For jobs in accounting and finance, it’s crucial to understand what a salary is, what varieties there are, and how it differs from wages. For your application or when haggling in an interview, it’s also beneficial to know how much an employee makes in a particular position. Making better-informed decisions during pay negotiations and job searches might be facilitated by having a basic understanding of how to determine your salary. This article explores more about the difference between salary vs hourly pay, for a non-exempt and exempt employee and the salary cap in NBA

Preamble: What Is Salary

A regular payment made by an employer to a worker in exchange for their labor and services in a particular position is known as a salary. Companies typically pay salaries once a month, although other companies may pay them weekly, biweekly, monthly, or even annually. Your employment contract specifies the amount and frequency, which may change over the course of your employment, e.g., in the event of a promotion or a reduction in your weekly working hours. The compensation might also be discussed during the interview.

Each salary payment is made up of a set monthly sum of money. Your salary may be supplemented by your employer through paid time off, paid holidays, health insurance, travel bonuses, and other benefits. Most salaries in the country are determined by supply and demand as well as the industry sector. Many sizable firms base their pay scales on organizational hierarchy and length of service.

Tips to Negotiate a Salary in an Interview

- In an interview, negotiating your wage is a difficult subject. The negotiation gives each side the chance to express their arguments and defend their positions because both parties have expectations for the planned wage. To negotiate your wage during an interview, use the following advice:

- Examine the company and the market. Most salaries are determined by the market’s supply and demand forces. Your employer, industry, job, location, experience, and education are all important factors to consider when determining your wage expectations.

- Choose the lowest and desired quantity. Before an interview, know your desired salary and your minimum. You will then have the means by which to realistically bargain for a raise.

- Think about your advantages. Consider additional negotiable benefits, such as paid time off, work schedule flexibility, and other opportunities, while negotiating your compensation. To demonstrate your desire to add value to your organization, mention some of these rewards.

- Develop your negotiation skills. The ability to negotiate is one that can be learned and developed with practice. To emphasize your best traits, you can train with others before the interview or sign up for a course.

What Is Salary Non Exempt

Employees who get a non-exempt salary receive overtime pay. The Fair Labor Standards Act (FLSA), which governs the minimum pay, working hours, and overtime compensation, safeguards the salary. The three key determinants of whether an employee receives this form of pay are the type of labor, the compensation, and the manner of payment (salary or hourly basis). Hourly workers are paid for the real hours they put in, whereas salaried workers are compensated in accordance with the demands of their employers. Both situations fall under the minimum wage.

What Does a non-Exempt Employee Do?

Non-exempt employees work a certain number of hours, usually 40, for a set income. When these people work more than their normal number of hours, they should get extra pay. The employee’s hourly rate is the basis on which businesses base their compensation calculations.

Employees who are eligible for a non-exempt salary include the following examples:

- Some staff, such as mechanics and aviation salespeople, are paid to market services to end users.

- Cab drivers, airline crew members, railroad workers, and delivery personnel who are paid based on approved trip rates

- Several non-urban broadcasting stations’ chief engineers, news editors, and announcers

- Employees of domestic services who reside with their employers

- Those who work at movie theaters

- Farmers

When are Non-Exempt Employees Eligible for a Salary?

Non-exempt workers can get a salary and overtime pay in a variety of ways, including Fixed Salary (for a predetermined number of hours) and Fluctuating Work Week (FWW), commonly referred to as a Belo Contract.

Employers who hire FWWs have two choices for how to pay their compensation. The first comprises paying employees who put in more than 40 hours a week a basic compensation as well as an additional premium for overtime work, which is frequently paid at 1.5 times the usual hourly rate.

What Is Salary Cap in NBA

Teams are prevented from acting any way they like by the NBA salary cap. In essence, they have a salary floor to compel club owners to spend a minimum amount and maintain the competitiveness of their teams and a salary cap to prevent them from going beyond. However, as compared to other significant American competitions, the NBA’s salary cap has a special characteristic. The NBA has a soft cap rather than a hard cap like the MLB, NFL, and NHL, hence there may be certain NBA salary cap exceptions allowing teams to go above it.

How Does the NBA Salary Cap Work?

