One of the two income statement types that firms can employ to report their profits is the multi-step income statement. The revenues, costs, and total profit or loss of a corporation are all reported on a multi-step income statement for a certain reporting period. It is a more sophisticated version of the single-step income statement that calculates a company’s net income using numerous equations. Along with a balance sheet and a cash flow statement, an income statement, often known as a profit and loss statement, is one of three primary financial statements that all firms should prepare as part of their financial accounting. So to help you get started with this, let’s go through some examples, a format, and a guide to help you prepare a multi-step income statement.

Furthermore, we will discuss some of the benefits of using this option against the single-step income statement.

What Is a Multi-Step Income Statement, and How Does It Work?

The multi-step income statement shows a company’s profits and losses throughout a given reporting period. It provides an in-depth examination of a company’s financial performance. Its structure distinguishes between operational revenue and operating expenses and non-operating revenue and expenses.

The multi-step income statement provides insight into how a company’s key business activities create income and affect costs, as compared to the performance of its non-essential activities, by distinguishing between operational and non-operating accounting.

Read Also: INTERIM FINANCIAL STATEMENTS Guide for Beginners (+ Samples and Template)

However, this multi-step income statement format for calculating net income is different from how an income statement calculates net income. To arrive at net income, a single-step income statement uses only one computation. Multi-step income statements, on the other hand, calculate net income using numerous equations. They calculate gross profit and operating income as well, which are not reflected on a single-step income statement. A single-step income statement, on the other hand, provides a straightforward record of financial activities.

Formulas for Multi-Step Income Statements

For this method of determining net income, you’ll need to employ three formulas.

The first formula helps you calculate gross profits, which is integral to the preparation of this type of statements.

Basically, you use this formula to determine gross profit on your income statement:

Net Sales – Cost of Goods Sold = Gross Profit

The next formula to pay careful attention to is the operating income formula. The operating income formula is vital to accessing all the information you need to forecast sales and business administration. For the most part, this formula pretty straight forward. So, applying it just demands the gross profit and operating expense information.

Gross Profit – Operating Expense = Operating Income

Finally, one of the most popular in the accounting world is the net income formula. The Net income formula will help set a lot straight when it comes to calculating the company’s worth.

In other words, it would help prepare the accounts for prospective investors.

Operating Income + Non-Operating Items = Net Income

What Type of Businesses Use Multi-Step Income Statements?

Multi-step income statements are typically used by large, sophisticated firms. And because most small businesses and sole proprietorships’ operations are uncomplicated, they may simply get by with a single-step income statement.

A multi-step income statement is recommended for businesses with many revenue streams. Large manufacturing companies and large, complicated merchants fall under this category. Plus because public firms are compelled by law to produce more thorough financial reports to illustrate their earnings, they need also create multi-step income statements.

Read Also: Single Step Income Statement: Definition, Examples, Comparisons &Format

How to Prepare a Multi-Step Income Statement With Example

A multi-step income statement is more difficult to prepare than a single-step income statement. The steps for creating a multiple-step revenue statement for your firm are as follows.

#1. Choose a Reporting Period

You must first choose a reporting period before you can begin preparing your income statement. Income statements are often prepared weekly, quarterly, or annually. However, financial statements are required by law to be prepared quarterly and annually for publicly traded corporations.

Meanwhile preparing monthly financial statements allows you to track how your profits change over time, which is useful information to have when making financial decisions regarding your firm, such as whether to invest in new machinery.

#2. Make a Header for your Document

Readers will get essential information from the header of your multi-step revenue statement. It contains your company’s name, identifies the document as an income statement, and specifies the reporting period that the document covers.

#3. Add Revenues from Operations

Your overall operating operations are included in the top section of your multi-step income statement. To begin, add your operating revenues, which are the proceeds from the sale of your goods or services.

#4. Add Operating Expenses

Now, in the operating activities column, add your entire operating expenses. This would include the cost of things sold, as well as expenses like advertising, salaries, and administrative costs like office supplies and rent.

#5. Calculate Gross Profit

Subtract the cost of items sold from the net sales to arrive at the gross profit. Under the cost of goods sold, add the final number as a line item and call it Gross Profit. After that, you’ll need to figure out your operating income.

Read Also: Accounting balance sheet explained: samples, templates, examples and definition

#6. Calculate Operating Income

Subtract your operational expenses from your gross profit to arrive at this figure. Add the final calculation as a line item labeled Net Operational Income or Income from Operations at the bottom of your operating activities section.

#7. Add Non-Operating Revenues and Expenses

Create a segment for your non-operating operations in the bottom area of your income statement, below your operating activities. Include all non-operating revenues and expenses, such as interest and the sale or purchase of investments.

