What is Book-to-Market Ratio Definition?

The book-to-market ratio measures the value of a company by comparing its book value with its market value. Book value is the value of a company on paper according to its share capital, while the market value of a company is determined by its market capitalization.

Share capital refers to the net worth of a company. It represents the amount that would be returned to shareholders if all of a company’s assets were sold and its debts were paid in full. The companies will include the capital stock on their balance sheet.

Market capitalization is the total market value of a company’s outstanding shares. It can be calculated by multiplying the current share price by the total number of shares issued.

Book-to-Market Ratio Calculator

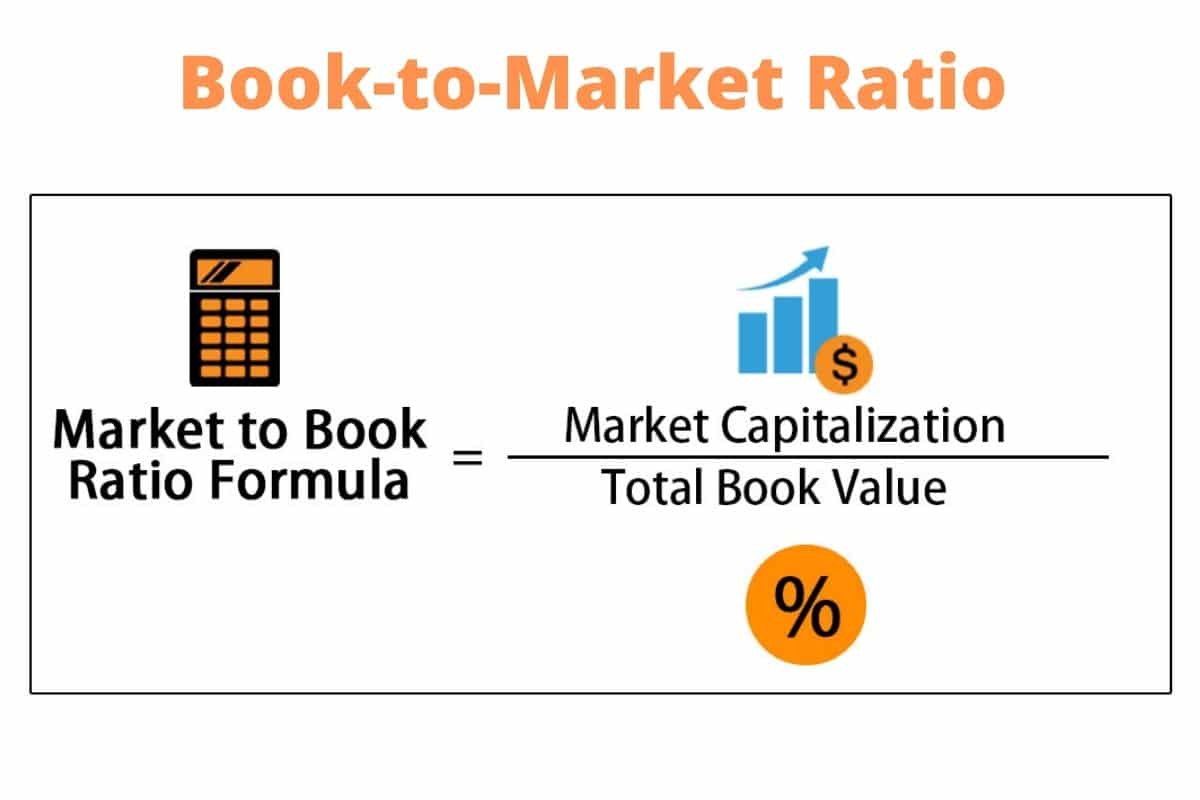

Book-to-market ratio formula

The formula for calculating the book-to-market ratio is very simple. You divide the market capitalization of a company by its book value.

Market capitalization is calculated by multiplying the share price by the number of shares issued. The easiest way to calculate book value is to subtract all liabilities from all assets. Book value = total assets – total assets.

Total assets and liabilities can be found on the company’s balance sheet. The book value can also be shown on the balance sheet under equity.

However, some sources use slightly different formulas to calculate book value. You can also calculate the market-to-book ratio by dividing the share price by the book value per share.

The inverse of the market-to-book ratio is the book value/book ratio. It is calculated by dividing the book value by the market capitalization.

How to Use the Book-to-Market Ratio

The book-market relationship identifies undervalued or overvalued securities by dividing the book value by the market value. The ratio determines the market value of a company relative to its true value. Investors and analysts use this comparative relationship to differentiate between the real value of a publicly-traded company and investor speculation.

