This post goes over the job description of a debt collection agent in detail to assist you to understand what they perform. It outlines the most important jobs, tasks, and obligations that most organizations include in their debt collection agent job descriptions. It also outlines the primary standards that most recruiters will expect you to meet if you’re looking for a job as a debt collector. Having said that, you need to continue reading to understand more on collection agent, job description, responsibility and all you need to know.

Collection agent

To collect debts and settle outstanding accounts, collection agencies function as liaisons between businesses and customers. They’re in charge of creating payment plans, locating debtors to start the recovery process, and negotiating debt payments. They may also be required to work up payment arrangements for recoverable debt.

A collections agent is a legal entity that is authorized to collect on behalf of the original creditor default payments and “charge-off” debts. Because charge-off debts are designated as uncollectible in the financial system of the lender, a successful recovery of delinquent amounts will result in a profit for the creditor’s organization. Typically, a debt collection agent represents a registered DCA (Debt Collection Agency), however, they can also act on behalf of a creditor.

It signifies that the collection agent is an employee of the lender’s company in the second situation. A recovery agent works to organize a diplomatic approach to the debtor in order to keep the first (the creditor) and second (the debtor) parties’ business relationships intact (the debtor). A collections agent can work on a local, national, or international level; his acts must adhere to a stringent code of local, national, and international legal practice and laws in order to avoid violating the debtor’s consumer rights. A collection agent’s debt recovery process includes a variety of negotiation and recovery tactics that lead to successful and complete debt collection.

Overview

Are you a salesperson or a financial strategist who knows everything there is to know about legal procedures, bankruptcy, and basic laws? If so, a collection agent might be a good fit for you. The primary responsibility of a collection agent is to recover unpaid invoices, loans, or other debts from debtors. You might work as a debt collector in this position, attempting to recover unpaid bills from corporations, organizations, and customers.

Working as a collection agent typically include making phone calls to customers or debtors, negotiating payment arrangements, doing thorough investigations into their payment status, and designing strategies to manage outstanding accounts.

You may provide financial advice or alternative repayment plans to customers while working as a liaison between a creditor and a customer. You may collaborate closely with accounts receivables, sales, and legal departments to establish collection strategies and procedures by collecting debts.

A high school diploma and experience working in customer service or as a call centre representative are usually required to become a collection agent. Taking classes at a community college or vocational school, on the other hand, may increase your prospects of success in the field of collection. You can work as a collection agent in a collection agency, for example. However, creditors or credit card firms, as well as healthcare facilities and banks, may hire you directly.

Collection Agent Job Description

We’re looking for a professional collection agent to help our company collect outstanding payments from debtors. In this position, you’ll be responsible for engaging with consumers over the phone, establishing payment schedules with debtors, and implementing debt-reduction initiatives.

To be successful as a collection agent, you should have prior debt collection expertise as well as understanding of the Fair Debt Collection Practices Act (FDCPA). Successful collection agencies will reduce financial losses by creating and implementing reasonable debt recovery strategies.

Collection Agent Responsibilities

#1. Customer Communication

The main responsibility of a collections agent is to communicate with clients, usually over the phone, in order to resolve overdue accounts and collect payments. As collections agents regularly deal with debtors who ignore their phone calls or hang up immediately once they understand the contact is an attempt to collect a debt, this needs patience and diligence. Furthermore, when dealing with a collections firm, some consumers can be unpleasant or impolite.

#2. Negotiation and Debt Settlement

Collection agents use negotiation to design and implement payment plans that remove the debt and are reasonable for the consumer, avoiding accounts from becoming delinquent again. Alternatively, collections agencies may need to reach an agreement with the debtor in order to receive payment on a portion of the debt.

#3. Documentation

Collections agents keep meticulous records of all customer conversations, agreed-upon payment arrangements, and sums paid over the phone. While most collections companies utilize software to help manage client information and keep track of debit balances and payments received. Collections agents must still verify that records are entered and kept appropriately throughout the debt collection process.

