This post takes you through the best format to follow when preparing a balance sheet and basically how to read one.

Let’s dive in without further ado…

Balance Sheet Format Overview

A company’s balance sheet summarizes its financial situation. It gives an account of where a company’s funds come from and where investments go into.

Like you know already, lenders and shareholders are the two sources of capital for businesses. The sum invested by shareholders is referred to as equity, whereas the sum borrowed from lenders is referred to as debt. Liability, on the other hand, refers to the sum of a company’s debt and other financial commitments.

And for the most part, companies invest their own money and borrowed money into assets that help them make money. As a result, a business’s obligations and equity must be equal to its assets. This gives you the fundamental equation for deciphering a balance sheet and deciding on a format;

Assets = Liabilities + Equity

But then, before we go any further into a format, let’s take a quick look at what a balance sheet is.

Balance Sheet Definition

The balance sheet, commonly known as the statement of financial position, is the accounting cycle’s third general purpose financial statement. It shows the assets, liabilities, and equity of a corporation at a specific point in time. You might think of it as a snapshot of the company on that particular day in history.

The balance sheet, unlike the income statement, does not show activities over time. The balance sheet is a snapshot of a company’s assets, liabilities, and ownership on a given day. As a result, the balance sheet is frequently regarded as less trustworthy or informative of a company’s present financial condition than the profit and loss statement.

On the other hand, annual income statements consider performance over a 12-month period, but the statement of financial position simply considers the financial situation on a single day.

The balance sheet is a report version of the accounting equation, often known as the balance sheet equation, in which assets equal liabilities + shareholder’s equity.

It displays how the business’s resources (assets) are financed by debt (liabilities) or shareholder investments in this fashion (equity). The statement of financial position is used by investors and creditors to determine how efficiently a firm can utilize its resources and how effectively it can finance them.

Balance Sheet Format : Objectives

The following are the primary objectives of a balance sheet:

- Understanding a company’s financial situation.

- Realizing the true value of your possessions.

- Knowing how much money you owe and what kind of debt you have.

- Verification of a company’s ability to pay its debts.

- Understanding the trends in asset and liability changes.

- Recognizing the profitability or loss of a firm.

- Knowing how to deduct depreciation from your assets.

- Knowing how much money you have in prepaid and unpaid expenses.

Balance Sheet Format: Types

Before a format is set in place, know that you’d need to understand the two types of balance sheet out there, namely;

- Unclassified balance sheet.

- Classified Balance Sheet

In other words, it is possible to present a balance sheet format in two ways:

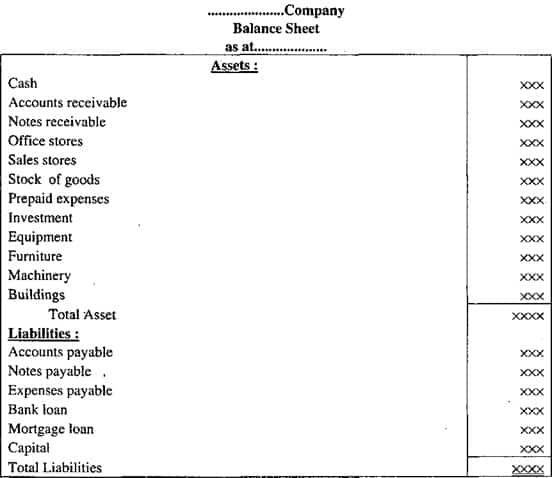

#1. Balance Sheet (Unclassified)

In the accounting process, there are various types of balance sheets.

An unclassified balance sheet displays all assets without any classification. Similarly, liabilities are displayed without being classified.

However, in writing, assets’ liquidity and durability are taken into account to the highest extent possible. Liabilities, on the other hand, are written with the short and long term in mind.

Simply put, if assets are written with liquidity in mind, long-term liabilities will come after short-term liabilities.

