From the earlier post on understanding yield curve, we established that the yield curve is a graphical representation of the differences in yield between securities that have different terms to maturity. This post examines the yield curve theories.

Let us begin.

Yield Curve Theories

There are four major theories of yield curve according to corporate finance. They are explained below;

1. Pure Expectation Theory

The pure expectation theory states that the market expectation of future interest rates determines the maturities of the securities and the shape of the yield curve.

Let me explain, ordinarily, interest rates risk and reinvestment risk determines yields. But this theory doesn’t take cognizance of their effects in determining risk.

All it considers is the market expectations of future interest rates, forgetting that there are factors that cause the interest rates to either grow or decline. And those factors include risk on both the interest rate (determined by the maturity of the security) and reinvestment risk (will the yield still be profitable if I reinvest after the maturity of the security?)

This theory is also called expectations theory or unbiased expectations theory.

The expectations theory states that expectations of a rising in short-term interest rates are what create a positive yield curve.

The theory contends that long-term interest rates differ from short-term interest rates because financial markets participants expect different interest rates and inflation in the short and long run.

From expectation theory, the yield curve is normal when the interest rate and inflation are expected to increase in the future.

It is used to identify interest rates that are inclining.

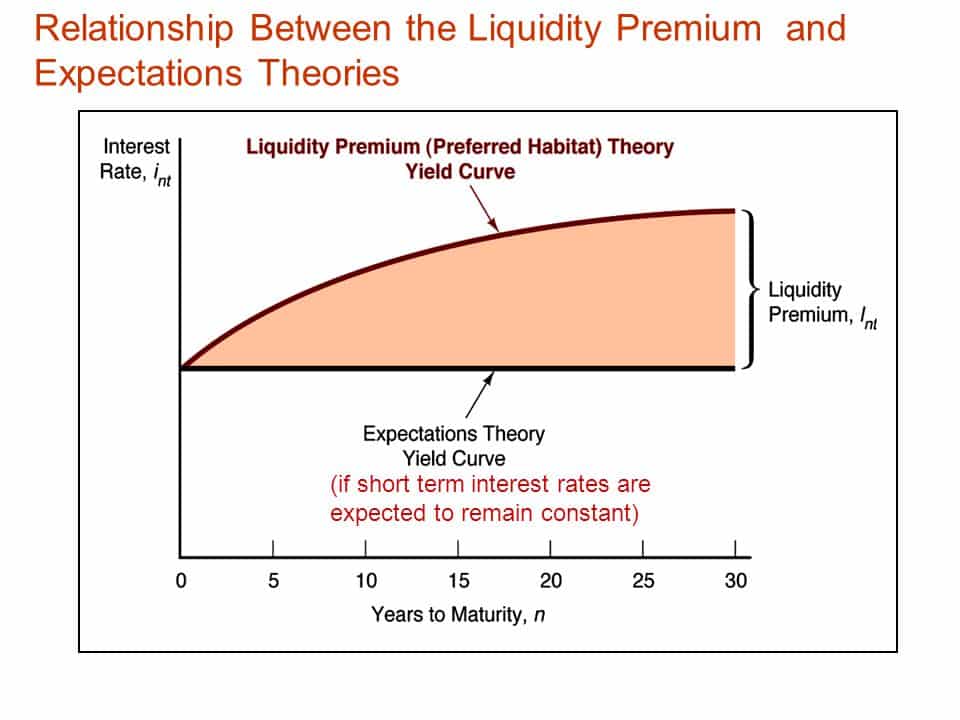

2. Liquidity Preference Theory

This theory adds liquidity or term premium to pure expectation theory. It shows the risks involved in having long-term securities more than short-term securities.

The theory was proposed with the assumption that all investors prefer short term securities to long term investments.

It explains the normal yield curve but makes no mention of inverted or flat yield curves. Any curve that is not positive will only be a temporary one.

3. Market Segmentation Theory

This is another yield curve theory that says that separate demand and supply exist for long and short term securities. In addition, their interaction in the financial markets determines the shape of the yield curve.

What it insinuates is that different securities have differing maturities and these cannot be substituted for another.

Every player in the market wants his securities to fit a distinct maturity he wants due to his demands.

For example, a pension fund will want only fixed income securities that will match the nature of their liabilities.

So, if the demand for short term capital is higher than its supply, the short term rate will go high.

Truth is, investors actually prefer short term securities because it has lower risks. Although the price will be higher, the yield will be lower because of the lower risk.

