A prolonged drop in prices, known as deflation, can be much more damaging to an economy. The Fed aims for a positive rate of inflation, which is defined as an increase in the overall level of prices for goods and services. The central bank’s ability to decrease rates in reaction to a slowdown in the economy is also made possible by the positive levels of inflation and interest rates. This article will shed light on how the inflation rates of an economy affect your interest rates, and when it does affect it, we will know the numerous effects inflation can have on your interest rates, why the rates rise due to the inflation rates, what happens later, and lastly, how does a rising interest rate help inflation?

How Does Inflation Affect Interest Rates?

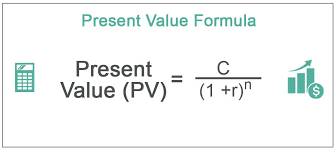

First, before we dive into the details of how inflation affects interest rates, I want us to look into the meaning of inflation and interest rates independently. The cost of borrowing money is what we call an interest rate. On the other hand, inflation is the rise in the price of goods and services across a country’s economy.

However, current interest rates fluctuate, and different types of loans have varying rates. For instance, if you’re a lender, a borrower, or both, it’s critical that you understand why these changes and disparities occur from time to time. They also have a significant impact on the rare metals market, which includes silver stocks. The actions that you take in reaction to rising inflation are very vital, and the total of these actions in order to avoid inflation is presently at 9%, and we are also expecting it to rise higher in the autumn. This is because we are already expecting price hikes to continue through 2023.

Understanding How Inflation Affects Interest Rates

The popular and confusing question now is why, then, should rising inflation affect interest rates? Understanding the connection between the two will aid in increasing your money. However, when you want to check if rates are rising, you need to examine whether the price of a basket of products has been increasing or decreasing over the past year. The consumer price index (CPI), which measures inflation, was at 9% on the 31st of April 2022. They were able to arrive at this result simply by selecting about 180,000 products and services that are based on what customers normally purchase.

The consumer price index (CPI), the most generally used indicator of inflation, is used to plug the overall price of this “basket” of commodities. This is because people’s likings and spending habits fluctuate over time. The virtual basket is reassessed every year.

The Effects of Inflation

Inflation is described as a long-term increase in the general level of prices in the economy. It has a disproportionately unfavorable impact on economic decision-making and lowers purchasing power. It does, however, have one positive effect, which is that it prevents deflation. The ways inflation can have possible effects on our business are our focus in this part of the post.

However, it’s worth noting that these consequences or effects will be influenced by the rate of inflation. A rate of 2%, for example, will not have the same impact as a rate of 100% every year. As a result, we’ll focus on the consequences of extended and persistent inflation rates above 2%.

#1. Money Depreciates in Value

Money loses its worth as goods prices rise. This is one of the effects of inflation. For example, due to inflation, if you put $1 under your pillow for 10 years, you won’t be able to buy as much as you could today.

When we compare the value of the US dollar from 1980 to 2019, we can see that it has lost more than half of its worth. In other words, a dollar today can buy half as many products and services as it could 30 years ago. So, if you put $1,000 beneath your bed in 1980, it’s now worth less than $500.

#2. Inequality

Inflation primarily has numerous effects on low-income households. This is because they spend most of their earnings. Therefore, price hikes typically eat away more of their earnings. When the cost of basic essentials such as food and clothing, for example, rises, the poor have little choice but to pay.

Hence, inequality rises as wealthier people amass more assets. They have more real estate, stock, and other assets. This means that when inflation happens, these assets rise in value ahead of everyday items like bread, milk, eggs, and so on. As a result, they end up with greater wealth than before, allowing them to purchase more goods and services. Low-income households, on the other hand, are forced to spend more just to get by.

#3. Deflationary Pressures are Reduced

In order to satisfy its goals of stable prices and maximum employment, the Federal Reserve aspires to long-term inflation of 2%. It aims for modest inflation rather than stable prices because a slightly positive inflation rate greases the wheels of commerce, gives a margin of error if inflation is underestimated, and deters deflation, which is significantly more destabilizing than similar inflation.

Inflation permits lenders to charge interest to compensate for the likelihood of repayments depreciating in value as a result of inflation. Borrowers can potentially benefit from inflation by making future repayments with inflated currency. Deflation, on the other hand, makes servicing debt more expensive in real terms because borrowers’ income is likely to decrease.

