People are hard to predict, and a lot of things might go wrong when you try to go about debt recovery the wrong way. When emotions and self-control are overridden in your pursuits for bad debt recovery, things might go around and you become the debtor. This happens, especially when you act outside of the provision of the law.

Sometimes filling a court case for bad debt recovery might mean incurring and spending more money than usual, as legal justice costs money and time too.

Using force to go about debt recovery can bring you the money but can as well land you in jail. I understand that emotions take laws into your hands as people can be totally insensitive and selfish, especially when paying back their debt. So what actually can you do to recover your business debts?

1. Change the debtor’s perception

2. Involve a legal practitioner

3. Diplomacy is key

4. Take preventive measures

5. Weigh your relationship with them.

Before we dive in let’s define the basic terms like debt, debt recovery, and bad debt.

What is debt?

Debt can be defined as money or resources owed to someone which should be returned. Dept can also be a state of being under obligation to pay or repay someone or something in return for something received; a state of owing.

Meaning of bad debt

Bad debt is money or resource owed to your business that has a high probability of not being recovered anymore for many reasons out of the control of the debtor or parties involved. Debt recovery for Bad debt is not totally impossible.

Meaning of debt recovery

Debt recovery is the process of making a debtor pay back what they owe to you or to the business using strategies, agencies, or simple diplomacy. What are these strategies to use for your debt recovery?

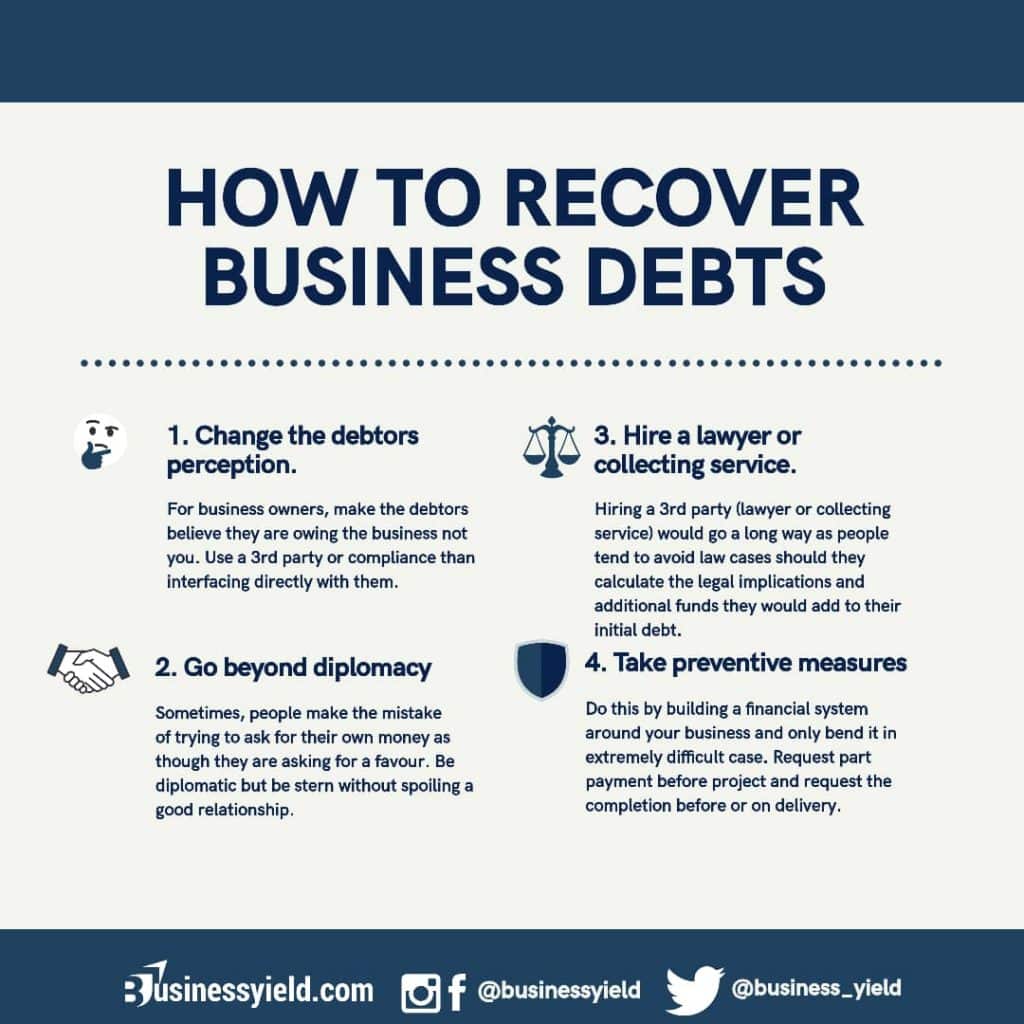

#1. Change the Debtor’s Perception:

When it’s debt recovery, especially bad debt, It matters a lot what you make people believe. If they believe it’s you they are owing, the debtor might want to sweep it under the umbrella of friendship, and complacency follows. If they think they owe a business, a firm, or an organization, the response is different.

