Consider producing a letter of agreement when you wish to specify the conditions of a working partnership between two or more parties. This letter serves as a reminder that each party is responsible for carrying out their obligations and is crucial for anyone who wants a record in writing of the services and terms they have committed to. Therefore, this post entails information on how to write a letter of agreement payment with an example.

How to Write a Letter of Agreement

A working agreement between two or more parties is described and its contents are put forth in a letter of agreement, which is a sort of commercial document. The letter of agreement, therefore, contains information like the parties’ contact information, the agreed-upon payment schedule, and the timetable. The agreement letter thus serves to safeguard your rights and make everyone’s obligations crystal apparent.

You can write a letter of agreement from the following situations:

- Leases

- Employment agreements

- Customer contracts

- Non-compete agreements

Use formal language and be as objective and thorough as you can when laying out the terms of the agreement in a letter of agreement. The procedures for writing a letter of agreement are as follows:

#1. Title the Document

Place the document’s title at the top. For convenience, you can utilize a “Letter of Agreement”. It could be helpful to include one or two specific facts, such as the names of the parties involved or the general agreement issue if you frequently compose numerous letters of agreement.

#2. List Your Contact Details

Your personal data can also be entered in the space provided just below the document’s title, including:

- Your name

- Physical location

- City

- State

- A ZIP code

#3. Include the Date

Put the date after your contact details. Thus, the date should be the day that you are writing the letter, not a previous date.

#4. Include the Person’s Details for the Recipient.

Include the recipient’s contact information after the date. The following details ought to be provided:

- Beneficiary’s name

- Recipient’s applicable title

- Name of the recipient company

- Physical location

- City

- State

- A ZIP code

#5. Address the Recipient

Subsequent to the recipient’s contact information, provide a salutation. The salutation is typically “dear” and then the recipient’s name. Such salutations like “Dear John” or “Dear Ms. Mong” are appropriate.

#6. Write an Introduction Paragraph

Explaining the letter’s aim and addressing each party involved should also be the first two sentences of your introductory paragraph. Only two or three succinct sentences should be useful to express your aim in this paragraph. Consequently, you can keep the reader’s attention capturing and holding it brief.

#7. Write your Body

You should go into greater information about the agreement in the body. Even though a letter of agreement is normally only one page long, you can extend it to incorporate all of the agreement’s pertinent information. It is also permissible to define each word in the agreement using a list of bullets.

#8. Conclude the Letter

Immediately following the agreement’s provisions, including a succinct conclusion. It can still restate the body and bring up any other information that you haven’t already covered. There should also be two to three sentences in this paragraph.

#9. Select a Closure

Add an honest yet appropriate closing to your letter. There are a variety of closings you can use, but some of the most popular ones are:

- Regards

- Sincerely

- Respectfully

#10. Sign the Document.

Lastly, below your signature, print your name. For each party, add the appropriate number of signature lines. Additionally, you can include lines to list the date on which they signed the contract.

How to Write a Letter of Agreement Example

An example of how to write a letter of agreement utilizing the aforementioned format is shown below:

Katie Beth Jones

4175 Elk Rd.

Westland, GA 85256

April 24, 2021

Harold Little

Finance Manager Blueway National Banking Corporation

367 Filbert St.

Ramsey, NY 10965

Dear Harold Little,

The collaboration between Blueway National Banking Corporation and First Financial Consulting is formally established by the letter attached. This agreement acknowledges Katie Beth Jones’ obligation to represent First Financial Consulting and offer her professional financial guidance throughout the undertaking with Blueway National Banking Corporation.

From the start of the project on December 1, 2021, until its conclusion on March 2, 2022, Katie Beth Jones will carry out the enumerated duties:

- Consult with clients of Blueway National Banking Corporation to learn about their needs in terms of finances and investments.

- Offer knowledgeable recommendations from Blueway Nation Banking Corporation’s portfolio depending on the client’s product requirements

- Provide current and potential clients with brokerage services and industry knowledge.

- To guarantee that no policy violations have occurred, accurately and promptly complete all financial paperwork.

- To ascertain clients’ present and future financial needs, conduct research and interview them.

- Preserve and improve connections between clients and the Blueway firm

- Actively seek out and win new business for the company.

- Be a mentor to less experienced employees.

