What is a simple P&L statement and is it necessary for every business? The simple profit and loss statement is an accounting record that helps businesses keep track of their revenue and expenses, and yes, you technically need one for that small business if you are self-employed. Every effort put into a business will fall through if you do not assert it often. What am I trying to point out? You need to measure what you are doing, such as the time invested, the money invested, and so on. One of the tools used to measure a business’s growth is the simple profit and loss statement. We will get on with elaborating what this is about with a sample excel template.

What Is a Simple Profit and Loss Statement?

A simple profit and loss statement is a financial report of a business that provides specific information about the business’s income and expenses. Every business needs a simple profit and loss statement, even if you are self-employed. So understanding how to make the simple profit and loss statement as well as how to interpret it helps you manage your company’s revenue and expenses.

How Does a Simple Profit and Loss Statement Work?

There are three basic financial records every business needs to have. These are the cash flow, balance sheet, and our focus topic, the simple profit, and loss statement. Businesses need these documents on a quarterly or yearly basis. Well, there are some who believed this statement can be prepared on monthly basis. However, there is little you can do with a P&L monthly statement unless you will be assessing a number of months. These three (Cash flow, balance sheet, and P&L statement) reveal a business’s financial stand and give investors clues on whether or not to pump money into a business.

The simple profit and loss statement is a financial record that will be prepared using the various accounting transactions that have taken place within a firm. Generally, it begins with records of a business’s income, followed by its revenue. Next, it subtracts its revenue from the business expenses. Business expenses are all costs incurred in the course of running the business. These include the cost of manufacturing, fixed costs, and operational and non-operational expenses. Then the final part of the simple profit and loss statement reveals the business’s net income or net loss.

Other Names of the Simple Profit & Loss Statement

The following are the other names for the simple P&L statement;

- Income statement

- Statement of financial income

- Expense statement

- Statement of P&L

- Statement of Operation and so on

Simple Profit and Loss Statement for Self Employed

If you are self-employed and managing your business, a simple profit and loss statement will help you create a budget with ease. What’s more? You will also get to calculate your working capital and crosscheck these with your annual revenue. With a simple profit and loss statement, a self-employed business owner will be able to summarize his revenue and operational and non-operational expenses for a specific. This can be done on a quarterly, bi, annually, or annually basis.

How to Make a Simple Profit and Loss Statement

Whether you are self-employed or working for another person, learning how to make a simple profit and loss statement is a basic management skill. And just in case you consider this too boring or not cut out for you, or you just simply want to avoid the errors that come with human work, you can use online accounting tools. There are several of them and we will highlight some of them.

Generally in preparing the P&L statement, you need two key pieces of information, your income and your expenditures for the period.

Steps to Preparing a Simple Profit and Loss Statement

The following guides line will help you prepare a simple P&L statement.

1. Decide on a Time Frame

As we said earlier on, the P&L statement is prepared during an accounting period. This is usually monthly, quarterly, or annually. Most often, the statement of income is prepared annually and rarely at monthly intervals. Why is this so? This is basically because a monthly statement of income will likely prove useful. A monthly statement will not give you the exact information necessary to make a decision. Therefore it is much better to do this quarterly, bi-annually, or annually.

2. Bring Out the Record of All Transactions Within the Specified Period

After indicating the period you will like to account for, get the records of all debit and credit transactions. This includes all revenue and expenses. Add this to the record with the revenues at the left and the expenses at the right.

#3. Sum Your Details for Both the Credit and the Debit Side

Add the totals on both sides

#4. Calculate Your Cost of Goods Sold, This Is the Cost of Production

Subtract your direct costs from your revenue to arrive at your gross profit. Although you heard profit, this is not the exact profit you realize from your business.

#5. Crosscheck Result For-Profit or Loss

Using the result of your calculations, determine whether or not you are profitable. Subtract your entire expenses from your gross profit to arrive at your net profit. A positive result means you are making a profit, a negative result means you are making a loss.

There is a catch however, there is a point called break-even. This is the point where you neither make a profit nor a loss. Most businesses pass through this phase.