#4. Intensifies Interest Rate Hikes

As the instances above show, governments and central banks have a strong interest in keeping inflation under control. Monetary policy has been used to manage inflation in the United States and around the world. When inflation effects threaten to surpass a central bank’s target (usually 2% in industrialized economies and 3% to 4% in emerging economies), authorities might raise the minimum interest rate, increasing borrowing costs throughout the economy by restricting the money supply.

#5. It Boosts Growth and Employment

In a short term, higher inflation can lead to stronger economic growth in the short run. While the 1970s are remembered as a decade of stagflation, between 1970 and 1979, the United States’ real Gross Domestic Product (GDP) increased by 3.2 percent annually on average, much above the economy’s average growth rate since.

Inflationary pressures discourage saving since it erodes the buying value of savings over time. Consumers and businesses alike may be enticed to spend and invest as a result of this promise.

#6. It Can Lead To Excruciating Recessions

The problem with the inflation-unemployment trade-off is that long-term acceptance of greater inflation to safeguard jobs may raise inflation expectations to the point where they trigger an inflationary spiral of price hikes and wage increases. The Federal Reserve was compelled to boost interest rates significantly higher and maintain them high for longer in order to recoup lost confidence and persuade everyone that it could control inflation. As a result, unemployment increased and was higher for longer than it would have been had the Fed not permitted inflation to spiral out of control.

Why Do Interest Rates Rise?

Rising interest rates serve to cool down an overheated economy by dampening consumer spending, resulting in lower demand for goods and services and lower prices. Interest rate levels will be affected by inflation. The higher the rate of inflation, the more likely interest rates will rise. (Clubdeportestolima)

Interest can thus be viewed as both an expense and a source of income for one organization. It can indicate the opportunity cost or missed opportunity of keeping your money under your mattress as cash rather than lending it.

Furthermore, if you borrow money, the interest you must pay may be less than the cost of foregoing the ability to access the money right now. Some of the factors that cause why interest rates to rise include;

#1. Inflation

Interest rate levels will be affected by inflation. The higher the rate of inflation, the more likely interest rates will rise. This happens because lenders will demand higher interest rates in order to compensate for the eventual loss of buying power of the money they are paid.

#2. Demand vs. Supply

Interest rates are determined by the supply and demand of credit ie., a rise in the demand for money or credit raises interest rates, while a fall in the demand for credit lowers them. In contrast, a rise in credit supply lowers interest rates, while a reduction in credit supply raises them.

#3. Government

The government has a say in what happens to interest rates. The Federal Reserve of the United States (the Fed) frequently makes statements about how monetary policy will affect interest rates.

The federal funds rate, or the rate at which banks charge each other for extremely short-term loans, has an impact on the interest rates that banks charge on the money they lend. This rate eventually finds its way into other short-term loan rates. The Federal Reserve affects these rates through “open market transactions.”

What Happens When Interest Rise

The purpose of raising the federal funds target rate is to raise the cost of credit throughout the economy. Higher interest rates make loans more expensive for both firms and consumers, resulting in increased interest payments for everybody.

Those who cannot or do not wish to make the additional installments may postpone projects requiring financing. It encourages people to save money in order to earn bigger interest payments. This reduces the amount of money in circulation, which tends to cut inflation and limit economic activity—in other words, chill the economy. Here is a list of what typically happens when interest rise. They include

#1. Stock Market Effects

When rising interest happens, higher interest rates rise in most markets, and might be detrimental to the stock market. When the Federal Reserve raises interest rates, the cost of borrowing money rises for public (and private) enterprises. Higher costs and fewer businesses may result in reduced revenues and profitability for public companies over time, affecting their growth rate and stock values.

#2. Savings Accounts and Bank Deposits are Affected

While increased interest rates may be detrimental to borrowers, they are beneficial to everyone with a savings account. The fed funds rate serves as a benchmark when the interest rate rises for yearly percentage yields on deposit accounts (APYs). When the Federal Open Market Committee raises interest rates, banks respond by boosting the amount you earn on your deposit accounts. As a result, the APYs on savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts are all increasing.

