It’s a major step to work with a financial advisor. If you do not engage a fiduciary, you may find yourself in a terrible financial situation, or even worse—your money may be squandered or stolen. Although anyone who provides financial advice can call themselves a financial advisor, a certain group of professionals are mandated by law to provide financial advice and product recommendations that are in the best interests of their clients. These experts, called fiduciaries or fiduciary financial advisors, are essential to making sure that your money and financial decisions are made responsibly. Hence, in this guild, let’s look at how to find a fiduciary financial advisor and their fees.

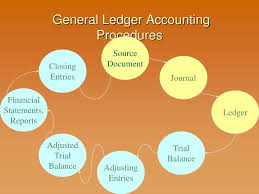

What is a Fiduciary?

A fiduciary is a person or organization with a legal obligation to act in the best interests of another person. Fiduciaries have a trusting relationship with their clients and must avoid conflicts of interest. Fiduciary financial advisors in the finance industry are only allowed to offer investments and other financial planning items that are the best fit for their clients.

What is a Fiduciary Financial Advisor?

An independent registered investment advisor who is not bound by a company’s agenda when it comes to what you buy is known as a fiduciary financial advisor. They are not a broker who sells you goods. Instead, a fiduciary advisor is bound by the law, which mandates that they prioritize your interests and eliminate (or at the very least disclose) any potential conflict of interest.

Being a fiduciary financial planner entails more than just making suggestions and diversifying investments. A fiduciary is someone who has a legal or ethical trust relationship with one or more parties. Some examples of fiduciary financial advisors are certified financial planners, discretionary investment advisors, and non-discretionary fiduciary financial advisors. Some fiduciary financial advisors focus on things like planning for retirement or helping small businesses.

The DOL Fiduciary Rule and the subsequent SEC Regulation Best Interest focused a lot of attention on fiduciary financial advisors. These regulations have altered the sector and prompted fiduciary advisors to improve their customer service. No longer do advisors just recommend stocks or other products and get a commission on them.

What’s the Difference Between a Fiduciary and a Financial Advisor?

The word “fiduciary” refers to any relationship that requires trust and requires one party to act in the best interests of another. Lawyers must act in their client’s best interests since they are fiduciaries. Real estate brokers are also fiduciaries because they have to look out for the best interests of the buyer or seller, not their own.

A fiduciary financial advisor makes decisions about your investments that are in your best interest. A non-fiduciary financial advisor, on the other hand, may recommend products for which they get a commission or some other kind of payment.

Why do I Need a Fiduciary Advisor?

You can see why it’s important to choose a fiduciary financial advisor based on the principle of fiduciary duty. What you thought you had all along: conflict-free advice, provided by a fiduciary advisor. According to the President’s Council of Economic Advisors, conflicted advice, backdoor payments, and hidden fees cost Americans approximately $17 billion every year. That amounts to around 1% of your returns being devoured. A 1% reduction in fees can mean your money will last nearly a decade longer in retirement, even if it may not seem like much.

When you work with a fiduciary financial advisor, the emphasis is on the relationship, not the commission. Most of the time, you pay them a flat fee straight up for your advice, and they do not earn money through commissions, trading incentives, or trailer fees. This means they have no motivation to sell you things that pay them this much. Fiduciary advisors exclusively look out for their client’s best interests because they are the ones who pay them. And what is a fiduciary if not someone who can assist you in achieving financial independence and living a life of amazing potential?

Best Fiduciary Financial Advisor

A financial advisor can assist you, whether you wish to start investing or have retirement savings goals that need to be managed. Financial advisors help you build long-term wealth by taking care of your investment portfolios, such as your 401(k) and individual retirement accounts (IRAs). Advisers can also help you reduce tax implications so that you don’t end up with a hefty bill at the end of the year. Here is a list of the best fiduciary financial advisors below:

#1. Fisher Investments

Fisher Investments is a large, fee-only financial advisory firm with over 100,000 individual clients, more than half of whom are wealthy. Those interested in working with Fisher should have at least $500,000 in investable assets, though this is negotiable.

#2. CAPTRUST

The firm with the most AUM on our list is CAPTRUST, which is a fee-based financial advisor in Raleigh, North Carolina. Tens of thousands of individual clients work with the firm, with roughly two-thirds of them having a low net worth. CAPTRUST works with many institutional clients, such as retirement plans, nonprofits, businesses, banks, government agencies, insurance companies, and investment firms. In general, the firm requires a $50,000 minimum investment from new clients; however, this barrier can be waived.

#3. Mercer Global Advisors

Mercer Global Advisors is a Denver-based financial advisory firm. The fee-based firm has thousands of individual clients, with a somewhat skewed ratio in favor of low-net-worth individuals. This difference is reflected in the firm’s minimum annual fee requirements, which range from $800 to $75,000, Retirement plans, philanthropic groups, and businesses make up the firm’s institutional clientele.

#4. Madison Investment Advisors

Madison Investment Advisors is a fee-only financial advisory firm in Madison, Wisconsin. The firm mostly serves individuals, with non-high-net-worth persons outnumbering high-net-worth individuals by about 10-to-1. Madison’s institutional clients include retirement plans, charitable organizations, government bodies, financial advisors, insurance companies, and businesses.

#5. Summit Rock Advisors

Summit Rock Advisors in New York City is a typical example of an exclusive family office. It has fewer than 50 clients, and all of them have a high net worth. The company’s Form ADV brochure says that “the average client size at Summit Rock is about $475 million,” which backs this up. In brief, Summit Rock Advisors will only accept clients who have at least $100 million in investable assets.

