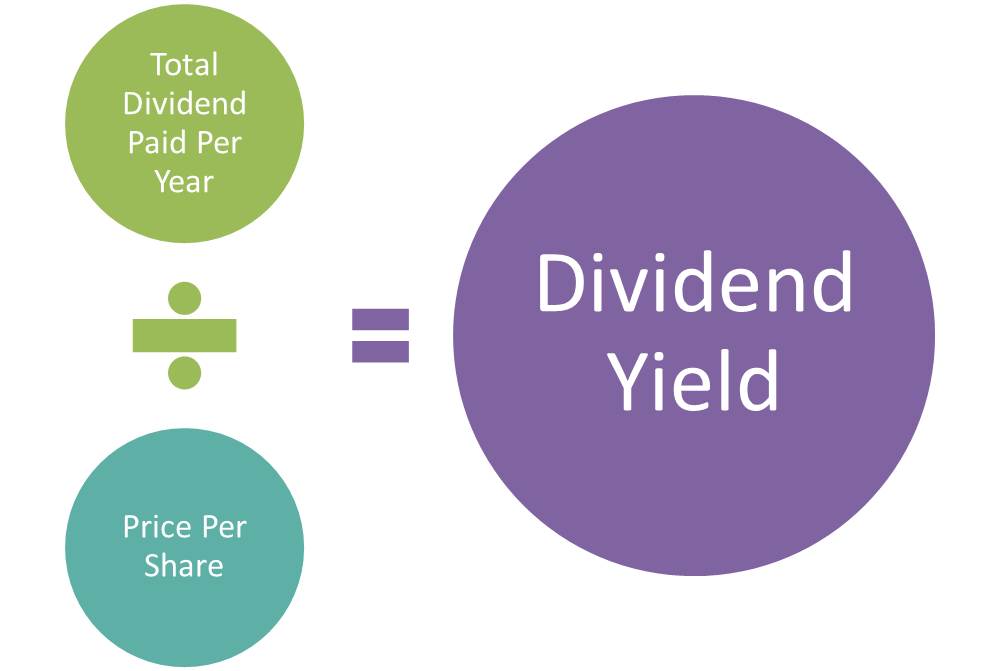

As an investor looking for high dividends, this parameter will help you in obtaining a substantial dividend income. Basically, dividend yield is a financial ratio that shows the amount a company pays in dividends each year relative to its share price. Dividend yield formula is stated below.

Simply put, dividend yield is an easy way investors determine the stocks with high dividend-paying abilities.

For example, Investor A may have stock B<C<D in Company AXC. By calculating the yield, the investor is able to determine which stock will give him more dividends in return.

Let us go in-depth into dividend yield and its formula.

What Is a Dividend?

A dividend is a percentage of a company’s profits that it pays out to its stockholders. Dividends are given out in addition to any gains in the value of the company’s stock and are a form of compensation for shareholders who own a stock.

Dividends are more common among established companies that can afford not to reinvest all of their profits back into the business. Basically, companies pay one-time special dividends or dividends on a regular basis, such as every quarter or once a year.

Although common stock may also pay monthly dividends, one of the major advantages of preferred stock is that it pays them consistently. However, dividend payments, unlike bond interest payments, are not guaranteed. When businesses face difficult economic pitfalls, dividends may be reduced or even scraped.

What Is Dividend Yield?

Dividend yield is the amount of money a firm pays out in dividends per dollar invested each year. For instance, if a company’s dividend yield is 7% and you own $10,000 of its stock, you’ll receive $700 in annual dividends or $175 in quarterly installments.

However, companies typically pay dividends based on the number of shares you own, not the value of those shares. As a result, dividend yields fluctuate according to current stock prices. You can get recent dividend yields in many stock research tools, but you can also compute dividend yield yourself using the formula.

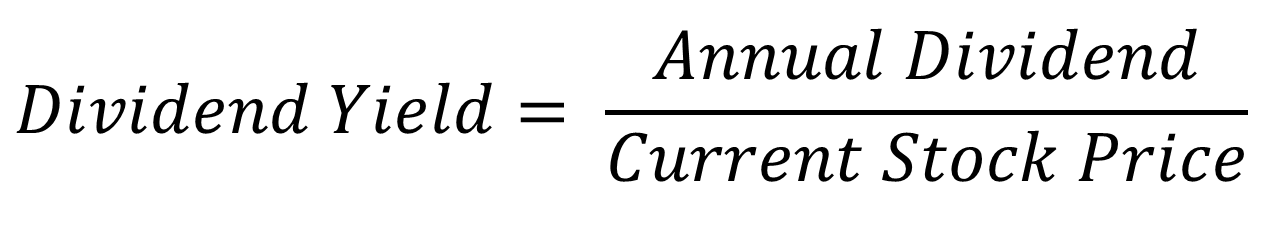

Dividend Yield Formula

Mathematically, dividend yield is a percentage calculated by dividing the dividends a company pays as a share price in a particular year by the value of one share of stock.

