The most critical profit-making strategy of every business is in knowing the break-even relationship between different prices and sales volumes.

Do you know what price it takes to break even in your business?

In this article, you will learn what Break-Even Price is, the pricing strategy, and how you can apply it to your business.

What is Break-Even Price?

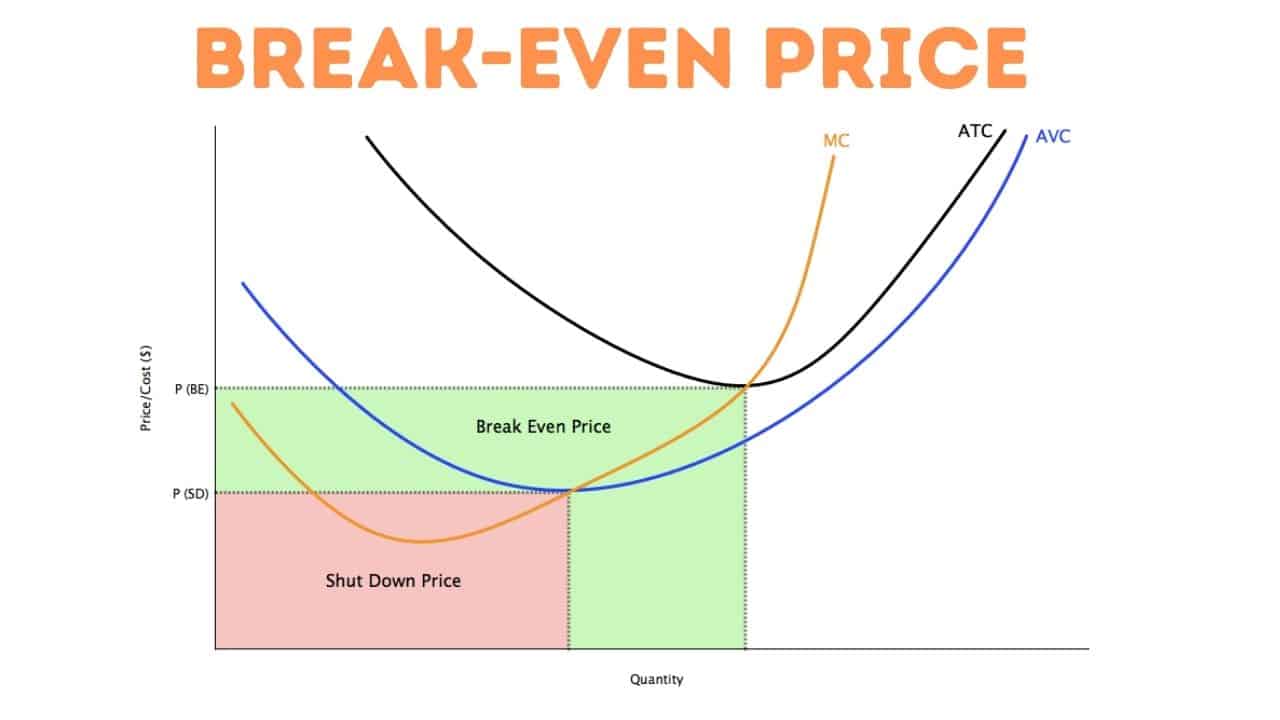

The equilibrium or break-even price is the amount of money or change in value that an asset must be sold for in order to cover the cost of acquiring and owning the asset. It can also refer to the amount of money that a product or service needs to be sold for to cover manufacturing or delivery costs. In options trading, the break-even price is the share price at which investors can exercise or sell the contract without suffering a loss.

Break-even Price Formula Economics

The break-even price is mathematically the amount of monetary income that corresponds to the number of monetary contributions. In terms of sales adjustment costs, the related transaction should be in equilibrium—no loss and no profit.

To formulate the break-even price, a person simply uses the amount of the total cost of a business or financial activity as a target price to sell a product, service, or asset, or to trade a financial instrument to achieve equilibrium. For example, the equilibrium price to sell a product would be the sum of the fixed cost of the unit and the variable cost of making the product

In an options contract such as a call or put option, the equilibrium price is equal to the level of the underlying security that fully covers the premium (or cost) of the option. Also known as Breakeven Point (BEP), it can be represented by the following formulas for a call or a sale:

BEPcall = strike price + premium paid

BEPput = strike price – premium paid

Break-Even Pricing Strategy

Using equilibrium price as a business strategy is more common with new business, especially when a product or service does not differ materially from the competition. By offering a relatively low equilibrium price with no profit margin, a company may have a better chance of gaining more market share, even if it does so at the expense of a profit not then made.

To be a cost leader and sell at breakeven, a company must have the financial resources to sustain periods of no profit. However, once dominance is established, a company can begin to raise prices if weak competitors can no longer undermine its higher-price efforts.

