Accounting software is a great tool to manage your finances if you own a small business, freelance, or work on a contract basis. Common features of these solutions include invoicing, expense tracking, and financial reports. However contrary to popular opinion, while free accounting software does not have all of the bells and whistles of paid accounting software, it can still be useful for managing your finances.

We’ve compiled a list of our top picks to help you find the best free accounting software for your needs. We chose these solutions based on their pricing, features, support, reputation, and other factors.

What is Accounting Software?

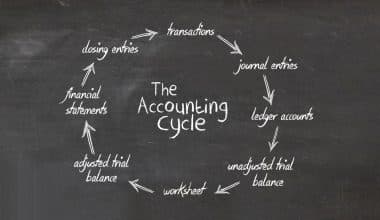

Small businesses must keep detailed records of all financial transactions, including invoice payments, travel expenses, or utility bills. Accounting software serves as a central repository for all of this information. When your financial records are kept up to date and basic accounting principles are followed, you better understand how your business is performing financially and what it can and cannot afford in the future.

Accounting software facilitates the creation of reports such as a balance sheet, and some products automate bookkeeping tasks such as transaction categorizing and matching. More importantly, it ensures you have all the necessary records come tax season.

Free Small Business Accounting Software: Overview

Free accounting software is computer-based cloud or desktop technology that allows business owners and financial professionals to manage a small business’s books for free.

Of course, even the best free accounting software will not provide you with the most powerful accounting software options. You must pay to access cutting-edge accounting innovations for your small business.

However, researching the best software options for small businesses will help you decide whether to pay for this financial resource.

Free Small Business Accounting Software

Free accounting software may appear to be a myth—in fact, many business accounting software options that claim to be free end up charging you in some way, whether you have to upgrade for a critical feature or pay for installation.

When looking for free software for your small business, ensure you understand each option’s potential costs. We’ve compiled a list of the best free accounting software options. Of course, most of these options will have paid versions and add-ons, but their most basic versions are completely free:

#1. Wave

Wave accounting software is a top free accounting software to consider from the start of your search. You can link unlimited bank and credit card accounts to your books using this option. You’ll also have free access to unlimited income tracking, expense tracking, and guest collaborators. You’ll also be able to invoice and scan receipts for free.

However, keep in mind that you will need to pay if you want your invoiced customers to be able to pay online directly through the invoice. Wave charges 2.9% + $0.30 for credit card payments and 1% (minimum $1) for ACH payments. You must also pay for payroll through Wave. You’ll pay a monthly base fee of $35 or $20, plus $4 per employee and contractor on your payroll, depending on where you do business.

#2. ZipBooks

ZipBooks is another excellent free accounting software for small businesses to consider. It provides all the essential accounting software features in one free account, including reports, bank syncing, billing, expense management, and invoicing.

You must use Square or PayPal to accept online payments from your invoiced customers through ZipBooks. You’ll be charged the standard PayPal and Square fees for those transactions.

ZipBooks and Gusto have an integrated payroll add-on option. Gusto’s monthly fee is $39, plus $6 per person. For a limited time, you can get the Core plan at a reduced monthly cost of $19 for the first six months. Gusto also has a new option for contractors who only pay the $6 per employee rate and have no base price.

#3. Akaunting

It would be best to look into Akaunting, a free accounting software. This option includes many of the most important features that small business accounting software should have. Using this technology, you can invoice, sync accounts, track expenses, set up recurring bills, manage customers, and manage vendors. To access more advanced features, such as online payments, you’ll need to download third-party apps, which will cost you a yearly fee in addition to whatever fees you have to pay for this third-party account.

To summarize, creating an Akaunting account is free, but as you navigate this software, you’ll notice that all the capabilities you might expect to be ready to use will require you to purchase these third-party apps.

#4. SlickPie

SlickPie, a free accounting software, is also worth investigating for your small business finances. This accounting software’s free version allows unlimited automated receipt entries, ten different companies on one account, and email support. It also lets you create quotes and estimates that can be easily converted into professional invoices. You can also connect your PayPal and Stripe accounts for free with SlickPie. Customers can pay their invoices online using a credit card or PayPal, and you will only have to pay the standard transaction fees charged by PayPal and Stripe.

Reports appear to be a feature that this free accounting software lacks—the SlickPie website makes no mention of any built-in reporting capabilities if you want to extract valuable, high-level insights from your accounting software, consider alternatives to SlickPie.

#5. GnuCash

GnuCash is a strong contender if you’re looking for free desktop accounting software for your small business. To access this free accounting software option, go to the GnuCash website and download it for free—it’s as simple as that. Though GnuCash can be used for personal and small business accounting, it includes small business-specific features such as customer and vendor tracking, job costing, and invoicing.

#6. CloudBooks

You can add an unlimited number of users, invoice, create projects, perform integrated time tracking, track expenses, and provide estimates with the accessible version of CloudBooks accounting software. To send more than five invoices per month, brand your invoices, and accept online payments on your invoices, you must upgrade from the free version and pay at least $10 per month.

#7. Zoho Invoice

Zoho Invoice is a great choice if you want the best free accounting software to automate your invoicing workflows. You can invoice customers and manage payments through a single account with the accessible version of Zoho Invoice. Through a client portal, you can customize and brand invoice templates, track expenses, and interact with customers. You can also use integrated time tracking for yourself and your employees to bill projects.

