When it comes to real estate investing, knowledge is power. That’s why finding the right resources to educate yourself on the subject is crucial. As I researched and observed the world of real estate investing books, I have curated a guide that features the best books about real estate investing. With this guide, you can be assured of receiving accurate and essential information to make informed decisions and succeed in the world of real estate investment.

Key Points

- Real estate investing books are invaluable for gaining knowledge and insights into various aspects of the real estate market, investment strategies, and best practices.

- The best books about real estate investing often cater to beginners, providing foundational information, step-by-step guides, and practical tips for getting started in real estate investment.

- These books cover various topics relevant to real estate investing, including rental property management, flipping houses, commercial real estate, market analysis, financing options, and legal considerations.

- Reputable real estate investing book authors often share their expertise, experiences, and successful strategies, offering readers valuable insights and actionable advice for achieving investment success.

- Real estate investors can use these books to screen and select the most suitable investment opportunities, assess risks, analyze markets, and make informed investment decisions.

- Real estate investing is a dynamic field, and the best books about real estate investing emphasize the importance of continuous learning, staying updated on market trends, and adapting investment strategies accordingly.

- In addition to technical knowledge, real estate investing books often discuss mindset, discipline, and personal development, which are crucial for success in the real estate investment journey.

- Real estate investing books, especially the best ones, are vital in empowering investors with the knowledge, skills, and confidence needed to navigate the complexities of the real estate market and achieve their investment goals.

What is Real Estate investing?

Investing in real estate involves buying, renting, owning, or selling properties to make money. There are several ways to invest in real estate, including:

- Rental Properties: Investors purchase properties such as single-family homes, apartments, multi-family homes, or commercial spaces that they then rent out to tenants, generating rental income.

- Flipping involves buying undervalued properties, fixing them up, and selling them for a profit.

- Real Estate Investment Trusts (REITs): REITs own, manage, or finance property generating income. Investors can purchase REIT shares to invest in properties without owning or running them.

- Real estate development involves buying land, obtaining permits, and constructing homes or apartment complexes that people can purchase or rent.

- Real Estate Syndication: A group of investors pools their money to buy larger real estate projects they might be unable to afford.

Real Estate Investing Books

Many people get rich and become financially independent by dealing in real estate. Reading books about real estate buying is an excellent way to get started. These books have helpful tips and information from investors who have been through the market and done well. These books talk about things like how to find good deals, how to analyze properties, how to negotiate with sellers, how to get money to buy properties, and how to handle rental properties. By learning from the pros, you can avoid making mistakes that cost a lot of money and increase your chances of success in real estate buying. Buying good real estate trading books can be great for building a real estate portfolio.

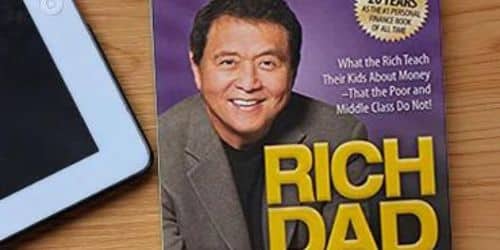

#1. Rich Dad, Poor Dad” by Robert T. Kiyosaki

Rich Dad, Poor Dad” by Robert T. Kiyosaki is a book that teaches basic money skills and changes your attitude towards investing. It’s a great starting point for people interested in personal wealth and investing. While it doesn’t focus on real estate deals, it gives investors who want to make money through real estate a solid base on which to build.

Credit: Rich Dad Store

#2. The Millionaire Real Estate Investor” by Gary Keller

This real estate investing book, The Millionaire Real Estate Investor,” by Gary Keller, is a must-read for anyone who wants to learn how to deal in real estate. The book provides valuable tips for investing in real estate based on conversations with more than 100 millionaire investors. It discusses many things, like money, land management, and risks. The book is based on the idea that dealing in real estate is like running a business, and it shows you how to make your real estate investment business successful.

#3. The Book on Rental Property Investing by Brandon Turner

This book is a comprehensive guide to investing in rental homes. It provides helpful advice on choosing and maintaining rental homes. The book details everything from choosing a property, screening tenants, and writing lease agreements. It also discusses financing choices, ways to manage properties, and the tax effects.

#4. “The ABCs of Real Estate Investing” by Ken McElroy

It gives a complete look at the rules and tactics of real estate investing. It discusses things like analyzing properties, different ways to pay for them, and managing properties. A well-known real estate investor wrote the book, including case studies and real-life examples.

#5. “Real Estate Investing For Dummies” by Eric Tyson and Robert S. Griswold

This is an easy-to-understand introduction to many aspects of real estate investing. It’s a great starting point for people who want to start dealing in real estate. The book discusses things like getting money, choosing a home, and managing risks. It’s written in a way that makes it easy for people new to real estate buying to understand.

Also Read:Navigating the Texas Real Estate Market: Strategies for Success

#6. “Investing in Rental Properties for Beginners” by Lisa Phillips

This book shows you how to start investing in rental properties step by step. It discusses choosing a property, screening tenants, and making lease deals. The book has real-life examples and case studies and is written in a way that makes it easy for beginners to understand.