According to Investopedia, the following formula is used to calculate a company’s breakeven point:

Fixed costs / (price – variable costs) = break-even point in units

The breakeven point is the total fixed costs divided by the difference between the unit price and the variable costs.

Advantages of Break-Even Pricing

By understanding the relationship between sales volume and pricing, marketers can plan pricing strategies and advertising campaigns. Equilibrium analysis shows the impact of changes in price and revenue on earnings, according to the University of Michigan.

When fixed costs increase, the break-even price analysis shows how much you need to increase sales volume or prices to offset the increased costs. It is important to do this balance sheet analysis in order for a business to run smoothly.

Calculating the break-even prices for different sales volumes provides valuable information about the profitability of individual products and sales strategies. In a highly competitive market, break-even prices can be used to discourage new entrants and to drive existing competitors out of the market.

Break-Even Price Effects

There are both positive and negative effects of trading at an equilibrium price. Breakeven prices not only gain market share and displace existing competition, but also help to create a market entry barrier for new competitors. This ultimately leads to a controlling position in the market due to reduced competition.

However, the comparatively low price of a product or service can create the perception that the product or service may not be that valuable, which could later become an obstacle to price increases. In the event that others are involved in a price war, even pricing would not be enough to gain control of the market. In the case of downward prices, losses can arise when the equilibrium prices give way to even lower prices.

Break-Even Point In Accounting

Break-Even Point (BEP) is an accounting term that refers to the situation when a company’s income and expenses were the same over a given accounting period. This means that there were no net profits or losses for the company: it was “balanced”. BEP can also refer to the income that must be generated to offset expenses incurred over a period of time.

Break-Even Point for Accounting Vs Financial Break-Even Point

There are several differences between the breakeven point of accounting and the breakeven point of the financial balance sheet.

The breakeven point in accounting is on the one hand the simplest and most common method for analyzing results. It’s easy to calculate by taking the total cost of a given production and calculating how many units of the product must be sold to cover the cost.

The financial break-even point, on the other hand, is more difficult to measure because different measures are applied despite the fact that it is the same concept. It does not refer to a specific product or a specific number of units, but rather to a company’s earnings, specifically how much it has to earn in order for earnings per share to be zero. Profit is the gross amount the company earns before taxes and expenses are deducted.

Factors that Increase a Company’s Break-even Point

It is important to calculate a company’s breakeven point in order to know its minimum target to cover its production costs. However, there are times when the BEP increases or decreases depending on certain factors. Here are some of the factors:

- Increase in sales with customers

When customer sales increase, it means higher demand. So a company has to produce more of its products to meet this new demand, which in turn increases the BEP to cover the additional costs.

- Increase in production costs

The hard part of running a business is keeping customer sales or product demand the same while the price of variable costs increases, e.g. B. the price of raw materials. In this case, the BEP also increases due to the additional costs. In addition to production costs, renting a warehouse, increasing employee salaries or higher ancillary costs can also increase.

- Repair of equipment

In cases where the production line fails or part of the assembly line fails, the BEP will increase as the target number of units will not be produced within the desired timeframe. Equipment failures also mean higher operating costs and therefore a better balance.

How to Lower the Break-even Point

In order for a company to generate higher profits, the BEP must be lowered. These are the most effective ways to reduce this.

- Increase product prices

This is something that not all business owners hesitate to do for fear that it could lose some customers.

- Opt for outsourcing

Profitability can increase if a company chooses to outsource. This can help reduce manufacturing costs as production volumes increase.

What Does Break Even Price Mean in Business?

The break-even point is the moment at which total cost and total revenue are equal, implying that your small firm has no loss or benefit.

Does Break-Even Mean Profit?

At this point, your total income (sales or turnover) meets your total costs. At this time there is no profit or loss—in other words, you ‘break-even’.

Why Do Companies Prefer Break-Even Pricing?

This pricing procedure supports the firm in identifying the lowest acceptable price at which cash flow can be maintained and the business can continue to operate. At the same time, you get a competitive advantage.

What Are the Limitations of Break-Even?

However, there are certain disadvantages to break-even analysis: Break-even assumes that a company will sell all of its stock (of a specific product) at the same price. Businesses’ calculations can be unreasonable. Variable expenses may change on a frequent basis, making the analysis erroneous.

Wrapping Up

Knowing your break-even point can help you decide whether to bring a new product to market, when to drop one, and what impact your sales beyond break-even will have on your profits and taxes. This can help you better define pricing strategies.

We Also Recommend

- Promotion strategy: Best easy practices and all you need (+ free pdfs)

- Business Model: Definitions, Examples, and Types

- Customer Satisfaction: 10 types of customers that will kill your business. (examples)

- Yield: Definition, Meaning, Types, and How to Calculate Yield

- How to gain a competitive advantage

- Buy and Sell Agreement: How It Works, Key Elements, and Importance