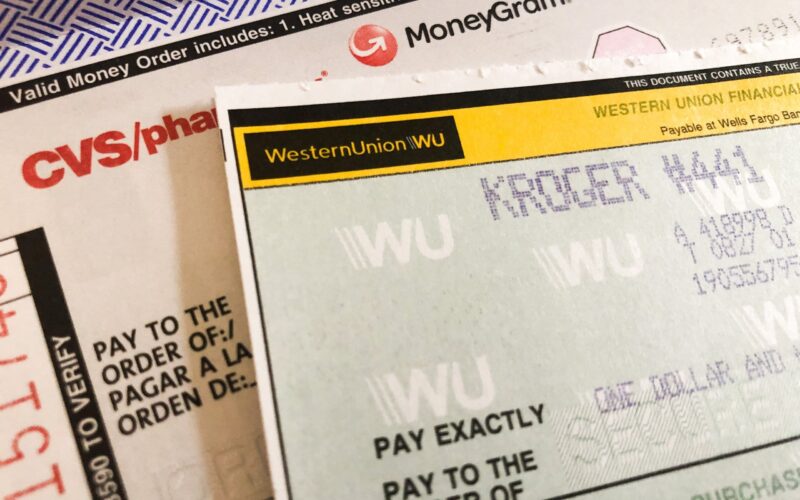

Writing money orders seems to be quite simple and easy stuff to do. However, this isn’t often the case. Either way, it’s pretty important to know how to write money orders more accurately than casually which is what many do. Hence, we’ll look over how to write a money order to USCIS, Moneygram, and Western Union.

What Is Money Order?

A money order is a certificate that enables the specified recipient to receive money on demand. It is normally given by a government or a banking institution. Moreover, a money order is similar to check-in, and the person who bought it has the ability to halt payment.

What You‘ll Need to Write a Money Order

The procedures for writing out a money order differ depending on the organization, whether it’s Western Union or the Moneygram. The appearance of each institution’s money order may also differ significantly. Nevertheless, you will typically require the following details:

- Payee’s name (i.e. the person to whom the money will be paid)

- Address of the Payee

- Amount of payment

- Your name and mailing address

- The purpose of the payment and/or the billing account number

To acquire the money order, you’ll also need a mode of payment (cash, check, debit card). Some issuers also restrict your payment choices. You won’t be able to acquire a money order with a credit card, for instance.

How to Get a Money Order

A money order can be purchased from banks and credit unions, check-cashing businesses, the United States Postal Service, numerous grocery stores, and some big-box stores. You can purchase the money order with cash or a debit card.

However, you should prevent utilizing your credit card to buy a money order since your credit card issuer may classify the transaction as a cash advance. Cash advances may incur hefty fees, as well as a higher interest until the balance is paid off. Some issuers will also refuse to take credit cards as payment.

The quantity of the money order you can buy may be limited. If you’re shipping it within the United States, the USPS, for instance, permits you to purchase money orders worth up to $1,000. In addition to the cost of the money order, you will normally be charged a fee ranging from $1 to $10.

Money Order Advantages

Money orders are a secure method of payment for buyers. You can send the documentation that can be tracked and cashed only by the recipient. Money orders, as opposed to checks, allow you to keep certain information secret, such as your bank account details. They’re also beneficial for transactions that don’t accept checks.

If you need to purchase and write out a money order, you can do so at a variety of locations, including the post office, financial services firms such as Western Union, retail establishments such as Walmart, or a traditional bank. Most merchants write a money order in western union for under a buck, but you’ll have to pay a little more if you go to your bank or credit union.

To write a money order in a western union is typically a secure means of payment for merchants. Purchasers must pay for a money order to write and with cash or a cash equivalent in western union, so it will not bounce like a personal check.

Money Orders Have Drawbacks

Till recently, money orders were a popular and low-cost payment method. New fintech payment alternatives, such as Venmo, have developed, though. These alternatives to money orders are less expensive, simpler, and faster. As a result, you might want to look into alternative modes of payment. Due to amount constraints and issuing fees, large transactions may necessitate the usage of multiple money orders. A cashier’s check might be a better option in this situation.

