Have you ever wondered what it takes to be a financial analyst? Well, you are just about to find out, as this post will walk you through the requirements and skills you’d need to become a financial analyst. Also included in this post are the job descriptions and salary scales for financial analysts.

Yea I saw that; the slight grin on your face immediately I mentioned salary.

True to what you may have heard before, salaries for financial analysts are jumbo. However, like every job out there, they come with a price and tons of responsibilities.

But don’t fret! This post promises to guide you every step of the way, feeding you with every piece of information that should be in your possession.

So, with these in place, let’s jump right in…

Financial Analyst Meaning

They are professionals that analyze financial data for companies, clients, or businesses. Basically, their analysis results in helping companies or clients make informed financial decisions.

Financial analysis is a broad title, therefore may always be used across places and companies or businesses. Financial analysts can also work as securities analysts, investment analysts, risk managers, and so on.

With that out of the way, let’s take a look at what they really do.

What do Financial Analysts do?

A financial analyst basically provides professional advice or caching to business owners based on a concluded analysis. However, a financial analyst’s skills also make him capable of overseeing investments like bonds, stocks, etc. Furthermore, in some firms, financial analysts are categorized into senior and junior levels based on skill. This means that their job description as financial analysts would be slightly different.

Therefore, a junior analyst in some firms specifically gathers data and maintains spreadsheets on finances. On the other hand, senior analysts spend a lot of their time developing investments, coaching teams in firms, including speaking, and negotiating with investors.

What they do

- A financial analyst pores over data to identify business opportunities or make investment recommendations.

- Junior analysts tend to do a lot of data gathering, finance modeling, and spreadsheet maintenance.

- Senior analysts spend time on developing investment theses, speaking with company management teams and other investors, and marketing ideas.

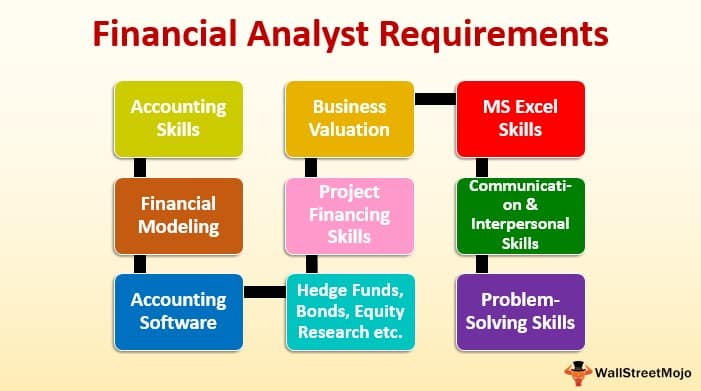

Financial Analyst Requirement

Becoming a financial analyst is not as complicated as people think, especially when compared with other high-paying careers. Although, there are certainly some requirements involved in becoming a Financial analyst but they are not rigid and well defined.

First off, you need to have a B.Sc. in Economics, Finance, or Statistics. Other related disciplines might be considered depending on your job description. For example, if the job is in the agricultural industry, a B.S. in a related course might be considered. However, basic knowledge in finance will be needed like any post-graduate studies.

Additionally, one other financial analyst requirement most employers fail to mention, which is often an added advantage, is the mastery of every finance-related skill. It may sound really stressful trying to master all of these skills, but it doesn’t hurt to keep your bases covered before an interview; at least 70% mastery should do the magic.

Above all, regardless of the aforementioned financial analyst requirements, your success still solely depends on the job specifications and your employer.

Note: Having anything less than a bachelor’s degree might kill your dream of ever becoming a financial analyst.

Financial Analyst Roles and Responsibilities

This gives a typical description of what financial analysts do, their roles and duties and also what is expected of them.

- They make financial forecasts based on their analysis. They track operational metrics.

- From the financial data after analysis, they create financial models for informed decisions to avoid mistakes.

- They analyze past results in order to make improvements that will be beneficial to the firm or business in the future. This also tries to ensure avoiding mistakes already made in the past.

- They supervise the accounting team while working closely with them to ensure accuracy.

- Financial Analyst skills include coaching and working with the accounting team, to ensure accurate financial reports.

- They bring out specific time to make go-to-market research in order to make informed decisions that will be beneficial to the firm.

- They make and enforce policies that guide the cost analysis process.

Financial Analyst skills

Financial analysts should have skills that make them experts at what they do. For example, technology, mathematical skills, problem-solving abilities, and communication skills are pretty vital to have as a financial analyst. These skills help financial analysts perform their duties excellently and effortlessly.