#8. Calculate your net profit

Calculating net income is the final stage in preparing a multi-step income statement. To do so, add your operational income and non-operating components together. As Net Income, add the total to the bottom of the income statement. You’re reporting a profit if the number is positive. You’ve made a loss if the total is a negative number.

Benefits of Using the Multi-Step Income Statement Format

A Multi-Step Income Statement aids in the analysis of a company’s entire performance. Creditors and investors can assess how effectively a company operates and performs.

It is simple to assess how a company performs its critical functions, regardless of the company’s other activities.

Basically, the main function of a retailer, as in a multi-step income statement format, is to sell his merchandise. But on the other hand, creditors and investors are often interested in knowing how well and conveniently that retailer is able to sell his merchandise without dilution in the numbers, as well as the other profits and losses from non-merchandise related sales.

To check them, all expenditures and incomes must now be listed separately under appropriate headings that are meaningful and easy to understand. A Multi-Step Income Statement is a good option for this.

Read Also: What are the Generally Accepted Accounting Principles: All You Need

Income Statements: Single-Step vs. Multi-Step

A single-step income statement accounts for a company’s net income in a straightforward manner, but a multi-step income statement accounts for net income in three steps, separating operational from non-operational revenues and expenses.

Single-Step Income Statements

- Single-step income statements take less time and effort to prepare than multi-step income statements since they need fewer computations and don’t break down operational versus non-operating line items.

- The single-step revenue statement is a simple and straightforward document. It concentrates on the bottom line, net income, so it’s simple to evaluate how well the company is doing financially at a glance.

Multi-Step Income Statements

- Multi-step income statements provide an itemized breakdown of a company’s revenue and expenses, categorized by operational and non-operating revenue, in order to have a better understanding of the company’s financial health.

- In contrast to single-step income statements, multi-step income statements report a gross profit.

Gross profit is an important indicator because it demonstrates how well a company generates income by utilizing labor and resources.

- Multi-step income statements detail a company’s operating income, which reveals how profitably it generates revenue from its major business activities.

Read Also: QuickBooks Accountant: Basic Guide for Optimal Results (+ Quick Tools)

Multi-Step Income Statement Format

The Multi-Step Income Statement Format is shown below. The operating Head and Non-Operating Head are the two major headings.

The operating head is further broken into two major heads that list the principal business revenues and expenditures. You could also call this a Trading Account because it shows Direct Incomes and Expenses.

#1. Operating Head – Gross Profit

Gross Profit is the first section of the multi-step income statement’s format. The gross profit of a business is calculated in the first section by subtracting the total sales from the cost of goods sold (COGS). It’s a crucial metric for creditors, investors, and internal management since it shows how profitable a company is at selling goods or producing items.

The overall sales figure on the retailer’s Multi-step income statement, for example, will comprise all merchandise sales made during that period.

On the other hand, the cost of goods sold will include all expenditures paid when acquiring, shipping, or conveying, and putting the merchandise ready for sale. Furthermore, the gross margin is the profit a firm makes from the sale of its goods.

However, it’s worth noting that no other expenses have yet been included. It’s just Cash Inflow from Merchandise Sales minus Cash Outflow from Merchandise Purchases. This part aids in determining the health of the company as well as the profitability of fundamental business operations.

Read Also: Double-Entry Accounting Explained!!! Definition, How it Works, & Examples

2 – Operating Head – Selling and Admin Expenses

The second element of the multi-step income statement is Selling and Administrative Expenses. It categorizes all of a company’s operating expenses into two categories: selling and administrative.

- Selling Expenses – Expenses incurred in the process of selling the products. Selling expenses include things like advertising, a salesperson’s wage, freight, and commissions.

- Administrative Expenses– Expenditures that are not directly related to the sale of the product, such as office staff salaries, rent, and supplies, are classified as administrative expenses.

Consequently, total operating expenses are calculated by adding both selling and administrative expenses. On the flip side, the Company’s operating income is determined by subtracting these total operating expenses from the gross profit stated in the first section.

#3. Non-Operating Head

Non-Operating Head is the third component of the multi-step income statement’s format. The non-operating and other head categorizes all types of business income and expenses that are unrelated to the company’s primary activity. Let’s say a merchant isn’t in the insurance business and a car crashes into their store. The insurance company paid a portion of the settlement so that the earnings obtained from the insurance company will be treated as non-operating income rather than total sales. As a result, it will appear in non-operating and other heads.

Other income and expenses, such as lawsuit settlements, interest, investment losses and gains, and any unusual items, fall under this category. As with the operating head, there are no sub-categories in the non-operating head. It just lists a variety of activities and adds them up in the end.