#3. Bond Effects

Interest rate rises happen, and they typically have a significant impact on bonds. When the Fed raises interest rates, the market price of existing bonds drops instantly. This is because new bonds will soon be available on the market that will pay greater interest rates to investors. Existing bonds will lose value as a result of the higher overall rates, making their comparatively lower interest rate payments more tempting to investors.

#4. Consumer Credit Effects

Personal loans, lines of credit, and credit cards all respond more slowly when the Fed rate hike happens to them in form of an interest rise than other types of credit.

Because variable rate loans are based on benchmarks that reference the fed funds rate, they are particularly vulnerable to fed rate changes. New fixed-rate loans can increase interest rates, while current fixed-rate loans do not affect any changes in the federal funds rate.

How Do Rising Interest Rates Help Inflation?

Interest rates rise about three-quarters of a percentage point at the Federal Reserve. The nation’s central bank, also known as “the Fed.” The move comes as the government announced new consumer price index figures showing that annual inflation slowed in April. The index did, however, rise at an annual pace of 8.3 percent, while the Bureau of Labor Statistics reported last Friday that inflation surged 8.6 percent from a year ago, the fastest rate since 1981.

One of the ways rising interest rates help fight inflation is that borrowing becomes more expensive at higher rates, which encourages people to save. Another way rising interest rates help inflation is that when debt becomes more expensive, it has an impact on consumer demand for products and services, as well as corporate investment and hiring plans. When demand exceeds supply, this can help to lower inflation.

Inflation is skyrocketing. They help interest rates by raising the prices and rates of bonds and stocks, which have fallen dramatically due to inflation. There are numerous forecasts about a probable recession. Clearly, everyone who has saved or invested money—or is considering doing so—is facing a difficult time. The Federal Reserve’s key economic objectives are to promote maximum employment, maintain price stability, and maintain moderate long-term interest rates. In general, the central bank strives to keep annual inflation below 2%, a figure that had lagged prior to the pandemic.

Why does increasing interest rates decrease inflation?

To combat inflation, the central bank’s one main instrument is raising interest rates, which it does by increasing the cost of borrowing money in order to reduce demand for goods and services. Later, economists will be able to assess the success or failure of the Fed’s actions.

Do interest rates go up or down with inflation?

The Federal Reserve normally boosts interest rates to slow the economy and lower inflation when it is out of control. The Federal Reserve normally reduces interest rates to boost the economy and raise inflation when it is too low.

Do interest rates go up when inflation increases?

Interest rate levels will also be impacted by inflation. Interest rates are more likely to increase the greater the inflation rate. This happens as a result of the fact that lenders will demand higher interest rates in order to make up for the declining purchasing value of the money they will eventually be paid.

Why increase interest rates when inflation is high?

Interest rates may increase if the base rate does. People may be encouraged to borrow less and save more as a result of the increased cost of borrowing money and the increased return on savings. As a result, fewer people will be in need of some goods and services, which could cut inflation.

What causes interest rates to rise?

Because of the increase in inflation, interest rates are increasing. The Federal Reserve boosts interest rates in an effort to stifle economic expansion and return inflation to desirable levels.

What are the 4 factors that influence interest rates?

Interest rates are influenced by the supply and demand of money, government borrowing, inflation, and the Central Bank’s monetary policy goals.

Conclusion

Currently, most countries of the world are facing a high rate of inflation rates due to the effects of the covid 19 pandemic. However, not all inflation is negative, and you already know from this post how positive inflation rates can be. Likewise, you already know the effects of inflation on interest rates, including why rates generally rise, how rising interest rates help inflation, and what happens when interest rates rise.

FAQs

How does inflation affect interest rate risk?

The Timing of a Bond’s Cash Flows and Interest Rates

If market participants believe that there is higher inflation on the horizon, interest rates and bond yields will rise (and prices will decrease) to compensate for the loss of the purchasing power of future cash flows.

Why does inflation go down when interest rates go up?

Because higher interest rates mean higher borrowing costs, people will eventually start spending less. The demand for goods and services will then drop, which will cause inflation to fall.

What happens when inflation affects interest rates?

An overall rise in prices over time reduces the purchasing power of consumers since a fixed amount of money will afford progressively less consumption. Consumers lose purchasing power whether inflation is running at 2% or at 4%; they just lose it twice as fast at the higher rate