Some of us remember what happened around 2007, and 2008 when it came to the housing market. Banks became loose with their lending policy and people borrowed so much to buy a house. Meanwhile, house prices shot up so high to pop a bubble. That was one of the events of the Bespoke CDO. So to get the gist, we are going to be looking at the definition of bespoke CDO, the basics, and the background data of bespoke CDO. We will also look at the pros and cons of BTO and the Bespoke CDO 2024 opportunities.

What is a Bespoke CDO?

A bespoke CDO is a financial product that is specially designed by a dealer for a specific group of investors. It is tailored specially to meet the investors’ needs. It is otherwise known as a collateralized debt obligation (CDO). The investor group invests by buying a single tranche of the bespoke CDO. The dealer then holds the remaining tranches and will usually try to hedge them against losses. He hedges it using other financial products like credit derivatives.

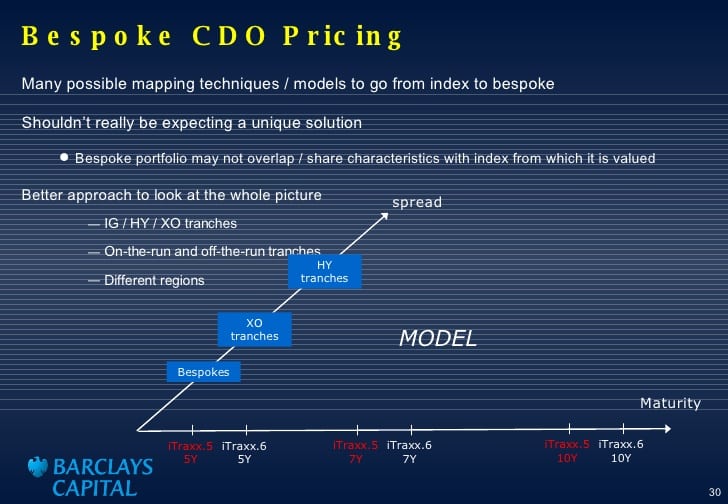

A bespoke CDO differs from other CDOs as it usually only involves a single tranche to be sold. Unlike in a regular CDO where they need to sell all the 3 tranches (equity, mezzanine, senior)to complete the transaction. A bespoke CDO is a tailor-made CDO to meet the investment needs of a specific group. It allows an investor to target a specific risk/return profile.

We can refer to bespoke CDO is generally as a bespoke tranche or a bespoke tranche opportunity (BTO).

Understanding the Basics

A collateralized debt obligation (CDO) basically works by gathering collections of cash-generating assets like mortgages, bonds, and other loan types. It then structures these assets into specific sections called tranches. These structures pool classes of debt with multiple income streams. We often refer to these structures as synthetic CDOs and the dealer can easily modify them to suit the investors’ demand.

They divide these tranches into sections according to their specific characteristic. Thus, different tranches can carry different degrees of risk, depending on the asset’s credit rating. Certainly, the greater the chance of failure of the tranche’s holdings, the higher the return it gives the investor. However, major rating agencies don’t grade bespoke CDOs rather evaluation is done by the issuer and sometimes the market. This is as a result of the complex financial instruments, bespoke CDOs only trade over the counter (OTC) which reduces the market volume for it.

Bespoke Tranche Opportunity is a type of collateralized debt obligation, which is an accumulation of assets. The CDO has the repute to always generate the flow of cash.

When investors purchase a single tranche, the dealers hold the remaining tranches. This is to keep investments intact and safeguard them for investors in time of crisis.

Background Data

The April 29 (IFR) – Synthetic CDOs are well noted as the kind of financial issue that led to the financial mess of 2008. CDOs lost their repute due to their striking role in the financial crisis that followed the mortgage meltdown between 2007 and 2009. The creation of these products by Wall Street contributed massively to the market crash. However, lack of common sense is also a contributing factor to the meltdown following the crisis. The structure of the investments that were hard to understand for both people buying and the ones selling. Hence they were difficult to evaluate.

In spite of this, bespoke CDOs are useful for parties willing to take the risks as they can open up opportunities for capital. This is what Wall Street has been doing. So, since around 2016, the bespoke CDO has surfaced again. This time around it came as a bespoke tranche opportunity (BTO).

Nonetheless, this new branding didn’t change the tool itself rather it’s better structured. They can do the pricing models with better analysis. Hopefully, the investors will meet a simpler structure.

A new trend is going on among the Global Investment Banks on selling this new product “Bespoke Tranche Opportunity” and banks are backing it. By end of 2017 alone, some banks have sold BTO worth over $50 Bn in a year.

So if you have been questioning whether CDOs will be accepted by investors or not, this insight has spotted the importance of this investment option. Hence it’s convincing enough to bank on.

Pros of Bespoke CDO

Here are some pros of Bespoke CDO:

- The investors/buyers can tailor the opportunities down to what they want and when they desire.

- The products are highly diversified, hence the different tranches.

- They generally have high proceeds depending on their risk profile.

Cons of Bespoke CDO

Some of the cons of bespoke CDO include:

- An investor usually gets very small access to the secondary market.

