Indeed, palladium is a scarce metal. The palladium ETF is generally also rare in the security market. The palladium ETF stock price is volatile. This article will help you with the ishare and inverse palladium ETF, not leaving behind the palladium ETF USD.

Let us discuss these things in detail. Shall we?

PALLADIUM ETF

As you know, palladium is a silvery metal often produce in catalytic converters and has importance in jewelry, and electronics. Palladium and other platinum-group metals are moderately rare. Hence, keeping their prices relatively high.

Palladium ETFs offer investors a display of the precious metal palladium. Unlike its precious metal equals such as gold, and silver, palladium works for industrial and commercial purposes.

Palladium ETFs trace the price of the precious metal palladium. However, the only palladium ETF in U.S. markets is the ETFS Physical Palladium Shares fund (PALL). With 1 ETF traded in the U.S. markets, Palladium ETF closes total AUM of $404.83M.

Additionally, the U.S. is a comparably minor producer of palladium. She generates an estimate of 12,000 kilograms in 2019. Russia was the highest producer, with 86,000 kilograms. Also, South Africa produce at 80,000 kilograms.

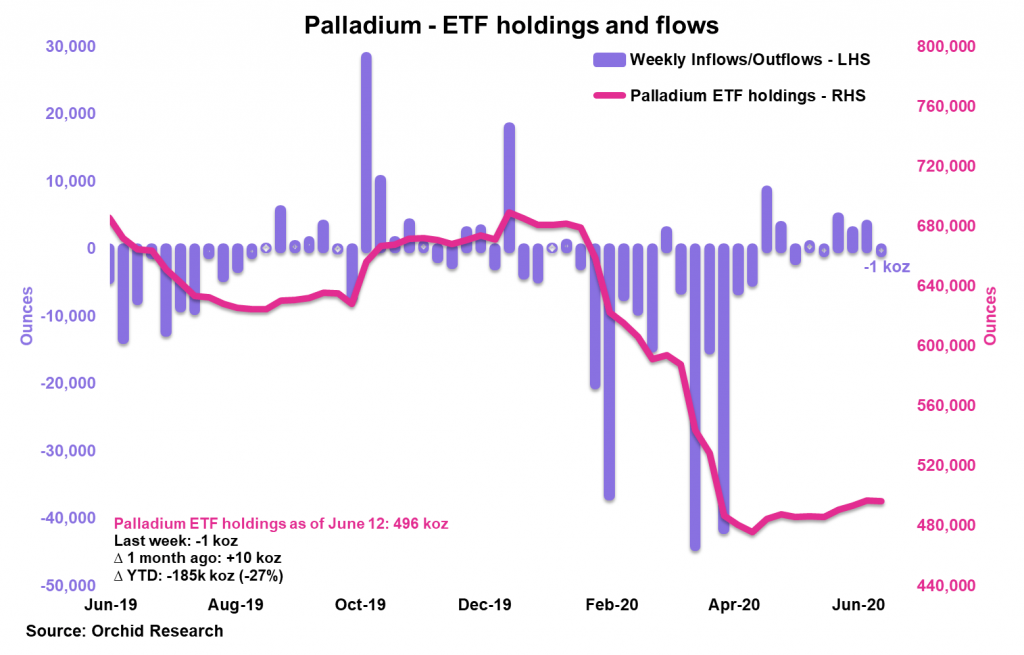

Nevertheless, palladium prices have historically been somewhat unpredictable. Prices peaked at more than $2,800 per ounce in February 2020. However, it fell below $1,600 a month later. Palladium has recovered reasonably since then, trading for around $1,800 an ounce. Nevertheless, investors involved in adding palladium to their portfolios might find the easiest path through ETFs or similar vehicles.

Having known this however, let us discuss what is palladium ETF stock?

Palladium Etf Stock

Indeed, ETF options for funding palladium are almost limited. However, the Aberdeen Standard (PALL) is possibly the largest. On March 31, 2020, the fund kept more than 131,500 troy ounces at a secured vault in London.

Specifically, PALL fund prices derive directly from the London Platinum and Palladium Market. Hence, it may be the most utter palladium play. The fund was established in December 2009 and has delivered more than 17% annually since its conception. The annual expense ratio is 0.60%.

Another Palladium ETF stock is the Sprott Physical Platinum & Palladium Trust (SPPP). Similar to the Physical Palladium Shares ETF, they also hold physical bullion as opposed to derivative securities. As of March 31, 2020, the ETF has more than 24,000 ounces of platinum and 44,000 ounces of palladium.

The ETF has delivered 6% annually since its initiation in December 2012. Trust unitholders may reclaim their units for physical platinum or palladium every month. However, only if they meet the minimum redemption requirements. The fund has an annual expense ratio of 1.29%.