#8. NCH Express Accounts

NCH Express Accounts is another free desktop accounting software option to consider. This accounting software’s free version can meet the accounting needs of small businesses with fewer than five employees. You’ll be able to access and generate 20 crucial financial reports, as well as analyze revenues by the customer, team member, or item, using this free accounting software for small businesses.

This software will also allow you to manage accounts receivable and payable easily. To access your books online, however, you must purchase the cloud version of Express Accounts, which isn’t free and currently starts at $59.95.

Methodology

We considered several factors, including features, customer reviews, and value, to determine the best free accounting software. After assigning weighted scores to each feature, we narrowed our options and ranked the companies based on those factors.

Invoicing, time tracking, and expense tracking are among the features we prioritized for small businesses. We also considered how simple the software is to use. Is it available on a variety of platforms? Is the user interface easy to use?

We also looked at customer reviews to see what people thought of the software. Because marketing promises do not always correspond to reality, reviews can assist in determining whether a software lives up to its claims.

Finally, we considered the service’s worth. You are investing time in learning and using the software despite not paying for it. Is it time well spent?

We considered these factors when ranking the best free accounting software to help you find the best software for your business.

Choosing Free Accounting Software

It is critical to consider your needs when selecting free accounting software. What characteristics are you looking for? Do you require time tracking? Invoicing? What about customer service? Consider what is important to you and your company, and then look for software that includes those features.

It is also critical to consider usability. Accounting software can be complicated, so look for something simple to use and install, or better yet, is available in the cloud. Consider how easy each software is to use and whether it is available on multiple platforms.

Finally, take into account customer feedback. What do users think of the software? Are they satisfied with the features? Is there customer service available to help with any problems? Read the positive and negative reviews to get a balanced picture of each software.

What You Might Miss Out On If You Use Free Accounting Software

Free accounting software is fantastic—avoiding a monthly fee can significantly reduce your company’s bottom line. And, especially if you’re just starting out, $0 per month can be a non-negotiable accounting software budget.

However, if you choose free accounting software for your small business, you will most likely miss out on a few features that other accounting software options provide. In some cases, the features that free software lacks may end up saving your company money.

Overall, more powerful accounting software frequently pays for itself, so consider the potential costs of using free accounting software, such as bookkeeping backup or tax fines. Examine the following features that free software typically lacks, and decide whether it’s time to make room in your budget for more powerful technology:

#1. Tax and Payroll Capabilities

Many accounting software options that charge a monthly fee will provide tax assistance to your business. They also frequently provide full payroll services, allowing you to integrate your payroll into your company’s books seamlessly.

#2. Technical Reports

Though many free accounting software options provide entry-level reports for small businesses, others typically provide even more sophisticated reporting options. Whether it’s data visualizations, more customizable numbers, or all of the above, reporting through non-free accounting software usually allows users to gain more valuable insights.

#3. Forecasting

Forecasting is typically not a feature of free accounting software. If you want to be able to project financial numbers to set goals and budgets more effectively, you should think about upgrading.

#4. Inventory and Order Management

Most free accounting software options do not include inventory or order tracking. This feature is critical if you’re looking for accounting software for a small retail business.

#5. User and Invoice Count

Most free software options limit your account to five users. Furthermore, some will limit the number of customers you can invoice and the monthly invoices you can send. If your small business frequently exceeds these limits, an upgrade is required. Otherwise, free accounting software that does not meet your requirements is simply not worth your time.

Accounting Software Trials: Alternatives to Free Accounting Software

It’s easy to be uncertain after reading this guide to free accounting software. On the one hand, you want the best for your company, and having access to the best accounting software possible may be worthwhile. On the other hand, nothing beats free, especially when you’re concerned with your company’s finances.

Fortunately, there is a happy medium: many of the most powerful accounting software options offer a 30-day free trial to new customers. For example, FreshBooks, Sage, Xero, and QuickBooks all provide free trials of their accounting software. With a free trial, you can test out more expensive options to see if they provide enough value to justify the cost. You may discover that the additional features aren’t necessary as you use the free trial and that a free accounting software option is sufficient. Alternatively, you may discover that the reports, tax assistance, and payroll services provided by more expensive accounting options save you enough time and money to justify their monthly fees.

In any case, a free trial will allow you to perform a quick cost-benefit analysis of your options. As a result, you can be confident that whatever decision you make is the right one.

In Conclusion

What should you do now that you’ve reviewed your top free accounting software options and learned about alternatives?

Your next steps will be determined by which option you choose to go with. If you’re determined to use free accounting software for your small business, it’s time to get started. Fortunately, you can choose a few and test them for free to see which one works best for you.

If you want to try out some accounting software that isn’t free, we recommend reading reviews of the free-trial options we listed above. Please choose the best fit for your company and test it alongside a free option. Compare the two and go with the one that provides the most net value for your company.

Related Articles

- SMALL BUSINESS ACCOUNTING SOFTWARE: Meaning, Best Software & Degree

- ACCOUNTING INVOICE: Definition, How to Record It, and Free Software

- NET 30 PAYMENT TERMS: Meaning, Examples & Reasons Why You Should Use Them or Not

- PAYMENT TERMS: How To Use The Best Payment Terms

- Business Accounting Guide: (+ Free Samples & Courses)