Time value of money says that getting something now is more valuable than getting the same thing later. Financial institutions, banks, and investment funds all use the Present Value formula. Aside from its numerous financial applications, current value analysis is frequently useful as a component in other financial models. In this article, you will understand how the calculation of the present value formula is done in its calculator, also the annuity and its formula for obtaining it.

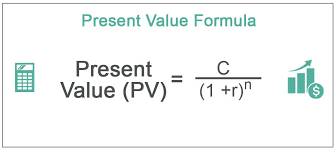

Present Value Formula

The present value formula is a time value application that reduces a future cash flow in order to obtain its existing value.

The formula for the present value combines the current value with the future value of compound interest. The beginning amount is known as the current or PV value (the amount you invest, the amount lent, the amount you borrow, etc). The final value, abbreviated as FV, is the future value. FV = PV Plus interest, in other terms.

The compound interest formula is,

FV = PV (1 + r / n)nt

Dividing both sides by (1 + r / n)nt,

PV = FV / (1 + r / n)nt

Thus, the present value formula is:

PV = FV / (1 + r / n)nt

Where,

- PV = Present value

- FV = Future value

- r = Rate of interest (percentage ÷ 100)

- n = Number of times the amount is compounding

- t = Time in years

The value of n varies depending on the number of times the amount is compounding.

- n = 1, if the amount is fuse yearly.

- = 2, if the amount is merge half-yearly.

- = 4, if the amount is merge quart-yearly.

- n = 12, if the amount is merge monthly.

- = 52, if the amount is merge weekly.

- n = 365, if the amount is merge daily.

Example

Some examples using the present value formula

Jonathan borrowed some amount from a bank at a rate of 7% per annum compounded annually. If he is through paying his loan by paying $6,500 at the end of 4 years, then calculate is the amount of loan he took? Round your answer to the nearest thousands.

Solution:

The future value is, FV = $6500.

The time is t = 4 years.

n = 1 (as the amount is merge annually).

The rate of interest is, r = 7% =0.07.

Substitute all these values in the the present value formula:

PV = FV / (1 + r / n)nt

PV = 6500 / (1 + 0.07/1)1(4) = 6500 / (1.07)4 = 5,000 (The answer is all to the nearest thousands).

Therefore, the borrowed amount = $5,000

Present Value

Present value (PV) is the current value of the future cash or cash flow stream given a particular return rate. The reduction rate for future cash flows and the higher the discount rate, the lower the current value of future cash flows

In other words, current value shows that money earned in the future is not as high as today’s income.

You calculate the current value assuming that a rate of return on the funds can be earned over the term.

The present value (PV) formula is useful in finance to calculate the actual worth of an item afterward obtained. The compound interest form is useful to derive the expression for the current value (PV formula).

Example of Present Value

Let’s say you have the choice of being paid $2,000 today earning 3% annually or $2,200 one year from now. Which is the best option?

- Using the current value formula, the calculation is $2,200 / (1 +. 03)1 = $2135.92

- PV = $2,135.92, or the minimum amount that you would need to be paid today to have $2,200 one year from now. In other words, if you were paid $2,000 today and based on a 3% interest rate, the amount would not be enough to give you $2,200 one year from now.

- Alternatively, you could calculate the future value of the $2,000 today in a year’s time: 2,000 x 1.03 = $2,060.

The present rate is useful in assessing future financial benefits and responsibilities. Hence, consider whether a future cash discount is low to the current value is worth a higher purchase price. Thus the same financial calculation applies to 0% auto loans.

Present Value Calculator

If you know the rate of return, a present value calculator can help you determine the current worth of a stream of cash flows or future payment. However, a large portion of the world’s economy is forming on calculating future values. It is also important when determining how much money to invest today in order to accomplish a specific future objective.

Now with this at the back of our minds, however, we will be looking into what the present value of the annuity formula is all about

Present Value Of Annuity

An annuity’s present value is the cash worth of all future payments multiplied by a certain discount rate. Thus, if you decide to sell future payments for cash, knowing this method might help you assess the value of your annuity or structured settlement. Hence, high discount rates reduce your annuity’s existing value.

An Example of an Annuity’s Present Value

Suppose a person is able to obtain an annuity paying $50,000 for the next 25 years at a rate of discount of 6 percent, or a lump-sum payment of $650,000. What’s the best option? The present value of the annuity is as follows:

Present value

=$50,000×0.06 1−((1+0.06) 25)

=$639,168

Hence the present value of an annuity is the current worth of future annuity payments based on the defined rate of return, or discount rate. Therefore the higher the discount rate, the smaller the annuity’s current value.

Present Value Calculation

As stated previously, to estimate the present value in the calculation, you must:

- Determine the future value. Let’s pretend it’s $100.

- Also identify an interest rate. Pretend it’s 8%.

- Decide on the period count. Let’s make it two.

- Add 1+interest rate to the future value.

- In our situation, it will be: 1+0.08 = 85.73 dollars.

Hence, you now know how to calculate the current value of future income using our present value calculator.

Current value computations are strongly linked to other formulas, such as the current annuity value. Annuity refers to a number of equal payments or receipts we have to pay equally, such as rental payments or loans. Thus this results in a somewhat different equation.

Current value computations are strongly linked to other formulas, such as the current annuity value. Annuity refers to a number of equal payments or receipts we have to pay equally, such as rental payments or loans. This results in a somewhat different equation.

you can use a present value calculation to determine whether you’ll receive more money by taking a lump sum now or an annuity spread out over a number of years.

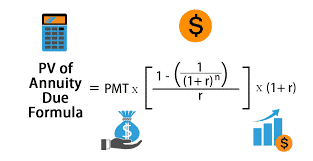

Present Value Of Annuity Formula

The present value of an ordinary annuity, as opposed to an annuity due, is calculated as follows. (Unlike an annuity due, an ordinary annuity pays interest at the end of the period rather than at the beginning.)

where:

- P=Present value of an annuity stream

- PMT=Dollar amount of each annuity payment

- r=Interest rate (also known as the discount rate)

- n=Number of periods in which payments will be made

With an annuity due, in which payments are made at the beginning of each period, hence the formula is slightly different. Also, to find the value of an annuity due, simply multiply the above formula by a factor of (1 + r):

How Do You Calculate Present Value?

PV=FV/(1+i)n is the present value formula, which also divides the future value FV by a factor of 1 + I for each period between the current and future dates. For the PV calculation, enter the following numbers into the present value calculator: FV is the future value sum. t is the number of time periods (years) in the formula.

What Is Present Value Method?

The net present value approach is thus a methodology for determining the profitability of a specific project. It also takes into account the temporal worth of money. The value of future cash flows will be lower than the value of today’s cash flows. As a result, the greater the cash flow, the lower the value.

What Is a Present Formula?

The present value formula thus combines the current value and the future value of compound interest. Hence, the starting amount is known as the present value, or PV (the amount invested, the amount lent, the amount borrowed, etc). Also, the final amount is the future value, abbreviated as FV. In other words, FV = PV Plus interest.

Is PV the Same as Fv?

Present value is the amount of money that needs to be invested now to reach a certain goal in the future. Future value is the amount of money that will be added to that amount over time if it is invested. The amount you have to invest now to get the future value is the present value.

What Is PV vs Fv Formula in Excel?

The FV function is a financial function that tells you how much an investment will be worth in the future if you know how much interest it will earn and how often payments will be made. The PV function tells you how much an investment is worth right now.