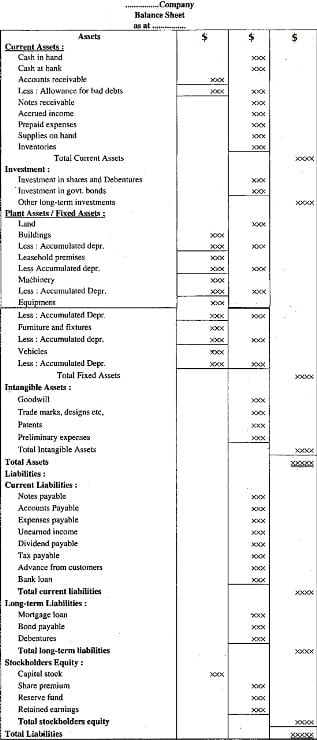

#2. Classified Balance Sheet

The balance sheet assets are shown first in statement form. Assets are categorized as follows:

- Current assets

- Property, plant, and equipment

- Investment

- Intangible assets (assets that are not physical)

Liabilities are classified into current liabilities, long-term liabilities, and owner’s equity in the later phase.

It is self-evident that the total of assets must match the total of liabilities and owner’s equity if assets, liabilities, and owner’s equity are appropriately written.

As a result, the equation A = L + OE is established.

In the accounting process, there are various types of balance sheets.

A categorized balance sheet is one in which assets are categorised as current and fixed, liabilities as short term and long term, and owner’s equity is shown separately.

How Do You Read a balance sheet for a business?

It is necessary to first comprehend the balance sheet’s structure in order to fully understand its format. A company’s balance sheet has two portions, as shown in the equation:

- Assets or uses of funds

- Liabilities and equity, i.e. sources of funds

The assets section of the balance sheet indicates what a company has, while the liabilities side shows what it owes. Assets and liabilities are classified as either long-term or short-term.

The assets and liabilities that are long-term remain with the company for over a year. The life span of current assets and liabilities is usually less than a year.

The sources of funds are usually the first item on the balance sheet. It displays all of the company’s current liabilities, followed by its long-term debt and other long-term liabilities.

The next line on a company’s balance sheet is equity. It is likewise a type of obligation, but it is presented separately because shareholders, unlike creditors, are the company’s owners. They have a stronger financial stake in the company than debtors. This increases the risk of their investment while also giving them more ownership rights in the company.

All of the company’s assets are listed in the balance sheet’s uses of funds section. It reports current assets first, then long-term (or fixed) assets.

| Balance Sheet of XYZ Limited | As at 31st December, 2022 |

| SOURCES OF FUNDS (LIABILITIES) Current Liabilities | |

| Short Term Debt | [xx] |

| Current Portion of Long Term Debt | [xx] |

| Accounts Payable | [xx] |

| Other Current Liabilities | [xx] |

| Total Current Liabilities | [xxx] |

| LoTerm Debt | [xxx] |

| Other LoTerm Liabilities | [xxx] |

| Stockholders’ Equity | [xxx] |

| Total Liabilities and Equity | [xxxx] |

| USES OF FUNDS (ASSETS) | |

| Current Assets | |

| Cash and Cash Equivalents | [xx] |

| Inventory | [xx] |

| Accounts Receivable | [xx] |

| Other Current Assets | [xx] |

| Total Current Assets | [xxx] |

| Fixed Assets | |

| Plant, Machinery, and Equipment | [xx] |

| Buildings | [xx] |

| Other Fixed Assets | [xx[ |

| Total Fixed Assets | [xxx] |

| Less: Accumulated Depreciation | [xx] |

| Net Fixed Assets | [xxx] |

| Total Assets | [xxxx] |

#1. Liabilities

The first step in balance sheet analysis is to figure out what a company owes. A company’s liabilities are all of its outstanding financial obligations. The majority of the company’s long-term liabilities are debts that have been raised for more than five years. It could be in the form of a bank loan or monies raised via the sale of bonds (i.e. debentures).

The following are current liabilities:

Short-term debt and the current portion of long-term debt; i.e. monies borrowed for less than a year and the fraction of long-term borrowings due to be paid back within a year.

Accounts payable; refers to the balance owed to vendors for materials provided.

Accrued Liabilities; are liabilities that a firm owes for services that it has yet to provide but for which it has already been compensated.

#2. The Equity of the Shareholders

Stocks and equity provide their holders with a stake in the company. The promoters of the company provide the initial capital. As the company expands, more cash is required.

To raise these funds, the promoters sell some shares to investors or the general public. These shares are sold for a higher price than the original. The original price is used to calculate the equity value on a company’s balance sheet. This is generally known as the book value of equity.

