, take a look at the ETF’s structure. A decision cannot be made based solely on the term. Several ETFs, for example, is comprised of water-related stocks. However, when the top holdings of each are examined, it is apparent that they approach the niche sector in very different ways. Although one ETF may be dominated by water utilities, another may be dominated by infrastructure stocks. Each ETF’s emphasis will result in a different set of returns.

Although past performance does not always predict future performance, it is useful to compare how similar ETFs have performed. While most ETF fees are low, keep an eye out for any significant variations in expense ratios, which may make ETFs more expensive than required.

Another thing to consider is the number of assets under administration. This is significant since an ETF with low levels can face liquidation, which is something investors want to avoid. Investors should also consider the bid/ask spread and the daily average price. Low volume also means low liquidity, making it more difficult to trade securities.

The Steps to Building an ETF Portfolio

If you’re thinking of building an ETF portfolio, here are some basic guidelines to follow:

Step 1: Determine the Appropriate Allocation

Consider your portfolio’s objective (e.g., retirement or saving for a child’s college tuition), your return and risk expectations, your time horizon (the longer it is, the more risk you can take), your distribution needs (if you need income, you will need to add fixed-income ETFs and/or equity ETFs that pay higher dividends), your tax and legal situations, your personal situation, and your risk tolerance. You may be able to do this yourself if you are knowledgeable about investments. If not, seek professional financial advice.

Finally, consider some market return results. Eugene Fama and Kenneth French’s research culminated in the creation of the three-factor model for analyzing market returns.1 The three-factor model states:

Market risk accounts for a portion of a stock’s return. (This means that because equities have higher market risk than bonds, they should outperform bonds over time.)

Because value stocks are inherently riskier, they outperform growth stocks over time.

Small-cap stocks outperform large-cap stocks over time because they have more un-diversifiable risks than large-cap stocks.

As a result, investors with a higher risk tolerance can and should allocate a large portion of their portfolios to small-cap, value-oriented equities.

Remember that allocation, rather than security selection and timing, determine more than 90% of a portfolio’s return. Try not to time the economy. Timing the market is not a winning strategy, according to research.

Once you’ve determined the best allocation, you’re ready to put your strategy into action.

Step 2: Put Your Strategy Into Action

The great thing about ETFs is that you can choose one for each sector or index to which you want exposure. Examine the available funds to see which ones will best meet your allocation goals.

Because timing is critical when buying and selling ETFs and stocks, placing all buy orders on the same day is not a wise strategy. Ideally, you should scan the charts for support levels and try to buy on dips. Purchases should be phased in over a three to six-month period.

Many investors would place a stop-loss order at the time of purchase to reduce future losses. Ideally, the stop-loss should be no more than 20% below the original entry price and should be adjusted upward as the ETF’s price rises.

Step 3: Track and Evaluate

Review the output of your portfolio at least once a year. For most investors, depending on their tax situation, the best time to do this is at the start or end of the fiscal year. Compare the output of each ETF to that of its benchmark index. Any discrepancy, known as tracking error, should be minimal. If it isn’t, you may need to replace the fund with one that invests more in line with its defined style.

Align your ETF weightings to account for any imbalances caused by market fluctuations. Avoid overtrading. Most portfolios should be rebalanced once every three months or once a year. Also, don’t be discouraged by market volatility. Maintain the initial allocations.

Examine your portfolio in light of changes in your circumstances, but keep a long-term outlook in mind. As the conditions alter, so will your allocation.

Building an all ETF Portfolio

If you want to build a portfolio entirely of ETFs, make sure to include a variety of asset classes to ensure diversification. As an example, you might begin by concentrating on three areas:

#1. Sector ETFs

These are ETFs that focus on particular industries, such as finance or healthcare. Select ETFs from diverse industries that are largely uncorrelated. Choosing a biotech ETF and a medical device ETF, for example, would not be true diversification. The inclusion of sector ETFs should be focused on fundamentals (the value of the sectors), technicals, and the economic outlook.

#2. International exchange-traded funds (ETFs)

They invest in all countries, from developing markets to developed markets. International ETFs can monitor an index that invests in a single country, such as China, or a region, such as Latin America. The decision, like that of sector ETFs, should focus on fundamentals and technicals. Take a look at the composition of each ETF in terms of individual stocks and sector allocation.

#3. Commodity exchange-traded funds (ETFs)

These are an integral part of every investor’s portfolio. ETFs or their cousins, exchange-traded notes, may be used to track anything from gold to cotton to corn (ETNs). Generally, Investors who believe they are knowledgeable enough may choose ETFs that monitor specific commodities. Individual commodities, on the other hand, can be extremely volatile, so a large commodity ETF might be better suited to your risk tolerance.

One wise way to start your quest for the best dividend-paying ETF in 2023 is to first define your dividend requirements and how they fit into the “big picture” of your investment portfolio and objectives. You may then consider specific characteristics such as high yield, low expenses, and investment style.

It’s also a good idea to consider how ETFs function and which investment accounts are best for ETF investing. Before diving into the list of best dividend ETFs in 2023, learn the fundamentals to ensure they’re a good fit for you and your investment needs.

Best Dividend ETFs to Add to Your Portfolio in 2023

We also included funds with a variety of goals and styles in this list of the best dividend ETFs of 2023. To put it another way, these ETFs aren’t exactly the ones with the highest dividend yields.

With that in mind, and in no particular order, here are some of the best dividend ETFs to consider purchasing in 2023.

