Break even point is a point where the entire cost and selling price are equal, and the firm makes no profit or loss. The business’s income and expenditure are exactly equal at this moment. When total costs are recovered, this point is also known as the minimal point of production. To calculate break even point is vital to the success of any business.

The amount of activity at which total income equals the sum of all variable and fixed costs is known as the break-even point. The activity can be measured in terms of unit sales or dollar sales. The point at which there is no profit or loss is known as the break-even point.

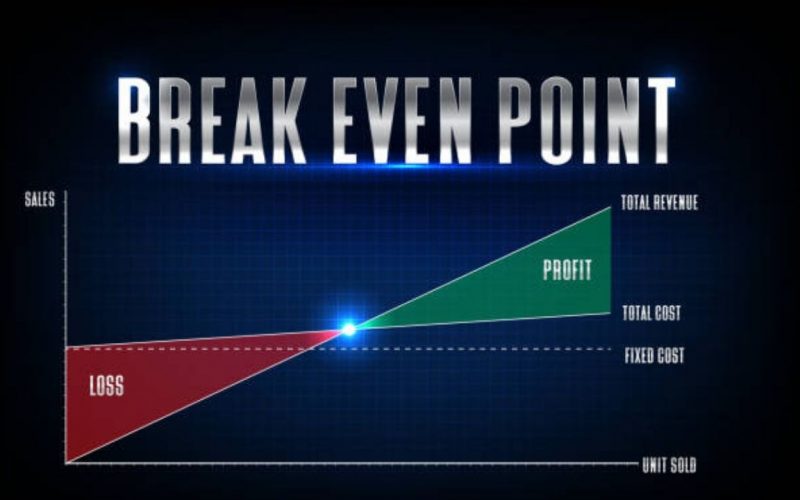

The break-even point can be estimated for a full company or for specific projects or activities carried out by an organization. A loss occurs when sales fall below the break-even point. Profits begin when sales exceed the break-even point.

The main goal of a break-even point study is to figure out how many units of a product must be sold in order for a business to break even. In other terms, the break-even point is the point where there is no profit and no loss.

In this article, you will learn what Break-Even Point is, how to calculate break even point, and how to determine break-even points using diverse methods.

What Is the Break Even Point?

The point at which a company’s revenues equal its costs is called the break even point. The break-even point can be calculated in one of two ways: one is by calculating the number of units that must be sold, and the other is by calculating the number of sales that must be made in dollars.

A company calculates break even point to determine when it, or one of its products, will become profitable. A corporation is operating at a loss if its revenue is less than the break even point. If it’s higher than that, it’s profitable.

The first time you hit a break-even point, your business usually takes a good turn. You’ve finally made enough money to cover your operational costs when you reach break-even.

You can use your break-even point to see if you need to do one or both of the following:

- Boost your prices.

- Cost-cutting

You’re losing money if your revenue is less than the break-even point. However, if your revenue exceeds the point, you have made a profit.

Calculate break even point to know how much you need to sell to pay your costs or generate a profit using the break-even point. Also, keep an eye on your break-even point to aid in budgeting, cost control, and deciding on a pricing plan.

There are a few simple break-even point formulas that might assist you in calculating your business’s break-even threshold. The first is based on the number of product units sold, while the second is based on points in sales dollars.

Here’s how to figure out your break-even point:

How to Calculate Break even Point Based on Units:

Subtract the variable cost per unit from the fixed cost per unit. Fixed costs are those that remain constant regardless of how many units are sold. The price at which you sell the product, minus costs that change, like labor and materials, gives you the amount of money you make.

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

When Determining a Break-even Point Based on Sales:

Divide the contribution margin by the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

What are the Factors that Affect Break-even Point?

Break-even is affected when:

- The sum of the company’s fixed expenses has grown.

- The variable costs or expenses per unit have gone up.

- There has been a drop in the company’s asking price.

- A shift toward less profitable product combinations in sales

Why is it Called Breakeven Point?

The break-even point (BEP) in economics and business, notably cost accounting, is the point at which cost or expenses and income are equal: there is no net loss or gain, and one has “broken even.”

How to Calculate Break Even Point ( Synonym: Calculate Break Even Point)

Calculate break even point by estimating a full company or for specific projects or activities carried out by an organization.

The main goal of a break-even point study is to figure out how many units of a product must be sold in order for a business to break even. In other terms, the break-even point is the point where there is no profit and no loss.

A loss occurs when sales fall below the calculate break even point. Profits begin when sales exceed the break-even point.

The Formula for Calculating Break even

We know that profit is equal to sales revenues minus expenses, which include both variable and fixed costs.

Profit = Sales revenue – variable costs – fixed costs

where sales revenue at break-even point = Fixed Cost + Variable Cost

The equation can be represented as follows:

Profit = (unit sales price x sales volume in units) – (unit variable cost x sales volume in units) – fixed costs

How Calculate Break-even Point Method

Here are ways to calculate break even point:

- The Algebraic/Equation method

- Contribution margin method or Unit Cost Basis

- Budget Total Basis

- Graphical presentation method ( Break-even chart or CVP graph)

>. The Algebraic/Equation method:

The following equations are key in finding the break-even point as per the algebraic method.

