I hope you know that despite how careful the bank software is, there are times that errors are recorded in your transaction and only a statement of account can reveal it. It may occur in little traces, but over time, it becomes a huge amount. Even a business owner can omit the record of your last transaction and still insist you owe them. The statement of account is necessary in addressing such discrepancies even with a cardholder. This guide entails everything you need to know about a statement of account. We also include a template to buttress how it works.

What Is a Statement of Account?

A statement of accounts is a document that records all transactions between you and a specific customer during a specific period. A customer will receive a statement of accounts from a business owner to remind or inform them of two things. The amount they owe for sales made on credit during that period and to give them a record of their transactions. The vendor issues a client a statement of account. This is also known as an account statement. It summarizes all financial transactions between a company and a client during a specified period. The statement of accounts may be sent in two forms, a printed document or mail.

Importance of Statement of Account

The accounts statement holds the following importance;

#1. Transparency in Price and Transaction Activities

Let’s assume Willmott distributes packs and cartons of board refill ink. He distributes this to several customers across the state. You will agree with me that the price of this product varies for several reasons. Discounts, allowances, inflation, and so on. With the statement of account, he will be able to trace the exact price at which goods were supplied to clients in different seasons. The statement of accounts also gives business owners a precise price record for each item they sell to clients. This allows them to keep track of information about a consumer over time and identify problems.

#2. Confirms and Verify Payment

If you give out your goods credit, chances are there will be some discrepancies at some point if care is not taken. When a company’s records are inconsistent, the summary report of the statement allows the owner to see if the client has paid his bills. With the statement account, business owners detect data inconsistencies and determine whether the claimed amount due includes the customer’s previous payments.

#3. Credit Balance Reminder

An outstanding credit balance is something most business owners have to deal with. So basically, statements of accounts serve as a tool that reminds clients to pay up their outstanding balance.

#4. Record Keeping

The statements of accounts are an excellent way to present a summary of the products and services that were billed to your clients. A statement also aids business owners in confirming payments made by customers during a statement period, which is usually a month.

#5. Keep Tracks Of Expense

A client’s statement of accounts is also useful because it enables them to keep track of their expenditures.

#6. Improve Saving Habit

A customer who receives his bank statement may decide to cut down on his expenses and save more for future expenses or emergency purposes.

What I Will Find in the Statement of Accounts?

Whether it’s a bank statement of account or one between a business owner and his client, all statements template include the following;

- Business name, email address, and business address.

- Customer’s name, email address, residence address, and phone number

- Statement Period (This is the time frame of the transaction)

- Customer’s identification number or account in the case of bank statement.

- Opening balance or previous balance.

- Record of transaction

- Time bucket Section

- Closing balance

Overview of the Statement of Account

Every account statement has two sections. We will hight these below.

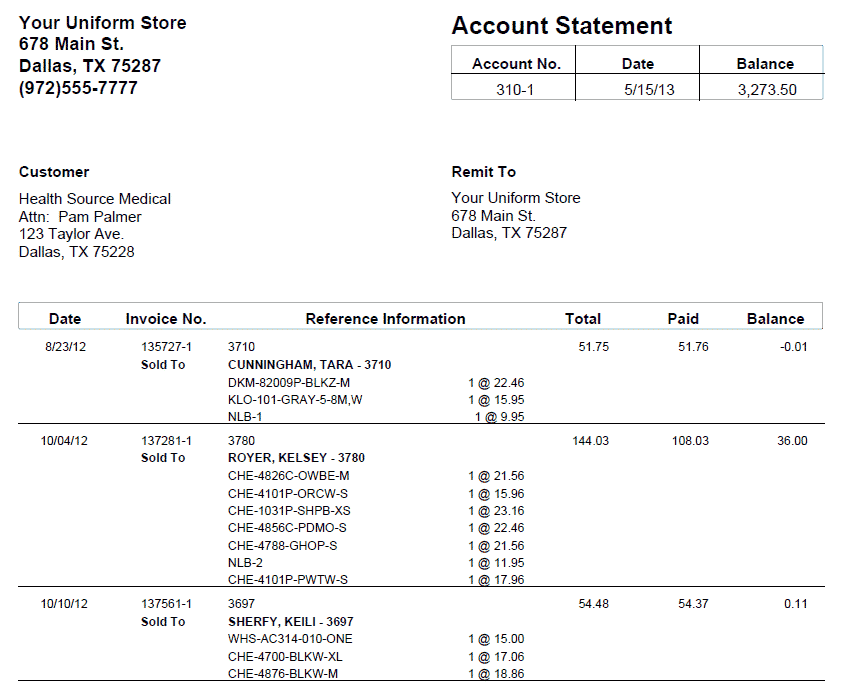

#1. First Section of Account Statement

The first part includes the period of the transaction, the information of the business owner, and the customer’s information. It also includes a summary of the account. This is the opening balance, the amount paid, the invoice amount, as well as the outstanding balance.

#2. Second Section of the Account Statement

The second part of the statement covers all the transactions within that period. This is arranged according to the start date of the specified period. This includes a column for date, reference, description, amount, payment, and amount due.

Is a Statement Account an Invoice?

