One of the simplest option trading strategies is the short put and the long call involving just a single option. Here we are going to discover more about what the short put option is by comparing it with an example. We’ll compare their cash flows and risks involved and we’ll conclude with recommendations on when to trade each of the strategies.

What is a Short Put?

A short put is basically the sale of a put option. A put or put option is a financial market derivative instrument that gives the holder, the right to sell an asset, at a particular price, by (or at) a particular date to the writer (i.e. seller) of the put. The holder here means the person buying the option, while the particular price is known as the strike. So when a trader sells a put option, he is said to be short the put. Here the trader sells the right to sell the short option’s underlying stock in the future-anytime before the option’s expiration. the trader sells it at the specific price of the option contract known as the strike price and for a particular number of shares in the contract.

The trader uses the short put approach aiming at profiting by the amount of the option premium he or she receives without executing the option. When the option buyer exercises the option, the seller needs to purchase the underlying stock at the option strike price (a specific price). This will result in incurring a loss. This is because the option buyer will only exercise their option if the stock market price goes below the strike price.

Short Put Option Strategy

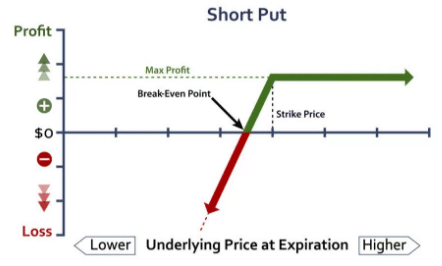

When selling puts without the intention of buying the stock, you want the puts you sell to expire worthlessly. The strategy is a low-profit potential if the stock remains above the strike price but poses a substantial risk as the stock price goes down. What is the potential in this short put option strategy, you may ask? Most traders go for this strategy because of the high probability of success when selling very out-of-the-money puts. Hence, when the market moves against you, you must have a stop-loss plan in place. So keep an eye on the strategy as it unfolds.

However, this strategy is based on mere speculation hence it is very risky. It mostly suits seasoned traders. It runs when the market is bullish to neutral.

There is a large sweet spot for this strategy. So as long as the stock price is higher or at the strike price, you’ll make your maximum profit. That’s why this strategy attracts most traders. For the maximum potential profit scenario, the potential profit is limited to the premium received for selling the put. Also, for the maximum potential loss, it is substantial but limited to the strike price minus the premium if the stock goes to zero.

Pros of Short Put Option

Some of the benefits of the short put option include:

- It establishes a higher futures price.

- The cost of a call is less by selling the put.

- It is highly flexible, offset at any time.

Cons of Short Put Option

- The limited benefit from the minimal futures price

- Capital expense of the potential margin exposure

- If you offset before expiration, it will change the cost & P/L (advantage in higher market, disadvantage in lower market)

Traders use a short put to buy the underlying security. For a short put option example, assume you want to buy a stock at $20, but it currently trades at $25. Selling a put option with a strike price of $20 means if the price falls below $20 you will have to buy that stock at $20. That what you wanted to do anyway. The benefit here is that you get a premium for writing the option. If you got a $2 premium for writing the option, then you have reduced your purchase price to$18. If the price of the underlying doesn’t drop below $20, you still keep the $2 premium.

What is the Risk of a Short Put Option?

The profit on a short put is limited to the premium received, but the risk can also be significant. When writing a put, the writer needs to buy the underlying at the strike price. So when the price of the underlying falls below the strike price, the put writer could face a significant loss.

Looking at this short put option example, assuming the put strike price is $25, and the price of the underlying falls to $20, the put writer will be facing a loss of $5 per share. They can close out the option trade to make a loss. Otherwise, they can let the option expire which will cause the option to be exercised and the put writer will own the underlying at $25.

If the trader exercises the option and the writer needs to buy the shares, it’ll require an additional cash outlay. In this case, for every short put contract, the trader will need to purchase $2,500 worth of stock ($25 x 100 shares).

Potential Adjustment of the Strategy

For a rising market, buying back the short put option will capture decay in premium. You roll up the long call option to make profits from an increase in price. Also, you can sell higher strike calls to generate additional credit.

Likewise, in a falling market, you can roll down a long call to capture savings from a drop in price. Also, you can roll down a short put to extend the range of opportunities to benefit from falling prices.

Short Put Option Example

Assume an investor is bullish on hypothetical stock ABC Corporation, which is currently trading at $30 per share. In this short put option example, the investor believes the stock will rise to $40 over the next several months. The trader can simply buy shares, but this requires $3,000 in capital to buy 100 shares. Writing a put can generate income easily, but could create a loss later on.

The investor then writes one put option having a strike price of $32.50, expiring in three months, for $5.50. Therefore, the maximum profit is limited to $550 ($5.50 x 100 shares). The maximum loss here is $2,700, or ($32.50 – $5.50) x 100 shares. The maximum loss occurs if the underlying goes down to zero and the put writer needs to still buy the shares at $32.50. In this short put option example, the loss is partially offset by the premium received.

Read Also: Short Call vs Long call Explained! Comparing risks and rewards

What Long Call and Short Put Have in Common

Long call and short put are among the simplest option strategies. Both of them involve just a single option. Both are bullish, which means they make money when the underlying security rises and they lose when the underlying decreases.