In other words, the formula shows the percentage of the company’s market price of a share that is paid to shareholders in the form of a dividend.

It is the ratio of an organization’s annual dividend compared to its share price.

OR

Dividend Yield Formula = Annual Dividend/Share price

ALSO

Dividend yield = Dividend per share/ Market value

Where,

Dividend per share = Total annual dividend / Total number of shares.

Market value per share = Current share price of the company.

Also, it is the relation between a stock’s annual dividend payout and its current stock price.

Dividend Yield Formula Interpretation

The dividend yield formula is used to ascertain the amount an investor gets from owning stock in a company. Therefore, it shows the amount derived from every stock.

The yield can be either high or low.

This is determined by the company or the industry. This is because some companies pay out little or no dividend, rather they retain most of their earnings for reinvestments.

One very important point to note is that the yield point or ratio doesn’t depict the growth or not of a company. It just shows investors the security that brings back more dividends.

Dividend Yield Example

Example 1

If stock XYZ has an annual dividend of $1.00 and a share price of $50, its yield will be;

$1.00 / $50 = 0.02, which is 2% yield.

If this share price rises to $60, but the dividend paid out was not increased, the yield will fall to 1.66%.

Example 2

Company A’s stock is trading at $20 and it pays annual dividends of $1 per share to its shareholders. Also, Company B’s stock is trading at $40 and also pays an annual dividend of $1 per share.

Company A’s yield is $1/$20 = 5%.

While Company B’s yield is $1/$40 = 2.5%.

The dividend used in calculating this is the annual yield not quarterly or monthly dividend.

Key Points to Note

From our source, take note of these:

- The dividend yield is the amount gotten for only the yearly stock whose dividend was said for by the company.

- It is the amount of money a company pays to its investors for owning stock in their company.

- Research shows that companies in the utility and consumer industries pay higher yields. In addition, mature companies pay dividends more frequently.

- Investors look at the stock price but not the high dividend yield. Earlier in the post, we established that high yield doesn’t mean the company is growing or making profits.

What Is the Importance of Dividend Yield?

The main purpose to learn about dividend yield is to figure out which stocks would give you the best return on your dividend investment. However, there are a few other advantages to consider.

#1. Dividend Yields Make Comparing Stocks Easy

If you’re looking for a way to supplement your income, you’ll want to compare and select stocks depending on which provide the highest dividend per dollar invested. Because of high fluctuation in companies’ stock values, the absolute dividend amount you receive per share is a less useful indicator.

Companies A and B, for example, both pay a $2 annual dividend per share. Company A’s stock, on the other hand, is $50 per share, whereas Company B’s stock is $100 per share. Company A’s dividend yield is 4%, whereas Company B’s is only 2%. This means that Company A is a superior pick for income investors.

#2. Increasing Dividend Yields Indicate Financial Health

When a firm decides to increase its payout—and thus its dividend yield—investors can assume that the company is doing well because it can afford to pay out more of its profits to shareholders.

In general, older, more established companies in stable industries pay regular dividends and have higher dividend yields. Younger, faster-growing companies, on the other hand, choose to reinvest their profits in order to grow rather than pay a dividend.

#3. Dividends Increase Your Profits

Your investment benefits from compounding when you reinvest your dividends rather than cashing them out every year or quarter. Compounding effects can dramatically increase your earnings over time.

Dividend Yield vs Dividend Payout Ratio

Dividend yield shows how much percentage an investor would earn if he invests in a stock at the current market price. Whereas, the dividend payout ratio will only show how much of the earnings are distributed to shareholders as a dividend.

So, if you want to assess a company on having a better returns, then dividend yield will be the right choice.

Tips for Investors

It’s crucial to remember while looking for dividend stocks, a high dividend yield alone does not make a stock a good investment. On the contrary, a yield that appears to be too good to be true could very well be.

Therefore, any investor that wants to get a portfolio that pays a high dividend income at the end of the year will have to scrutinize the company’s dividend payment history.

To know a stock that will have a high dividend, Dividend.com says to look out for the following things:

#1. The Stock Price

When a stock price reduces and the dividend paid remains the same, the dividend yield will increase.

For example, if stock XYZ is $50 and pays a $1.00 annual dividend, the yield will be 2%. If the stock’s share price falls to $20 and the company still pays a dividend of $1.00, its new yield will be 5%. While many investors will be attracted by this 5% yield, the company is actually not doing well.

So, investors should find out what is making the yield high.