#6. Buckingham Strategic Wealth

Buckingham Strategic Wealth is a St. Louis-based financial advisory firm that focuses mostly on individual clients. Its approximately 10,000 individual clients are a mix of people with and without a high net worth, with the latter slightly outnumbering the former. Buckingham’s clients include pension plans, charitable organizations, and businesses. For new clients, the firm does not have a standard asset minimum, but rather a $3,000 minimum yearly fee.

Fiduciary Financial Advisor Fees

Only fiduciaries, such as certified financial planners, should be used as financial advisors. Several methods of charging exist for financial advisors. Some charge a flat fee, often between $2,000 and $7,500 each year, while others charge a percentage of the client’s assets, typically between 0.25% and 1% per year.

How to find a Fiduciary Financial Advisor

All investment advisors in the United States who are registered with the Securities and Exchange Commission (SEC) or a state securities regulator must act as fiduciaries. On the other hand, brokers, stockbrokers, and insurance agents only have to meet a suitability responsibility. This means that, while they must make appropriate recommendations to their clients, they are not required to put their client’s interests ahead of their own.

There are several resources available to assist you in determining whether or not an advisor is a fiduciary. The National Association of Personal Financial Advisors (NAPFA) has an online search tool to help you find licensed financial planners in your area. In that structure, each advisor works on a fee-only basis and swears to act in a fiduciary capacity. A search engine for advisors is also available from the Certified Financial Planner Board.

But, the screening process should not end there. Once you’ve identified suitable advisors, here are some questions you should ask to ensure that they meet your needs and have no conflicts of interest:

- How do you make a living?

- Do you have any certificates or licenses?

- What kinds of services do you provide? Who is your typical customer?

- How frequently do you communicate with clients?

- Is there a written guarantee of your fiduciary duty?

You should also get a copy of Form ADV and Form CRS, which financial advisors must file with the SEC. This will provide details on an advisor’s business, compensation structure, educational background, potential conflicts of interest, and disciplinary past. The SEC’s Investment Advisor Public Disclosure (IAPD) tool also makes this information accessible online. You can also ask for a performance evaluation and a list of client references to contact.

Why It’s Essential to Work With a Fiduciary Financial Advisor

You can gain more peace of mind by working with a fiduciary financial advisor. When you work with a fiduciary financial advisor, you can be confident that the person managing your money is acting in your best interests at all times. Fiduciary financial advisors, on average, have fewer conflicts of interest. Yet, they are required by law to report any potential conflicts of interest.

Financial experts who get paid on commission may be more likely to promote their products, even if cheaper ones are available. Fiduciaries are obligated to negotiate the best feasible terms and rates for their clients. As a result, working with fiduciary increases your chances of receiving a product or suggestion that is appropriate for you.

For the most part, fiduciary-duty-bound financial experts are more transparent. Fiduciaries must tell their clients about their decisions and give them all the facts and information they need. This makes it easier for you to make sure you understand the decisions that affect your assets and future finances.

Although not all non-fiduciaries are negative actors, working with a fiduciary makes it easy to guarantee that you’re working with someone who has your best interests in mind. Also, if you work with someone who does not have a fiduciary duty to you, you will have fewer legal options if you find out that your interests have not been served.

Do All Financial Advisors Have a Fiduciary Duty?

A professional is not inherently committed to a fiduciary obligation just because they manage their clients’ money. Some financial advisors work for brokerage firms and are merely required to meet a suitability threshold; they are not required to act only in their client’s best interests.

A registered investment advisor (RIA) or a financial advisor who works for an SEC-registered firm is who you should hire. An advisor’s certificates are another indication that they are bound by fiduciary responsibility. Many will have a Certified Financial Planner (CFP), but you should always confirm that the firm is a registered advisor before dealing with them.

Is a fiduciary better than a financial advisor?

Yes. A fiduciary financial advisor makes investment decisions that are in your best interest, while a non-fiduciary financial advisor may offer goods for which they get a commission or other type of payment.

Are fiduciary advisors worth it?

Yes, whether or not a financial advisor is worth your money is determined by your situation and the financial advisor you choose to work with.

How do I know if a financial advisor is a fiduciary?

Asking and then verifying their status is the simplest approach to determining whether a potential advisor is a fiduciary financial advisor. Use FINRA’s BrokerCheck database to confirm if they are registered with the SEC.

How do fiduciaries get paid?

For managing a client’s portfolio, a fiduciary adviser may charge fixed fees, commissions, or a percentage of the portfolio’s assets under management (AUM). In many different industries, there are fiduciary connections.

How much money do you need to invest with a fiduciary?

Some advisors have minimum asset thresholds. This could be a small sum, such as $25,000, but it could also be $500,000, $1 million, or much more.

Conclusion

Registered investment advisors are legally bound to act in the best interests of their clients, but broker-dealers and other types of money managers are not. Fiduciaries include some financial experts, like certified financial planners. If your financial advisor is not bound by a fiduciary duty to you, they may be able to recommend investments or products that pay them a higher commission than those that are the best fit for you, which may cost you more.

Related Articles

- HOW DO FINANCIAL ADVISORS MAKE MONEY? What Does a Financial Advisor Do To Earn?

- General Partnership Definition: Taxes, Liability & Agreement

- BREACH OF FIDUCIARY DUTY: Definition, Examples, & Statute of Limitations

- FINANCIAL PLANNER: How to Become a Certified Financial Planner

- FIDUCIARY DUTY: Meaning, Importance, And Examples