Your checking account has other purposes apart from checks. They can be used to set up direct deposits and also automated payments. For example, you can use your check to set up automatic transactions online, all you need to do is void the check. you can also use a Chase or Wells Fargo voided check to set up direct deposits with your employer.

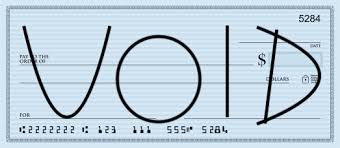

A voided check is simply a paper check with the word VOID written on it. If you want to present a voided check, all you have to do is pull out a check and write VOID boldly on it. You should take care, not to write over the basic information needed by the bank. By voiding a check, you are rendering it unfit to make any transactions and only useful for providing your account information. That’s why banks do request a voided check instead of a blank one.

How to Get a Voided Check

Voiding a check is quite easy. If you have a checkbook, you can draw out a check and write the VOID on it. The word should be written wide enough to cover the blank spaces in the check, making sure not to cover the account information on the check. It should be written with a marker or pen to make the word bold and visible. That way, no one can be able to erase it.

However, if you don’t have a check, you can visit any of your bank branches and ask for a counter-check. The bank teller might be able to print a check with your account information on it. You can then void the check the same way you will the one from your checkbook.

To keep your account secure, it is best not to sign your voided check. And if you must send it via email, you should send it as an encrypted pdf, so that no third party will have access to it.

Why Void A Check?

Here are some of the instances where you’ll need a voided check.

#1. Setting up direct deposits

If you want to set up direct deposits with your employer, you’ll need to provide a voided check. this is to ensure that your bank account number and routing number that is needed to process your request are accurate.

#2. Setting up automatic transactions online

Most times, you will need a voided check to set up automatic transactions like loan payments, rent and utility bills payments, and phone bills. Oftentimes, you can earn a better rate by using automatic payments, which makes the effort worthwhile.

#3. Authorizing a government agency to direct deposit your benefits

You can use your voided check to set up a direct deposit with a government agency to send your benefit payments to your account electronically. you won’t be charged for direct deposits. you can as well choose to have your tax refund sent by direct deposit.

#4. Correcting mistakes

If you make a mistake when writing a check, the best way to correct the mistake is to void the check. However, you must note that you can only void the check before it is presented for payment at the bank. You’ll have t contact your bank if you want to cancel a payment that has already been requested from your bank.

Voided Checks for Direct Deposits

Direct deposit is a way that employers, government institutions, and other agencies pay you electronically using your bank account information. It is simple and cost-effective and only requires your bank account number and your routing number. Hence, the need to present a voided check to present this information. Some payments that qualify for direct deposit include a paycheck from your employer, and benefits from government agencies such as pensions, retirement funds, and unemployment checks. They can also include investment income, such as profits from deposit certificates, mutual funds, and annuities.

Chase Voided Check

You can set up direct deposits with your employers using your Chase voided check. The following are steps you can take to achieve that:

#1. Log in to your Chase account online or via the mobile app.

#2. Go to “Account Services”, click on “Set up direct deposit form” and download the Chase direct deposit form.

#3. Take the form and a Chase voided check to your employer’s payroll department. The voided check contains your chase bank account number and routing number. The routing number is a nine-digit code that identifies your bank, and each bank has its unique routing number.

#4. Your employer will deposit your paycheck into your bank account. However, your direct deposit may take effect after about two pay cycles.

#5. Check your monthly account statement or log in to your account online to know when the direct deposit begins, and then monitor the payment. You can sign up for alerts to notify you when the direct deposit begins.

Note that Chase can process your direct deposits on the same day they are made, but the funds will be made available on the next business day.

Read Also: CASHIER’S CHECK SCAMS: How to Identify a Fake Cashier Check

Voided Check Wells Fargo

As with Chase, you can also set up direct deposits using a Wells Fargo voided check. Follow the steps below:

#1. Log in to your Wells Fargo account and select the account you want to use for the direct deposits. Wells Fargo will automatically enter your account number and routing number in the direct deposit form.