Simple Profit and Loss Statement Excel Template

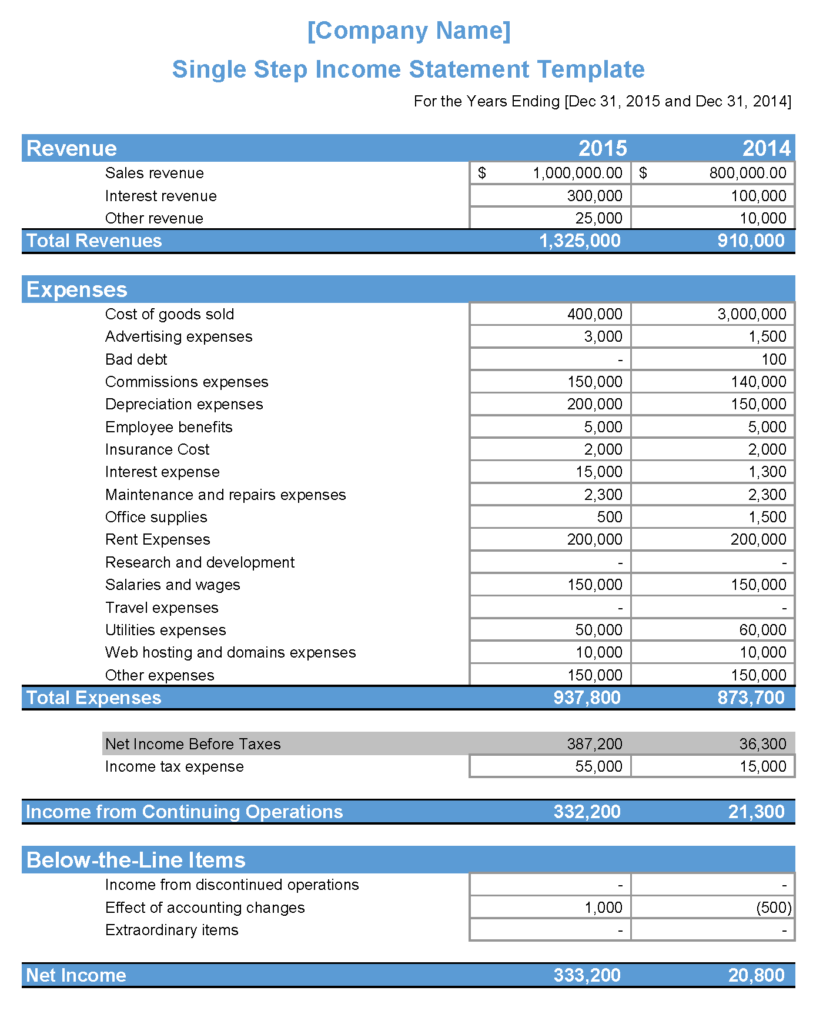

If you want to make a simple profit and loss statement for your self-employed business, you can choose a template from the numerous excel template available online. We will upload some simple profit and loss statement excel templates, and you can pick a sample template and prepare your income statement.

Simple Profit And Loss Statement Sample

When you come across a sample of the simple profit and loss statement, the items recorded on it will be classified as seen below. These are what a typical simple P&L statement contains;

#1. Expense

These refer to all the expenses your business incurred within that specified period. It includes direct expenses, these are cost directly traced to the cost of production, operating expenses, which are the costs of the day-to-day running of the business, and non-operating expenses, which are the cost not directly traced to the business’s daily activities.

#2. Revenue and Income

Revenue refers to all the earnings that come into your company. Generally, a P&L statement usually begins with a summary of all revenue gathered within the specified period.

#3. Cost of Goods Sold COGS

The cost of goods sold COGS are all the costs that are directly traceable to the cost of production of a business product or service. They are subtracted from revenue to get the gross profit in a simple income statement account.

#4. Gross Profit

The gross profit refers to the total left after you have subtracted the cost of goods sold from total revenue.

#5. Operating Expense

Operating expenses are also known as OPEX. They are the cost of operating the business on daily basis. These costs are not directly traceable t the cost of production. In accounting, operating expenses are grouped into the following categories office-related expenses, sales & marketing expenses, and compensation-based expenses.

