Recurring revenue sounds pretty straightforward; from the word “recurring”. It gives the impression of something happening over and over again. Now, that sounds good, right? I mean, more revenue equals more success.

Yes, that’s right. Recurring revenue has several benefits and helps a company in several ways, most importantly with the predictability and stability that it offers. It is an effective model that businesses and organizations use when providing products and services. However, it isn’t limited to these alone.

In this article, I will go in-depth to explain what recurring revenue means, as well as its models and the benefits it offers.

Key takeaways

Companies and organisations have several methods of generating revenues, from predictable sales at consistent intervals to one-off transactions.

Recurring revenue comprises the stable, predictable and regular sales. They always come in at regular intervals and so can be expected with some degree of assurance.

A company running a recurring revenue model primarily generates its revenues from such recurring sales.

It’s worth remembering however, that recurring revenues may stop at any time despite its typical regularity.

What is recurring revenue?

Recurring revenue is the income a company earns continuously and can expect to earn regularly. Recurring revenue often comes from subscription-based services and sometimes from recurring sales of special accessory items necessary for an initial product purchase. When businesses and organizations rely on predicted cash flows regularly, they use a recurring revenue model to outline the products and services necessary for recurring sales.

Recurring revenue represents the stable, predictable and regular segment of a business’s revenue. This is in contrast to one-off sales as the gist of a recurring revenue is that certain sales are guaranteed at specific intervals.

Businesses, investors and analysts pay particular attention to a company’s revenue, also known as its top line, recorded on the income statement. The top line determines the bottom line or profit, since all expenses and taxes are subtracted from revenues to get net income.

On the opposite side of the spectrum is the one-time revenue model, which is based on single, non-recurring payments that may or may not happen again. One-time sales can have a higher sense of immediacy and closure compared to recurring revenue

With non-recurring revenue, it’s harder for businesses to forecast and plan for the future. They don’t have as much certainty as a recurring revenue model. With a one-time purchase, you don’t know when new customers are going to make another purchase, or even if they’re likely to purchase again.

Recurring revenue formula

The recurring revenue formula can be used to calculate monthly recurring revenue as well as annual recurring revenue. The most crucial point here is to use the corresponding data for the period (a month, quarter, or year) under review.

Recurring revenue is equal to the product of the overall number of paying users and average revenue per user (ARPU). The formula looks like this:

Recurring revenue = [overall number of paying users] X [average revenue per user (ARPU)]

