A credit shelter trust is a tool used by affluent couples to reduce or avoid estate tax liabilities that is as a result of the death of one spouse.

More so, this tool allows the surviving spouse to maintain certain rights to the trust assets while they are still alive.

When the surviving spouse dies, the trust’s assets will go to the remaining beneficiaries without any tax levy.

Find out more about credit shelter trust and how it can be of use to you.

Let’s start from the basics.

READ MORE: General Liability Insurance Policy: For Businesses

What is a Credit Shelter Trust?

A credit shelter trust (CST) is a trust that is made after the demise of the first spouse of a married couple.

Assets put in the trust are normally held differently from the estate of the surviving spouse, so that they may hand it over to the remaining beneficiaries at the death of the surviving spouse.

The assets that are held in the CST can be of advantage to the surviving spouse only while they are alive.

Furthermore, the credit shelter transfer not only saves the demised spouse’s death tax credit but also shelters the assets from the surviving spouse’s creditors and future spouses.

The credit shelter trust can also be drawn up to make sure that the assets pass to the demised spouse’s children or family at the surviving spouse’s death. Keeping them out of the reach of the surviving spouse’s next spouse.

READ MORE: Trade Finance: Overview, Definition, Course, Examples

What Does The Credit Trust Shelter Involve?

Credit Shelter Trust is set up to let wealthy couples reduce or completely escape estate taxes when passing assets on to their heirs or beneficiaries, normally, their children.

In addition, credit shelter trusts are made upon a married person’s death and are financed with that person’s whole estate or a part of it as written out in the trust agreement. These assets then move to the surviving spouse.

The trust is managed by a selected trustee and for this reason, the surviving spouse never really takes total control of the trust’s assets. Hence, the transfer does not make any addition to the taxable estate of the surviving spouse.

Furthermore, a last will and testament can give directions that a credit shelter trust is created and financed at the death of the first spouse, with a part of or all of the demised spouse’s available assets.

The credit shelter trust will still be of advantage to the surviving spouse in such a way that it gives the surviving spouse the right to some of the trust’s income. As well as the ability to withdraw trust principal for the spouse’s education, health, maintenance or support.

Furthermore, the assets of the trust are weighed outside the surviving spouse’s estate and will be passed on to the remaining beneficiaries, tax-free, when the surviving spouse dies.

For this to work optimally, each spouse is supposed to have enough assets in their own name. So that the value of each spouse’s assets meets or exceeds the applicable exclusion amount.

A credit shelter trust can be drafted in different ways to serve a purpose. Hence, it is important to meet with an estate planning attorney to draft it out in a way that accomplishes its purpose.

READ MORE: Open Banking: Definition & How it Works

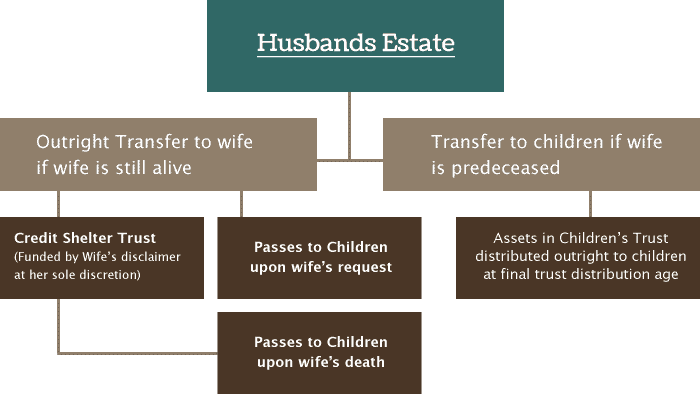

Credit Shelter Trust Diagram

Credit Shelter Transfer Example

Here is an example of Credit Shelter Trust from Bankrate

Daphne and Niles have two sons, Peter and Paul. Thanks to their successful careers, the couple’s joint estate is estimated to be worth $12.5 million and is still growing.

Although Daphne will not have to pay estate taxes when Niles dies, their children will likely face a big tax bill when Daphne dies. This is because the joint estate will be greater than the $10.98 million exclusion allowed for a married couple.

To minimize future tax obligations for their descendants, they speak to their attorney, who draws up a credit shelter trust.

READ MORE: Average Collection Period (ACP): Formula, Calculations & Importance

Pros and Cons of Credit Shelter Trust

As much as credit shelter trust has lots of advantages, it also has a downside. Below are the pros and cons of the credit shelter trust tool.

Pros of Credit Shelter Transfer

Below are the advantages of credit shelter transfer.

#1. It offers protection of assets

Assets are protected when they are being held in trust by the surviving spouse. There are a lot of facts that determine the provision of distribution of the trust. These factors include;

- Provisions of distribution of the trust

- Who is named as the trustee of the trust,

- Protection from creditors or from a future divorce – if the surviving spouse were to remarry – can be a benefit.

#2. It helps ensure the use of immunity

If the appropriate paperwork is not filed when the first spouse dies, the second spouse may lose immunity.

By forcing the financing of the credit shelter trust, the first spouse to pass on can help make sure that his or her immunity is used.

READ MORE: Lean Production: Definition, Methods, Advantage & Disadvantage

#3. It offers control

By making use of this trust, the first to demise can influence the way the assets are eventually distributed when the surviving spouse passes away.

This can be important especially in situations where there has been a previous marriage that produced children or if the surviving spouse remarries.

For instance, the first spouse to demise can ensure that the children from a first marriage receive the assets when the surviving spouse demises. Additionally, he/she can monitor, the surviving spouse’s capacity to spend the funds if the trust is set up correctly.

