The numbers on a check are what? A check will have three sets of numbers at the bottom. Your routing number is followed by your account number and check number. So in this article, we will explain to you where the routing number on a check is located. You probably know how to interpret a check that you’ve received if you know how to write a check.

Finding these crucial data is helpful for setting up automatic payments for monthly bills and submitting paperwork for procedures like direct deposit. Below, you may find more information on routing numbers, account numbers, and check numbers.

What is a Routing Number?

The routing number serves as a marker for where to send money that is being paid to you and identifies the banking institution where your money is housed. Your routing number is necessary for employers to set up payment methods like direct deposit.

Your checking account number at the bank you use lets the bank know which account you have. This number is used by your bank to specify where money meant for you should be placed or withheld. You must give this number whenever you set up payment methods like direct deposit or an electronic payment app.

Where is the Routing Number on a Check?

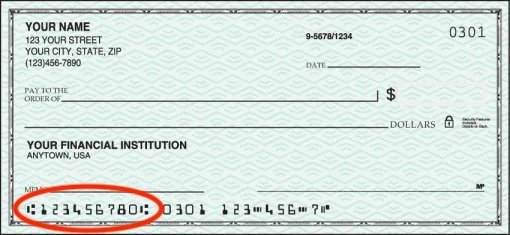

The routing number is the first set of numbers on the lower left corner of a check. Remember that the routing numbers on checks are 9-digit codes, not including the character sign that surrounds the numbers. Public routing numbers, also known as transit numbers, may differ depending on the area in which you started your account.

Where can I find a Check Number and what is it for?

On a personal check, the check number is typically the last set of numbers. However, the check number and account number may be placed in a different order. They are the shortest group of numbers on the check, and they serve only to remind you which check you are writing.

What Number Appears on a Check as the Account Number?

Your account number is the second set of numbers that come after the character symbol immediately after your routing number. Simply select the longer number to find your account number. You can only find this private, specific bank account number by logging into your online account or on your personal checks.

Where are Routing Numbers on a Check

The routing number is the first set of numbers on the lower left corner of a check. Customers can access their specific bank accounts and the numbers linked to them via the websites and mobile banking apps offered by every major bank. These figures can be found on your bank statements as well. These statements will typically arrive in the mail each month if you haven’t signed up for paperless banking. You can contact or visit your bank in person to get your routing and account numbers if digital means are unavailable to you for any reason.

What is a Check Account Number?

Your checking account number at the bank you use distinguishes and identifies your particular account. This number is used by your bank to specify where money meant for you should be placed or withheld. You must give this number whenever you set up payment methods like direct deposit or an electronic payment app.

Is a Check Routing Number Always a Digit?

A routing number is a special nine-digit number that serves as your bank’s address. It is used for electronic transactions like bill payments, direct deposits, and money transfers.

Is the Routing Number Always First on a Check?

The account number is always listed after the routing number. This is so that your account can be found since a routing number is how a bank tells you who it is. and it can be used in conjunction with your banking account number.

Where is the Account Number Located on a Check?

Your account number, which is the second set of numbers from the left and ranges in length from 9 to 12 digits, may be found at the bottom of your checks. This number informs the bank which checking account to debit for the money. If you don’t have a check on hand, you can obtain your account number by signing into your Huntington Online Banking account or by looking it up on your bank statements. Additionally, you can obtain your account number by going to a Huntington bank and presenting a legitimate ID.

Why Do I Have Two Routing Numbers?

Huge financial institutions frequently have a large number of routing numbers. which are unique to the state or region where your account is held, even if no two banks would have the same routing number.

What Is IBAN Number?

A global standard for sending bank payments is the IBAN, or international bank account number. The 34 alphanumeric characters it is made up of are used to identify the country, bank, branch, and account. In order to send payments to nations that have ratified the IBAN, North American, Australian, and Asian nations will not use the IBAN for internal money transfers.

What is Routing VS Account Number on Check?

It is a comparison of account numbers and routing numbers

You will need both your bank’s routing number and your account number for those activities. Whether you need to set up a direct deposit, like your paycheck, or order checks online.

Account numbers resemble a unique fingerprint or customer ID for each account holder. To pinpoint exactly where the money in a transaction is coming from and going, routing and account numbers are assigned.

Similarly, each banking institution is uniquely identified by its routing number. The routing and account numbers. For example, when you do an electronic money transfer, you need to send to the right financial institutions.

- Account numbers: typically range from nine to twelve digits in length, however, some may be longer. Routing numbers are always nine digits long.

Routing Code

The routing number is a string of nine digits used by banks to identify particular financial institutions in the United States. (also referred to as an ABA routing number, in reference to the American Bankers Association). This figure demonstrates that the bank has a Federal Reserve account and is an entity with a federal or state charter.

In the past, paper checks used ABA routing numbers, and electronic transfers and withdrawals from accounts used ACH routing numbers. However, most banks today utilize a single routing number for all transactions, whether they are paper-based or electronic.

While major multinational banks may have numerous different routing numbers, typically based on the state in which you hold the account, small banks typically only have one. Routing numbers are typically used for ordering new checks, paying consumer bills, setting up a direct deposit (like a paycheck), or paying taxes.

The routing numbers stated on your checks are not the same as those utilized for domestic and international wire transfers. But you may also readily get them online or by getting in touch with your bank.

Routing Number

In conjunction with the routing number, the account number is used. The account number, which is typically between eight and 12 digits, identifies your account, while the routing number identifies the name of the financial institution. The routing numbers for your two accounts at the same bank will typically match. But your account numbers will be different.

The routing number of a bank may be found by anyone. But since your account number is specific to you, you should protect it just as you would your Social Security number or PIN code.

How Many Digits is an Account Number?

Financial institutions utilize routing numbers, which are nine-digit codes, to identify other financial organizations. It is also referred to as an “ABA” (American Bankers Association) routing number. and an RTN (routing transit number). When used with your account number, it lets institutions find your specific account.

Is the Routing Number the Same for Both Checking and Savings?

The savings or checking account’s routing number identifies the financial institution that holds the account. Your savings account and checking account will both have the same routing number if they are both at the same bank.

On a Bank Statement, Look for your Routing Number

Your routing number can be found by using the third and fourth digits of your account number. On a bank statement, your account number can be found at the top of the right column.

Using the chart below, you would use 34 to find your routing number in the example. Route number 34 matches the number 084000062.

Conclusion

Always remember to double-check both numbers anytime you give them to someone else and to call your banking institution. If you are ever confused about which number is which. This will guarantee a smooth transaction and prevent any delays or associated bank fees brought on by the money ending up in the wrong account.

Related Articles

- Eccentric Security Issues of Blockchain in 2023

- Voided Check: All You Need to Know(+ Set up Guide for Direct Deposit)

- VIRTUAL PHONE SYSTEMS: The Top Best Virtual Phone Systems For any Business (+ Detailed Guide)

- Predictive Analytics Tools and Software: Best 15+ Tools

- 15+ BEST PHONE NUMBERS for Business in 2023

- https://businessyield.com/insurance/best-rv-insurance/

- https://businessyield.com/business-services/sales-development-representative/