It might seem that they are the same and it doesn’t matter which one you choose when you think a stock will go up. It matters anyway. In fact, these two strategies differ in diverse ways, which we will illustrate in an example.

Example

Assuming you think a stock, currently trading at $35 per share, might go up. You have to choose between buying a $35 strike call option and selling a $35 strike put. Both options are currently trading at $2 per share or $200 for one contract ( ie 100 shares of the underlying stock).

Initial Cash Flow

You initiate a long call position by buying a put. So, to initiate the trade, you must pay the option premium – in our example $200.

You can initiate a short put position by selling a put option. For that, you’ll receive a premium.

Hence a Long call has a negative initial cash flow while a Short put has a positive.

Maximum Possible Profit

The long call makes money when the underlying stock rises. If the stock is above the strike price of $35 at expiration, the call option’s value rises dollar for dollar with the stock. For instance, if the stock ends up at $40, the call will be worth 40 – 35 = $5 at expiration. The total initial cost, the long call trade will make $3 per share or $300 for one contract. If the stock ends up at $50, the option’s value will be 50 – 35 = $15 and gross profit $13 per share, or $1,300 for one contract. The higher the stock goes, the higher the proceeds.

A short put is also yielding profit when the stock goes up. However, the profit is limited to the $200 received for selling the put in the beginning. There is no way you can make more, regardless of the stock going to $40, $50, or $500. So you keep the option premium received.

The long call has unlimited potential profit while the short put has its profits limited to the premium received (initial cash flow).

Maximum Possible Loss

This is how much you can lose in the worst-case scenario when you are wrong and the stock price falls.

For a long call, the worst-case scenario is that the stock ends up below $35 and the option expires worthless. You will lose the option premium paid in the beginning and nothing more. The maximum possible loss from the example is $200.

A short put position is much riskier. The put option will rise in value as the stock falls. Because you are short of the option, its value is your loss. For example, if the stock ends up at $30 at expiration, the put will be worth 35 – 30 = $5 and you will lose $500. With the $200 premium received in the beginning, your overall loss will be $30.

Theoretically, in the worst case, the stock can fall to zero and the put option’s value will be equal to its strike price which is $35 per share, or $3,500 for one contract. With the premium, your total loss will be $3,300.

The maximum risk of a long call trade is limited to initial cost (option premium paid) while the maximum risk of a short put is usually very high and equal to strike price minus option premium received.

How does a short put option work?

A short put option is a bearish strategy where an investor writes (sells) a put option, betting that the price of the underlying stock will remain above the strike price. The writer of the put option collects the premium from the buyer and is obligated to buy the stock at the strike price if the buyer exercises their option.

What is the impact of an increasing stock price on a short put option?

When the stock price increases, the value of the put option decreases. The writer of the put option will profit if the stock price remains above the strike price, as they will not be required to buy the stock at the higher price.

What happens if the holder of a short put option decides to buy the underlying stock?

If the holder of a short put option decides to buy the underlying stock, they will have effectively closed out their short put position. The holder will incur a loss if the stock price is above the strike price, but will earn a profit if the stock price is below the strike price.

How can a short put option be closed out?

A short put option can be closed out by purchasing a put option with the same underlying stock, strike price, and expiration date. This will offset the original short position and end the obligation to buy the stock if the option is exercised.

What is the role of implied volatility in a short put option?

Implied volatility is a measure of the expected volatility of the underlying stock price. It can impact the price of the put option and affect the return of the short put option. A higher implied volatility will result in a higher put option price and lower return for the writer, while a lower implied volatility will result in a lower put option price and higher return for the writer.

What is the difference between European and American style put options?

European style put options can only be exercised on the expiration date, while American style put options can be exercised at any time prior to the expiration date. This means that American style put options are more flexible and can be exercised to take advantage of market movements, while European style put options are less flexible but have a simpler pricing structure.

Conclusion

We can see the simple option trading strategies commonly used by traders, the short put and the long call. We were able actually to state what short put strategy is all about, the risks, cashflow, and rewards

Subsequently, we can see their similarities and differences. We can see that while long call has a negative initial cash flow, short put has positive cash flow. For the risks, the long call has unlimited potential profit while the short put has its profits limited to the premium received (initial cash flow). The maximum risk of a long call trades limits to initial cost while the maximum risk of a short put is usually very high and equal to strike price minus option premium.

Short Put Option FAQs

What is a short put option?

A short put is when a trader sells or writes a put option on security. The concept behind the short put is to profit from an increase in the stock price by collecting the premium connected with a short put transaction. As a result, the option writer will suffer losses if the price falls.

Can you short sell a put option?

A put option gives the contract holder the right, but not the responsibility, to sell the underlying asset at a fixed price by a certain date. This also provides the ability to short-sell the put option.

How do you protect a short put option?

Using this method, you buy a put option with a higher strike price and then sell a put option with a lower strike price. Both alternatives, however, have the same expiration date. A put spread protects the investor by separating the strike prices of the bought and sold puts.

Is a short put bullish?

A bull put spread makes the most money when the underlying stock’s price is greater than the strike price of the short put (higher strike price) at expiration.