#4. Research and Customer Location

Collection agents are frequently to locate debtors in order to begin the recovery process. In order to comply with the Fair Debt Collection Practices Act. This component of the job may entail accessing database information. Pulling up credit reports, and locating other publicly available records. Collections agents are adept at finding and analyzing large amounts of data in order to keep accurate records. That is of debtor addresses and phone numbers to aid debt collection attempts.

Collections Agent Education and Training

A high school diploma or GED is usually for collections agents. While on-the-job training is possible, a background in customer service or telemarketing is typical. Furthermore, some jurisdictions and organizations may require collections agents to obtain the American Collectors Association Professional Debt Collector Certification.

Finally, collections agents should be aware of the Fair Debt Collection Practices Act. Which establishes guidelines for debt collection and consumer communication.

Collections agent- varieties and profile specifications

Consumer and business recovery agents are two types of collections agents. The first pursues consumer debts, in which the debtor is an individual; the second pursues corporate debts, sometimes known as “business-to-business,” in which the debtor and creditor are both businesses.

A recovery agent can also be divided into numerous sorts on their area of competence and activity. If the recovery agent is a member of the creditor’s company and acts under his trading name. He will be a “first-party” collections agency. Because there is no data transmission process in this situation, such entities begin the gathering process early.

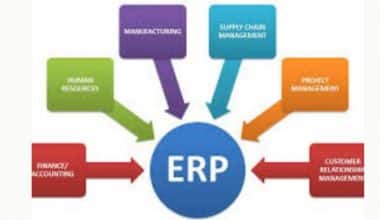

A third-party collections agent is a recovery operative who works for licensed DCAs. For a fixed interest, this type recovers delinquent payments on behalf of the original creditor (commission fee). Integrated APIs (Application Programming Interfaces) are used by such agents to share information about debtor default profiles between the collection agency and the originating lender.

A debt buyer can also be a collections agent. He can work for a debt collection agency or independently. His major goal is to buy bad debt profiles from original creditors in exchange for a percentage of the payment to the lender. After that, the agency can either begin the recovery procedure. As a new creditor or resell the debts purchased to another debt buyer.

Is Collections a Stressful Job?

When challenged about their debts, some individuals become hostile and belligerent, making the work of collectors a potentially difficult endeavor. When trying to carry out their duty, collectors frequently come up against opposition. Collectors that are successful must be prepared to deal with rejection on a frequent basis while maintaining a pleasant attitude and always being ready to make the next call.

What Should I Not Tell a Collection Agency?

Do not disclose any personal financial information to a collector, make payment in “good faith,” make pledges to pay off the debt, or acknowledge that the debt is legitimate. You don’t want to make it simpler for the collector to have access to your money, nor do you want to take any actions that could potentially restart the statute of limitations clock.

How Do I Get Clients for Debt Collection?

Call the human resources departments of companies that have openings for credit managers or positions in accounts receivable. StartingaBiz.com reports that businesses of this nature might think about employing you to do their debt-collecting tasks if you have relevant experience. Check out the collection agency jobs that are available on contract or as freelancers on free internet job marketplaces.

Collections Agent Salary

In 2016, the typical annual wage for bill and account collectors was $35,350 (about $17 per hour). According to the Bureau of Labor Statistics. In 2016, the lowest 10% of earners in this industry made less than $23,610. While the top 10% earned up to $54,970. Collection agents frequently receive a commission depending on debts collected, which can cause actual profits to fluctuate.

And, because of a multitude of causes, including greater automation and software efficiency and outsourcing work to overseas call centers. Jobs in this industry are expected to fall by 3% between 2016 and 2026.

How To Become a Collection Agent

If you want to work as a collection agent, one of the first things you should think about is how much schooling you’ll need. A bachelor’s degree is held by 28.2 percent of collection agents, according to our research. When it comes to higher education, we discovered that 2.2 percent of collection agents hold a master’s degree, even though some collection agents have a college degree. Anyone with a high school diploma or GED can work as one.

When looking at how to become a collection agent, picking the right major is critical. When we looked into the most prevalent majors for collection agents. We discovered that the majority of them have a high school diploma or a bachelor’s degree. Associate’s degrees and diplomas are two more degrees that we frequently see on collection agent resumes.