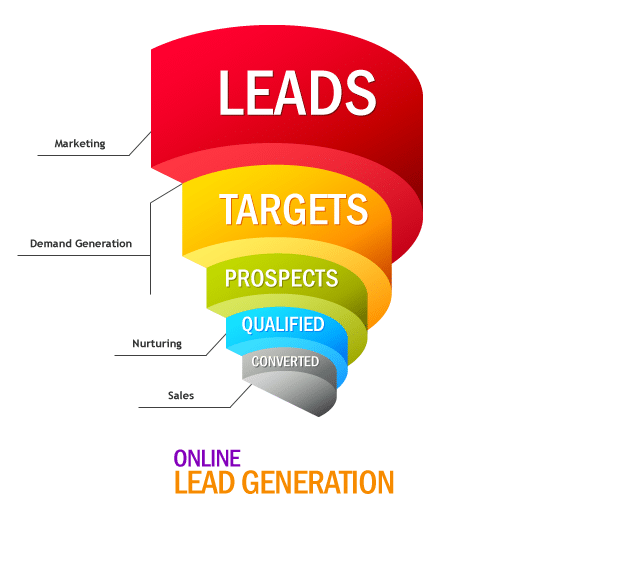

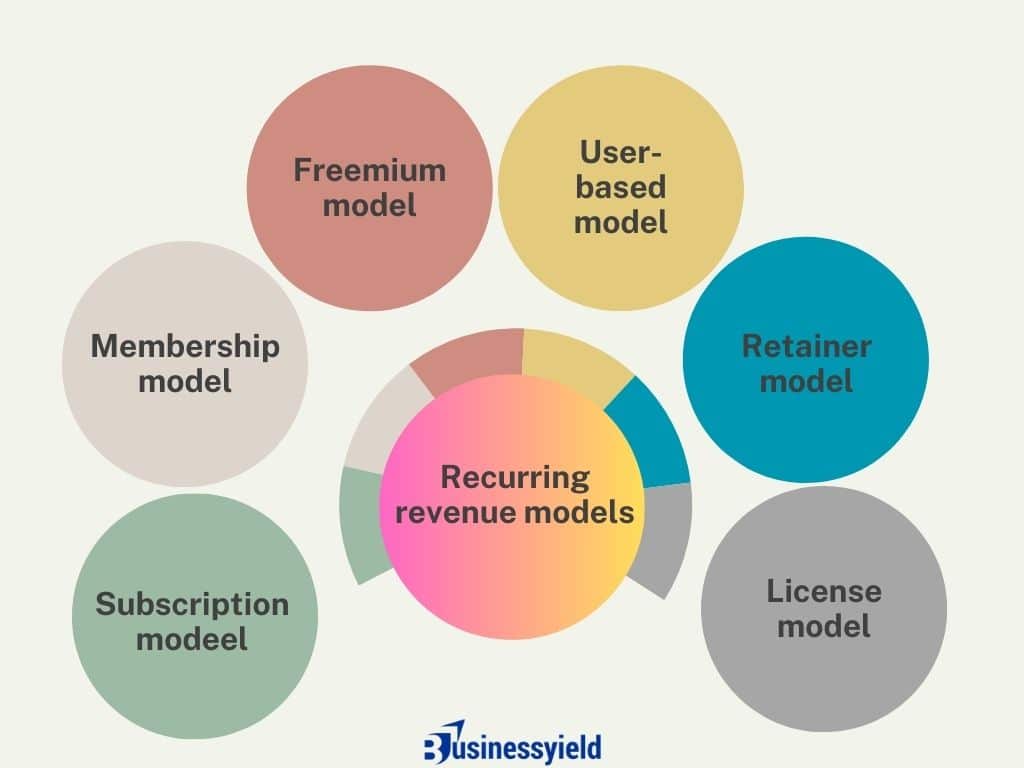

Types of recurring revenue models

Recurring revenue models have helped businesses across the world build sustainable, long-term relationships with their customers. Diverse in form and function, these models can match the various needs and consumption habits of customers, while also offering businesses a more predictable revenue stream.

Here are some of the most common types of recurring revenue models:

Subscription model

In this model, customers pay a recurring fee to gain access to a product or service. The fee is typically fixed and charged regularly, such as monthly or annually. Examples of this model include Netflix, where users pay a monthly fee for access to a wide variety of shows and movies, or Adobe Creative Cloud, where customers pay for access to a suite of creative software tools.

Membership model

Similar to the subscription model, the membership model involves customers paying a recurring fee for access to exclusive benefits, services, or products. It’s often used where there’s an exclusive community aspect. An example would be Costco, where customers pay an annual membership fee to gain access to shop at their warehouse clubs.

Freemium model

This model involves offering a product or service for free while charging for premium features or enhancements. The idea is to acquire a large user base with the free product and then convert a portion of those users to paying customers. An example is Spotify, which offers free ad-supported music streaming but charges for an ad-free and feature-rich premium service.

Usage-based or pay-as-you-go model

In this model, businesses charge customers based on how much they use a product or service. This can be beneficial for customers who don’t use the service heavily. An example would be cloud computing services like Amazon Web Services (AWS), where customers are billed based on the computing resources they consume.

Retainer model

Customers pay a recurring fee for access to a service on an ongoing basis. This is commonly used in professional services such as legal or consultancy services. For example, a company might retain a law firm for ongoing legal advice and pay them a set monthly retainer fee.

