If you’re a newbie in bookkeeping and accounting then certainly you may get confused about accounts payable and accounts receivable. For starters, both operations are part of the accounting cycle, plus organizations that employ double-entry or accrual accounting frequently use them. But while accounts payable and receivable may be administered in a similar manner, there are several significant differences between the two, the most notable of which is that accounts payable is a liability account, whilst accounts receivable is an asset account. As you may recall, assets are everything your company possesses, while liabilities are everything it owes. It’ll be much easier to manage accounts payable and accounts receivable for your firm if you remember this distinction. Hence, this post will explain the major differences between accounts payable vs accounts receivable.

Accounts Payable vs Accounts Receivable

Generally, comparing accounts payable vs accounts receivable starts with their definitions. Other distinctions are pretty much visible in their mode of operations, processes, and so on.

What Exactly are Accounts Payable?

Accounts payable is the amount owed by your company to vendors for products acquired on credit. Accounts payable often include items like:

- Bills for electricity

- Rent

- Postage

Basically, it’s up to your vendors to decide whether or not to offer credit terms to your company. If they do, any invoice you get will almost certainly have a particular pay-by date that you must adhere to in order to avoid violating the credit terms in place.

For example, your company has printed 25 pamphlets to deliver to potential consumers. The vendor agrees to sell you these items on credit, with payment due 30 days from the date of the invoice.

The delivery comes in the next day, along with a bill for $500. To record the bill into accounts payable, make the following journal entry:

| DATE | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 15-08-2021 | Printing Expense | $500 | |

| 15-08-2021 | Accounts Payable | $500 |

In other words, recording accounts payable also means that the amount of the invoice or expense will be added to your accounts payable liabilities. So when it’s time to pay the bill, you’ll need to debit accounts payable and credit your cash account to show that the bill has been paid, reducing your liabilities account.

Meanwhile, most accounting software solutions handle vendor management, accurate spending allocation, and the capacity to track due dates to ensure payments are made on time, making the accounts payable process considerably easier.

Read Also: Automating Accounts Payable Process: What You Should Know Before Automation

But then accounts payable isn’t just about paying bills. Accounts payable management for your business allows you to develop beneficial professional relationships with vendors and suppliers while also ensuring that you pay your invoices on time, avoiding costly late fees.

How to Keep Accounts Payable Records

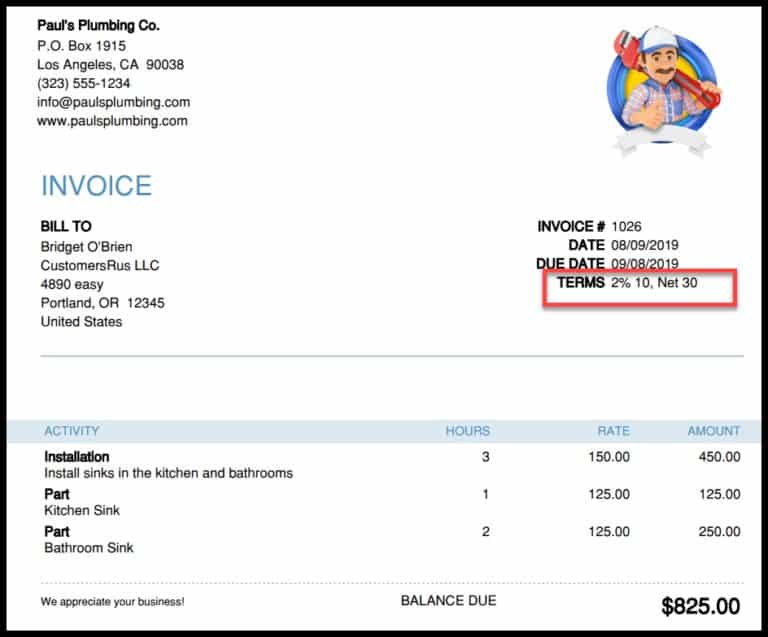

The following invoice is received by Bridget O’Brien for services from Paul’s Plumbing Co. Because the company got the services on credit, this invoice is recorded as an accounts payable item when it is received.

Basically, they must pay $825 before the 8th of September according to the invoice’s accounts payable conditions of net 30 and the invoice date of 09-08-2019.

What is Accounts Receivable?

Literally, you’re raising your accounts receivable balance each time you sell items or services to your clients. Customers who have been given credit terms owe you money, and this is represented by accounts receivable.