However, if you also want to employ a financial analyst these are some skills to look out for.

#1. Accounting Skills

A financial analyst’s job description includes lots of accounting. For instance, managing cash flow, financial management, budget analysis, and reconciling bank statements are now part of the daily routine for financial analysts. Therefore, having these accounting skills will help you work effectively.

#2. Effective communication

Financial analysis as a job requires effective and steady communication. This is because it requires interaction. For instance, while coaching a financial team, you’d need interactive sessions to get the work done. And more importantly, this also applies when the communication is non-verbal, like sending emails or newsletters.

#3. Interpersonal Skills

The job description of a financial analyst includes meeting and deliberating with investors and colleagues. Therefore, possessing this skill will help you retain important relationships necessary for your career and the firm you work for.

#4. Problem Solving Skills

One very important skill every financial analyst should possess is the skill of problem-solving. This is because solving problems is the major job description of a financial analyst. Similarly, they also come up with innovative solutions to financial problems of a client or firm they work for.

#5. Technical Skills

Just like it was mentioned above, technical skills are essential for the financial analyst’s job. However, they use current accounting tools and software, which are sophisticated enough to carry out the technical tasks. For instance, if the firm wants to do a more complicated amount of bookkeeping or accounting, they use software like Hyperion, SQL, and QuickBooks. Meanwhile, this software needs to be updated from time to time. This means that at some point they would also need to learn these skills in order to save time, resources, and money.

#6. Financial Literacy Skills

Basically, you should know that for any financial analyst, the very basic step is to have financial literacy skills. Having these skills means having the ability to understand current financial happenings like the financial market, interest rates, investments, and so on. All these help financial analysts become more effective.

Other skills include;

- Leadership and Management Skills

- Critical thinking skills

- Organizational skills

- Analytical skills

Financial Analyst salary

An individual working as a financial analyst in the United States typically receive salary of about 126,000 USD per year. However, in general, salaries range from 66,600 USD (lowest) to 191,000 USD (highest).

The median, the maximum, and the minimum

Although for most individuals, this may seem irrelevant but trust me, this is one piece of information you should have at the back of your palm. It’s vital for a number of reasons, including salary negotiation with your new employer as a financial analyst or preparing salary scales as an employer.

Salary Range

Financial Analyst salaries in the United States range from $66,600 per year (minimum salary) to $191,000 per year (maximum salary).

Median Salary

The median salary for a financial analyst is 118,000 USD per year. This means that half (50%) the individuals working as financial analyst(s) earn less than $118,000 while the other half are earning more than $118,000.

The median represents the middle salary value. Generally speaking, you would want to be on the right side of the graph with the group earning more than the median salary.

Financial Analyst Jobs

Below are the most recent job opportunities open to financial analysts. The pieces of information were gotten from reliable online sources. However, it should be noted that these opportunities will be updated from time to time.

#1. VP Chief Financial Officer – Guide Well Health

Jacksonville, FL

As the Chief Financial Officer for Guide Well Health, this role is accountable for driving profitable growth across Guide Well Health’s entities. This is achieved by improving the performance of, expanding, maturing, achieving scale, rapidly optimizing, and growing its “delivery of care” asset.

Financial Analyst Job description

- Leads the organization, coordination, and implementation of comprehensive strategic and operational performance review processes. Furthermore, must do a perfect job at reporting vehicles, forecasting and performance management processes, and financial analyses for Guide Well Health entities to ensure strategic goals and objectives are attained…

- Strong leadership/influencing skills with the ability to work effectively within a complex system, influence others, and drive results.

#2. Chief Financial Officer

Dallas, TX 75224

Job Description

Bishop Dunne Catholic School, located in Oak Cliff, is searching for an experienced professional with financial experience and training, preferably with a school or nonprofit. Our diverse and joyful community of faith values individuals who desire to contribute in substantial ways to the organization.

Job Requirement

- Bachelor’s degree in finance, accounting, or business required

- 5 years of experience in finance, accounting, or management-related capacity

- 5+ years of managerial experience with progressive experience in operational/administrative management. Also, must possess excellent communication and interpersonal skills

#3. Chief Financial Officer- job post

Local Motors, Inc. Tempe, AZ 85284

Set up and enforce internal accounting, finance, planning, and controlling rules and processes. This includes revising and optimizing these rules and processes regularly. Furthermore, you should possess the ability “to rise above the numbers” with a critical review of key drivers, overages, shortfalls, etc., while instilling the best processes that provide financial and operating data that leads to business optimization.