You might find that previous work experience will assist you in becoming a collection agent. Many collection agent roles, in fact, need prior experience in a customer service representative capacity. Many collection agents, on the other hand, many collection agents have previous work experience as a cashier or sales assistants.

Can a Collection Agent Come to My Home?

When there is no other predetermined location for the appointment, the collection agent will come to your residence. In the event that the borrower cannot meet at their residence, the meeting will take place at the borrower’s place of business. You should not, under any circumstances, try to avoid meeting the agent because doing so could get you labeled as absconding, which could result in legal action being taken against you.

Can You Dispute a Collection With the Credit Bureaus?

If you believe that a collection contains errors, you have the right to contest such information. Formal disputes need to be filed separately with each credit bureau, which can typically be done online through the respective website of each credit bureau. In addition to this, you need to contest the information with the company that gave the information.

Should I Use a Collection Agency?

The bottom dollar is the most important consideration. When a creditor is deciding whether to continue internal recovery attempts or to outsource collections to a third-party vendor, the creditor needs to have a solid understanding of the estimated net yield of each method and compare that to the cost of paying commission versus the cost of operating a highly specialized, intensely trained team of customer support specialists.

Lenders are often better able to focus on their primary business if they hire a managed service such as a collection agency. This is because hiring such a service often makes more sense (and also more financial sense). But in order for the lender to run a successful operation with third-party providers, it must have comprehensive systems and processes in place to regularly measure productivity and compliance standards, as well as to monitor how customers interact with one another.

This almost certainly entails some type of automation, which is a technology solution that can help manage account movement, assess and monitor vendor performance, comply with regulations, and securely store consumer information when dealing with a large portfolio. Compliance is the guiding principle behind all of NeuAnalytics’ operations and decisions. Investigate our comprehensive set of solutions for creditors, as well as the ways in which our third-party vendor management can be of assistance to you.

Law regulations for collections agent

In most cases, national, state, and local laws regulate both third-party and first-party collecting agents. There are a few exceptions, however. For example, the FDCPA (the United States Fair Debt Collection Practices Act) distinguishes between these two categories of debt collectors. They both have the legal right to collect delinquent sums under this act. But a first-party collections agent acting under the creditor’s corporate trading name is barred from charging the debtor a DCA’s interest fee.

The actions of collections agents are governed by a number of different regulations. Because they safeguard debtors’ rights as consumers, the majority of these regulations apply to all sorts of recovery agents. The Federal Trade Commission for the United States, the Office of Fair Trading for the United Kingdom and Wales, the Office of Consumer Affairs and the Consumer Protection BC for Canada, the Solicitors Regulations Authority for the United Kingdom and Wales, and Bankruptcy Abuse Prevention for the United States. Consumer Protection Act (UK & Wales), European Collectors Association, Solicitors Order 1976 (for Northern Ireland), European Small Claims Procedure, and European Collectors Association (for international debt collection) are some examples of such acts.

Conclusion

If you are a recruiter or an employer looking to hire a competent person for a debt collection agent position in your company. You should write and publish a job description for interested candidates to see what duties they will be expected to perform if recruited.

This information will be valuable to prospective applicants in determining their appropriateness for the debt collection agent position in your firm and determining whether or not they can succeed in it.

This will assist you in attracting the most qualified people for your company’s vacant debt collection agent position. Individuals interested in a career in debt collection will benefit from this article since they will learn everything they need to know about what a debt collection agent performs.

FAQ

Is collections a good career?

Debt collectors can earn good money depending on their experience and success in the field. The state you work in often impacts how much you earn as a debt collector even more. No matter the earning potential, bill collectors ranked No. 27 in Best Business Jobs by U.S. News in 2019.

Is collections a stressful job?

Collections can be a stressful job. As a collection agent you’re dealing with intimate details of people’s businesses and their lives. You occasionally hear disturbing stories, and are faced with difficult decisions. Few people are happy to get a call from a collection agent and some are downright cruel or threatening.

Can debt collectors work from home?

Under normal circumstances, in order to work from a residence, some states have specific requirements for debt collectors, such as requiring that the agency register an agent’s home address as a “branch office” with the state regulatory board. The regulation is currently valid for six months but could become permanent.