For the most part, accounts receivable management is critical for every organization, especially for small enterprises with minimal cash flow. It, however, begins with the choice to extend credit to your customers and ends with the implementation of suitable collection efforts for customers who do not pay on time.

Calculating your accounts receivable turnover ratio, which informs you how efficiently your entire accounts receivable process is running, is one of the simplest ways to discover how quickly your customers are paying you.

DWP, for example, sells some pieces of clothing to Andrew Gilmore on a net 30 basis. Andrew Gilmore now has until the 17th of March to settle the invoice and be in compliance with the contract’s provisions.

DWP will need to follow up and possibly initiate the collection procedure if Andrew Gilmore does not pay by then, with the option of adding a late fee to the past-due sum.

How do you keep track of your receivables?

The journal entry to record accounts receivable is straightforward, albeit you should remember to separate out your sales tax, which must be remitted to the appropriate authority regardless of whether your invoice is paid or not.

The invoice sent to Andrew Gilmore is recorded as follows:

| DATE | ACCOUNT | DEBIT | CREDIT |

|---|---|---|---|

| 15-02-2016 | Accounts Receivable | $401 | |

| 15-02-2016 | Sales | $324 | |

| 15-02-2016 | Sales Tax Payable | $ 77 |

We’ll need to debit accounts receivable because it’s an asset account. After the invoice is paid, you’ll debit (increase) your cash account while crediting (decrease) accounts receivable.

What’s the difference between accounts payable and accounts receivable (Accounts Payable vs Accounts Receivable)?

The following are some of the most important distinctions between accounts payable and receivable.

- Accounts receivables are the cash that is expected to be received in the future for credit-based sales. On the other hand, acccounts payable is the cash a business must pay to creditors for the acquisition of raw materials or services.

- Both are on the balance sheet, however accounts receivable is in the current assets section while accounts payable is in the liabilities portion of the current liabilities section.

- A business generates accounts receivables during a sale, whereas they generate accounts payables during a purchase on credit.

- Receivables can be offset by a provision for questionable debts, while payables cannot.

- Money is to be collected in the case of Accounts receivables, whereas money is to be paid in the case of Accounts payables.

- Accounts receivables literally increases cash flow, whereas accounts payable decreases cash flow.

- Credit sales result in accounts receivables, whereas credit purchases result in accounts payable.

- Debtors and bills receivables are components of accounts receivables, while billed payable is a component of accounts payable.

- Accounts receivables are held accountable by debtors, whereas account payables are held accountable by the company.

How Accounts Payable and Receivable Have Equal Importance

Both accounts payable and accounts receivable have a direct impact on your organization and are equally vital if you use accrual accounting. Both are required to produce accurate financial projections, analyze current cash flow, and even modify or adjust management processes.

Mismanagement of these two critical accounting activities can result in your inability to secure business credit, a decline in your creditworthiness, a long list of uncollectible bills, or a large drop in cash flow.

Conclusion

Now that you understand the differences between both terms, it’s hardly going to be a big deal when you come across them during assessments. Meanwhile, there’s also room for questions and inquiries in the comment section. Furthermore, you can also subscribe to our updates to receive vital business pieces of information as they come in.

What Is the Difference Between Accounts Receivable and Accounts Payable?

The following are some key differences between accounts receivable and accounts payable;

- A business generates accounts receivables during a sale, whereas they generate accounts payables during a purchase on credit.

- Receivables can be offset by a provision for questionable debts, while payables cannot

Is Accounts Receivable Higher Than Accounts Payable?

Basically, higher accounts payable simply means the company has more debts to pay. Higher accounts receivable on the other hand, could be a good or bad thing Good because tons of clients are owing the company which means more money to fund future projects. Bad, because on rare occasions customers may delay payments which means fewer funds to deal with immediate needs.

What Is the Difference Between Bills Receivable and Accounts Receivable?

When a company sells goods or services on credit to a customer, this creates an account receivable. Bill receivables, on the other hand, are short-term or long-term loans to outside parties. They don’t involve giving or getting anything from the other party other than cash.

What Are Examples of Accounts Payable?

Bills that a company has to pay are called “accounts payable.” It’s the money a business owes to its suppliers for goods and services they’ve given. Cleaning services, staff uniforms, software subscriptions, and office supplies are all examples of accounts payable. Accounts payable does not include payroll