#2. Alternatively, you can download the blank direct deposit form and enter your account information. You can find your routing number printed after your account number at the bottom of your check.

#3. Print out the completed form and take it together with a Wells Fargo voided check to your payroll department to process your request.

#4. Verify that the direct deposit has taken effect. it normally takes up to two pay cycles to take effect. You can sign up for alerts to notify you when the direct deposit takes effect. You can also log in to your account to monitor payments.

Wells Fargo does process direct deposits the same day they receive them. However, if they receive the deposit on a non-business day, your account will be credited on the next business day.

Read Also: WHAT IS DIRECT DEPOSIT? How It Works

Alternatives to a Voided Check

Oftentimes, a voided check can be the simplest way to approve direct deposits or automatic payments. However, if you don’t have a checkbook or you don’t want to void your check, you’ll have to find an alternative means of providing your account information.

In place of a voided check, you can use any one of these means:

- A direct deposit authorization form. You should be careful not to make any mistakes when entering your bank routing number and account number into this form.

- You can go to your bank and request a counter-check. That is if your bank offers one. A counter check is a blank paper similar to a standard check, and you void it in the same way you would a normal check. This check is often presented at a counter, hence the name.

- You can also use a deposit slip that has your banking information preprinted on it. Deposit slips you get in the bank might not contain your banking information. However, your checkbook might contain some printed deposit slips that contain your information.

- If you have a photocopy of a cleared check or deposit slip for your account, you can use it to process your requests.

The option you use depends on what your bank or recipient requires, and then your personal preference.

What is an Example of a Voided Check?

For instance, an employee may submit a check to their employer in order to initiate direct deposit payroll. This check may have been issued in error, contain illegible handwriting, or be a test payment. The void check is never paid in any of these situations.

Can I get a Voided Check from my Bank?

Yes, you can. Visit your local bank and inquire about getting a counter-check. You can have it printed, then cross out the information before handing it over to your potential new boss.

How do you get a Voided Check without going to the Bank?

A voided check can be obtained from any financial institution without your involvement. Simply remove the check from your stack and mark it “VOID.” The word “VOID” should be large and dark enough that the check cannot be cashed, but it need not cover the entire check.

Is a Voided Check Necessary?

It is standard practice for employers to request a voided check from employees in order to initiate a direct deposit.

Is Voided Check same as Blank Check?

The word “void” is printed in large letters across the front of a canceled check. To prevent any accidental use, it is usually printed in big, bold letters. Having a check voided prevents it from being used as a blank check.

What can I Submit instead of a Voided Check?

In the absence of a voided check, a letter from your bank or a current statement will do. The correct answer must be provided for each account in order to prove ownership. An official bank letter features the bank’s name, complete routing and account numbers, and the representative’s signature.

How much does it Cost to Void a Check?

The maximum fee for putting a stop payment on a check is $35, and it will remain in effect for 24 months. If the stop payment must be renewed after 24 months, an additional fee will be assessed. Some consumer accounts offer a stop payment fee discount.

Conclusion

There are many instances where you’ll need to provide a voided check. If you want to set up automatic payments, for example, you’ll need to provide a voided check to process it. Also, if you made a mistake in filling out a check, you can void it to prevent any transaction with the check. This is especially important to protect your account from fraudsters. You also use a voided check when you want to set up direct deposits with your employer. This will save you the stress of having to drive down to the bank to deposit money into your account.

We have shown you that it is actually easy to void a check. All you need to do is detach a check from your checkbook and write the word VOID across it. The word should be big enough and dark enough so that it can’t be erased. Also, you should make sure not to write over your bank account number and routing number.

- BACK OF CHECK: How to Sign, What to Write & Wrong Endorsement Solutions

- Cash Flow Statement Direct Method: Overview, Examples, Pros & Cons

- SBA Loan Rates: All you need, Updated!

- BANK ACCOUNT BALANCE: 5 ways to spot Fake Account Balance Prank Easily (+ Quick Tips)

- Insufficient Funds: A Definitive 2023 guide {updated}