Bad checks, NSF checks, bounced checks, rubber checks, insufficient checks, bogus checks, etc., can be a big problem for an individual or business of any size. There are both civil and criminal penalties for this illegal act, although it is much more expensive and difficult to prove a criminal case.

In this article, you’ll learn how to record a bounced check in QuickBooks. QuickBooks doesn’t have a bounced check feature, so the process requires several steps.

What is a Bounced Check?

A bounced check is a slang term for a check that cannot be processed because the account holder has insufficient funds (NSF). Banks return these checks, also known as rubber checks, or “bounce” instead of cashing them, and banks collect NSF fees from check issuers.

Spending checks can be illegal and the offense can range from a misdemeanor to a felony, depending on the amount and whether the activity involves crossing state lines.

Check Bounced Fee

If an account has insufficient funds and a bank decides to cash a check, it will charge the account holder a NSF fee. If the bank accepts the check but the account is negative, it will charge an overdraft fee. If the account remains negative, the bank may charge an extended overdraft fee.

Different banks charge different fees for checks and overdrafts. However, as of 2019, the average overdraft fee was $ 33,361. Banks typically charge this fee for invoices worth $ 24. These invoices include checks, as well as electronic payments, and some debit card transactions.

What Happens if a Check Bounces?

Bank charges are only part of the process of cashing a check. In many cases, the beneficiary also charges a fee. For example, if someone writes a check at the grocery store and the check is returned, the grocery store may reserve the right to return the check along with a check fee.

In other cases, if a check bounces, the payee reports the problem to debit agencies like ChexSystems, which collect financial data on checking and savings accounts. Negative reports with organizations like ChexSystems can make it difficult for consumers to open checking and savings accounts in the future. In some cases, companies compile a list of customers who have cashed checks and prohibit them from rewriting checks at that facility.

How to Record a Bounced Check in a QuickBooks: Steps-by-step process

To record a bounced check, you must do the following:

- Step 1: Reduce your bank balance for the deposited check that was returned to you.

- Step 2: Reopen the original invoice and show that it was not paid.

- Step 3: Record the Insufficient Funds Fee (NSF) charged by your bank.

- Step 4: Charge your customer an NSF fee.

How to Record Bounced Check in QuickBooks Online

The Record Bounce Check feature can only be used in single-user mode and only applies to checking payments made through the Customer Payment window. If you have a returned ACH item, change your payment method to “Verify” before proceeding with the steps. If your payment method is grayed out or you can’t complete the steps, go to option 2.

QuickBooks for Windows

As seen on quickbooks intuit

Option 1: Use the Record Bounced Check feature

- Go to Customers, then select Customer Center.

- Select the Transactions tab, then choose Received Payments.

- Double-click the payment you want to record as NSF.

- On the receive payments window, select the Record Bounced Check icon on the Main ribbon tab.

Note: The check must not be waiting to be cleared in the Undeposited Funds account, as it would have to have cleared the bank in order to bounce. - In the Manage Bounced Check window, enter the following information, then select Next.

Note: All these fields are optional. You can leave them blank if there weren’t any additional charges from the bank or if you don’t want to charge your customer for it.- Bank Fee and Date

- Expense Account for the Bank Fee

- Class

- Customer Fee (how much you will charge the customer)

- QuickBooks will show you the Bounced Check Summary, for you to know what will happen behind the scenes. For example, you may see:

- The following invoices will be marked unpaid

- The following fees will be deducted from your bank account.

- This invoice will be created for the fee you want to charge your customer.

- Select Finish.

Option 2: Manually record bounced check

- Create an item and income account for tracking bounced checks and their associates charges.

Important: This only needs to be set up once, if you’ve done this before, proceed to step 2.- Create an income account:

- Type: Income Account

- Account Name: Bounced Checks Income

- Create Bad Check Charge item:

- Type: Other Charge

- Item Name: Bad Check Charge

- Amount or %: Leave it at 0.00

- Tax Code: Non-taxable

- Account: Select Bounced Checks Income (created in step a).

- Create an income account:

- Create a journal entry to reverse the original payment.

- From the Company menu, select Make General Journal Entries.

- In the General Entries window, debit your account receivables for the same amount of the NSF check.

- Enter a note in the Memo column describing the transaction.

Example: Bounced check #123 – NSF - Select the name of the customer or job associated with the NSF check, under the Name column.

- Credit the checking or bank account that received the original deposit.

- Select Save & Close.

