Several mature markets exist in the economy today. These markets have long-term demand but no longer experience significant growth or innovation. Consider the printer market. Slow growth but steady demand. HP, or Hewlett-Packard, is a dominant player in the printer market. This company controls 42% of the global market and has ruled it for over 20 years. The printing division alone generated 17.64 billion US dollars in revenue for the company in 2020, making it one of its most important business segments. HP’s printing division exhibits all of these characteristics, which point to it being a cash cow. But what are cash cows in marketing, and what are some examples?

What are Cash Cows?

A cash cow is one of the four categories (quadrants) in the growth-share matrix (BCG), which represents a product, product line, or company with a large market share in a mature industry. A cash cow is also a company, product, or asset that, once purchased and paid off, will generate consistent cash flows over its lifetime.

Understanding Cash Cows in Marketing

A dairy cow that produces milk continuously and requires little to no care is referred to as a cash cow. The phrase refers to a business that is also low-maintenance. Modern-day cash cows require little investment capital and provide positive cash flows, which can be allocated to other divisions within a corporation. They are investments with low risk and high reward.

The Boston Consulting Group introduced the BCG matrix, a method for organizing business units, in the early 1970s. Cash cows are one of the four quadrants in the matrix. The BCG matrix, also known as the Boston Box or Grid, categorizes a company’s businesses or products into one of four categories: star, question mark, dog, or cash cow. The matrix assists businesses in understanding where they stand in terms of market share and industry growth rate. It is a comparative analysis of a company’s potential as well as an evaluation of the industry and market.

However, some businesses, particularly large corporations, recognize that the businesses/products in their portfolio fall into one of two categories. This is especially true for different product lines at various stages of the product life cycle. Dogs and question mark waste resources less efficiently than cash cows and stars.

Cash Cows in BCG Matrix

The question mark, stars, dogs, and cash cows are the four grids or divisions in the Boston Consultancy Group (BCG) matrix. The BCG matrix now has two axes: market share on the x-axis and market growth on the y-axis.

Moneymakers reflect the following on the BCG quadrant:

- Large Market Share: A product, asset, business unit, or firm with a large market share. They have long been popular with consumers. They have devoted customers, high output, economies of scale, and low manufacturing costs.

- Low Market Growth Rate: Growth opportunities are limited. The product does not require additional investment. As is, it continues to provide consistent returns.

Examples of Cash Cows

A few examples of marketing cash cows are listed below:

#1. Apple’s iMac, iPad, and iPhone

Apple products generate the majority of Apple’s revenue. The iPhone accounts for 61.65% of Apple’s revenue, while the iPad and iMacs account for 8.39% and 11.27% of total revenue, respectively. All three of these products are part of a market that is experiencing slow growth.

The aforementioned products have made a name for themselves in their respective industries, and as a result, they control a sizable portion of the market share in these industries. As a result, it can be concluded that Apple Inc.’s cash cows are these products.

#2. Microsoft’s computing (Windows)

Since the release of Windows in 1983, Microsoft has been the dominant player in personal computing. Despite generating consistent revenue for the company, Windows now only accounts for a small portion of Microsoft’s business. As a result, Microsoft relies on Windows as a cash cow.

#3. HP’s printing division

HP’s printing division has dominated the market for about 20 years. Its printing division has generated significant revenue for the company. Thus, there is no doubt that HP’s printing division has been the company’s cash cow over the years.

#4. Google Search Engine

Alphabet’s (formerly Google) search engine, which has a market share of 67.6% in the United States, is the most prominent example of a cash cow.

Benefits of Cash Cows in Marketing

Whether a product, service, or business unit, Cash Cows typically provide a company with numerous benefits, including:

- Steady growth: These businesses and products typically grow steadily, resulting in consistent cash flows.

- Larger reserves: When these companies or products are consistent, the company’s cash reserves may increase. These increased reserves may provide security for the company’s future capital spending.

- Higher customer loyalty: Customer loyalty may be increased by these businesses and products. Loyal customers may refer others to the business, which may result in additional profits without incurring additional costs for marketing and advertising.

- Lower investments: The profits generated by highly profitable products may be greater than what the company needs to keep the product running. The excess profits could then be used for future investments, potentially lowering their cost.

- Reduced competition: Because these products usually prevent new entrants into the market or industry, producers may benefit from reduced competition.

Strategies that Aid Cash Cows Product

Companies frequently employ various strategies to ensure that their profitable goods are long-lasting due to the numerous benefits they provide, including:

#1. Make a budget.

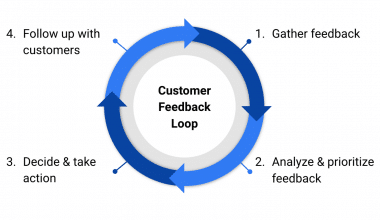

While a highly profitable product is usually a consistent source of high-margin revenue, few products and services are completely self-sustaining. Because of the importance of profitable products to the company and its financial records, companies generally create a budget to ensure their continued success. This budgeting entails investing in equipment and infrastructure that enables the company to meet the demand for these products and services. Companies also typically allocate resources to monitoring demand and reviewing feedback to make necessary product adjustments.