License model

Here, customers pay a recurring fee to license a product or service. It’s particularly common in software, where customers pay for the right to use software during a certain period. For example, many businesses license Microsoft’s suite of productivity software on a per-user, per-month basis.

Adopting a recurring revenue model

Transitioning to a recurring revenue model can be a significant shift for your business, but it can also offer stability and long-term growth potential. However, this cannot happen if you don’t understand your current business model. This includes your products and services, customer base and revenue streams. You need to know which aspect of your offerings can be transformed to generate recurring revenue.

Alongside this, you need to also think about what makes your offerings valuable to customers over time, and how you can structure your subscriptions to deliver ongoing benefits that keep them engaged and committed. This might involve bundling products or services together, offering exclusive content or features, or providing regular updates and improvements.

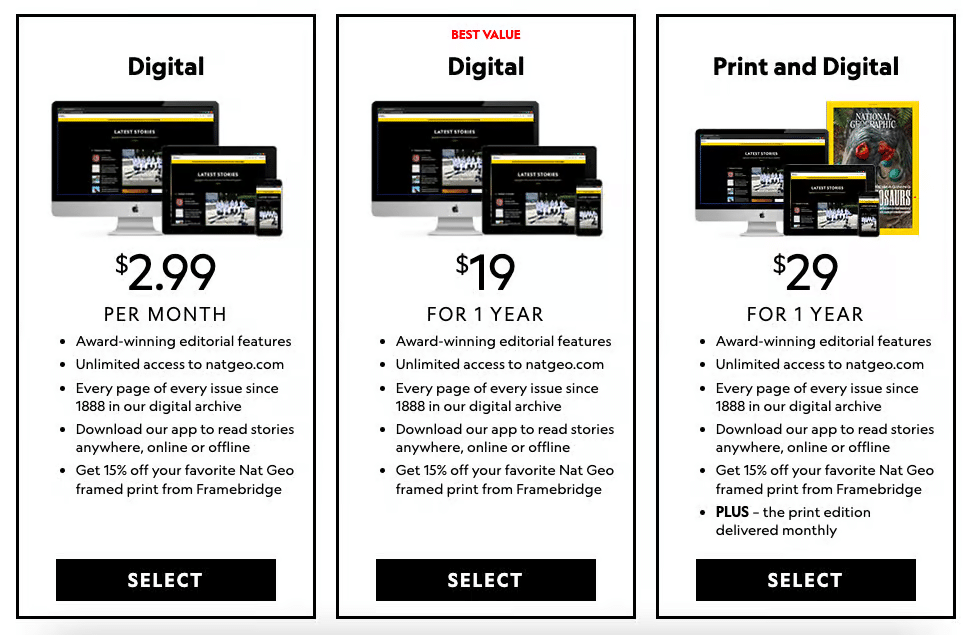

Next, assess your pricing strategy. You must determine how much value your subscriptions provide to customers and price them accordingly. You can also consider offering different subscription tiers to cater to varying needs and budgets. Experimenting with pricing models such as tiered pricing, usage-based pricing, or freemium options can also help you find the approach that resonates best with your target audience.

Finally, be prepared for challenges and setbacks along the way. Transitioning to a recurring revenue model requires patience, persistence, and a willingness to adapt. You have to monitor key metrics such as churn rate, customer lifetime value, and monthly recurring revenue to gauge the success of your efforts and make adjustments as needed. Stay focused on delivering value to your customers and building long-lasting relationships that drive sustainable growth for your business.

Below is a checklist of steps that you can follow to adopt a recurring revenue model:

Adopting a recurring revenue model

Communication is key throughout this transition process. You have to clearly communicate the value proposition of your recurring revenue model to your existing customer base and prospective customers. Highlight the benefits of subscribing, such as convenience, cost savings, and ongoing support. Also, listen to feedback from your customers and iterate on your offerings based on their needs and preferences.