Of course not. A statement of account differs from an invoice. While an invoice is issued on every transaction, the account statement is issued after a while. To buttress this, let’s take a look at the difference between a statement of account and an invoice. It also has a section for the subtotal, interests if any, and the total amount.

Then just beneath the left side, you the following;

- Business owner’s appreciation

- Amount overdue

- The duration of time you have to pay your overdue amount and the exact due date.

- Where and how to make payment

- Penalties for defaulting payment

- Remittance

- Business owner’s address

- Reference

On the right, we have the following;

- Customer’s name

- Invoice number

- amount paid

- Total paid

Difference Between Account Statements and Invoices

Invoice- An invoice explains the items purchased, the price of the item per unit and the quantity purchased.

| STATEMENT OF ACCOUNTS | INVOICE |

| This highlight all the invoice issued over some time. | This is issued in every transaction. |

| Reveals overall outstanding balance. | Reveals the balance of each transaction. |

| Include a time bucket for due payment. | Does not include a time bucket, only the transaction’s date. |

| Reveal both credit and debit balances in one single document. | bears the record of just one transaction |

Why Do You Need Your Statement of Account?

The statement of accounts serves a different purpose for the cardholder, a business owner, and a customer as well. The following are some of the reasons why a cardholder, a business owner, and customers need a statement of account.

- Customers have the privilege of cross-checking their transactions for discrepancies.

- Clients use the statement of accounts to track their spending for the period.

- Business owners use it to remind clients to pay up an outstanding due balance.

Bank Statement of Account

Once you have a bank account, you are entitled to a statement. The bank statement account is, in a way, similar to the one between a business owner and his client. Most often, your bank will send you a copy of your account statement for the month via mail, but if you need a printed document, you can go to your bank. The bank statement of an account is a monthly document delivered by the bank to its account holder with a summary of all the account’s transactions for the month. Generally, it includes every record of bank charges, deposits, withdrawals, online payments made from your account, and other credit and debit transactions.

Bank Statements In Practice

How does the bank statement work? Once you are an account holder with an active email address, the bank will monthly issue you a statement account. The statement entails all the transactions that took place within a set period. Usually a month. Account-holders can either walk into the bank and get their statement or receive it via their mail. Some banks permit customers to print their transaction history using their ATM cards. Even with that, people still prefer both options.

Why is Bank Statement Necessary?

Financial institutions are extremely careful when dealing with a record. However, discrepancies still arise at times. This gives rise to the reconciliation of bank accounts. All emailed statements come with a disclaimer that reads the number of days you have to get back to the bank for reconciliation else it will be deemed as correct. This means any account holder that noticed discrepancies must report back to the bank without delay. It is also proof of a bank’s accountability to its customers’’ money.

Who issues a statement of account?

A vendor will provide a customer an account statement or statement of accounts. It details each financial transaction between the two companies during a given time period (typically, monthly). The statement might show a balance of zero, but if not, it serves as a reminder to the client that payment is still owed.

Is statement of account same as Bill?

A statement is an accounting of the transactions that have taken place for a specific time period. It could consist of charges that have not been paid in full or unpaid balances. Although a statement is not a bill, it could contain an invoice for payment.

Can I request for statement of account online?

Yes, you can view your statements online including with photos of your checks: 36 months’ worth of your statements are always available for you to browse, print, and download.

How can I get my statement of account without going to the bank?

Access your past and present statements by simply logging into online banking. Your statement will be safely preserved after you’ve reviewed it and be accessible to you via online banking for up to 18 months. Please call us if you require a printed copy in the future; we will be pleased to do so.

What is the purpose of statement of account?

A statement of accounts is a document that lists every transaction that occurred between you and a specific customer within a specific time period. Customers are typically sent statements of accounts by business owners to inform them of the amount they owe for purchases made during that time period on credit.

Can I get statement of account in any branch?

A physical branch location or the bank’s internet banking service/email can be used to access bank statements in print form.

When should statement of account be issued?

How soon do I have to send out a statement of accounts? Although each business must make its own decision, monthly statements are typically published.

Statement of Account Template

Generally, the statement of account template has two parts. While the first part of the statement of account template entails the summary of the customer’s assets. The second part entails the transaction details.

What Is the Cardholder Statement of Account?

The cardholder statement of account is a document that records all of a cardholder’s purchases, credits, and other transaction data within a period. This can also be a credit card statement of account. Does a credit cardholder holder have access to a statement of account? Yes. The cardholder’s credit card statement of account contains all the transactions, including purchases made at a point of sale, listed on credit card statements. It also includes all fees charged by the credit card company and the cardholder’s balance.

Conclusion

A statement of accounts reflects a client’s entire transaction in one document. The account statements not only identify errors in every transaction but also clear discrepancies before they escalate. Finally, there are several templates for writing statements of accounts, they all serve the same purpose to their customers.

FAQs

Who issues a statement of account?

A business owner issues the statements of accounts to a client. The banks also issue it to their account holders.

Is a bank statement of account same as transaction history?

Both may have similar information but still differs. While the transaction history is a record of all transactions for that bank account over a specified period. This is usually o the account holder’s demand. The bank statement only reflects one month’s transactions.

Who can access my Statement?

Statements are confidential documents. Even when sent to your mail, they are encrypted and locked with a password. In most cases, the password is your account number for banks. But between a business owner and his client, it depends on how the client carefully handles his statement.