#2. Promote the product

Because of their significant profitability, marketing cash cows are typically efficient uses of a company’s resources. Well-established profitable products that generate consistent sales may require little marketing. If the company does not properly establish the product or service, it may have to spend more money on sales and promotion.

Companies can market these products in a variety of ways, including hosting an event and providing free or discounted samples to opinion leaders. Opinion leaders can gather information about the product and summarize it in a way that persuades others to purchase it. Another strategy for marketing these products is to identify and devote resources to the most effective advertising channels.

#3. Give the product top priority.

Profit margins between highly profitable products and other products are typically large without the firm investing much. Sustaining and increasing these profit margins necessitates prioritizing profitable products. Businesses frequently devote resources and energy to increasing sales. That may include using other products and services to support and complement them.

#4. Create the product.

Very profitable products and services frequently require development and improvement to maintain market dominance. Developing the product can be done by adding new features that ensure the product’s continued relevance in the market or by creating a product mix. The profitable product may also be featured as part of a broad product mix that expresses the company’s interests and passions while also providing customers with a variety of appealing options.

Other Cash Cows Company And Product Categories

Aside from the lucrative category, other categories for a business or product exist:

#1. Question marks

Products and businesses in this category have growth potential but have a small market share. They are in a growing industry, but have lower profit margins and frequently require large investments. That is, they spent a lot of money to start the business or create the product. These signs that they display frequently raise questions that may have an impact on their outcome, which is why experts refer to them as question marks.

#2. Stars

These companies and products are experiencing rapid market growth and control a sizable portion of the market. Their high growth often requires substantial capital to increase their market share further. With the right strategy, stars may also transform into lucrative businesses or products.

#3. Dogs

Businesses, products, and services can all fall into the “dog” category. They’re typically low-profit businesses with lower growth and lower market share. Because their growth potential is lower than that of other categories, investors typically avoid owning or financing them.

Advantages of Cash Cows in Marketing

- To the Company

A larger market share indicates greater consumer confidence. Thanks to moneymakers, the money keeps coming in. Because moneymakers require less investment, these funds are kept as reserves. As a result, the funds can be used to finance new projects, innovation, and expansion. Such organizations do not rely on external funding.

- To the Investors

Cash cow investors, who do not expect higher returns but are concerned about the degree of uncertainty, are known as risk-averse investors.

- To the Market

Moneymakers are industry leaders who frequently guarantee higher-than-average returns. They establish quality and sales benchmarks. As a result, they act as industry price makers. Price leadership refers to a situation where the dominant firm sets the price of goods or services in the market.

Disadvantages of Cash Cows in Marketing

The restrictions are as follows:

- Moneymakers have reached a point in their careers where they must consistently maintain the quality of their products or services. Only then will they be able to keep consumers’ trust? The hype creates its own set of unrealistic expectations.

- It is extremely difficult to gain consumer confidence in new products in the same market.

- Because it already has a large market share, a moneymaker cannot expect to grow in sales and profitability.

- It discourages new entrants because competing with these established companies requires significant capital investment.

- Moneymakers dominate the industry, which has an impact on the smaller players. Price leadership describes a situation in which the moneymaker determines the price. Even if they cannot afford it, the competition must match the price.

- Due to the lack of competition, monopolistic practices flourish. To survive, competitors must lower the prices of their products.

- Occasionally, a new entrant defies industry stereotypes by introducing new technology to capture the moneymaker’s market share.

What does “cash cow” mean?

A cash cow is a company or business unit in a mature, slow-growth industry. Cash cows have a sizable market share and require minimal investment. For example, the iPhone is Apple’s (AAPL) cash cow.

What are cash cows in the BCG matrix?

The BCG matrix, which examines the value of various units within a corporation, has four quadrants, one of which is a cash cow. Cash cows are mature, slow-growing industries with a large market share that require little investment to thrive.

What is the opposite of a cash cow?

The opposite of a cash cow is a question mark. This is an asset that has a relatively low market share but operates in a rapidly growing market.

How do you deal with cash cows?

CASH-COW has the following synonyms: moneymaker, money-spinner, angel, backer, golden goose, grubstakes, meal-ticket, patron, stalker.

How do you deal with cash cows?

Prioritize. Your cash cow will play a role in your overall business strategy, depending on your priorities. If you want to make the most money possible, focus your resources and energy on increasing its sales, with other products and services serving primarily to supplement it and flesh out your line.

What is the origin of the cash cow?

Cash cows were first introduced around 1970, and since then, their popularity has surpassed that of milch cows. Cows are the literal source of both expressions. Farmers can continue to milk a female cow if she has given birth at least once. They can sell that milk for a consistent income with little work and upkeep.

Related Articles

- BCG MATRIX: Definition, Application, and Importance

- DECISION MATRIX: Meaning, Use, and Guide.

- Competitor Analysis: All you need (+ How to Start Guide)