Likewise, money orders are not a replacement for a traditional bank account that enables you to write cheques or use a debit card. Money orders, unlike check or debit card purchases, need you to pay a fee each time you make a payment, making them less economical for frequent transactions.

Similarly, money orders are occasionally counterfeit and used in typical internet scams, so make sure you fill them out correctly and that any monies you receive clear your bank before spending them.

How to Write Out a Money Order

After you’ve bought your money order, thoroughly write it out to ensure that it gets to the appropriate person and it’s cashable. Here are the steps to take when filling it out:

#1. Enter the Recipient’s Name Here

Fill in the “pay to” or “pay to the order of” field with the name of the receiver of the money order. This could be a person’s or a company’s name. Make sure to write everything accurately and that your writing is readable.

It is critical to complete this area as soon as you acquire the money order, as this will be the only individual permitted to cash or deposit the money order. (If you forget or misplace a money order before writing in the payee’s name, anyone can write their name on the money order and cash it.)

#2. Fill Out the Purchaser Box With Your Address

Where the money order asks for the purchaser’s address, fill in your address. There could be an additional address field where you can enter the address of the person or business to whom you are paying or transferring money.

#3. Fill Up the Memo Field With the Account or Order Number

A memo line allows you to specify what the money order is for. You can, for instance, declare that it is to be used to buy a particular piece of land or to pay off a certain debt. If you have an account or order number from the payee, add it here. This field may also be referred to as “payment for” or “account number.”

4. Fill Out the “Purchaser’s Signature” Area With Your Name

Sign the front of the money order in the section marked “Signature.” This part could be labeled “Purchaser’s signature,” “Purchaser,” “From,” “Signer,” or “Drawer.” The backside of the money order should not be signed. This is where the person or business being paid endorses the money order before cashing it.

#5. Save Your Receipt

Save your receipt, which includes a tracking number. This number can tell you if your money order was cashed by the correct individual. In addition, if it is lost or stolen, you can utilize the tracking number to assist you in replacing it. When changing money orders, there may be a processing cost. If your plans change, your receipt can assist you to terminate the money order.

Tips on How to Write Money Order USCIS

Make the money order out to the United States Department of Homeland Security. This should not be shortened.

If to write money order requests the recipient’s address, enter the USCIS address, If the Money Order requests the Purchaser’s or Sender’s address, enter the address from Form I-765, item #5.

In the Memo or Payment For Section for money order, write “USCIS I-765” and your “SEVIS number,” which can be found in the upper left-hand corner of your I-20. The back of the money order should not be signed.

Useful Info: Save a copy of the USCIS write order money receipt for your documentation and keep track of the payment. A sample receipt for a US Post Office money order is provided below.

How to Write Money Order Moneygram

A Moneygram money order should be accurately carried out in order for the payment to be approved and processed without difficulties.

#1. Request a Money Order From the Teller

Before you can write out the money order, you must first purchase it, before you go to a MoneyGram location, you should understand the amount of money you need to send the receiver. MoneyGram will bill you a modest charge for the transaction, so make sure you have enough money to cover that as well.

#2. Get a Money Order Once You Acquire It

The money order is as good as cash once you’ve paid for it. If you leave the sections blank and subsequently lose the money order, whoever picks it up might make it out to himself or herself and keep your money. To avoid this, fill out the form as soon as you receive your product

For the advantage to write MoneyGram users, the money order marks its numerous fields in both English and Spanish.

#3. Please Sign the Money Order

The “Purchaser, Signer for Drawer” line is located beneath the “Pay to the Order Of” line. Write in the blanks of the Moneygram money order with your signature. It is not necessary to print your name legibly. Use your official signature – the one on your driver’s license, the backside of your credit cards, and the one you use to sign checks.

#4. Include Your Mailing Address

A line named “Address” appears beneath the signature line. You might not be able to identify whether the address should be yours or the recipient’s based on the money order.