The premium is also noted in the balance sheet’s shareholders’ equity column. Other essential aspects of equity include:

Retained Earnings; the percentage of a company’s net income that hasn’t been dispersed to shareholders.

Capital Reserve; a portion of a company’s retained earnings set aside for future investments in fixed assets.

Reserves and Surpluses, i.e. monies set aside to cover future needs

#3. Assets

A company’s assets are its lifeblood. When performing a balance sheet analysis, this is where you should spend the majority of your time. A company’s asset is anything it owns, tangible or intangible, that can generate revenue in the future.

Accounting standards stipulate that possession can only be classified as an asset if its value can be determined with certainty and it can be sold separately.

Companies own a variety of intangibles that qualify as assets in addition to tangible or “hard” assets like land and machinery. These include patents, copyrights, and trademarks. They can’t be touched or felt, but they can generate revenue, be reliably valued, and sold separately.

On the balance sheet, assets are classified as either “current” or “fixed.” Plant and machinery, as well as land and buildings, are examples of fixed assets. Apart from land, all fixed assets depreciate in value over time. Depreciation is the term for this decrease in value.

Every year, it is recorded as an expense on the income statement. Basically, the difference between the purchase price of a fixed asset and the total depreciation charged up to the balance sheet date is the value that is recorded on the balance sheet.

Meanwhile, the annual loss in value of intangible assets is referred to as amortization. It is considered in the same way as depreciation.

The following are some of the current assets:

- Cash

- Commercial papers, t-bills, and certificates of deposit;examples of short-term investments in financial instruments (CDs).

- Unsold products, raw materials, and unfinished items inventory

- Accounts receivable, or the sum owed to the company for items sold on credit but not yet received.

There is no depreciation on any of these assets.

Importance of a Balance Sheet

The importance of a company’s balance sheet cannot be overstated as its analysis exposes a wealth of information about the company’s overall performance. You can do the following things by looking at the components of a balance sheet:

- Recognize the financial health of the organization.

- Keep track of its progress.

- Analyze a company’s financial performance and liquidity condition.

- Find out whether a company is funded by profits or debt, and how likely it is to meet project deadlines.

Balance sheet Limitations

Several items have significant financial worth and may be crucial for financial statement users in making sound decisions, but they are not recorded on the balance sheet because they are difficult to quantify objectively. Examples of such items may include an IT company’s ability and knowledge, a strong customer base, and a good reputation.

Although the current fair value of particular assets and liabilities may be essential to some decision-makers, it is not shown on the balance sheet because assets and liabilities are typically reported at their historical costs.

On the basis of judgments and estimates, the value of some items is stated in the balance sheet. Depreciation, for example, is normally computed based on the assets’ projected life. As a result, the book value reported on the balance sheet is also an estimate. Accounts receivable, for example, are presented at their anticipated net realizable value.

How Do I Make One?

Preparing a company’s balance sheet is a job that comes with a lot of obligations because there is so much sitting on it. It’s crucial for a company to know what it owns and what it owes in order to make the best decisions. While the balance sheet format is provided in Schedule III of the Companies Act 2013, the following steps should be followed before preparing:

- Find out how often you should prepare. Preparation timeframe is usuallyy between a quarter or annual basis.

- Have a good idea of your assets and liabilities.

- Calculate the equity of the company’s stockholders.

- Prepare it by first stating the equity of the shareholders, then the liabilities, and finally the assets. It’s worth noting that assets should match the equity and liabilities of the shareholders.

- If you’re unsure about any of the balance sheet’s components, get assistance from concerned individuals.

Balance Sheet Format

There are two ways to report this statement: account form and report form. The assets are displayed on the left column of the report, while liabilities and equity are displayed on the right column. Consider it in terms of debits and credits. On the left, you’ll see debit accounts, and on the right, you’ll see credit accounts.

On the other hand, the report form simply contains one column. This is a more typical report format most businesses use. Liabilities and equity are always present first, followed by assets.

Assets are divided into current and long-term assets in both formats. Again, current assets are those that will be used in the coming year, and long-term assets are those that will survive longer than a year.

Liabilities are also divided into two categories: current and long-term.

Let’s take a look at each balance sheet account and how it’s reported.

Section on Assets

Assets always come first, just like in the accounting equation. The asset part is divided into two or three subcategories and is ordered from current to non-current. This structure allows creditors and investors to know what assets the company is investing in, selling, and keeping. It also aids in the analysis of financial ratios. The current ratio, for example, helps to determine the leveraging status of a company based on its present resources and commitments.

