Simply put, the price elasticity of demand describes how, when the price of goods rises, the quantity of demand for that particular good falls. In this post, we will use the formula for price elasticity of demand to determine and understand the reason for the fall in demand for these goods. We will also use the example below to highlight the types of price elasticity of demand, which includes cross elasticity. Lastly, we will look into the factors or determinants of the price elasticity of demand.

Price Elasticity of Demand

You can say that this is a measure of how active the quantity in demand is in relation to its price. The basic meaning of this definition is that when the price of goods rises, the quantity in demand for any good falls. However, this fall has its differences because some fall more than others.

Again, this brings about a change in the quantity percentage of demand. Especially when there is a one-percent increase in price, which typically holds everything else constant. This means that, if the price elasticity is one percent, it will lead to a rise. This will also lead to a two percent decline in the quantity demanded. It can also be defined as the ratio of the percentage change in the quantity you demand to the percentage change in the price of a specific good or service.

Importantly, note that price elasticity is always negative. However, this is except in special situations or cases. When the phrase “more elastic” comes up, it simply means that a product’s elasticity has a greater magnitude. You can say the demand for a good is inelastic when the elasticity of that particular good is less than one in absolute value. This means that a change in price has a relatively small effect on the quantity in demand. Furthermore, a good demand is elastic when its elasticity is greater than one. While a decent one of minus 2 has an elastic demand. This is because the quantity typically falls twice as much as the price increases. Lastly, an elasticity of -0.5 has an inelastic demand because the quantity feedback is half the price increase.

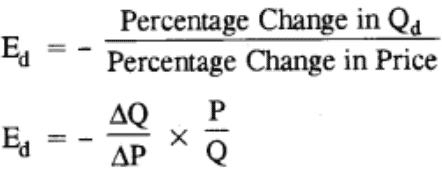

The Formula for the Price Elasticity of Demand

Speaking of the formula for the elasticity of demand, it can be formulated in two different forms. The two formulas are correct and will typically arrive at the same result. However, I recommend you use any of the formulas depending on your business needs. Also, consider what is available to you at the time. However, the formula is thus;

In order to calculate the elasticity of demand using any of the formulas, you will need a good demand curve. Which can be in graphical, or in equation form as the case may be.

Importantly, when determining the elasticity of demand, you are typically trying to get the result of the slope of the demand curve at a particular point.

Understanding the Formula for the Price Elasticity of Demand

Furthermore, the second method is known as point-price elasticity of demand. You can also, use this method when it involves the following:

- When you already have the mathematical equation for demand

- If you are confident with taking derivatives of equations

Like I said above, the elasticity of demand is basically evaluating the slope of the demand curve at a particular point. Meanwhile, the arc formula for the elasticity of demand uses the difference between two points along the curve. So, there can be slight errors while you’re using the formula. Moreover, it makes use of an arc on the curve rather than a single point. This is also how the second formula, point-price, calculates this elasticity.

Arc Elasticity Formula

The formula for the arc elasticity of demand is thus:

E sub d = (P sub 1 + P sub 2)/(Q sub d1 + Q sub d2) * change in Q sub d/change in P,

where:

- P sub 1 is the original price point, P sub 2 is the new price point,

- Q sub d1 is the quantity demanded at the original price point.

- Q sub d2 is the quantity demanded at the new price point.

- The change in Q subd is the change in quantity demanded: Q sub d2 – Q sub d1

- Change in P is the change in price: P sub 2 – P sub 1

Price-Point Elasticity Formula

While the second formula, the price-point goes as thus:

Ed = P/Q sub d * dQ/Dp,

where:

- At P the price at which you are evaluating the elasticity of demand

- Q sub d is the quantity demanded at the point you are evaluating the elasticity of demand.

- dQ/dP is the first derivative of quantity demanded with respect to price

Now, when you’re going towards the downward sloping demand curve while calculating the elasticity of demand for all your goods, it’s important that you get a negative value. This is because it is a good reality check on your work. However, in reports and texts, most people tend to leave out the negative sign when reporting the elasticity of their demand. This is because it is always negative.