#5. Separate the Money Order From the Receipt

You will notice a detachable stub on the side of the money order that serves as your receipt. Bend along the perforated line to ensure that the receipt stub may be removed without destroying the real money order. Keep the stub until you’re certain that the money order has been received and processed by the individual to whom you’re sending the payment.

Key Takeaway

Money orders can be a convenient way to transfer and receive funds. They are a generally recognized method of payment with no expiration date and can easily be restored if lost or stolen. Furthermore, because money orders are prepaid, unlike checks, they will not bounce, making them a safe way to make transactions or deliver through the mail.

Understanding how to obtain and use money orders helps you add this solid instrument to your financial toolbox.

Can I Write on a Personal Money Order?

If the money order is for a private purpose, the memo line might be utilized to add a brief explanation. The account number for the bill should be entered on the note line if it is a household bill.

Why Would You Use a Money Order Instead of Cash?

They can be sent over the mail in a safe manner as payment.

Personal checks contain your bank account number, which you might not feel comfortable disclosing with the recipient, and cash sent over the mail is susceptible to theft. The contents of a money order are not private banking information.

What Address Do You Put On a Money Order?

Put your own address in the purchaser section if you’re sending a money order. Instead of “purchaser,” this part could be marked “from,” “remitter,” or “sender.”

Why Is ID Required For Money Orders?

A current form of identification must be shown in order to cash a money order because it is only good for the intended receiver. That entails a photo ID that matches the name on the money order, such as a driver’s license, passport, state ID, or military ID.

Do You Tear the Bottom of the Money Order?

Remove and save the receipt.

You can confirm if the recipient accepted it and deposited or cashed the money. You can use it to receive a refund if it gets misplaced along the route and is attempted to be cashed by someone else.

Who Signs the Purchaser Line on a Money Order?

The banking institution has been given permission by your signature to pay the payee of your money order. The drawer or buyer are other names for the payor. Look for one of these three phrases in the money order’s necessary signature area. A tracking number will be provided with the money order.

What Occurs if I Make a Money Order Mistake?

Making a Money Order Error

The official regulation is that money orders must be canceled and/or refunded if there is an error; changing the information on the completed money order will make the order unsuitable for cashing.

Conclusion

A money order is a certificate that enables the specified recipient to receive money on demand. It is normally given by a government or a banking institution. And the above states how to write a money order.

How To Write Money Order FAQ

Do you write anything on a money order?

On most money orders, it’s your signature that’s necessary, just as you sign a check. But on USPS money orders, the blank is only labeled “From.” Whether you write or sign your name is up to you.

What do you write on the front of a money order?

The following are steps to write on the front of a money order;

- Payee name.

- Payee’s address.

- Date of purchase.

- The dollar amount you’re paying.

- Your name and address.

- Reason for the payment.

How can I cash a money order not in my name?

You can do that if you have an ID but if you don’t, you can endorse the money order to someone else, like a sibling or friend, who does have an ID. Then they can cash it for you. Don’t forget that you’ll probably face some service fees to cash the money order

Can you put 2 names on a money order?

As a general rule, it has always been accepted that 2 names on a money order or check would have to be signed by both parties unless there is an ‘or’ placed between the names. So this would mean that 2 names (one after the other) would require both parties to be present with proper ID to cash the money order or check.

Where can I cash a money order that is already written on?

If the money order is not altered and in good condition, you may try to cash the money order at your bank or a check-cashing store. Once you are with a teller, write the following phrase: “Not Used for Purpose Intended” on the back of the money order.

- How to Send Money Online Instantly in 2022(+ Top 10 money transfer apps )

- Sales Order Automation Process Steps (+ Free Sales Order Form Template)

- MONEYGRAM HOURS: Simple Steps To Using MoneyGram At A Post Office Branch

- What Are SHORT-TERM INVESTMENTS: Definition, Examples, and Banks

- BACK OF CHECK: How to Sign, What to Write & Wrong Endorsement Solutions

- How do Money Orders Work? (+How to Buy with Debit Cards)