Furthermore, after totaling all of the non-operating head items, the net income for the period is calculated by subtracting or adding the total of the non-operating head to or from the income from operations.

Read Also: SAP ACCOUNTING: What is Sap Accounting? (+ Top 2023 Courses)

Example of a Multi-Step Income Statement

With the help of an example, let’s create a multi-step income statement.

The steps for preparing a multi-step income statement are as follows:

Prepare the section on gross profit

The gross profit section of an income statement begins with gathering the information you need for calculation. Basically, this includes total sales and the cost of goods sold.

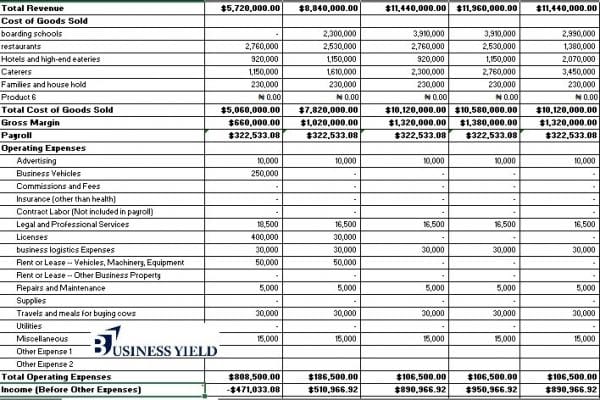

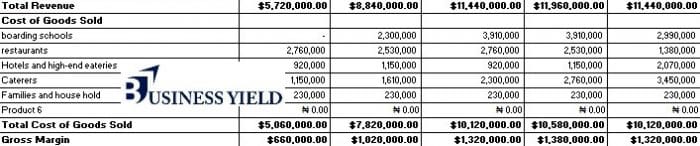

The Gross Profit computation is shown in the table below.

Total Sales – Cost Of Goods Sold = Gross Profit

Therefore, gross profit is $5,720,000 – 5,060,000 = $ 660,000

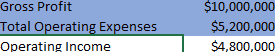

Prepare a Second Section Showing Operating Income/Profit for the Operating Head

The calculation of Operating Income is shown in the table below.

Gross Profit – Total Operating Expenses = Operating Income

Therefore, operating income is equal to $10,000,000 – 5,200,000 = $4,800,000

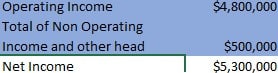

Prepare all the Non Operating Heads

The calculation of Net Income is shown in the table below.

Operating Income + Total of Non-Operating and Other Head Income = Net Income

Hence, in Net Income, $500,000 + $4,800,000 = $5,300,000

Read Also: ACCOUNTING PROCESS: Understanding the 8 Steps in the Accounting Cycle

What Is the Difference Between a Single-Step and a Multi Step Income Statement?

A single-step income statement accounts for a company’s net income in a straightforward manner, but a multi-step income statement accounts for net income in three steps, separating operational from non-operational revenues and expenses.

What Does a Multiple Step Income Statement Look Like?

Basically, the operating head and non-operating head are the two major titles in a multiple-step income statement. The operating head is further broken into two major heads that list the principal business revenues and expenditures. You could also refer to this as a Trading Account because it shows Direct Incomes and Expenses.

How to Prepare a Multi Step Income Statement

Preparing a multi-step income statement starts with defining your gross profit, operating expenses, revenues, and so on. However, the following are actionable steps to follow;

- Choose a Reporting Period

- Make a Header for your Document

- Add Revenues from Operations

- Add Operating Expenses

- Calculate Gross Profit

- Calculate Operating Income

- Add Non-Operating Revenues and Expenses

- Calculate your net profit

What Is a Multi Step Income Statement

The multi-step income statement shows a company’s profits and losses throughout a given reporting period. It also provides an in-depth examination of a company’s financial performance. Its structure distinguishes between operational revenue and operating expenses and non-operating revenue and expenses.

What Is the Advantage of Multi Step Income Statement?

Multiple-step income statements have separate breakdowns for each step, which makes it easier to look at margins and get a more accurate picture of the costs of goods sold. By showing how the gross, operating, and net margins compare, this level of detail gives stakeholders a clearer picture of how a company runs its business.

Conclusion

A multi-step income statement format is far superior to a single-step income statement in terms of depth. However, if not properly prepared, it could be misleading. To artificially boost its margins, the company’s management may shift expenses from the cost of products sold to operations.

So, it is critical to examine comparative financial records over time in order to spot and analyze patterns, as well as to detect potentially misleading expenditure placement.

But in any case, if you encounter issues with preparing a multi-step income statement, you can contact the Businessyield financial team.

Read Also: General Ledger Accounting: All You Need To Know( +Quick Tools)