- The structure of the CDOs might completely go wrong.

- Pricing can get difficult as daily pricing since there isn’t access to the market.

- The total worth of the CDO can be difficult as the financial structure is complex.

An Example of Bespoke CDO

Citigroup is one of the leading dealers in bespoke CDOs. They were having US $7 billion worth of business in them in 2016 alone. In order to increase its transparency in the market, the bank offers a standard portfolio of credit default swaps. The CDOs are built by the assets thus making the tranches pricing structure open on the client’s portal. Hence the asset is usually used to build the CDOs. It also makes the figures of the CDO tranches pricing structure visible on its client portal.

Bespoke CDO Covid-19 Realities

COVID-19 has provided investing opportunities that we haven’t seen in over a decade. BSP’s thorough underwriting and adaptive portfolio and risk-management practices have resulted in a relatively solid performance across portfolios as we performed detailed analyses of COVID-19 on each of our portfolio companies.

Over the past few months, experts have been working together with companies to provide covenant relief. They have been deliberating with companies owned by private equity firms. They expect them to share in the support of their companies by providing more equity. Below is a summary of certain dynamics that we are experiencing or most likely to see:

#1. Better Terms:

A company that is facing balance sheet challenges can approach its creditors to seek amendments or relief on certain terms in its credit agreement. In fact, any company that has applied for government relief programs will have to seek from the experts. During the negotiation, the bespoke CDO dealers/lenders have the opportunity to request certain credit enhancements in exchange. The credit enhancements include more prevalent financial maintenance covenants, tight cushions to the performance projections, and heavily scrutinized payments to equity owners. They also request the ability to build over time, timing, and step downs for excess cash flow and restrict the incurrence of additional debt.

#2. Better Pricing:

In 2019, much of the illiquidity premium associated with middle-market deals had a lot of irregularities in the market. Experts expect that this will now normalize. Based on stats from SPP Capital Partners, single tranche pricing on directly originated loans for issuers with >$20 million in EBITDA currently ranges from L+600 to L+800 vs L+500 to L+650 s a few months ago. This is a decent proxy for some of the issuers in our space.

#3. Industry Focus:

There are several industries, such as energy-related businesses, that we might completely avoid.

So, this is all about Bespoke CDO. In as much as there are great risks associated with Bespoke CDO, one shouldn’t shy away from it. We advise that you should learn and understand completely about this investment option to make the right choices. One should weigh the pros and the cons of the Bespoke CDO opportunity. The opportunities when chosen and managed properly can bring about the regular cash flow that we need.

CDO: collateralized debt obligation is a type of structured asset-backed security. Originally developed as instruments for the corporate debt markets.

Tranches: A separate part of an overall bond or investment offer. For example, a $50 million bond offering may have four tranches. Each of them can be sold in a different currency, such as the U.S. dollar, Japanese yen, rupee, and British pound. Each currency offer represents one tranche of the overall bond. Read more…

Synthetic CDO: A synthetic CDO (collateralized debt obligation) is a type of CDO. It generally makes use of credit default swaps and other derivatives to obtain its investment goals.

BSP: A billing and settlement plan (BSP) (also known as “Bank Settlement Plan“) is an electronic billing system. It has a design to facilitate the flow of data and funds between travel agencies and airlines.

What Is A Bespoke CDO?

In simple terms, a bespoke CDO is a collateralized debt obligation that has been tailored to meet the specific requirements of a certain set of investors. Shunned because of their disproportionate part in the 2007-09 financial crisis, custom CDOs began reappearing in 2016 in the guise of bespoke tranche opportunities (BTOs).

Why Do Banks Sell CDO?

Banks sell CDO for the following reasons

- CDOs provide banks with profitable products to sell, which raises share prices and bonuses

- The profit they get provides them with more funds to give new loans

- The process shifts the risk of loan default from the bank to the investors.

Do Synthetic CDOs Still Exist?

Yes, but today’s synthetic CDOs are mostly free of exposure to subprime mortgages, which drove much of the crisis’s devastation. The majority are credit-default swaps on European and American corporations, and they amount to bets on whether corporate defaults would rise in the near future.

Where Can I Buy CDOs?

Typically, retail investors cannot purchase a CDO directly. Instead, they are purchased by insurance companies, banks, pension funds, investment managers, investment banks, and hedge funds. These institutions seek to outperform the interest given on bonds, such as Treasury rates.

How Are CDOs Created?

Investment banks produce CDOs by repackaging cash flow-generating assets such as mortgages, bonds, and other types of debt into discrete classes, or tranches, based on the level of credit risk assumed by the investor.

Related Articles

- Bespoke Tranche Opportunities 2024: Definition & All You Need to Know

- SOFTWARE DEVELOPMENT COMPANY: Top Software Development Companies In the UK

- Pricing Strategy: Best strategies to Maximize profit

- Career Opportunities That Don’t Require a College Degree: The Ultimate List of Best Opportunities

- Get A Grant: How To Get A Grant For Any Business(+ Government Aids)

- SHORT TERM DEBT: Definition, Examples, and Debt financing