Every company needs financial capital to operate its business. For most companies, its by selling debt securities, stocks or even through financial leverage.

But is financial leverage the right solution to the financial problems of a firm? In fact is financial leverage an important survival of a business?

While in a hurry to acquire more funds for operational purposes, lots of companies decide to use financial leverage with the hope that the value of the acquired assets will exceed the debt plus its interest rate.

This makes financial leverage a very important finance topic, and this article very handy. As it shows everything you need to know about financial leverage, and if its the right ecision for your business.

So, let’s answer the big question, “What is Financial Leverage?”

What is Financial Leverage?

Financial leverage is the use of borrowed funds to acquire assets with the expectation that the value/income/capital gain of the asset will exceed the cost of borrowing.

According to Wikipedia, it is any technique involving using debt (borrowed funds) rather than fresh equity in the purchase of an asset, with the expectation that the after-tax profit to equity holders from the transaction will exceed the borrowing cost.

Hence the provenance of the word from the effect of a lever in physics, a simple machine which amplifies the application of a comparatively small input force into a correspondingly greater output force.

The use financial leverage to manage a greater amount of assets (by borrowing money) will cause the returns on the owner’s cash investment to be increased.

That is to say, with financial leverage, there is

- an increase in the value of the assets which will result in a larger gain on the owner’s cash, when the loan interest rate is less than the rate of increase in the asset’s value

- a decrease in the value of the assets will result in a larger loss on the owner’s cash

In most cases, the provider of the debt will place a limit on how much risk it is ready to take, as well as the extent of leverage it will allow.

In the case of asset-backed lending, the financial provider uses the assets as collateral until the borrower repays the loan. If it’s a general cash flow loan, the overall creditworthiness of the company is used to back the loan.

In general, the concept of financial leverage is not just relevant to businesses but it also applies to individuals.

READ ALSO: MUTUAL FUNDS UPDATED: 15+ Best Mutual Funds in 2022 (+ Detailed Beginners’ Guide)

Why is Financial Leverage Important?

Financial leverage is the ratio of equity and financial debt of a company. It is an important element of a firm’s financial policy.

The concept of leverage is common in the business world. It is mostly used to boost the returns on equity capital of a company, especially when the business is unable to increase its operating efficiency and returns on total investment.

Financial Leverage provides the following benefits for businesses.

- Financial leverage is an essential tool a company’s management can use to make the best financing and investment decisions.

- It provides a variety of financing sources by which the firm can achieve its target earnings.

- It is also an important technique in investing as it helps companies set a threshold for the expansion of business operations. For example, it can be used to recommend restrictions on business expansion once projected return on additional investment is lower than cost of debt.

READ ALSO: FINANCE: Definition, Types, Importance

Impact of Financial Leverage

The use of financial leverage by a business can positively or negatively impact a company’s return on equity because of its high level of risk.

Firstly, since financial leverage is all about taking a debt to acquire an asset, it may have an adverse level of risk to the company. This is due to the fact that income must be used to pay back the debt even if earnings or cash flows go down.

Secondly, financial leverage can affect a company’s return on equity. Return on equity is the rate of return on the shareholder’s equity of a company’s common stock owners.

Return on equity shows how well a company uses investment funds to generate earnings growth.

Financial leverage increases a company’s return on equity because the use of leverage increases stock volatility, increasing its level of risk which in turn increases returns.

Thirdly, financial leverage multiplies losses. A company that constantly borrows to acquire assets might soon face bankruptcy during a business downturn.

Generally, in business practice, it is advised to borrow money to buy an asset with a higher return than the interest on the debt.

RELATED ARTICLE: PRINCIPLES OF FINANCE

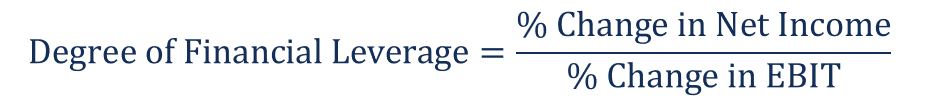

Degree of Financial Leverage

According to CFI, the degree of financial leverage is a financial ratio that measures the sensitivity in fluctuations of a company’s overall profitability to the volatility of its operating income caused by changes in its capital structure.

It signifies the level of volatility in the earnings per share (EPS) with the change in operating income as a result of capital restructuring i.e., acquisition of debts, issuing of shares and debentures and leasing out assets.

