It is no news that Netflix (NFLX) faces tons of competition in this present era and age. The era where cable networks and over-the-top online video services are competing and screaming for more attention through every means possible. Although current and future Netflix shareholders should be aware of the companies that pose the greatest threat to the company, they should also consider whether those threats are truly significant. Every industry has competitors, but Netflix’s situation might be unique. Continue reading to learn more about Netflix stocks, offerings, its major competitors with respect to competitor analysis as well as what they have to sell.

Important Points to Remember

More people are cutting the cord and using video platforms to watch movies and TV shows.

With approximately 183 million paying subscribers worldwide as of March 2020, Netflix remains the world’s largest subscription streaming service.

Amazon’s Prime Video service, which is cheaper and has 150 million subscribers, could steal market share from the company.

The New Trend

The things that people watch and how they watch them change all the time. Consumers are connecting less to their television sets than they were the previous year, according to Nielsen’s Total Audience Report from February 2020. Rather, they are moving to mobile and web-based streaming on smartphones.

In 2019, adults spent an average of three hours and 27 minutes a day watching live television, compared to three hours and 44 minutes in 2018. However, the most significant improvements in viewing time are due to mobile streaming, which has now surpassed live-television viewing. In the last three months of 2019, people spent just under four hours a day on their phones, compared to two hours and 31 minutes in the same timeframe of 2018.

Statista estimated that 74% of American audiences used subscription video-on-demand services in 2019, up from 64% in 2017. According to the report, Netflix was the country’s most popular subscription-based streaming service. However, according to Forbes, 182.5 million Americans, or more than 55 percent of the population, use streaming services to watch content.

On the other hand, the “Nielsen Total Audience Report” from February 2020, says 93 percent of U.S. users with streaming service subscriptions expect to either increase or maintain their current subscriptions.

An Overview of Netflix

One of the largest contributors to the cord-cutting frenzy is Netflix. This refers to when customers forego conventional cable network television in favor of a subscription service. And for the most part, this trend is aiding Netflix in crushing its competition as it delivers high-quality original content at an affordable price.

The Fundamentals

Netflix is available on smart TVs, game consoles, streaming media players, and Amazon’s Fire TV, among other devices. At the end of the first quarter of 2020, the company had about 183 million paying customers around the world. This reflects a 22.8 percent increase in subscriptions year over year. Netflix expects membership growth to begin in the second quarter of 2021, with over 25.6 percent rise in view.

How much does it cost?

Subscribers can choose from a variety of options:

- The Basic Plan costs $8.99 a month and has a limited set of features. Subscribers can only stream on one platform at a time, and standard definition content is restricted (SD).

- The Standard Plan: For $12.99 a month, you get high definition (HD) viewing on two separate screens.

- The Premium Package is the most expensive, costing $15.99 a month and enabling viewers to stream in Ultra HD on four different screens at the same time.

Netflix Offerings to defeat Competitors

Netflix makes money by offering a variety of viewing choices that vary by region, giving them an upper hand against competitors. Every month, the organization rotates through original and new titles. There are tons of feature movies, documentaries, cartoons, and television shows to choose from, including Netflix original titles. Stranger Things and Orange Is the New Black are two of the company’s most well-known titles. And the list continues to expand.

Financial Statements

Netflix posted revenue of $5.77 billion in the first quarter of 2020, which was in line with the company’s projections due to the strengthening of the US dollar against other currencies. For the year, net income was $0.71 billion. These numbers are up from the same time last year, when revenue was $4.52 billion and net income was $0.34 billion. The company attributed its financial results for the quarter to three factors:

- increased membership growth as a result of home detention from the Covid-19 precautions,

- a drop in foreign sales as a result of a sharply growing dollar, and

- postponed content creation investment as a result of production shutdowns.

The Changing Scenery

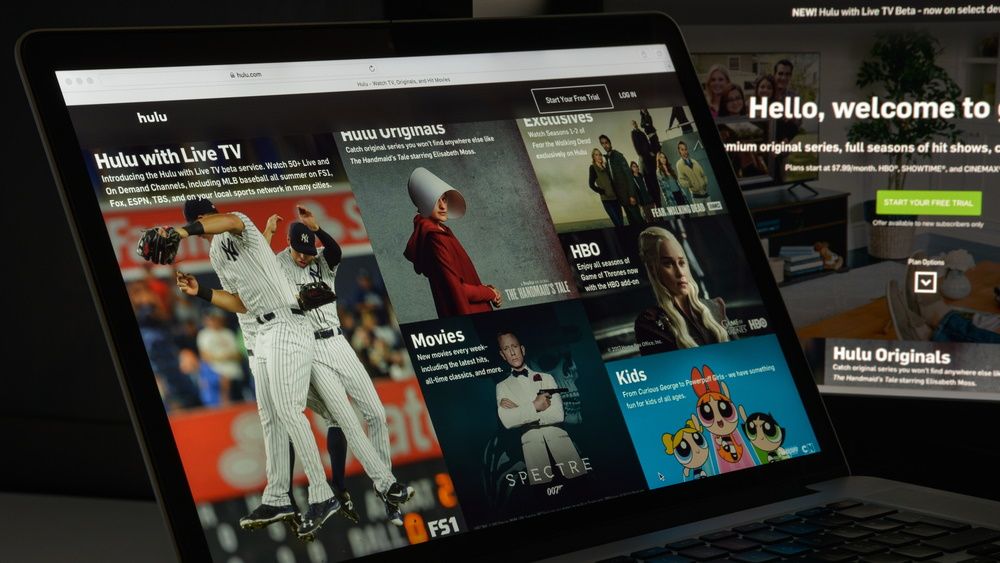

Hulu, Amazon, and Walt Disney’s streaming service, which debuted in November 2019, as well as several cable channels’ subscription services, are among the rivals threatening to eat into Netflix’s market share including competitor analysis.