The maximum amount of money that each NBA team may spend on player wages is known as the NBA salary cap. The Collective Bargaining Agreement (CBA) specifies that figure, which was chosen with the approval of the NBA Players’ Association as well as the NBA franchises. The NBA has a soft cap, in contrast to other competitions. That implies that there are some NBA salary cap exceptions that let teams to sign players by spending more than the cap. This enables the teams to keep their own stars while adding more quality around them.

What Happens if a Team Goes Over the NBA Salary Cap?

The “Larry Bird Exemption” is the only way teams can go above the limit to resign their own players. A team must pay the luxury tax, though, if its payroll exceeds a specific amount of the NBA salary ceiling. This tax is calculated using a complex method, and teams are required to pay amounts based on brackets for every single dollar that their player wage exceeds the tax threshold.

Due to the league’s subsequent equitable distribution of tax income among non-filing teams, owners of teams in small areas frequently decline to go above the payroll cap. However, going overboard has a slight domino effect, forcing the team to pay a greater tax based on how much money they spend.

Can an NBA Trade Put you Over the Salary Cap?

No matter what their compensation, teams under the salary cap are allowed to move their players as long as they don’t exceed the cap by more than $100,000 following the deal. However, teams that are above the cap or that would spend more than $100,000 following a trade are only allowed to acquire players worth up to 125% plus $100,000 of the salary they are giving up.

When can NBA Teams Trade Players?

Also, it’s important to remember that players who signed agreements as free agents cannot be traded until December 15 of that year or until at least three months have elapsed, whichever comes first. This makes it difficult for teams to sign players just to use them as trade assets. Also, following a trade, players can be straight-up traded for another player if their salaries match. If not, the 2011 CBA stipulates that the team must wait 60 days before trading him for a player who is “more expensive”.

What Is Salary Requirements

An employer will probably ask you about your salary requirements at some point during the hiring process. While some employers may ask you during a phone screen or interview, others may require you to specify a wage range in your application. It’s crucial to be ready, no matter when you’re asked for this information.

How to Answer Salary Requirements: The 4Bs of Negotiating

What is your pay requirement?” is a typical interview question asked of candidates when they advance to the interview stage. What response should job seekers provide to this query? The “4Bs” are a list of bargaining techniques our experts came up with for job seekers.

#1. Be Assured.

The job seeker’s mentality is the most important factor; keep a positive outlook! You need to be confident in your abilities and deserving of the pay you want. The interviewee won’t be at a disadvantage in the talks as a result of this. It’s also crucial to know where your confidence comes from.

#2. Begin with a High Salary Expectation

One effective negotiating tactic is to set a high wage expectation at the outset. Salary negotiations are almost like a game for both the candidate and the employing firm; one wants greater compensation and the other wants to be paid less. In this method, the applicant is straightforward to interpret.

#3. Based on Logic and Facts

Being honest is crucial even though the candidate is taking part in a game. To convince the interviewer that your pay requirements are valid, you must provide your own supporting documentation. Your pay request must be supported by evidence and reason.

#4. Be Adaptable

Being flexible when questioned about wage requirements during an interview is a crucial ability, much like stating salary criteria in the cover letter. Attempt to gauge the interviewer’s response while you haggle inside your own estimated salary range.

Why do Employers ask for Salary Requirements?

Employers may inquire about applicants’ desired salaries for a number of reasons. Top three are as follows:

#1. They Want to Make Sure your Requirements Fit Their Budget

Employers can better grasp the possible effects on their accounting if they are aware of your wage requirements because they normally have a budget set up for each job they make. Employers might need to ask for a larger budget for your employment if you require more than they had planned.

#2. They Want to Ensure that you are Aware of the Worth of Your Abilities and Experience.

How much value you add to a business depends on a variety of things, including your education, work background, and talents. Employers can tell you are confident in your talents and have done your study if you can articulate the value of your knowledge and skills.

#3. They Want to Confirm that you are Qualified for the Role.

It may be a sign that you lack the necessary amount of experience if your compensation expectations fall short of what an employer has budgeted for the position. In contrast, if you want a lot more than is reasonable, it could be taken as an indication that you are overqualified for the position.

Salary vs Hourly

You will earn an annual salary as a salaried employee, which is a regular payment made to your bank account often once a month or twice a quarter. Your employment contract will specify how much you are paid and how many hours you work. On the other hand, hourly pay is when you are paid for each hour that you work; as a result, the more hours you work, the more money you will make.