Vanguard High Dividend Yield Investing (VYM)

Vanguard’s Dividend ETF monitors the FTSE High Dividend Yield Index. As of November 2019, the fund held nearly 400 stocks with high dividend yields.

Vanguard Dividend Growth Fund (VIG)

Investors who want to hold a basket of stocks from companies that have a track record of which dividends should consider purchasing an ETF such as Vanguard’s Dividend Appreciation fund. This ETF monitors the Nasdaq U.S. Dividend Achievers Select Index (previously known as the Dividend Achievers Select Index), which includes approximately 182 dividend stocks.

This BlackRock dividend ETF tracks an index of approximately 90 stocks that have paid dividends over the past five years.

HDV is a dividend ETF that offers exposure to approximately 75 dividend-paying U.S. stocks that, according to parent company BlackRock, “have been tested for financial health.”

Invesco Zacks Multi-Asset Income

Investors who don’t mind paying higher expenses in exchange for higher yields may be interested in this ETF. The fund is based on the Zacks Multi-Asset Index, which includes 149 dividend-paying stocks.

Financial Portfolio Invesco KBW High Dividend Yield (KBWD)

Invesco’s dividend ETF achieves its high yields by focusing the portfolio on stocks of financial firms. The cost ratio is extremely high, at 1.58 percent, but the current SEC 30-day yield is also extremely high, at 12.93 percent.

ALPS Sector Dividend Dogs (SDOG)

Investors interested in receiving dividends from “Dogs of the Dow” stocks should consider adding SDOG to their portfolio. SDOG is based on the S-Network Sector Dividend Dogs Index, which begins with the S&P 500 index and then screens at the sector level to produce a diverse mix of dividend stocks.

SPDR S&P Dividend ETF (SDY)

This dividend ETF, one of only a few to receive a five-star ranking from Morningstar, is one of the best funds with fair fees that cover a broad range of dividend stocks. SDY monitors the S&P High Yield Dividend Aristocrats Index, which includes more than 100 dividend stocks.

WisdomTree U.S. SmallCap Dividend Fund

Diversifying away from the traditional large-cap dividend ETF and adding a good small-cap dividend ETF to the mix makes sense from time to time, and DES is one of the best ETFs to accomplish this task. The WisdomTree SmallCap Dividend Index is tracked by DES.

Dividend on Schwab US Equity (SCHD)

Investors seeking low-cost exposure to top-paying dividend stocks in the United States should consider SCHD. The fund is based on the Dow Jones U.S. Dividend 100 Index, which features some of the most dividend-paying stocks in the United States.

Please keep in mind that these are just suggestions for areas to work on. It all depends on your tastes.

Robo-advisors, which are becoming increasingly common, often build all-ETF portfolios for their clients.

How do I determine my investment goals and risk tolerance for my ETF portfolio?

Determining your investment goals and risk tolerance involves considering factors such as your time horizon, investment objectives, and financial situation. It’s important to have a realistic understanding of these factors to help guide your investment decisions.

How often should I rebalance my ETF portfolio?

The frequency with which you rebalance your ETF portfolio depends on your investment goals and strategy. Some investors choose to rebalance their portfolio on a regular basis (e.g., annually or quarterly), while others choose to rebalance only when certain asset allocations have become significantly imbalanced.

What is the impact of taxes on an ETF portfolio?

The impact of taxes on an ETF portfolio depends on the individual investor’s tax situation and the specific ETFs held in the portfolio. Some ETFs are more tax-efficient than others, so it’s important to consider the tax implications of any investment decisions.

How much should I invest in an ETF portfolio?

The amount you should invest in an ETF portfolio depends on your individual financial situation and investment goals. A financial advisor can help you determine the right amount to invest based on your specific circumstances.

How do I manage the risk in my ETF portfolio?

Managing risk in an ETF portfolio involves a combination of diversification, regular rebalancing, and careful selection of ETFs based on your risk tolerance and investment goals.

What is the impact of market volatility on an ETF portfolio?

Market volatility can have a significant impact on an ETF portfolio, but a well-diversified portfolio and a long-term investment strategy can help to mitigate the effects of short-term market fluctuations.

ETF Portfolio FAQs

How much of my portfolio should be ETFs?

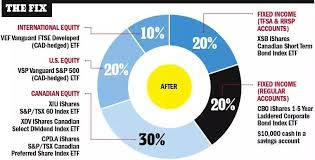

According to Vanguard, international ETFs should make up no more than 30% of your bond investments and 40% of your stock investments. Sector ETFs: If you’d prefer to narrow your exchange-traded fund investing strategy, sector ETFs let you focus on individual sectors or industries.

Are ETFs good for beginners?

Exchange-traded funds (ETFs) are ideal for beginner investors due to their many benefits such as low expense ratios, abundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

Do ETFs pay dividends?

ETFs payout, on a pro-rata basis, the full amount of a dividend that comes from the underlying stocks held in the ETF. … An ETF pays out qualified dividends, which are taxed at the long-term capital gains rate, and non-qualified dividends, which are taxed at the investor’s ordinary income tax rate.

Can you day trade with ETF?

In addition to stocks, exchange-traded funds (ETFs ) have emerged as another instrument of choice for day trading. They offer the diversification of a mutual fund, the high liquidity and real-time trading of a stock, and low transaction costs.

In conclusion

Markets and individual stocks will experience ups and downs over time, but a low-cost ETF portfolio can reduce uncertainty and help you meet your investment objectives.