#2. The Industry

Real Estate and Partnerships/Utility companies are amongst those that pay high dividends. This is because they are required to distribute at least 90% of their earnings through dividends.

Investors tend to recline towards them because their dividend is higher than stocks.

They do not pay regular income tax on a corporate level, instead, the tax burden is passed down to the investor. Investors should take note of this as well.

Questions to Ask

Other few items, inform of questions, you should ask before you acquiring any dividend-paying stocks, include;

#1. Dividend Growth:

Does the company have a track record of growing earnings and rewarding shareholders with regular dividend increases? The Dividend Aristocrats, a group of S&P 500 firms that have increased their dividends for at least 25 years, are an excellent place to start.

#2. Financial Strength:

Does the company have an investment-grade credit rating and a sustainable debt load for its industry? Is there enough cash and working capital on hand to weather an economic slump or a downturn in its industry?

#3. Dividend stability:

Is there a safety margin between what it earns and what it pays out in dividends? A useful approach to measure this is the payout ratio, which is the percentage of profits that a company spends on dividends. And because there are various non-cash expenses that can affect a company’s net income under generally accepted accounting principles, this metric is best used over a longer time; not simply a quarter or even a year. It can also be combined with the cash payout ratio.

Read Also: GAAP: Overview, Importance, History, Limitations

#4. Competitive Advantages:

How does the company consistently outperform or keep its competitors at bay? Durable competitive advantages include cost advantages, network effects, and a brand that consumers are willing to pay a premium for.

Furthermore, is the company in an industry that is rapidly growing, or is demand for its products or services shrinking? Even the best firm in a dying industry will struggle to stay afloat, let alone increase, its dividend over time.

#5. Dividend Traps:

How does the dividend yield compare to its peers or competitors? High yields aren’t always a bad thing, but they can be a hint of problems in some circumstances. More often than not, if a firm’s dividend yield is significantly greater than that of its closest competitors, it may be a dividend yield trap. So keep on the look out.

Is a High Dividend Yield Beneficial?

Yield-seeking investors would normally seek out companies with high dividend yields, but it is critical to go deeper to understand the factors that led to the high yield. Investors might focus on companies that have a lengthy track record of preserving or increasing dividends, while also ensuring that such companies have the underlying financial strength to continue paying dividends well into the future. Other indicators, such as the current ratio and the dividend payout ratio, can be used to do this.

Disadvantages of Using Dividend Yield as an Investment Metric

#1. Stock Market Fluctuations: Because the stock market is not stable, this is not a good parameter to calculate stock earning.

#2. Insufficient as an Overall Return Metric: There are some profitable companies in the market that do not pay dividends as they have profitable investment opportunities so they choose to reinvest their earnings.

#3. Dividend: Some companies pay more dividends because they don’t have a profitable reinvestment opportunity. So, only higher DY does not mean that the company is doing well. You need to use other metrics and criteria for your analysis along with this before making a conclusion.

Best Dividend Yielding Stocks

If you’re seeking for high dividend yields, look at dividend aristocrats, which have regularly increased their dividend distributions over decades, as well as stocks in the following sectors:

#1. Utilities

Electricity and water providers, in general, pay out substantial, steady dividends. Even natural gas companies have historically paid out relatively substantial and consistent dividends.

#2. Consumer staples

Companies that sell consumer staples frequently have long-standing dividend programs. In fact, many dividend aristocrats are consumer staples companies.

#3. Telecommunications

Companies that provide telephone and internet services frequently pay out substantial profits.

#4. Energy

Energy companies frequently pay greater dividends. This is due, in part, to the fact that many are master limited partnerships (MLPs), which must distribute all of their revenues to shareholders in order to keep their tax-favored status.

#5. Real estate

Real estate investment trusts (REITs), like MLPs, must pay nearly all of their revenues to shareholders as dividends in order to maintain their tax status. This can result in dividend yields that are significantly greater than usual.

Conclusion

We discussed an important feature for potential investors that will aid them in making wise investments. Do ensure to read the post and ask for clarity where you don’t understand.

Dividend Yield FAQs

Whats a good dividend yield?

Dividend yields are influenced by a variety of factors, including the broader market, interest rates, and the financial status of the specific company. However, a dividend yield of 2% to 6% is often regarded as good according to experts.

How does a dividend yield work?

The dividend yield is the amount of money a firm pays out in dividends per dollar invested each year. For instance, if a company’s dividend yield is 7% and you own $10,000 of its stock, you’ll receive $700 in annual dividends or $175 in quarterly installments.

Is a higher dividend yield better?

Some companies pay more dividends because they don’t have a profitable reinvestment opportunity. So, only a higher DY does not mean that the company is doing well. You need to use other metrics and criteria for your analysis along with this before making a conclusion.