In implementing this strategy, Make them believe they are owing to the business and use words like these goods were given to you on trust, and partners are already thinking I did something fraudulent with you to make away with this money. Or statements like the board is threatening to relieve me of my role if this money isn’t recovered in two weeks. The sole purpose of this strategy is to appeal to conscience and foster urgency and a sense of responsibility.

Simply remove yourself from the equation and turn to a third party. If it’s a personal debt, help them understand you went out of your way to borrow the money, and the interest is compounding on you.

Would this strategy work perfectly for your debt recovery? The majority of the time, it’s a no, especially when the debtor has no sense of responsibility and conscience.

Read Also: Attributes of a successful entrepreneur that helps them scale debt

#2. Involve a legal solicitor during debt recovery:

Getting a lawyer or other third party, known as a collection service, who understands the business process would go a long way.

People try as much as possible to avoid legal cases, and should they calculate the cost of hiring their own lawyer, they naturally would think it better to pay their debt than incur more costs on a debt they surely would pay. Have a lawyer send letters to all those debtors with a deadline. Using a deadline in debt recovery puts pressure on the debtor. A client of mine attested to this working for him and reducing his debtors by 70%.

This works too, but be sure there is evidence of a transaction to hold on to before engaging a lawyer for debt recovery.

Read also: Federal Government business grants that will help you out of financial burden

#3. Diplomacy isn’t always a good tool for debt recovery:

I understand there are bad debts you might wish to write off because of the relationship involved. Don’t make it look like a debtor is doing you a favor by owing you. Make it clear that it’s a debt, but you’ve chosen to write it off.

Going beyond diplomacy, it’s important that documentation is made when dealing with people, as it makes debt recovery easier. Personally, for me, every job I do for someone involves generating an invoice, which I send to their email, and once payment is made through the link, it automatically marks them as paid no matter our level of friendship.

Read Also: wise investment tips for business newbies

I often use some online payment services integrated into my business platform. If this payment isn’t honored, I send another official email using my business email address, like customer-service@yourcomany.com or compliance@yourcompany.com, and have someone else put a call through to the client officially. Anybody can do this call for you.

In going about debt recovery, sometimes people make the mistake of trying to ask for their own money as though they are asking for a favor. You’re asking for your own money, not a favor. Get it clear. Yes, you can do this without spoiling a good relationship.

Personally, I used a lady even when I was the only one working for me. This is to create a perception that the business (not me) needs the money. They are dealing with the business, not me. Most times, these people would call you directly telling me about the pressure my worker is mounting on them, I will be firm to reply that she is doing her job and there is little or nothing I can do. I do all these to create a perception as though someone is about to lose her work if the debt recovery fails.

#4. Prevention is better than cure:

It’s far better to prevent situations that will lead you to seek debt recovery strategies. One way to do this is to build a system around your business from the start. A financial system is highly needed to prevent or reduce business debt.

When someone needs your service, send an invoice demanding part payment. In my business consulting career, even if it’s to write a business plan, I ask for a partial deposit with an invoice and payment link sent to the client’s email. Once the work is done, a watermarked screenshot of some (but not all) vital pages are converted to PDF and sent with another invoice to the client. With this, we have reduced our receivables and money owed to us by 85%. Another way is to keep a record of bad debt expenses.

Read Also: The New Business rule every entrepreneur should master

Bonus:

Debt recovery can be difficult but not impossible, especially with bad debts. Some people might truly not have enough resources to pay back, maybe due to one incident that made them bankrupt, e.g., the COVID-19 pandemic that left businesses bankrupt in 2020. Be sensitive enough to understand, except in cases when debtors are taking advantage of you and take your grace to mean weakness. In those cases, be firm and apply all the provisions of the law to recover your money. It’s your money, not a gift.

Bad Debt Recovery FAQs

How are bad debts recovered treated?

If the amount collected does not reach the predicted amount, the remainder will be classified as bad debts. If the amount received exceeds the recoverable amount, the extra amount is considered income in the fiscal year of receipt.

How do you calculate bad debt recovery?

Divide the amount of bad debt by the total accounts receivable for a period, and multiply by 100.

Is bad debts recovered debit or credit?

The bad debts account is debited because bad debts are considered a loss to the firm and are now considered a gain to the business when they are recovered. As a result, they are moved to the Profit and Loss Account.

- SERVICE RECOVERY: Ultimate Guide to Service Recovery

- COLLECTION AGENT: Definition, Roles & Responsibilities(Opens in a new browser tab)

- 30 Most Searched Customer Service Skills (full details)

- Business Impact Analysis BIA: Detailed Process Steps & Examples(Opens in a new browser tab)(Opens in a new browser tab)(Opens in a new browser tab)