The Price Elasticity of Demand

The elasticity of demand is also known as the price elasticity of demand. This basically measures how responsive demand is to the changes in the price of a particular good. Specifically, it is the percent change in the quantity you demand relative to a one percent change in price, thereby holding all else constant. This is known in economics as ceteris paribus. Meanwhile, you can classify the demand as the following ;

- Perfectly elastic.

- Elastic

- Unitary elastic

- Inelastic or perfectly inelastic

This classification is based on the elasticity of demand. Because both the demand and supply curves relatively show the relationship between the price and the number of units on demand or that your business has supplied. Also, you can say that it is the percentage change in the quantity of demand or supply. Therefore, the corresponding percent change in price.

This elasticity is also the percentage change in the demand for a good or service divided by the percentage change in the price. The price elasticity of supply is the percentage change in quantity supplied divided by the percentage change in price.

Elasticity can be usefully divided into three broad categories: elastic, inelastic, and unitary. Elastic demand or elastic supply is one in which the elasticity is greater than one, indicating high responsiveness to changes in price. Elasticities that are less than one indicate low responsiveness to price changes and correspond to inelastic demand or inelastic supply. Unitary elasticity indicates proportional responsiveness of either demand or supply,

Example of Price Elasticity of Demand

There are two types of goods involved here, and they include elastic and inelastic goods. When you demand that the quantity of a product you purchase begins to change more than the price, then consider the product elastic. (For instance, if the price goes up by 10% but the demand falls by 15%.)

You already know that elastic goods are goods that have visible changes in their demand or supply that are caused by the response to a change in price. Generally, these goods can pass for necessities or goods for which there are substitutes readily available.

Understanding the Example of Price Elasticity of Demand

Using demand as an example of price elasticity, if the price of a good decreased by an X amount, there would be a greater increase in the amount that consumers would want to buy. If the price were to increase by X amount, there would typically be a greater reduction in the amount that people would want to buy. An example of the price elasticity of demand goods include:

- Soft drinks

- Cereals

- Clothing

- Electronics

- Cars

On the other hand, inelastic goods have a smaller percentage change in quantity change in demand and supply. This shows that elastic goods are more sensitive to changes in price than inelastic ones which are less sensitive and they include:

- Gas

- electricity

- Post-secondary education

- Cigarettes

- A life-saving medication

Cross Price Elasticity of Demand

Basically and in economics, the cross elasticity of demand is responsible for measuring the percentage change of the quantity on demand for a good to the percentage change in the price of another good. In recent times, the quantity you demand of these goods depends not only on their own price but also the price of other products in the market that can relate to it.

The cross-price elasticity of demand measures how exactly the shift in the price of one good affects the demand for another good. You can calculate it as the percentage change of Quantity B divided by the percentage change in the price of the other.

CROSS PRICE ELASTICITY OF DEMAND = % change in quantity demanded of Product A/% change in the price of Product B.

Meanwhile, there are 3 concepts that you can use to know the relationship between two goods. The relationship includes:

- Complements

- Substitutes

- Unrelated

Note that a negative cross elasticity typically denotes two products that are complements, while a positive cross elasticity denotes two products that are substitutes. For instance, if products X and Y are complements, an increase in the price of Y will lead to a decrease in the quantity of demand for X. This is because X is put to use in conjunction with Y. Although, if the price of product Y decreases, the demand curve for product A changes to the right and starts highlighting the increase in X’s demand, which now results in a negative value for the cross elasticity of demand. In conclusion, X and Y can substitute for each other, so an increase in the price of Y will automatically increase the market demand for X because consumers will easily replace Y with X. For instance Omo and Klin detergent.

Determinants Price Elasticity of Demand

Firstly, elasticity is the general measurement of the responsiveness of a particular economic variable to changes in another economic variable. This definition can get a little tricky, which is why you need to go in-depth with the determinants of price elasticity of demand to understand it further. In recent times, economists have utilized elasticity to measure how variables affect each other.

There are three major forms of elasticity, and they include price elasticity of demand; cross-price elasticity of demand, and income elasticity of demand.