#1. Amazon

Amazon Inc. is potentially Netflix’s most serious competitor (AMZN).

Amazon Prime Video had around over 150 million subscribers as of the fourth quarter of 2020. This figure has been rapidly increasing over the past few months as the company has expanded the output of original content.

If you’re a regular Amazon shopper, you’ll likely profit from Prime membership, which includes free two-day delivery on all orders as well as a streaming subscription. This subscription costs $119 per year or $12.99 per month if paid annually. Furthermore, as a student, the subscription gets cheaper: $59 per year or $6.49 a month.

However, If you decide to go for just the streaming service alone, you’ll pay $8.99 a month. A simple competitor analysis shows that this amount is the same as Netflix’s standard plan. But it’s somewhat less than the premium subscription.

Prime Video users have access to tens of thousands of titles, including feature films, documentaries, and television shows. To an extent, a little beyond Netflix offerings.

According to competitor analysis, Amazon Prime, like Netflix, has its own original films and movies, such as The Marvelous Mrs. Maisel and Tom Clancy’s Jack Ryan. The Prime Video app, as well as smart TVs, game consoles, streaming media devices, and Amazon’s Fire TV, provide access to the service.

#2. Hulu

The big break for Hulu came in May 2019, when Comcast and Disney announced a deal in which Disney would buy Comcast’s equity in the company for a reported $5.8 billion. As Disney made a major step into the streaming services field, this gave Disney complete ownership of Hulu and consolidated the rivalry.

According to competitor analysis, Hulu’s subscriber base is much smaller than Netflix and Amazon’s. Furthermore, at the end of 2020, Hulu had over 30.4 million subscribers.

Hulu is, however, expanding the range of options and add-ons. Hulu’s subscription plans are divided into four categories: regular, premium (ad-free), basic plus live TV, and premium plus live TV. Hulu’s monthly rates start at $5.99 for Hulu and $54.99 for Hulu + Live TV. Premium add-ons, such as HBO, Cinemax, and Showtime, are available for an extra charge. Disney+ and ESPN+ are available as part of Hulu’s subscription packs.

#3. Disney+

There has been a lot of buzz about Walt Disney’s upcoming streaming service. Disney+ is an ad-free, on-demand service that includes the entire Disney film library as well as original Disney television programsPixar, Marvel, Star Wars Enterprise, and National Geographic titles are among the titles available in the library. Furthermore, the service also contains all seasons of The Simpsons as well as 21st Century Fox movies. Subscribers have access to unlimited downloads that they can watch wherever and whenever they want.

Before Disney decided to join the streaming battle, Netflix and Disney had an exclusive partnership. When Disney revealed that it would launch its own service, it terminated its contract with Netflix. Netflix gave the studio a range of titles in exchange for agreeing to exclude them all from its lineup in 2019.

Disney+, Hulu, and ESPN+ bundle subscriptions cost $12.99 a month as of May 2020. Disney+ subscriptions are $6.99 per month or $69.99 per year.

The Real Risks

The first and most visible challenge to Netflix is the rising cost of programming. In 2019, the company said it would spend up to $15 billion on content. That’s a lot of money to spend on content, plus have you thought about the fact that bidding wars could drive up the price even further. However, Netflix’s top line is rising at such a rapid pace that it might be able to help mitigate this issue.

Free cash flow (FCF), which was +$162 million in the first quarter of 2020, is a related issue. This represents a substantial improvement over the -$460 million recorded in the same period last year. According to the firm, its FCF has increased as a result of higher operating margins and revenues.

However, whether Netflix can maintain this rate of expansion depends on its ability to outgrow its costs. Netflix would almost certainly need to keep churning out big hits after big hits if it wants to maximize its chances of making this happen in the long run.

Netflix Stocks

The other issue is much more straightforward. Netflix has a trailing 12-month price-to-earnings ratio (TTM P/E) of 88.17 as of May 15, 2020, making it a relatively high-growth stock. Simply put, Netflix stocks will not be seen as a safe haven if the broader economy faltered due to investors believing it is overvalued.

In reality, those who have invested in Netflix may panic and sell in order to diversify into safer stocks. This will have a significant impact on Netflix’s stock considering the fact that it’s stock price that matters most to investors. The good news is that there isn’t a single direct rival to Netflix in the same league.

Netflix Competitors’ Stocks

For the most part, Netflix’s competitor stocks are often inconsistent. In other words, they are always in motion between different price levels. So giving you pieces of information about Netflix competitor stocks that may become irrelevant in the next few minutes or hours isn’t the right call. Rather a trip to the platforms below will be a better option.There, you will be able to get first-hand information concerning Netflix Competitor stocks and some analysis to an extent.