Examples of recurring revenue

Recurring revenue can appear in different forms across various industries. Examples include:

Long-term contracts

Long-term contracts that create recurring revenue often come from service contracts, in which customers pay a regular fee to continue using a service for a long period. Several examples of long-term contracts that generate recurring revenue include cell phone providers, internet providers, insurance providers, and other service providers that have long-term contract obligations.

The long-term contract model helps businesses and organizations establish the time and recurring payment that customers must contribute to keep the service. Additionally, some long-term contracts have a minimum period to which customers must commit to receive the service.

Annual recurring revenue

The annual recurring revenue model is similar to long-term contract models in which customers establish a recurring payment to companies for certain products or services. Unlike long-term contracts, though, annual recurring revenue generates income for businesses yearly. So if a company sells a product or service that requires renewal, it may implement an annual recurring revenue model to receive payments from customers once per year.

Some examples of the annual recurring revenue model include subscription-based services like online magazines and digital video streaming memberships.

Monthly recurring revenue

Monthly recurring revenue is a form of recurring revenue that companies can expect to receive each month from customers who purchase products or services continuously. The monthly recurring revenue model measures a company’s overall normalized monthly earnings from sales of its products or services.

With monthly recurring revenue, a company that offers various product or service prices (such as tiered pricing) can normalize this revenue, making it a consistent metric to gain insight into total recurring revenues.

The monthly recurring revenue model is also a type of recurring revenue that companies with subscription-based services often use to generate income.

Auto-renewing subscriptions

Evergreen subscriptions, including auto-renewal policies such as Microsoft Corp.’s (MSFT) Office 365, Norton/McAfee anti-virus registrations, cloud services, music streaming, internet domain registrations, print or digital news publications, etc. are other examples of sources of recurring revenue.

Companies are sure to collect these payments until customers terminate their subscriptions. Monthly recurring revenue, an important metric for subscription-based businesses, is calculated by multiplying the total number of paying users by the average revenue per user (ARPU).

Cross-selling

Companies use cross-selling to sell items that are necessary for customers to get continued use from a primary product or service. For instance, a cell phone provider that sells a subscription-based cell phone service can cross-sell cell phones and mobile accessories when customers purchase their service contracts.

Cross-selling is advantageous for companies selling specific products in an initial transaction and then continuing to supply customers with items that are necessary to keep using the product. Additionally, companies that establish a cross-selling method of recurring revenue may also integrate one or more of the other recurring revenue models.

READ MORE: Choosing Upselling & Cross-selling Strategies to Strengthen Your Sales Approach

Benefits of using a recurring revenue model

A recurring revenue model has many benefits for businesses, especially in a digital economy where sustainable customer relationships and predictable revenue streams are valuable.

Let’s dig into these benefits in detail:

- Predictability of revenue

Businesses can forecast their revenue more accurately. This improves financial planning and budgeting, providing a valuable sense of stability when planning for growth or navigating market uncertainties. - Increased cash flow

With regular payments coming in, businesses benefit from a consistent cash flow. This can significantly improve the financial health of a company and provide funds for reinvestment or growth initiatives. - Customer retention

A recurring revenue model incentivizes businesses to retain their customers, shifting the focus from generating one-off transactions to cultivating long-term relationships. This emphasis on retention often increases customer lifetime value. - Scalability

Recurring revenue models, especially in digital or service-based businesses, are often highly scalable. As the customer base grows, the business can increase its revenue without necessarily needing to proportionally increase its resources or costs. - Flexibility for customers

These models can provide greater flexibility and affordability for customers, particularly with models like subscriptions or memberships. For a predictable fee, customers can access a wide range of products or services that might be prohibitively expensive to purchase outright. - Opportunity for upselling and cross-selling

Businesses have more opportunities to offer additional premium services or complementary products, increasing the revenue per customer. - Increased business valuation

Businesses with recurring revenue are often valued higher than those with transactional revenue models. Predictable revenue can make the business more attractive to investors or buyers.