This trust also gives people the capacity to control the manner in which the funds are shared with the younger family members.

Many families are concerned about handing a lot of money to young adults. With a well set up trust, the amounts and timing of the distribution to the children when the surviving spouse demises can be controlled.

#4. Protecting the initial intention of the trust’s creator

In an integrated family, each spouse may intend to make sure that their share of the estate is passed to their chosen beneficiaries or children from a prior marriage. Credit shelter trust when set up well can carry out this intent properly.

#5. Flexibility in the trust’s sharing provisions

The trust can include a limited power of appointment for the surviving spouse. Hence, the surviving spouse may share the assets among a class of beneficiaries (e.g. “the issue of the demised spouse).

For instance, a child who did not need a special needs trust at the time the trust was drafted, but after the decedent spouse’s demise, a special needs trust was preferred.

In this case, the surviving spouse would be able to appoint the assets to a new special needs trust to provide for that child.

#6. Property tax benefits

A distribution to a child from the credit shelter trust is considered a transfer from the demised spouse and not the surviving spouse.

The distribution can take advantage of the demised spouse’s $1 million non-residence parent-child property tax reassessment exclusion.

An additional $1 million in reassessment exclusion can benefit spouses who own valuable rental or vacation properties.

READ MORE: Growth Investing Strategy: Step by Step Guide For Beginners (+Free Tips)

Cons of Credit Shelter Transfer

Below are the disadvantages of credit shelter transfer.

- The trust possesses a separate tax ID number, so must file a separate tax return.

- The surviving spouse must be willing to accept some rights and restricted control over the assets in the trust. If the trustee is someone other than the surviving spouse, then he/she may receive trust assets for other reasons at the trustee’s discretion.

- Income tax returns must be filed in order for the trust to get the benefits of a credit shelter trust. If the assets used to finance the trust are complicated, this filing can be cumbersome and expensive.

Credit Shelter Trust New York

In New York, the estate tax exemption is presently $5.93 million but there is no “gift” tax. New York residents can gift up to the federal exemption amount ($11.7 in 2023) during their lifetime, even if said gifts exceed $5.93 million.

However, any assets gifted within three years of a New York resident’s date of death will be clawed back and includable in their estate.

If a New Yorker dies with more than $5.93 million in their sole name, the estate will incur an estate tax rate between 5% and 16%.

Additionally, the entire estate will pay tax, not just the amount over the limit referred to as estate tax cliff.

New York does not offer portability rights. As such, a surviving spouse cannot use their demised spouse’s unused immunity towards their own immunity. Unless it involves certain estate planning techniques, and the credit shelter trust is one of them.

READ MORE: Value Investing: Detailed Guide To Value Investing Strategy

Credit Shelter Trust Vs. Marital Trust

A marital trust is a trust relationship between the trustor and the trustee for the benefit of a surviving spouse and the married couple’s heirs. Also called an “A” trust, a marital trust goes into effect when the first spouse dies.

A marital trust allows the couple’s beneficiaries to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deduction. A provision that enables spouses to pass assets to each other without tax consequences.

Although, when the surviving spouse dies, the remaining trust assets will be subject to estate taxes. To avoid this situation, a marital trust is sometimes used in conjunction with a credit shelter trust known as a “B” trust.

Credit Shelter Trust Washington State

If you are married, a Washington Credit Shelter Trust effectively creates “portability” of your exemptions.

Most wills in Washington State have this provision included in it. You create this trust alongside your will to receive assets when the first spouse dies. This is typically to preserve the $2.193 million exemption that would be lost by passing everything directly to the surviving spouse.

The spouse is usually the trustee of this trust and may receive income from for life. Then upon passing, the proceeds go their beneficiaries free of Washington estate taxes.

READ MORE: AD and D Insurance: Definition, Benefits, Coverage, & Payouts

Credit Shelter Trust Massachusetts

Creating a credit shelter trust is one way to keep more money in your estate than losing them to estate taxes.

Credit shelter trusts are related to marital deduction estate tax laws. In Massachusetts, an estate worth less than $1 million is not subject to estate tax.

Massachusetts does not recognize portability, which means that one spouse’s exemption doesn’t transfer to the surviving spouse.

Because of the marital deduction, the assets of the first spouse to demise will go to the surviving spouse. These assets are not subject to estate tax. The surviving spouse’s estate may pay tax when he or she dies.

READ MORE: Asset Allocation: Beginner’s Guide to the Investing Strategies (+Examples)

Credit Trust Shelter FAQs

What is the main purpose of a credit shelter trust?

The main purpose of a credit shelter trust is to allow wealthy couples to minimize or avoid estate taxes. This is usually important when they want to pass their assets to their heirs.

Is marital trust the same as credit shelter trust?

Both of these trusts are considered credit shelter trust because they preserve the estate tax exemption of the donor.

When should you set up a credit shelter trust?

A credit shelter trust is a trust created after the death of the first spouse in a married couple.

Bottom Line

Credit Shelter trust is a kind of irrevocable trust that works with the demise of the trust’s creator or settler. The assets held in the trust, as well as the income they bring go to the creator’s spouse.

I hope this article explains what credit trust shelter is all about. If you have my questions, kindly let me know in the comments section.

All the best!

Recommendation

- Market Penetration: Best 2023 Strategies & Definitive Examples (Updated)

- Pull Strategy: Guide to The Pull Marketing Strategies (+Free Tips)

- Real Estate Industry: Overview, Types & Examples

- Alternative Investments: Beginners Guide to the Investment Options

- LIABILITY INSURANCE: Simplified!!!, Overview, Types & Quotes