The first subcategory organizes the current assets by liquidity. Here’s a rundown of the most popular accounts in this section:

- Current

- Accounts Receivable

- Cash

- Inventory

- Prepaid Expenses

- Due from Affiliates

The long-term assets are listed in the second subcategory. And because many long-term assets decline over time, this section differs slightly from the previous one. This means that the assets are often stated with a sum deducted for total accumulated depreciation. In this section, you’ll find a list of the most frequent long-term accounts:

- Long-term

- Equipment

- Improvements to the Leasehold

- Buildings

- Vehicles

- Receivables on Long-Term Notes

Read Also: Balance Sheet vs. Income Statement: Examples, Differences & Relationship

Meanwhile, investments, intangible assets, and or property that doesn’t fall into the first two categories, there is often a third subcategory. Here are some instances of these items on the balance sheet:

- Other

- Investments

- Goodwill

- Trademarks

- Mineral Ownership

All assets, with the exception of some intangible assets, appear on the balance sheet at their purchase price, according to the historical cost principle. In other words, they are valued at the same amount as the corporation paid for them on the report. This usually results in a disparity between the report’s indicated value and the true fair market value of the resources. For example, a building acquired for $20,000 in 1975 could now be worth $1,000,000, but it will only be recorded for $20,000. This is in line with the balance sheet concept, which specifies that the report should reflect actual events rather than hypothetical figures.

Section on Liabilities

Liabilities are also broken down into several subcategories. In the liabilities section, there are usually two or three different liability subcategories: current, long-term, and owner debt.

The current liabilities part is always reported first, and it covers all debt and other commitments due in the current period. This usually refers to trade debt and short-term loans, but it can also refer to the portion of long-term loans that is due this year. Starting with accounts payable, the current debts are always displayed by due dates. The following is a list of the most common current liabilities, in the order in which they appear:

- Current Liabilities

- Accounts Payable

- Accrued Expenses

- Unearned Revenue

- Lines of Credit

- Current Portion of Long-term Debt

The second column of liabilities contains the obligations that are due in more than one year. Long-term debt is frequently grouped together in a single general listing, although it can also be broken down further. Some instances are as follows:

- Long-term Liabilities

- Mortgage Payable

- Notes Payable

- Loans Payable

Owners frequently loan money to their businesses rather than taking out a standard bank loan.

Also because investors and creditors wish to distinguish this kind of debt from typical debt payable to third parties, a third column for owner’s debt is frequently added. This simply lists the amount owed to the company’s owners or officers.

Section on Equity

The equity part, unlike the asset and liability sections, varies based on the type of business. Corporations, for example, list common stock, preferred stock, retained earnings, and treasury stock on their balance sheets. Sole proprietorships, on the other hand, list the capital of the owner, while partnerships list the capital of the members.

The balance sheet, like all financial statements, has a heading that includes the company name, the statement’s title, and the report’s time period. For example, Businessyield Consult’s annual income statement would include the following heading:

- BusinessYield Consult

- Balance Sheet

- September 26, 2021

What Are the 4 Sections of a Balance Sheet?

Assets, liabilities, and equity make up a company’s balance sheet. Assets are valuable items that a firm owns and has in its possession, as well as items that will be received and can be objectively measured.

What Are the 2 Types of Balance Sheet?

A balance sheet shows the assets, equity, and liabilities of a company or an individual at a certain point in time. There are two types of balance sheets. Basically, these include the report and account forms. Simple balance sheets are common among individuals and small enterprises.

What Is the Format of Vertical Balance Sheet?

A vertical balance sheet is one in which the balance sheet presentation structure is a single column of figures, with asset line items appearing first, followed by liability line items, and shareholders’ equity line items appearing last. Meanwhile, line items are provided in decreasing order of liquidity within each of these categories.

What Are the 3 Forms of Balance Sheet?

The classified, common size, comparative, and vertical balance sheets are the most prevalent.

What Is Balance Sheet Explain?

A balance sheet is a financial statement that shows the assets, liabilities, and shareholder equity of a corporation. One of the three fundamental financial statements used to analyze a corporation is the balance sheet. It gives a snapshot of a company’s financial position (what it owns and owes) as of the publication date.