Inverse Palladium Etf

An inverse palladium ETF is an index ETF that gains value when its correlating index loses value. It achieves this by containing several assets and derivatives, like options, to generate profits when the underlying index falls.

Some investors prefer implementing advanced ETF trading strategies like using leveraged and inverse ETFs. These funds are for serious traders. Hence, attention is deeply encouraged when placing your money into these investments. Here is a list of leveraged and inverse ETFs for investors who want to employ other tactics to the commodity ETF market.

Leveraged and Inverse Broad Agriculture ETFs

- COWS – Direxion Daily Agribusiness Bear 3x Shares ETF

Leveraged and Inverse Energy ETFs

- ERX – Direxion Daily Energy Bull 3X Shares ETF

- ERY – Direxion Daily Energy Bear 3X Shares ETF

Leveraged and Inverse Oil ETFs

- DDG – Short Oil and Gas ProShares ETF

- DNO – United States Short Oil Fund ETF

Leveraged and Inverse Natural Gas ETFs

- Boil: ProShares Ultra DJ UBS Natural Gas ETF

- Kold: UltraShort DJ UBS Natural Gas ETF

- DDG: ProShares Short Oil and Gas ProShares ETF

- GASL: Direxion Daily Natural Gas Related Bull 3X Shares ETF

- GASX: Direxion Daily Natural Gas Related Bear 3X Shares ETF

Leveraged and Inverse Gold ETFs

- DGLD – VelocityShares 3x Inverse Gold ETN

- DUST – Direxion Daily Gold Miners Bear 3x Shares ETF

- GLL – ProShares UltraShort Gold ETF

- NUGT – Direxion Daily Gold Miners Bull 3x Shares ETF

- UGLD – VelocityShares 3x Long Gold ETN

Leveraged and Inverse Silver ETFs

- AGQ – ProShares Ultra Silver ETF

- ZSL – ProShares UltraShort Silver ETF

- USLV – VelocityShares 3x Long Silver ETN

- DSLV – VelocityShares 3x Inverse Silver ETN

Knowing the ishare palladium ETF is a crucial issue in the world of stock.

IShares physical palladium are series of secured metal-linked debt securities. They also invest in one or more regulated exchanges. Also, they give investors easily accessible, and transparent exposure to precious physical metals.

Furthermore, its objective is to trace the day-to-day movement of the price of palladium by keeping physical palladium. However, palladium backs the securities allotted. It also evaluate daily at the London PM fix price. The metal is kept as allocated palladium bars with JPMorgan (and its sub-custodian). State Street acts as the Trustee. iShares Physical ETCs are exchange-traded commodities and are neither funds nor exchange-traded funds.

However, iShares Physical ETCs give investors exposure to the act of individual precious metals without the need to take physical delivery or trade commodity futures contracts.

Palladium Etf Usd

The fund invests in physical palladium in the form of standard bars (1-6 kilograms, according to London Platinum and Palladium Market Palladium pm Fixing Price). The palladium is physically separated and saved in a high-security vault in Switzerland. It was established on November 25, 2010.

However, WisdomTree Physical Palladium (1675) was created to give security holders a secure, simple way to reach the palladium market. It provides a return equivalent to the movements in the palladium spot price less the applicable management fee.

Palladium Etf Price

There are several palladium ETF price. However, let us list a few of them.

ETFS Physical Precious Metals Basket Shares (GLTR)

They trace the spot prices of a gold, silver, platinum, and palladium basket, less holding costs, using bullion held in London and Zurich.

ETFS Physical Palladium Shares (PALL)

They trace the palladium spot price less holding costs using palladium bullion held in London and Zurich.

Sprott Physical Platinum and Palladium Trust (SPPP)

It is a closed-end trust that trades in unencumbered and fully-allocated Good Delivery physical platinum and palladium bullion.

Conclusion

In summary, Palladium ETF stock and price should be considered when dealing with share and inverse palladium ETF.

Palladium Etf FAQ

Is there an ETF for palladium?

Palladium ETFs keep an eye on the price of the precious metal palladium, and they can be bought and sold like stocks. A palladium ETF called the ETFS Physical Palladium Shares fund (PALL) is the only palladium ETF in the US right now.

Is palladium a good investment?

A lot of people are looking for palladium, but there isn’t enough of it to go around. This has made it more scarce than gold and helped push it above gold in the last few years. They all have the potential to be good investments.

- Understanding Dividend Stocks and How to Invest

- How to Spot High Yield Investments (Easy Guide)

- Financial Leverage: Simple Guide to help you get started, with Examples (+ quick tips)

- Best business to start with little money right now (+ all you need to start)

- BALANCE OF PAYMENTS: Definition and Components