#4. Chief Financial Officer – CFO Consultant- job post

ExecHQ

Fargo, ND 58103

Job description

- Apply your skills and knowledge as a CFO to assist your clients as needed with financial, accounting, and operational needs.

- Employ our training and coaching to expand your business network. Furthermore, build great business relationships, follow-up, and help to close leads for new clients that come to your attention.

- Able to interact with CEOs/Business owners at a peer level. Also must be willing to listen, learn, ask the relevant questions to determine the core issues in an organization.

Qualifications and Skills

- Bachelors degree in business, accounting, or related field required. However, MBA or other relevant Master’s degree preferred.

- Five or more years experience as a CFO or equivalent position.

How to become a financial Analyst

If you have ever considered becoming a financial analyst, trust me, it is not as complicated as you think. Below are a few steps on how to become a financial analyst;

#1. Get a bachelor’s degree

This is the primary step every aspiring financial analyst should take. Deciding on a course to study can be a bit challenging. So, it is advisable to study courses that are related to the field. For Instance, Science in financial services, financial management, economics, statistics.

#2. Get certifications and licensing.

After you have gotten your bachelor’s degree, the next step is to gather work experience.

Basically, in the course of that experience, you will get to understand the importance of getting a certification. Therefore, you will also need to get certified in order to move further in your career. Similarly, if your financial analyst career has to do with sales of financial products, then you can’t do without certifications.

Starting out, one of the certifications you should get is the Chattered Financial Analyst (CFA).

But, according to BLS, there are certain requirements needed to get the Chartered Financial Analyst credential. These include:

- A bachelor’s degree in finance or accounting

- A minimum of four years of qualified work experience

- Passing scores on the three CFA Institute exams

However, financial analysts may also achieve certification in more specialized areas by demonstrating their expertise and passing additional exams.

#3. Get a job experience

The more job experience you get, the more you increase of your expertise. Working for different people and firms gives you a cumulative experience that can however take you to the next level in your career.

#4. Further studies

After you’ve gotten enough job experience, in order to reach the peak of your career, you might need to get some extra degree. This can be post-graduate studies or a master’s degree in finance-related courses.

Is Financial Analyst a Hard Job?

In all honesty, the job of a financial analyst is not an easy one. The majority of financial analysts say they are constantly stressed out and overworked. The nature of the work is difficult, and extensive preparation and study are prerequisites for success. While financial analysts can expect to make a good living wage, this often comes at the expense of a work-life balance.

Do Financial Analysts Get Paid Well?

Yes. Financial analysts have a lucrative and varied career, with average annual salaries of $85,000, though this will vary greatly depending on the analyst’s specific path.

Is Financial Analyst Better than Accountant?

Generally speaking, financial analysts earn more than accountants, and their starting salaries tend to be higher as well. There will be a 4% increase in demand for accountants and a 5% increase in demand for financial analysts, according to the United States Bureau of Labor Statistics.

How Long is a Financial Analyst Degree?

Four years. Financial analysts should have a bachelor’s degree in finance or an area closely related to it, such as economics, marketing, management, or business administration. These programmes typically take four years to complete (depending on the chosen major) and require around 120 credit hours.

What does Financial Analyst do Daily?

In the daily life of a financial analyst, he or she gather information, compile spreadsheets, draught reports, and review any and all non-legally relevant information pertaining to potential transactions. They analyse the deal’s financial viability and devise a strategy accordingly.

Is a Financial Analyst an Accountant?

While these two fields of study share some common ground, they each have their own unique approach to the management of one’s financial resources. While an accountant may look at a company’s financial data on a daily basis, a financial analyst analyses past and present trends to predict what the future may hold.

Conclusion

Financial analysts need to remain vigilant about gathering information on the macroeconomic level, as well as gathering information about specific companies, specifically assessing their financial fundamentals via company balance sheets.

To a large extent, this is achievable by staying on top of the financial news.

But, in order to stay on top of the financial news, analysts will need to do tons of reading on their own time. Analysts tend to peruse publications such as The Wall Street Journal, The Financial Times, and The Economist, as well as financial websites.

Furthermore, subscribing to financial newsletters could do a lot of good. However, ensure you pick the right ones.

- Banking and Finance: Why is it the most preferred career choice? (+ detailed guide)

- FREELANCING BUSINESS: 2021 Models and Ideas to consider starting out (+ free tips)

- 5 Internet business consultants for your online business

- FINANCIAL REPRESENTATIVES: Requirements to Becoming One

- Highest paying management jobs

- Financial Stability: Best Practices & Every detail you should know