4. Preference Habitat Theory

This is another one of yield curve theories. It states that investors have a limit or horizon they prefer. Investing outside this horizon will make them require a certain increase in premiums.

One of the important features this yield curve theory explains is why the yield for long term investments is higher than that of short term investments.

This theory is similar to market segmentation theory because it suggests that different participants in the market have different needs and these needs dictate the maturities of the securities they prefer.

However, these preferences are not based on market fluctuations or assumptions, rather, it describes that for the investors to go out of their preference (habitat) and accept a higher risk, there has to be gain. This gain will be in the form of increased yield.

What is the Yield Curve Risk?

The yield curve risk is the risk of experiencing a negative interest rate when investing in fixed income security like bonds. When yield changes, it will affect the price of the securities.

If market yield otherwise interests rate increases, the price of a bond will decrease.

Simply put, a yield curve risk is a risk that a change in interest rate will affect fixed-income security.

The yield curve shows whether the interest rate will be high or low based on economic growth. Since short term bonds have a lower yield, we can say that bond price and the interest rate has a negative relationship in that when interest rates increase, prices decrease. When the interest rate increase, the yield curve will shift representing a risk called yield curve risk to the investor.

Types of Yield Curve

#1. Normal Yield Curve

Because this is the most typical shape for the curve, it is referred to as the normal curve. The normal yield curve shows that 30-year bonds have higher interest rates than 10-year bonds. If you think about it intuitively, you anticipate to earn a bigger compensation if you lend your money for a longer length of time.

The positively sloped yield curve is said to as normal since a rational market will desire more pay for higher risk. As a result, because long-term securities are more risky, the yield on such securities will be higher than the yield on lower-risk short-term securities.

A longer period of time raises the likelihood of unanticipated unfavorable events occurring. As a result, long-term maturities often have higher interest rates and increased volatility.

#2. Inverted Yield Curve

When long-term yields fall below short-term yields, the curve inverts. An inverted yield curve arises when long-term investors believe interest rates will fall in the future. This can happen for a variety of reasons, but one of the most common is the expectation of lower inflation.

When the yield curve begins to invert, it is regarded as a leading indicator of an impending economic downturn. Historically, interest rate adjustments have mirrored market sentiment and economic expectations.

3. Steep Yield Curve

Long-term yields are growing faster than short-term yields, indicating a steep curve. Historically, steep yield curves have signaled the commencement of an expansionary economic cycle. The normal and steep curves are both based on the same underlying market conditions. The sole difference is that a steeper curve represents a wider gap between short-term and long-term return expectations.

#4. Flat Yield Curve

When all maturities have similar yields, the curve flattens. This indicates that the yield on a 10-year bond is nearly identical to the yield on a 30-year bond. When there is a transition between the normal yield curve and the inverted yield curve, the yield curve flattens.

#5. Humped

When medium-term yields exceed both short-term and long-term yields, the yield curve becomes humped. A humped curve is uncommon and usually signals that economic development is stalling.

Yield Curve Empirical Studies

Empirical yield curve research indicate that all three theories have an effect on the form of the yield curve. Future rate expectations are crucial, but so are liquidity and institutional issues. The yield curve’s average form is climbing, indicating that long-term bondholders do earn (il)liquidity premiums. In addition, the yield curve appears to be a forecast of future economic activity. While inverted yield curves are not always followed by a recession, they have preceded all recessions recorded in the United States over the last four decades. A signal of this type is consistent with the logic of the expectations theory. An inverted curve indicates that investors anticipate lower future interest rates. Recessions typically lower interest rates by reducing business loan demand and supporting expansionary monetary policy.

In conclusion, understanding the types and theories of the yield curve will further enhance the understanding of yield curve risks. They actually help investors know the term/maturity of the securities to invest in and the interest rates to expect.

(Opens in a new browser tab)

Yield Curve Theories FAQ’s

What are the three yield curve theories?

The shape of the yield curve is explained by three economic theories: expectations, liquidity preference, and institutional or hedging pressure.

What is the yield curve and why is it important?

A yield curve is a method of measuring bond investors’ risk tolerance, and it can have a significant impact on the returns you receive on your investments. A yield curve can even be used to predict the direction of the economy if you understand how it works and how to read it.

What's the riskiest part of the yield curve?

In a normal distribution, the end of the yield curve is the riskiest because minor movements in short-term yields compound into bigger movements in long-term yields. Long-term bonds are extremely sensitive to changes in interest rates.

Related Articles