#7. The Real Estate Wholesaling Bible” by Than Merril

“The Real Estate Wholesaling Bible” by Than Merrill is mostly about quickly making money by selling real estate. It discusses things like getting deals, negotiating contracts, and advertising properties. A successful real estate investor wrote the book, and it is full of helpful information for people who want to start selling real estate.

#8. “Buy It, Rent It, Profit!” by Bryan M. Chavis

This book explores investing in rental homes to make money over time. It discusses choosing a house, screening tenants, and managing properties. The book also explains how to build a successful business by investing in rental properties.

#9. “The Book on Flipping Houses” by J. Scott

This book discusses how to find deals on houses and fix them so you can sell them for a profit. It also discusses things like analyzing a property, getting financing, and planning how to fix a house. A successful real estate investor wrote the book, full of valuable tips and strategies for people who want to start selling houses.

#10. How to Invest in Real Estate” by Brent Turner and Joshua Dorkin

How to Invest in Real Estate” by Brent Turner and Joshua Dorkin tells you everything you need to know to start investing in real estate. It discusses different ways to get money, choose a house, and manage a property. The book is written in a way that makes it easy for people new to real estate buying to understand.

#11. “The ABCs of Property Management” by Ken McElroy

This is mostly about how crucial good property management is for real estate investors who want to make money. It talks about screening tenants, lease papers, and ways to keep the property in good shape. The book provides valuable tips and methods for managing rental properties well.

Credit: Freepik

#12. “Real Estate Investing: Market Analysis, Valuation Techniques, and Risk Management” by David M. Geltner

This book thoroughly explains how to analyze and value real estate markets. It covers things like analyzing the market, figuring out how much a place is worth, and managing risks. The book is a complete guide to real estate and was written by a top expert in real estate finance.

#13. Estimating Rehab Costs” by J. Scott

The Book on Estimating Rehab Costs” by J. Scott is a helpful guide on estimating rehab costs for fix-and-flip projects. It talks about things like how to plan a makeover, how to choose a contractor, and how to figure out how much the project will cost.

Credit: Amazon

#14. Every Landlord’s Legal Guide by Mark Stewart, Ralph Warner, and Janet Portman’s “

Anyone in charge of rental homes needs to have this book. It advises on how to deal with the legal aspects of owning land and managing rentals. It discusses leases, tenants’ rights, and landlords’ duties. The book is written in a way that makes it easy for people new to managing rental properties to understand.

#15. Commercial Real Estate Investing for Dummies by Peter Conti and Peter Harris’

This book covers the basics of investing in business real estate. It discusses things like choosing a property, different ways to pay for it, and how to handle it.

Checklist on How to Become a Successful Investor

What Is the 5 Rules of Real Estate Investing?

Based on the figures provided, the cost of capital for a rental property is approximately 3%. This includes both mortgage payments and down payments. In addition to this cost, property maintenance and taxes are estimated to account for another 2%. When these costs are combined, we arrive at what is commonly known as the 5% rule. This rule suggests that homeowners expect to pay around 5% of the value of their home in expenses that cannot be recovered, such as capital costs, maintenance, and taxes. It is essential to factor in these costs when evaluating the net income potential of a rental property. This helps investors decide which properties to buy and how to get the best long-term results.

Checkout our article on FREEHOLD ESTATE: Definition, Types, & Examples

Which Real Estate Investment Is Best?

The investor’s goals, the property’s location, and the type of property all play a role in determining which real estate investment is the best. Some investors prefer investments in residential properties, while others prefer investments in commercial properties. In addition, it is of the utmost importance to consider the characteristics of the local market, which include supply and demand, vacancy rates, and rental yields. Real estate investments that align with an investor’s financial goals, level of risk tolerance, and investment horizon are, in the end, the most successful investments in real estate. It is recommended that before making any decisions on investments, one should first carry out extensive research and analysis to guarantee the most favourable outcome.

What Is the 80% Rule in Real Estate?

The 80% rule in real estate is a general rule of thumb that states that an investor should not pay more than 80% of a property’s after-repair value (ARV) minus the cost of repairs. This rule is commonly used in fix-and-flip real estate investing, where investors purchase distressed properties, renovate them, and sell them for a profit. The 80% rule helps investors avoid overpaying for a property and ensures enough room for profit after accounting for repair costs and other expenses. However, it is important to note that the 80% rule is not hard and fast and should be used with different analyses and due diligence.

What Is the 1% Rule in Real Estate?

The 1% rule in real estate is a general rule of thumb that states that the monthly rental income of a property should be at least 1% of the total purchase price. For example, if the purchase price of a property is $200,000, the monthly rental income should be at least $2,000 to meet the 1% rule. This rule is used to determine the cash flow potential of a rental property and to quickly assess whether a property is worth considering as an investment. However, it is essential to note that the 1% rule is not hard and fast and should be used with other analyses and due diligence. When evaluating a rental property’s investment potential, local market conditions, property maintenance costs, and vacancy rates should also be considered.

- Best Business Books of All Time 2023 (Updated)

- HOW TO GET RICH: Free Tips to Get Rich in 2023 & Books

- The 2023 BEST BOOKS FOR REAL ESTATE INVESTORS: Top 17 Picks(

- TOP FINANCIAL LITERACY BOOKS IN 2023