Put-call parity is one of the most important principles in options trading. The term refers to the functional equivalent of a put option and a call option for the same asset, time frame, and expiration date. When the prices of otherwise equivalent put and call options do not match, an arbitrage opportunity arises. In other words, traders can profit only from the contracts’ imparity (misalignment). As a result, put-call parity is a critical concept in options trading. Consider consulting with a financial advisor to improve your understanding of put-call parity and how it can fit into your overall options investment strategy. However, let’s see an overview of the put-call parity formula, equations, calculator, and some examples.

Before delving into put-call parity, let’s go over the fundamentals of options trading. A long call position means you purchased a contract that gives you the right to buy an asset at a predetermined price, whereas a long put position means you purchased a contract that gives you the right to sell an asset at a predetermined price. A short call position implies that you sold a call contract and must acquire and sell an asset at a predetermined price if the contract buyer exercises their option. A short put position means that you sold a put contract and must buy an asset at a specified price if the contract buyer exercises their option.

What is Put-Call Parity?

Put-call parity is a key concept in option pricing that demonstrates how the prices of puts, calls, and the underlying asset must be consistent with one another. This formula establishes a relationship between the prices of a call option and a put option with the same underlying asset. The call and put options must have the same expiration date and strike price for this relationship to work.

According to the put-call parity relationship, a portfolio consisting of a long call option and a short put option should be equivalent to a forward contract with the same underlying asset, expiration date, and strike price. We can rearrange this equation to show several different perspectives on this relationship.

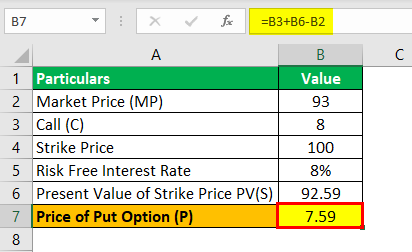

Excel Calculator for Put-Call Parity

This put-call parity calculator demonstrates the relationship between a European call option, a put option, and the underlying asset. By entering data, you can see what any of these variables should be if this parity relationship holds.

Here’s a quick look at CFI’s put-call parity calculator:

Visit the CFI Marketplace to get CFI’s free put-call parity Calculator

What does the Put-Call Parity Equation/ Formula entail?

So, the put-call parity equation can be written in a variety of ways and rearranged to yield different inferences. The following are a few examples of put-call parity equation common expressions:

St + pt = ct + X/(1 + r)^T

The above equation can be interpreted to mean that a portfolio with a long position in the underlying asset and a put option should equal a portfolio with a long position in the call option and the strike price. This relationship should hold according to the put-call parity, or else an arbitrage incentive exists.

Ct – Pt = St – X/(1 + r)^T

A portfolio with a long position in the call and a short position in the put should equal a portfolio with a long position in the underlying asset and a short position in the strike price in this variant of the put-call parity.

Read also: PUT OPTIONS: How to trade put options in simple steps

Intepretation of the Put Call Parity Formula Variables

We can interpret the variables in the Put-Call Parity as follows;

St = Underlying Asset Spot Price

Pt denotes the price of a put option.

Ct denotes the price of a call option.

X/(1 + r)T = Strike Price Present Value Discounted from Expiration Date

r = The Discount Rate, also known as the Risk-Free Rate.

We can also rearrange the put-call parity formula to focus on a single variable. A synthetic call alternative, for example, can be generated based on the put-call parity. The following is an example of a synthetic call option:

Ct = St + Pt – X/(1 + r)^T

The call option should be equivalent to a portfolio with a long position on the underlying asset, a long position on the put option, and a short position on the strike price, as seen here. This portfolio is similar to a synthetic call option. If this partnership fails, an arbitrage opportunity occurs. If the synthetic call was less than the call option, you could benefit from buying the synthetic call and selling the real call option.

Example of Put-Call Parity

Consider a situation involving put-call parity. Assume a one-month European call option on a barrel of crude oil with a strike price of $50 trades for $5. What is the cost of a put premium with the same strike price and time before the expiration of the one-month risk-free rate is 2% and the underlying asset’s spot price is $52?

The following is the put-call parity equation that will be used to determine the put premium:

These calculations are also possible in Excel. The following is an excel answer to the above question:

Why is it Important?

Options traders will use the entire put-call parity formula to get a sense of how to properly balance these premiums. Let us return to our previous example. ABC stock is currently trading at $20 per share. Our options have a strike price of $25 and an expiration date of 0.5 year (or six months). Assume a risk-free interest rate of 3%. Our premiums will be calculated as follows:

PT + 20 = C + 25/(1+0.03)0.5

PT + 20 = C + 25/(1.03)0.5

C + 25/1.0148 = PT + 20

C + 24.63 = PT + 20

24.63 – 20 = PT – C

C – PT = 4.63

In a real market, our put options should be priced $4.63 higher than our call options. This represents the probability that the put option will expire in the money before the call option.

The lack of parity between these options opens up the possibility of arbitrage. Essentially, an investor will purchase the less expensive asset, sell the more expensive asset, and pocket the difference. This method can be difficult, but it can also be profitable.

Put-Call Parity Example 2

Assume we overestimate the value of our put option. Our put is priced at $10, and our call is priced at $5. Our options are $0.37 out of sync. We may now proceed as follows:

- Sell the put option on ABC for $10.