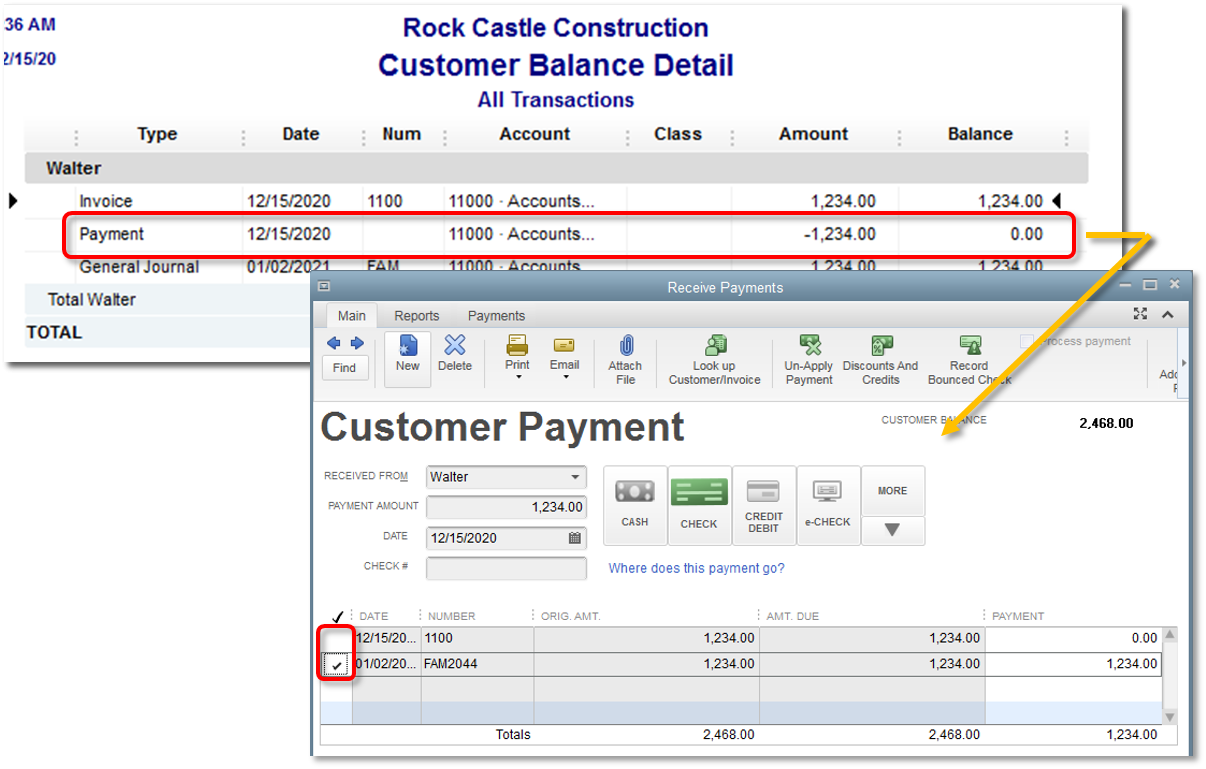

- Switch the payment for the invoice to the reversing journal entry.

- From the Reports menu, select Customers Receivables, then choose Customer Balance Detail.

- Double-click the original payment line for the NSF transaction.

- In the Receive Payments window, move the check mark from the invoice to the reversing journal entry.

- Select Save & Close.

Note: This will reduce your bank account by the amount of the bounced check. The invoice where the bounced check came from will be marked unpaid.

- (Optional) Resend open invoice

- Go to the invoice where the bounced check originated.

- Add the item Bad Check Charge (created in step 1). Note: You can skip this step if there weren’t any additional charges from the bank or if you don’t want to charge your customer for it.

- Select the Email icon on the Main ribbon tab, then choose Send.

QuickBooks Desktop for Mac

Note: You can only use the Bounced Check feature if the customer payment is a check you already entered in QuickBooks, and isn’t deposited to the Undeposited Funds account.

- Go to the Customers menu, then select Receive Payment.

- Find and open the check, then select Bounced Check.

- Complete the info needed. Take note that for bank fees, QuickBooks creates a bank service charge expense account if you don’t have one.

- Select Next. You’ll see a brief explanation of what happens with the invoice, check, and bank fees.

- Select Record. The invoice is now unpaid and outstanding. It also includes a Bounced Check Charge for your customer. If you don’t have one, QuickBooks creates a Returned Check Charges income account for the charge.

The Importance of Recording a Bounce Check in QuickBooks

When a check is cashed, the balance shown in QuickBooks Online is overestimated since the cashed check is shown as a deposit. It is important that you adjust your QuickBooks bank balance immediately so that the correct amount is displayed. You will also need to provide evidence that the customer still owes you the original invoice and the fees you charge for returned checks.

Registering a check is complicated and involves several steps. There are several ways to register a cashed check. However, we’re going to present what we think is the most efficient way to do it, while still maintaining a paper route and making reconciling your QuickBooks banking activities as easy as possible.

How to Avoid Bounce Checks

Consumers can reduce the number of checks they write by keeping track of their balance, using a unique system in which every debit and deposit is instantly recorded in a check register, or by closely monitoring their checking accounts using online banking. .

Consumers can also top up a savings account and link it to their checking account to cover overdrafts. Alternatively, consumers can write fewer checks or use cash, debit cards, instant online payments like mobile wallets, PayPal, or the like for discretionary spending.

