The modern workforce is witnessing a surge in freelancers and independent contractors, who offer specialized services on a project basis.

These professionals enjoy flexibility and autonomy in their work arrangements.Invoicing is a critical aspect of financial management for self-employed individuals. Proper invoicing ensures timely and accurate payments, facilitates professionalism, and helps maintain a healthy cash flow.

Understanding Invoicing for Freelancers and Independent Contractors

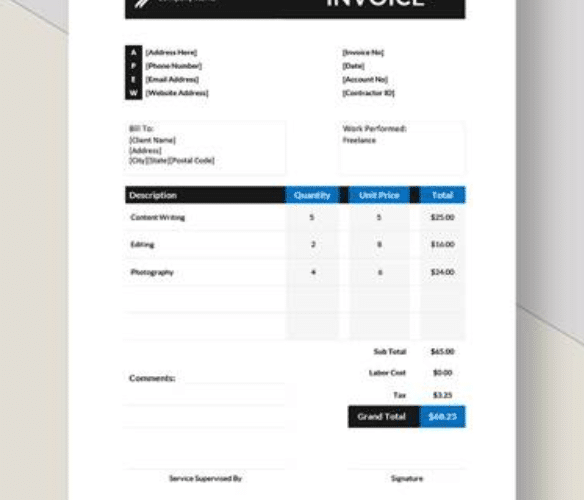

Invoices serve as formal requests for payment, providing a breakdown of services rendered and the associated costs. They also establish credibility and professionalism, which are crucial in building strong client relationships https://saldoinvoice.com/freelance-invoice/

Understanding the legal aspects of invoicing is essential. This includes essential information such as contact details, payment terms, and itemized services. Complying with invoicing best practices ensures seamless transactions and satisfied clients.

Creating Effective Invoices

Using pre-designed invoice templates and invoicing software simplifies and speeds up the process of creating professional-looking invoices.

Customizing invoices with personal branding, such as a logo and color scheme, helps freelancers leave a lasting impression on clients.

Billing Methods and Payment Terms

Freelancers can choose from various billing options, such as hourly rates, project-based fees, or retainer agreements, depending on the nature of their work and client preferences.</p>

Setting clear payment deadlines, preferred payment methods, and late payment penalties encourages clients to pay promptly and ensures a steady cash flow.

Tracking and Managing Invoices

Implementing effective strategies for organizing and tracking invoices allows freelancers to stay on top of their finances and maintain accurate records.

Utilizing invoicing tools and automation streamlines the invoice tracking process, reduces administrative burdens, and minimizes errors.

Dealing with Late Payments and Unpaid Invoices

Tactfully addressing late payments helps maintain professional client relationships and encourages prompt resolution.

When faced with unpaid invoices, knowing the appropriate escalation procedures and legal steps can help freelancers recover owed funds.

Tax Implications and Reporting

Navigating the unique tax responsibilities and deductions available to self-employed professionals is crucial for proper tax compliance.

Maintaining organized financial records ensures smooth tax reporting and minimizes potential tax issues.

Invoicing Tips for Success and Client Retention

Clear and professional invoicing plays a role in maintaining positive client relationships, leading to client satisfaction and repeat business.

Invoicing can be used strategically to foster client loyalty and generate referrals, contributing to long-term success.

Leveraging Technology and Digital Payment Methods

Adopting digital payment methods, such as online payment gateways, offers freelancers and contractors speed, convenience, and security in financial transactions.

Integrating digital payment gateways into invoicing systems facilitates seamless and efficient transactions, enhancing the client experience.

Conclusion

Invoicing is a cornerstone of financial success for freelancers and independent contractors, ensuring timely payments and maintaining professionalism.

By adopting proper invoicing practices, self-employed professionals can achieve financial stability and growth in the dynamic gig economy. Embracing technology and best practices enhances their competitiveness and reputation in the marketplace.