- ABC can be shorted for $20.

- We are now up a total of $30.

- Purchase the call option on ABC for $5.

- Invest $24.63 in our secure asset at a rate of 3% for six months.

- We’re down a total of $29.63.

So, to begin, we open our place with a total profit of $0.37. Not by chance, this is the number by which our choices are misaligned. One of two things will happen when our contracts expire:

- The closing price of ABC stock is less than $25.

- Our investment yields a profit of $25.

Because of the put deal, we pay $25 to buy stock. We supply this stock to cover the short selling, resulting in a zero-loss transaction. The call choice is out of the money until it expires. This transaction resulted in neither a profit nor a loss for us.

In the end, ABC stock was trading above $25. Our investment yields a profit of $25. Because of the call deal, we pay $25 to buy stock. We supply this stock to cover the short selling, resulting in a zero-loss transaction. The placed contract expires in red.

This transaction resulted in neither a profit nor a loss for us. We make the $0.37 difference between the two contracts regardless of what happens. We would make it regardless of what happens in the economy, allowing major investors to pump billions of dollars into this opportunity and transform a tiny gap into a huge profit.

What are some common misconceptions about put-call parity?

Some common misconceptions about put-call parity include the idea that it is always applicable in all market conditions, or that it can be used to guarantee a profit. Put-call parity is a theoretical concept that assumes certain conditions, and in practice, deviations can occur due to market factors such as volatility and liquidity.

How can put-call parity be used to evaluate option combinations?

Put-call parity can be used to evaluate option combinations by comparing the theoretical value of a long put and a long call with the same expiration date and strike price. This can help traders assess the potential risks and rewards of different option strategies and make informed trading decisions.

How does put-call parity relate to the Black-Scholes model?

Put-call parity is closely related to the Black-Scholes model, as the Black-Scholes model is based on the assumptions of put-call parity. The Black-Scholes model uses put-call parity to calculate option prices, which are based on the current stock price, strike price, time to expiration, interest rate, and volatility.

How does dividend yield impact put-call parity?

Dividend yield can impact put-call parity by affecting the price of the underlying stock. A higher dividend yield will increase the value of the underlying stock, which will cause the call option price to rise and the put option price to fall. This can create a deviation from put-call parity, which assumes that dividends have no impact on option prices.

What is the role of volatility in put-call parity?

Volatility plays a significant role in put-call parity, as it affects the price of both call and put options. Higher volatility increases the uncertainty of the stock price at expiration, which leads to higher option prices. This can cause a deviation from put-call parity, as the relationship between put and call prices may change based on changes in volatility.

Can put-call parity be used in combination with other options strategies?

Yes, put-call parity can be used in combination with other options strategies to enhance the potential rewards or reduce the risks of a trade. For example, a trader could use put-call parity to evaluate the potential benefits of a bull call spread or bear put spread, or to analyze the risk-reward trade-off of a straddle or strangle strategy.

Summary

Trading options are not for every individual investor. It necessitates much more effort and expertise than standard stock and bond investing. However, put-call parity is an essential principle for some individual investors, as well as accredited and institutional investors, who choose to trade options. It specifies the functional equivalent of a put option and a call option for the same commodity, time period, and expiration date. When put and call options are not in parity, understanding this concept allows you to book income.

Investing Advice

Doctors should not self-diagnose, and self-represented litigants are said to have a fool for a lawyer. And, no matter how sophisticated the approach, any investor might benefit from the assistance of a financial advisor. Finding one does not have to be difficult. SmartAsset’s matching tool will help you find several in your field in minutes, allowing you to ensure that your own investment plans are designed to suit your needs now and in the future. If you’re ready, get started right away.

Don’t mix up futures and options. A futures contract binds you to purchase or sell an underlying asset at a predetermined price on a certain date. Depending on whether the deal ends profitably or not, you either make or lose money. An options contract offers you the right – but not the duty – to buy or sell an underlying asset at a predetermined price on a specific date.

Why are puts more expensive than calls?

The further out of the money the put option is, the larger the implied volatility. In other words, traditional sellers of very cheap options stop selling them, and demand exceeds supply. That demand drives the price of puts higher

How do you replicate a put option?

The replicating portfolio to value a put option is a short position in the stock and purchase of a bond. This portfolio is called a replicating portfolio because if you sold the stock now (quantity discussed below) and lent the present value of the stock, your payoff will exactly match the payoff from the put option

Why does the put call parity relationship only come close to holding?

Why does the put-call parity relationship only come close to holding, but not predict the exact price? A. In practice, excessive amounts of arbitrage weaken the strength of the relationship. … The put-call parity relationship is a theoretical finding which cannot be expected to hold in practice.

How do you value a put option?

A put option is said to have intrinsic value when the underlying instrument has a spot price (S) below the option’s strike price (K). Upon exercise, a put option is valued at K-S if it is “in the money”, otherwise its value is zero.

- COVERED CALL OPTION: How To Use Covered Call Option Strategy Effectively (+ Detailed Guide)

- PROTECTIVE PUT: How To Master Protective Put Strategy In 5 Simple Steps

- COVERED CALL Explained: Understanding Covered call Formula With Examples

- PUT OPTIONS: How to trade put options in simple steps

- SHORT PUT OPTION: Overview, Examples (+trading tips)