The degree of financial leverage is one of the methods used to quantify a company’s financial risk (the risk associated with how the company finances its operations).

Financial leverage is a main source of financial risk. Hence, a high degree of financial leverage indicates that even a small change in the company’s leverage may result in a significant fluctuation in the company’s profitability.

Also, a high degree of leverage may transform into a more volatile stock price because of the higher volatility of the company’s earnings.

Increased stock price volatility means the company is forced to record a higher expense for outstanding stock options, which represents a higher cost of debt.

READ ALSO: Bridge Loan Explained!!! (+ all you need)

How is Financial Leverage Used?

Financial leverage is the process of borrowing money to undertake an investment with the goal of generating higher returns. It is predicated on the principle of investing money to generate income. Purchasing a home, funding a business, or investing in real estate are examples of using financial leverage.

What Happens if Financial Leverage is High?

A higher financial leverage ratio is a sign that a firm is using debt to finance its operations and assets, which is frequently a red flag for potential investors that the company would be a risky investment.

What Causes Financial Leverage?

When a company decides to finance the bulk of its assets with debt, financial leverage results.

Where is Financial Leverage Found?

Leverage ratios and financial information from a company’s income statement, cash flow statement, and balance sheet are used to assess financial leverage.

Is Financial Leverage Good or Bad?

Because it enables investors and businesses to profit from assets they otherwise wouldn’t be able to afford, financial leverage is a potent instrument. Every dollar of their own money that they invest is multiplied by this. Leverage is a useful tool for businesses to buy out or acquire rival firms or to repurchase stock.

Formula for Degree of Financial Leverage

There are several ways to calculate the degree of financial leverage. The method of calculation to be used depends on the goals and context of the analysis.

Hence, according to CFI, the degree of financial leverage is calculated as,

However, if an investor wants to determine the effects of the company’s decision to incur additional leverage, the earnings per share (EPS) is a more appropriate figure because of the metric’s strong relationship with the company’s share price.

Hence, the degree of financial leverage is given as;

Another formula that allows calculating the degree of financial leverage in a particular time period is given as;

For better understanding, read this: What Is DEGREE OF FINANCIAL LEVERAGE: Overview, Formular, Importance

Factors Affecting Financial Leverage

Financial leverage is more about borrowing from external sources and repaying according to the agreed time frame.

Hence, it is affected by the following factors.

#1. Financial liability

The debts encountered during financial leverage create financial liability on the company.

#2. Financing Decision

The financial leverage decision is a part of the company’s financing strategy planned by the directors.

#3. Interest Rates

Because financial leverage involves borrowing, you’d have to pay back with high interest.

#4. Stability of the Firm

Finance is a major part of a firm. So, before the company’s management decides to take a financial leverage decision, they have to consider the company’s status, its stability, and whether it can bear the risk or not.

#5. Return on Assets

The assets that will be acquired through borrowed funds need to be estimated, to find out if the company will be able to generate higher profits from it or not.

RELATED ARTICLE: Personal Finance: Basics, Importance, Types, Management ( + Free Softwares)

How Can Financial Leverage Harm A Company?

Borrowers must repay their loans on schedule, per the lender’s requirements. For young businesses that borrow money for long-term investment initiatives, this poses a challenge. Loan repayments can be a debilitating burden if they become due before the company starts to earn profits.

What Affects Financial Leverage?

The leverage effect shows how debt affects the return on equity: More debt can boost the owner’s return on equity. This is true as long as the overall project return exceeds the cost of extra debt.

Measures of Financial Leverage

After acquiring external funds, the management of a company uses several financial ratios to measure the performance of a company.

The four most crucial measures of financial leverage are;

#1. Debt-Equity Ratio

The debt-equity ratio is the ratio of the borrowed funds to the funds raised from shareholders.

Simply put, it is the ratio of the borrower’s fund to the owner’s fund. It shows the likelihood of the borrowing entity facing difficulties in meeting its debt obligations, or if its levels of leverage are at healthy levels.

Mathematically, debt-equity ratio is given as;

Where total debt refers to the company’s current short-term liabilities and long-term liabilities.

And Shareholder’s equity refers to the the amount that shareholders have invested in the company plus the amount of retained earnings (the amount that the company retained from its profits).