Basically, the stock is undervalued when the ratio is greater than 1. If it is less than 1, the stock is considered overvalued. A ratio greater than 1 indicates that the price of a company’s stock is trading for less than the value of its assets. Value managers prefer a high share, which they interpret to mean that the company is a value stock, that is, it trades at a low price in the market compared to its book value.

A book-to-market ratio of less than 1 means that investors are willing to pay more for a company than its net assets are worth. This could indicate that the company has strong future earnings outlooks and investors are willing to pay a premium for this opportunity. Tech companies and others in industries that don’t have many physical assets tend to have low book-to-market ratios.

What Does the Book-to-Market Ratio Tell Traders?

When the market value of a company is higher than its book value per share, it is considered overvalued. If the book value is higher than the market value, analysts consider the company to be undervalued. The book-to-market relationship is used to compare the net asset value or book value of a company with its current value or market value.

The book value of a company is the historical acquisition or the book value calculated from the balance sheet of the company. Book value can be calculated by subtracting total liabilities, preferred shares, and intangible assets from the total assets of a company. In fact, book value is the amount of assets that a business would have left if it had ceased operations today. Some analysts use all of the equity on the balance sheet as book value.

The market value of a publicly-traded company is determined by calculating its market capitalization. This is simply the total number of shares in issue multiplied by the current share price. Market value is the price that investors are willing to pay to buy or sell shares in secondary markets. Since it is determined by supply and demand in the market, it does not always represent the true value of a company.

Book-to-market ratio Vs Price-to-book ratio

The price-book value relationship is the opposite of the book value-market relationship. Instead of dividing the share capital by the market capitalization, the price-to-book ratio divides the market capitalization by the share capital.

The price-book relationship tries to assess whether a stock is undervalued or overvalued, but according to the opposite of the book-to-market relationship. A price-to-book ratio of less than one indicates that a stock is undervalued, while a price-to-book ratio of more than one indicates that a stock is overvalued.

Difference Between the Book-to-Market Ratio and Market-to-Book Ratio

The market-to-book ratio, also known as the price/book value ratio, is the inverse of the book value/ book value ratio. As with the book-to-market relationship, an attempt is made to assess whether a company’s shares are overvalued or undervalued by comparing the market price of all outstanding shares with the company’s net worth.

A market/book value ratio greater than 1 means that the company’s stock is overvalued. A ratio below 1 indicates that it may be undervalued. The opposite is the case with the book-market relationship. Analysts can use both indices to make a comparison of a company’s book and market value.

Can I Invest based on Book-to-Market Ratio?

The market-to-book ratio, or P/B ratio, is one of the most common relationships used to determine whether a company’s stock is cheap or expensive.

For example, a ratio below 1 indicates that the stock is very cheap, while a high ratio may indicate that it is expensive.

A market-to-book ratio of less than 1 means that you can buy the business for less than the value of its assets.

So if you buy the company, liquidate it, sell its assets, and pay off its liabilities, you will get a positive return on your investment.

However, keep in mind that a high or low ratio should not be used in isolation to evaluate an inventory. When companies are listed for less than book value, they are often cheap for a reason.

Also, companies with a high market-to-book ratio can be expensive for a reason. They are expected to make a lot of profit in the future.

However, the market-to-book ratio is not a good way to evaluate all types of businesses. Some types of businesses don’t need a lot of physical assets to make money.

For example, many information technology stocks have high market-to-book ratios. But they can still be immensely profitable and appear cheap based on other measures, such as the PE ratio.

Therefore, do not make investment decisions based solely on this index. Also, take a look at other financial metrics and compare market-to-book ratios with other companies in the same industry.

What Is a Good Market to Book Ratio?

In general, your book to market ratio should be approximately 1. A value less than one indicates that a company can be purchased for less than the worth of its assets. A higher figure of about 3 indicates that investing in a company will be costly.

How Do You Calculate Market to Book Ratio?

This ratio indicates how much equity investors pay for each dollar of net assets. The market-to-book ratio is derived by dividing the current closing price of the stock by the book value per share for the most recent quarter.

Is a High Book to Market Ratio a Value or Growth Stock?

High book-to-market stocks, also known as value stocks, generate big positive excess returns, whereas low book-to-market equities, also known as growth stocks, generate significant negative excess returns.

- MARKETING INFORMATION SYSTEM: A Detailed Guide

- Buy and Sell Agreement: How It Works, Key Elements, and Importance

- Marketing Environment: Definition, Concept & Best Practices (+ Case Studies)

- BREAK-EVEN PRICE: What is Break-Even Piont In Accounting?

- Below-the-Line Advertising: Definitions, Examples, Marketing Ideas