Salary vs. Hourly Pay: Pros and Cons

It might be difficult to decide between salary and hourly income, and your decision will be influenced by your particular situation. For some people, salaried job works better because they appreciate the certainty of consistent wages. Others might want a more adaptable strategy, which hourly pay can support. Below, we’ve described the key distinctions between hourly and (vs) salary compensation as well as the benefits and drawbacks of each.

Advantages of Salaried Pay

- This is beneficial for making a budget and making plans to pay your bills because the quantity of money you receive each month is not determined by the number of hours you put in.

- The contract will specify the number of paid vacation days and sick days you will be entitled to utilize annually.

- The advantages of salary vs. hourly pay include access to additional perks like healthcare and pension plans in addition to your paycheck.

- Employees that are paid a permanent salary are frequently given more trust and responsibility, which can open up more prospects for professional advancement.

Drawbacks of Salaried Pay

- You perform labor as an employee in exchange for your yearly compensation. Your employer won’t have to pay you extra even if you are forced to work longer than your agreed upon hours to complete this.

- Due to the necessity of scheduling your vacation time around the needs of other workers and your obligations at work, there may be less freedom when taking yearly leave.

- Working for a business implies that working for anyone else could be challenging. If you want to change jobs or take on more work, you must work around your existing employer and determine whether your current contract permits you to accept other work.

Advantages of Hourly Pay

- Every hour that you put in is compensated, and if you go beyond your allotted hours, you may be entitled to overtime money.

- Your ability to work overtime with hourly employment may give you the chance to earn more money in less time.

- More flexibility allows you to tailor your work/life balance to suit your interests.

Drawbacks of Hourly Wage

- Because your income will depend on the availability of your job, budgeting may be more challenging.

- Sick days and holidays are not reimbursed.

- There is no specific number of promised hours per week or month, and if hours are reduced, your pay will be affected.

- Generally speaking, none of the extra advantages that come with salaried labor are accessible.

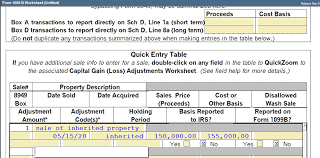

How to Calculate Annual Salary from Hourly Wages (Salary vs Hourly)

It is typically quite easy to get your annual compensation from your hourly pay. Find out how many hours you typically work each week, for instance, 30. To determine your hourly rate, multiply this value by—

How to Convert Your Salary to Hourly Wages (Salary vs Hourly)

Use the same values as above and apply the formula backwards to determine your hourly rate from your salary.

Is it Better to get Paid Hourly vs. Salary?

How much financial stability you desire will determine whether you choose to work as an hourly or salaried job. When deciding between an hourly wage and a salary, it’s wise to take the following factors into account:

- Stability. Do you need the security of a steady income? If you have monthly fixed expenses, a salary might be the best option for you. Yet, hourly pay frequently enables you to put in more time if necessary. If you’re saving for a particular occasion or have any unforeseen payments to make, this may be helpful.

- Flexibility. Hourly paid employment can frequently provide additional flexibility if you need it in terms of the amount of work you take on as well as the hours and days you work. Most salaried jobs require you to request any time off and only permit a specific amount of vacation each year.

- Benefits. You typically receive a benefits package with salaried employment, such as paid vacation time, a pension, or incentives.

What is an Example of Salary?

Examples of pay are a $4,500 monthly wage for a high school teacher or a $194,000 yearly compensation for a house representative in the US House.

Is Salary Monthly or Yearly?

The conditions of a paycheck might typically change, but they are typically paid on a monthly basis.

What are the Types of Salary?

- Hourly salary.

- Salary by commission.

- Salary by Projects or Task.

How is a Salary Paid?

Regular, biweekly, or monthly paychecks are the norm for salaried workers.

How the Basic Salary is Calculated?

Typically, the basic pay is 40% of gross income or 50% of CTC. Basic pay equals Gross pay minus all allowances

What are the Benefits of Salary?

Regardless of the number of hours you work each week, you are paid a certain sum.

Related Posts

- NON-EXEMPT EMPLOYEE: Meaning, Benefits, and Difference

- HOW DOES SALARY PAY WORK: How Salaried Workers are Compensated

- WHAT IS HOLIDAY PAY?: Who’s Entitled to its Benefits

- CAP RATE: Definition and Uses In Real Estate Investing

- Real Estate Cap Rate: What Is a Good Rental Cap Rate In 2023