Analysis: The higher the debt-equity ratio is, the weaker is the financial position of the company. Therefore, this ratio should always be less to avoid the risk of bankruptcy and insolvency.

#2. Debt to Capital Ratio

The debt-to-capital ratio is a another measurement of a company’s financial leverage. It is calculated by dividing the company’s interest-bearing debt, both short- and long-term liabilities with its total capital.

Total capital involves all interest-bearing debt plus shareholder’s equity, which may include items such as common stock, preferred stock, and minority interest.

Mathematically, debt to capital ratio is given as;

Analysis: The debt-to-capital ratio gives analysts and investors a better idea of a company’s financial structure, and whether or not its a stable investment. More so, the higher the debt-to-capital ratio, the higher the risk.

#3. Debt to EBITDA Ratio

Debt to EBITDA Ratio is a ratio measuring the amount of income generated and available to pay down debt before covering interest, taxes, depreciation, and expenses. It measures a company’s ability to pay off its incurred debt.

Oftentimes, banks include debt/EBITDA target in the covenants for business loans, and a company must maintain this agreed-upon level or risk till the entire loan become due.

The debt to EBITDA ratio is used by credit rating agencies to assess a company’s probability of defaulting on an issued debt.

Analysis: A high debt to EBITDA ratio indicates that the company has a too-heavy debt load. It means that the firm may not be able to service their debt in an appropriate manner, leading to a lowered credit rating.

#4. Interest Coverage Ratio

This is used to determine the ability of a company to pay off the interest with the profits earned.

The interest coverage ratio measures how many times a company can cover its current interest payment with its available earnings.

The interest coverage ratio is also called the times interest earned (TIE) ratio. Lenders, investors, and creditors use this formula to determine the risk of lending capital to a firm.

Mathematically, Interest coverage ratio is given as;

The debt to equity ratio is the most commonly used measure of financial leverage. While, the other three are used in corporate finance to measure a company’s leverage.

RELATED ARTICLE: CORPORATE FINANCE: The Complete Guide (+ free courses)

Risks of Financial Leverage

Although financial leverage may result in increased earnings for a company, it could also lead to some losses. Oftentimes, losses occur when the interest rate for the asset exceeds its returns.

Hence, the following risks are associated with financial leverage;

#1. Volatility of Stock Price

High amounts of financial leverage may result in large flunctuations in company profits. As a result, the company’s stock price will fall, and it will hinder the proper accounting of stock options owned by the company employees.

When the stock price increases, it means that the company will have to pay more interest to its shareholders.

#2. Reduced Access to More Debts

When lending out money to companies, financial providers assess the firm’s level of financial leverage.

For companies with a high debt-to-equity ratio, lenders are less likely to release funds because they have a higher chance of risk.

However, if they agree to lend out funds, it will lead to a high interest rate that is sufficient to compensate for the higher risk of default.

#3. Bankruptcy

The flunctuations in revenues of a company can easily push a company into bankruptcy. As a result, it will be unable to meet its rising debt obligations and pay its operating expenses.

With looming unpaid debts, creditors may file a case at the bankruptcy court to have the business assets auctioned in order to retrieve their owed debts.

#4. Operating Leverage

Operating leverage is defined as the ratio of fixed costs to variable costs incurred by a company in a specific period.

So, if the fixed costs exceed the amount of variable costs, a company is considered to have high operating leverage.

This is common in capital-intensive firms such as manufacturing firms because they require a huge number of machines to manufacture their products.

Regardless of whether the company makes sales or not, the company needs to pay fixed costs such as depreciation on equipment, overhead on manufacturing plants, and maintenance costs.

Conclusion

A company must carefully analyze its financial leverage position before making the decision to borrow.

This is because, although financial leverage presents enhanced profit opportunities, there are still some risks associated with it.

PS: Don’t have a business plan yet? Or you’re still a bit confused about the idea of a business plan? Don’t worry, we got you!

Click on the button below to have access to our list of workable business plans. These plans have helped a lot of business owners in over 10 countries of the world.

- Best online payday loans: Top 10 companies in 2022

- Financial Freedom: A Detailed Guide to Help you Achieve it in 2022 (+ quick tips)

- Hard money lenders: Beginners’ Guide & Best Picks

- SHORT TERM DEBT: Definition, Examples, and Debt financing

- What Is BUSINESS CYCLE?- Definition, Internal and External Causes