Examples of Sales & Marketing Operating Expense

The following are some examples of sales & marketing operating expenses;

- Travel Expense

- Direct mail expense

- Costs of advertising and son on

The following are some examples of office-related expenses;

- Utilities

- Insurance premium

- Legal Expense

- Property taxes

- Depreciation and so on

Examples of Compensation-Based Expenses

The following are some examples of compensation-based expenses;

- Contributions to non-production employees’ pension plans

- Allowances that are given to non-production employees such as secretary, personal assistant, and so on.

#6. Depreciation

Depreciation is the amount by which a business asset is written off as a result of losing its usefulness. It simply means the asset’s value decreases. Generally, depreciation is treated as an operating expense in the simple profit and loss statement.

#7. Earnings before Interest and Taxes

This is one of the last items in a simple profit and loss statement.

Earnings before interest and taxes, or EBIT, is a term used to describe profits before interest and taxes.

#8. Earnings Before Tax

These are the totals you will get when you subtract COGS, depreciation, and operating expenses from revenue.

#9. Net Income or Loss

When you deduct your expense from your revenue, you will be left with a profit or loss.

Major things to look out for in a P &L Statement

There are key things that every business must look out for in a P&L statement if they must get a positive result. It is the business expenses. A business expense comprises all the costs businesses incur in the cause of running their business.

What is a “profit and loss statement,” in simple words?

A financial report called a “profit and loss statement” details how much money your company has spent and made over a given period of time. The term comes from the fact that it also displays your overall financial performance throughout that time. A profit and loss statement is also sometimes referred to as an income statement or a P&L.

Can I write my own profit and loss statement?

Your own statement can first be assembled, and the document can be made using a spreadsheet. Templates are available in programs like Excel and Google Sheets.

What are the most important parts of a P&L?

Revenues, COGS, and operational expenses make up the three primary elements of a P&L statement. Any item that is documented on a P&L falls under either revenue or an expense account, and both of these accounts together determine the net income.

How do I calculate profit?

Revenue less costs equal profit. You deduct a few expenses from your earnings. Subtract all costs to determine net profit.

What is a profit and loss PDF?

A profit and loss statement, sometimes referred to as an income statement, is a financial report overview of the costs, expenses, and revenues that the company incurred for a specific period.

Online Accounting Tools For your P& L Statement

There are several online accounting tools available presently and this means you do not have a good reason for not having a P&L statement. Examples are as follows;

- FreshBooks

- Sage Accounting

- Sage 300

- Xero

- Gusto

- QuickBooks Online and so on.

Final Thoughts

Every business needs a P&L record. Aside from keeping track of your business, it helps you know when you are making a profit and a loss. Simply put, it is used in decision-making. For instance, if you have recently discovered your P&L reveals high expenses, you can trace these to the root cause and tackle it to maintain a healthy cash flow.

FAQs On Simple Profit and Loss Statement

How do I create a profit and loss statement for free?

You can draw the simple profit and loss statement for free by downloading an excel sample template from the net or by simply using online accounting tools such as Freshbooks.

What is a profit and loss statement for self employed?

The self-employed P& L statement, also known as an income statement, helps you track your company’s revenue (or sales) and expenses over time. In other words, a profit and loss statement shows whether or not your company is profitable.

What is the difference between profit and loss and a balance sheet?

The balance sheet, on the other hand, is an important financial report that shows a company’s assets, liabilities, and shareholders’ equity. When you combine the balance sheet with the profit and loss statement, you get a strong overall picture of a company’s financial health. While the P&L statement determines whether or not your company is profitable on a fundamental level.

- Balance Sheet vs. Profit and Loss Statement: Relationships & Differences

- FINANCIAL STATEMENT OF A COMPANY: Best 2023 Samples & Templates to Learn From

- Payroll Report: Detailed Guide to Payroll Report

- NET SALES: Definition, Importance & How To Calculate It

- CASH INFLOW: Definition, Examples & Everything You Need to Know