Katie Beth Jones will get compensation from Blueway National Banking Corporation in the amount of $9,000 per the agreed-upon terms. On the project’s completion date, Katie Beth Jones is to be paid in full by direct deposit for the services she rendered. Should such circumstances develop, any additional pay for an extension of Katie Beth Jones’ services will be decided at that time.

Please acknowledge your agreement to the provisions of this letter by signing and dating the lines below. Please preserve one copy for your records and send the other one to the address listed above.

Sincerely,

Jones, Katie Beth

Nov. 2, 2021

Harold Little

Nov. 2, 2021

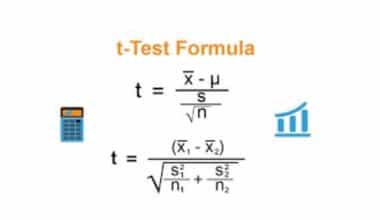

How to Write a Letter of Agreement Payment

Between a lender and a borrower, a payment agreement establishes the terms and conditions of a loan, including the sum, the due date, and any penalties. Fields can also be added or removed, new fonts or text colors can be selected, a custom signing order can be established, and automated email notifications can be customized.

What are The Essential Parts on How To Write a Payment Agreement Letter?

Depending on the terms, circumstances, persons involved, and payment arrangements changes. The restrictions, exceptions, or penalties that are particular to your circumstance should also be accurately reflected and described in your payment agreement.

While your agreement should be customized to your particular needs, all payment agreements must contain the following elements:

- Payment schedule

- Payment strategy

- Mortgage rate

- Rules and regulations

- who are involved

- Contact details

- Policy for resolving disputes

- Signatures

You may make sure your agreement contains the essential loan-related details by incorporating the information above.

How Does a Payment Agreement Letter Work?

Both the lender(s) and the borrower(s) consent to abide by the conditions of the payment agreement by signing it. Both parties are subject to legal action if they violate any of these conditions.

Invoices and receipts have a lot in common with payment agreements. However, they outline a mechanism in which borrowers will repay lenders over a predetermined period of time rather than documenting a single payment. These contracts also require lenders to adhere to the conditions laid down at the outset of a loan, shielding borrowers from unjust or unplanned alterations.

Since the provisions of these contracts are binding, it is crucial that they are written in plain terms so that both parties may carefully review them before signing.

What are the Common Use Cases to Write a Payment Agreement Letter?

Any long-term payment transaction requires a payment agreement, which is a generally accepted legal form. The following are the most typical use scenarios for these kinds of agreements:

- Auto loans

- Mortgage loans

- Individual loans

- Payment schemes

- Payment of taxes

- Payment of debt

Make sure you have a payment agreement in place before you give any money to a borrower. This kind of contract obligates both parties to abide by the conditions of the arrangement.

Use a payment agreement template like this one to create these documents faster. Using a template streamlines the already labor-intensive loan process by providing a reusable and adaptable resource.

Who Needs A Payment Agreement and When?

A crucial component of any financial lending transaction is thus the payment agreement. Having a comprehensive payment agreement is essential for any two parties involved in a loan or lending transaction. These contracts provide protection for both parties and lay out a specific course of action, which includes:

- Common payment agreement users include

- Government entities

- Businesses

- Financial institutions

- Borrowers

A payment agreement should also be useful for any group of willing participants that sign into a payment or installment plan. These agreements also make sure there are no misconceptions or problems regarding the payment terms and hold both parties accountable for their obligations under the contract.

Can I Make My Own Written Agreement?

The straight answer is Yes!!! You can write your own contracts.

What Is a Standard Letter of Agreement?

A working agreement between two or more parties is described and its contents are put forth in a letter of agreement, a sort of commercial document.

What Is the Difference Between a Letter of Agreement and a Contract?

An informal legal agreement can exist where neither a witness nor a written record is required. On the other hand, a contract is more formal and legally binding, thus it needs to be documented.

Does an Agreement Need to Be Signed to Be Legally Binding?

For a written agreement to be binding in court, both parties must sign it.

Related Posts

- HOW TO WRITE A BUSINESS LETTER: Examples, a Guide to Writing Proposal, Complaint & Introduction

- WHAT IS A COVER LETTER: How to Write It & Guide

- OFFER LETTER: Meaning, Job & Template

- JOB OFFER LETTER: How to Write It, Template, and What Not to Do