The types of price elasticity of demand are not ours to use here, but I just listed them for knowledge. The determinants of price elasticity of demand are our focus in this part of the post. You can say that the determinants of price elasticity of demand are the factors that affect the demand or supply of a particular good and its price. Some of these factors include:

1. Availability of close substitutes

In a situation when customers have other options and can substitute a particular good for another readily available good, the price elasticity of demand for the first good would be said to be elastic. And when customers are unable to substitute a good, the good will experience inelastic demand.

2. If the good is a necessity or a luxury

Subsequently, the price elasticity of demand is low if a good is a type of commodity that customers need, like gas. This is why the price elasticity of such good demand tends to be higher if it is a luxury good.

3. The proportion of income spent on the good

The price elasticity of demand for a good gets lower if spending on a good is only a small proportion of their income. This means that a change in the price of a good has only a very small impact on the consumer’s willingness to consume the good. While, in a situation when the good represents a large amount of the consumer’s income, the consumer will definitely possess a more elastic demand.

4. Time elapsed since a change in price

In summary, consumers tend to be more elastic over longer periods compared to the long term, after which the price of a good increases. They automatically find other acceptable and less costly substitutes.

These are the main determinants of the price elasticity of demand for goods. Although there are a lot of them, the ones above are the most common ones you will find in today’s society.

What does a 0.5 price elasticity of demand mean?

When the elasticity of demand for a good exceeds one, the demand is said to be elastic. A good with an elastic demand of 2 has a quantity response that is twice as great as the price rise, whereas a good with an inelastic demand of 0.5 has a quantity response that is only half as great as the price increase.

Is negative 1 elastic or inelastic?

With lower values (that is less than one) being inelastic and larger values (that is greater than one), minus one is typically chosen as the key cut-off point.

What if elasticity is greater than 1?

Demand is elastic if the formula yields an absolute value greater than 1. To put it another way, quantity varies more quickly than price. The demand is inelastic if the value is less than 1. So, quantity changes more slowly than price.

What is price elasticity between 0 and 1?

An inelastic score is one between 0 and 1, meaning that changes in price have little effect on demand. Since changes in price have no effect on demand, a good would be deemed perfectly inelastic if its elasticity was 0.

What is high vs low price elasticity?

High elasticity is a question with a single element. It has more elasticity if any one issue can make consumers buy less of the goods. Low elasticity is a concern of net-factor. This is a low elasticity product if, once all is said and done, no demand factor will significantly influence consumption.

Conclusion

In conclusion, don’t just leave the knowledge of price elasticity of demand for economists to understand because, as long as you’re a business owner, you need to understand the formula for price elasticity of demand as well as its common determinants for the purpose of your business growth and to understand the reason for the increase and decrease in prices and demand of goods. The knowledge of a good example and types of price elasticity of demand, especially the cross elasticity is a bonus to the details.

FAQs

What are the 3 types of price elasticity of demand?

Elasticity is a general measure of the responsiveness of an economic variable in response to a change in another economic variable. The three major forms of elasticity are price elasticity of demand, cross-price elasticity of demand, and income elasticity of demand.

What is elasticity and different types of elasticity?

Four types of elasticity are demand elasticity, income elasticity, cross elasticity, and price elasticity.

What is elasticity in economics PDF?

Elastic demand is one in which the change in quantity demanded due to a change in price is large. Inelastic demand is one in which the change in quantity demanded due to a change in price is small. The formula is used here for computing elasticity. of demand is: (Q1 – Q2) / (Q1 + Q2)

What is an example of elasticity?

An example of a product with an elastic demand is consumer durables. These are items that are purchased infrequently, like a washing machine or an automobile, and can be postponed if the price rises. For example, automobile rebates have been very successful in increasing automobile sales by reducing prices.

Related Articles

- DETERMINANTS OF DEMAND Explained!!! ( +Detailed Guide)

- Value-Based Pricing Marketing Strategy: Detailed Guide

- Golden Cross Stock: Definition and 2023 Trading Strategy for Beginners

- GOLDEN CROSS STOCK: 5 Simple Steps to Applying the Golden Cross Trading Strategy

- Financial Times: History, Subscription, News (+ Free Sub Tips)