These benefits make a compelling case for adopting a recurring revenue model. But keep in mind that the success of this model depends on a business’s ability to continuously deliver value.

Challenges of using a recurring revenue model

While there are many advantages to adopting a recurring revenue model, businesses should also be aware of potential challenges:

- High customer service demand

With ongoing customer relationships, there’s more demand for continuous customer support. Providing high-quality, responsive service may require additional resources, but it is important for retaining customers and reducing churn. - Customer retention effort

Retaining customers over the long term requires continuous effort. Businesses need to regularly prove their value to prevent customers from leaving. This might involve regular product updates or re-engagement strategies. - Price sensitivity

Customers paying a regular fee are often more sensitive to price changes. Any price increase, no matter how minor, can increase churn if not managed properly. - Regulatory compliance

Depending on the sector, businesses may need to comply with regulations related to subscriptions and recurring payments; for example, making it easy for customers to cancel their subscriptions or providing certain disclosures about recurring charges. - Billing complexity

Managing recurring payments can be complex, especially when dealing with upgrades, downgrades, prorations, refunds, or cancellations. This complexity requires robust billing systems and processes. - Revenue recognition

For many recurring revenue models, it can be complicated to time revenue recognition—especially for subscription businesses that collect payment upfront but deliver value over time. This can impact financial reporting and taxation. - Slower initial revenue growth

Compared to one-time transaction models, recurring revenue models might grow revenue slowly at first. Businesses need to be prepared for this gradual climb and plan their financials accordingly.

While these challenges can seem daunting, they can be addressed effectively with careful planning, the right resources, and strategic decision-making. Understanding these potential roadblocks can help businesses transition to a recurring revenue model or refine their existing recurring revenue strategies.

Impact of recurring revenue on businesses

Let’s take a look at some of the impacts that this type of revenue can have on your business growth:

Better manage your cash flow

Unlike one-off sales, recurring revenue sales are predictable. They occur at regular intervals with a (relatively) high degree of certainty, which means you can get a handle on the following information:

- How much money is coming into the business

- When the money is coming in

- What your outgoings are

With this information, you can keep a better track of your cash flow. As a result, you can make informed decisions about business growth and effectively allocate resources.

Easily predict future earnings

Knowing what’s coming in and out of your business gives you a solid foundation for forecasting future earnings. You can predict your sales for the next month, the next quarter, even the next year.

You can also calculate business growth. You’ll be able to visualize:

- Your average revenue

- How and when your business can grow

- Where the best opportunities are

From here, you can accurately predict how your business will grow and what milestones you’ll hit along the way.

Successfully scale your business

With a clear picture of your cash flow and future earnings, you’re in a good position to scale your business with minimal risk. A recurring revenue model helps you create a realistic and achievable plan for growth. Here’s how:

- You can predict future sales and profits. You’re not taking a stab in the dark and hoping for the best. Rather, you have recurring income coming into the business, so you can predict how your business will grow over the coming months.

- You understand what your customers are looking for. With this type of revenue model, you build trust and loyalty with your customers. They stick around because your product or service is worth paying for, which reduces customer churn and boosts your profits.

- You can identify the best areas of growth. Based on insights from your recurring revenue, you’re able to pinpoint areas of growth. Let’s say the data shows that 60% of your customer base pays for your mid-level service. You might want to focus on how you can make this service even better to boost customer acquisition.

Recommended Articles

- Maximizing Revenue for Restaurants: Exploring Cost-Effective Strategies

- UNEARNED SERVICE REVENUE: Definition, Examples & Calculations

- 7 Tried And Tested Marketing Strategies To Drive Revenue

- How to Calculate Revenue In Business Accounting (Steps and Examples)

- REVENUE BASED FINANCING: Definition, Types & Methods