SP = VC + FC where SP = Sales Price, VC = Variable Costs, FC = Fixed cost

SP – VC – FC = 0 (Break-even Point)

>. Contribution margin method or Unit Cost Basis

C.M = SP – VC

Use the following formula to calculate the break-even point in sales units:

B.E Point = Fixed Costs / C.M per unit

>. Budget Total Basis

Brek-even Point = Total Fixed Cost X (Sales / Contribution Margin)

>. Graphical presentation method ( Break-even chart or CVP graph)

How to Calculate Break even Sales

Fixed Costs ÷ Contribution Margin

Fixed Costs

Contribution Margin

The difference between a product’s price and its product expenses is known as the contribution margin.

The calculation is as follows:

(Sale price per unit – Variable costs per unit)/Sale price per unit

What Happens to the Breakeven Point If Sales Change

What happens if your sales fluctuate? If the economy is in a slump, for example, your sales may suffer. If sales decline, you may find yourself unable to reach your breakeven point.

What options do you have in this situation? If you look at the breakeven calculation, you can see that there are two options for dealing with this problem: either raise your product’s price or discover ways to reduce your fixed and variable costs.

Calculate Break Even Quantity

Breakeven quantity is the number of additional units sold to pay the cost of a marketing program or other sort of investment. If the company does not sell the BEQ equivalent as a result of the investment, it will lose money and will not repay its costs.

If the corporation sells more than the BEQ, it has not only recouped its investment but has also generated a profit.

How Do You Calculate Break even Quantity?

To figure out break-even quantity, start by setting up an equation where Total Revenue = Total Costs, which will mathematically represent the point at which profit is equal to zero, i.e., where you will break even, Then you must find a unit quantity that equalizes both sides of the equation (your break even quantity).

However, because the number of units sold influences both the firm’s revenue and the costs it must incur to earn it, the break even will be present on both sides of this equation. The selling price per unit multiplied by the number of units sold equals revenue.

Calculate Break Even Price

The break-even price for your product is the lowest price that will cover your fixed costs at a certain volume of sales.

Break Even Sales Price = (Total Fixed Costs/Production Volume ) + Variable Cost per Unit

The expenses that must be paid regardless of sales level are known as fixed costs. Rent, utilities, insurance, office salaries, licensing, accounting fees, and advertising are all examples of these costs. These costs are usually consistent independent of the volume of production and sales.

The costs of making a product are known as variable costs. Materials, direct labour, and supplies would all go into this category. These prices fluctuate based on the product and how it is sold, as their name suggests. A sales volume greater than the break even point will result in a profit at a given price.

What is a Good Break-even Point?

The question is, at what point do you stop losing money?

When your business’s expenses are exactly equal to its revenues, you have reached the break-even point. Simply put, you have reached “breakeven,” or the point at which the costs of producing a product are equal to the profits it generates.

What Causes Breakeven to Decrease?

Any of the following will bring about a lower break-even point: Reducing the total amount of ongoing expenses. decreasing variable costs or expenses per unit produced. Raising prices without a corresponding drop in revenue.

Break-even Point Calculator

Calculating break-even point is an essential part of most business plans, especially for new startup businesses to ensure the business does not fail. You can calculate break even point by using a break-even point calculator to estimate your company’s profit, the number of units you need to sell to break even, and the amount of revenue you need to generate to cover your fixed and variable costs.

Why is Break-even Analysis Used?

Break-even analysis, in its most basic form, is used by both business owners and investors to ascertain the moment at which they will see a return on their initial investment in a company or a new product or service.

What is Break-even Analysis Advantages?

There are numerous advantages to using break-even analysis in business. One of them is that it shows how many items need to be sold to break even. That’s how you know if a product is safe to buy or not.

What Is the Formula of Break-Even Point?

Here is the formula for calculating the break-even point:

Break-even point= Fixed Costs ÷ Contribution Margin

Conclusion

Your overall sales equal your whole expenses when your business reaches the break-even point. This means you’re taking in the same amount of money as you need to meet all of your expenses and manage your company.

The first time you calculate the break-even point and have a positive result, your business usually takes a good turn. You’ve finally made enough money to cover your operational costs when you reach break-even.

FAQs on how to Calculate Break-even Point

How do you calculate break-even point in sales?

Divide fixed costs by revenue per unit minus variable cost per unit to find the break-even threshold based on sales. Fixed costs are those that remain constant regardless of how many units are sold. The revenue is the price at which you sell the product less variable costs such as labour and materials.

Why we use break-even analysis?

Simply put, break-even analysis helps you figure out when your firm – or a new product or service – will start to make money, and it’s also used by investors to figure out when they’ll recoup their investment and start generating money.

What is the formula to calculate sales?

The revenue is calculated using the sales revenue formula, which multiplies the number of units sold by the average unit price.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “

What is the formula of break-even point?

“,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “

Here is the formula for calculating the break-even point:

Break-even point= Fixed Costs ÷ Contribution Margin

“

}

}

, {

“@type”: “Question”,

“name”: “How do you calculate break-even point in sales?

“,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “

Divide fixed costs by revenue per unit minus variable cost per unit to find the break-even threshold based on sales. Fixed costs are those that remain constant regardless of how many units are sold. The revenue is the price at which you sell the product less variable costs such as labour and materials.

“

}

}

, {

“@type”: “Question”,

“name”: “Why we use break-even analysis?

“,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “

Simply put, break-even analysis helps you figure out when your firm – or a new product or service – will start to make money, and it’s also used by investors to figure out when they’ll recoup their investment and start generating money.

“

}

}

, {

“@type”: “Question”,

“name”: “What is the formula to calculate sales?

“,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “

The revenue is calculated using the sales revenue formula, which multiplies the number of units sold by the average unit price.

“

}

}

]

}