Bounced Check Laws

Writing a bad check can result in significant criminal penalties. To avoid these consequences, it is important to know that writing a bounce check has some legal actions and countermeasures you may take.

Type of crime

Bad check writing occurs when a person intentionally writes a check for an amount they know is not available in the bank account for which the check was written. In some cases, a check must be written to an account that is already closed. In other cases, you will need to write a check for an amount greater than the balance in that account, deposit the check in another account, and withdraw the funds before the check can be cashed.

In some cases, a person will write a check for money that is not available but believes that a future deposit that will be made in a few days will be able to cover it.

Many states will not make it a crime or fire someone if the check is paid within a few days, usually ten, after your bank notifies you of insufficient funds. However, people who use this process can put themselves in a precarious situation if they forget to make the deposit or ignore a communication received from the bank.

Many states have vague definitions of the element of knowing that the account has run out of funds. The law assumes that a person is acting as a reasonable person, verifying statements and actively knowing how much is in an account. As a result, in many states, a person does not need to know the exact amount in his account for the government to show that the defendant “knew” that he had written a bad check.

Criminal penalties

The severity of the conviction for this crime depends on how the crime is defined in state law. In some cases, this can have civil and criminal implications. In other cases there can only be civil penalties. In New York, a person could face a prison sentence of up to three months and a fine of up to $ 750 based on the face value of the check.

In California, a person can stay in prison for up to one year if they are found guilty of the crime. In Texas, penalties are particularly harsh when it is considered a criminal offense to write a bad check. A person can face from 180 days to two years in state prison and be fined up to $ 10,000.

Some states have triple or triple damages, so a person must pay three times the face value of the check, subject to certain minimum or maximum payments.

Civil liability

In addition to the possible criminal consequences, a person can also be punished under civil law. The bank or the person who received the bad check can sue in civil court. The defendant may be asked to pay the verdict, which may include court costs and legal fees.

Fines

Check cashers may have to pay a hefty fee. Many banks charge between $ 25 and $ 35 for checks. This fee is applied to each cashed check. Banks generally have the ability to process transactions in a specific order as long as they follow the procedures set out in their customer agreement.

This means that they can process all charges before the credits arrive the same day. Even if a person makes a deposit, there may be an additional fee for each transaction that the bank clears before the deposit is processed. This may not be enough to bring the account back to black, given all the additional fees.

Other consequences

If a person repeatedly cashes checks, the bank may decide to close the account. This can create roadblocks and challenges when paying public benefits on that check or automatically paying a person’s salary.

Some companies report patterns for writing checks and share this information with banks and retailers. Therefore, a retailer may refuse to accept a check from someone who has not even cashed a check with that particular company. This can also result in future accounts being rejected. An individual’s credit report may show signs of a bad check letter if the check is being cashed.

A person can maintain a criminal record based on these allegations that he can follow for the rest of her life. Also, you may be denied a certain job due to a crime or poor creditworthiness.

Legal advice

People accused of writing checks can go to a criminal defense attorney to explain to him and her the rights of the defendant and the charges against him. An attorney can help formulate a defense based on the particular circumstances of the case and pursue reduced or dismissed charges.

Bounced check recovery

According to the Brown & Joseph law firm, if the bank says they received a check, call the client. If you are not a regular customer, please use the phone number on the check, if available. Tell them the check has cleared and ask if they can return it with a money order, cash, or credit card over the phone. You can also ask them to pay the check fees that the bank added.

You should also check with the bank, Groupon recommends. Perhaps the bank made a mistake or you deposited the check before the customer deposited the money. Do not try to resend it unless you are sure the money is there or the bank can charge you another check fee.

It is also a good idea to call your attorney and see what laws apply in your state. For example, the California attorney general’s website states that you must send a “request letter” by certified mail to the check writer in that state before you can take legal action. State bad check laws also dictate how much you can collect if you go to court and win. In many states, it is three times the amount of the check.

Bounce Check Legal Action

If the customer refuses to pay or cannot be found, you need to go one step further. You have several options.

- Contact the prosecutor. Some states have a bad check refund program where the DA office has someone contact the writer of the check and ask them to pay. A letter on official government letterhead may be enough to get someone to spit money out.

- Work through a debt collection agency. Even if the client is targeting you, debt collection agencies have the resources and skills to find people. However, you have to pay for the service.

- Use a check recovery service. These organizations monitor the account and reinsert the check as soon as there are sufficient funds.

- Take your client to court when he refuses to figure things out. Depending on the size of the check, you may be able to go to small claims court where you do not need and cannot hire an attorney. Even if the writer wasn’t willing to scam you, you can get paid if he doesn’t pay.

- It is important to keep all documents in the case until they are resolved. Keep the check, a copy of the certified letter you sent, the bank statement showing the charges for the checks, and other relevant documents.

Bounced Check Letter Sample

We Also Recommend: