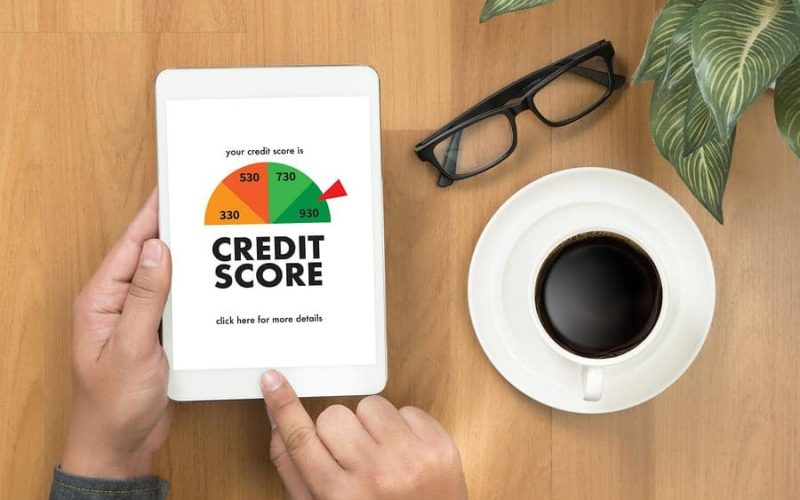

Your credit score puts a start to your future potential in the financial sphere. In general, it is the level of your creditworthiness. The higher the score, the better a borrower looks in the eyes of potential lenders. Realizing what exactly affects your credit rating will help you plan, manage, and control the most effective ways to improve, and protect your reputation.

Companies calculate your current position according to your financial possibilities based on several factors as well. While it is possible, we can glance at some secrets and get to know what we have to undertake to achieve a perfect credit score.

Why is it so important to take care of your credit capabilities? Your credit is often the key to other spheres of your life: whether you can get a loan, at what interest rate; whether you can buy, or rent a property; even whether it would be possible to take out a mortgage. So, are you still interested in getting to know what credit rating holds for you?

The next question is: does checking your credit score lower it? In fact, if you check your credit score by yourself, it doesn’t lower it. But if a lender, it might. “Hard queries” may cost something. They happen when someone checks your balance and personal data with the purpose. On the contrary, a “soft request” occurs when you or a lender who wants to pre-approve you for a loan verifies your account. A soft request does not affect your credit score at all.

Checking your score by yourself regularly can alert you in case something goes wrong. A hidden, unexplained change in your score can cost you more than you expect and maybe your first sign of potential errors and problems. Unfortunately, things happen. However, What Credit Score is good enough to start with?

Differences in Credit Scores by State

What is the average credit score in the United States? It’s really confusing here. According to statistics, the lowest credit scores are in the South: Tennessee, Arkansas, Louisiana, and Alabama. But even these statistics cannot be considered accurate.

Source: Fico.com

Below are the average FICO scores by state:

- Alabama — 680;

- Alaska — 707;

- Arizona — 696;

- Arkansas — 683;

- California — 708;

- Colorado — 718;

- Connecticut — 717;

- Delaware — 701;

- District Of Columbia — 703;

- Florida — 694;

- Georgia — 682

- Hawaii — 723;

- Idaho — 711;

- Illinois — 709;

- Indiana — 699;

- Iowa — 720;

- Kansas — 711;

- Kentucky — 692;

- Louisiana — 677;

- Maine — 715;

- Maryland — 704;

- Massachusetts — 723;

- Michigan — 706;

- Minnesota — 733;

- Mississippi — 667;

- Missouri — 701;

- Montana — 720;

- Nebraska — 723;

- Nevada — 686;

- New Hampshire — 724;

- New Jersey — 714;

- New Mexico — 686;

- New York — 712;

- North Carolina — 694;

- North Dakota — 727;

- Ohio — 705;

- Oklahoma — 682;

- Oregon — 718;

- Pennsylvania — 713;

- Rhode Island — 713;

- South Carolina — 681;

- South Dakota — 727;

- Tennessee — 690;

- Texas — 680;

- Utah — 716;

- Vermont — 726;

- Virginia — 709;

- Washington — 723;

- West Virginia — 687;

- Wisconsin — 725;

- Wyoming — 712.

As we figured things out, you should select a wise approach connected to taking out a loan. This plays a major role when the lender decides what he’s going to do with you. People with quite low interest rate are forced to stick to a shorter repayment term. In simple words, to keep you and your money safe.

A credit score is considered good by society and can encourage the lender to offer a borrower a lower interest rate, causing them to pay less money. If you have an excellent rate, you automatically have no worries about your future with loans. Let’s figure things out together. What phenomena affect your credit score conditions and how can you improve them by following the next tactics?

#1 Fresh Credit

If you are planning to open the world of loans, you should be ready that some lenders usually go through a request procedure (not smooth sometimes), which is the process of checking your credit information. Hard questions can cause problems. Why? If you have recently opened several accounts and the percentage of these accounts is high relative to the total, you may present a greater credit risk.

Because people tend to do this when they have cash problems or plan to take on a lot of new debt, to sum up, what we said, just choose an accurate approach to this question and do not overwork with new credits.

#2 Amount of Money Borrowed

The amount of money you own directly affects your future ability to pay it back. One of the biggest misconceptions is that many people think you have to have a zero balance in your accounts to get high marks. The less is better. You see, lenders have to see that you are completely responsible, realize the consequences, and are financially stable enough to pay the debt back. By the way, lenders also love to see that you have a mix of different types of loans. If you manage them skillfully, it’s more than better. How much do you owe in total? Likewise, the smaller, the better.

#3 Different Types of Loans

This is the thing you can try if you are an experienced borrower and you know who to trust and how to make smart moves connected to loans. For example installment loans and mortgages. People also look at how many accounts you have in total. Don’t be crazy by creating as many accounts as possible and taking as many loans as possible. It doesn’t work like this. Just make smart decisions.

#4 Length of Credit History

How long has it been since you took out a loan? Answer this question. How much time is it possible to spend paying off a debt? A long credit history is good (if it’s not identified as one with negative consequences), and a short history is also not bad too if you make your payments on time.

So, try to track the age of your loan taken, because it’s super easy to just forget and bail on it. In the worst case, you will be dealing with time limitations, which is not pleasant at all, believe us. Personal finance experts always recommend keeping credit card accounts open. Account age alone will help increase your score.

#5 Payment History

It is your tracked list of payments. Your end picture definitely consists of your historical experience. Moreover, payment history takes a significant percentage on the way to the perfect credit rating. Finances companies call payment history “extremely vital”.

Pay all bills on time. It just goes without saying that, to achieve the desired result, you must literally “train” your responsibility and make it a habit to automatically pay bills on time. Delaying your payments by a month or more can already affect your grades—aand cause significant damage. Set up online calendar reminders if it’s easier for you to control in this way so you don’t miss deadlines. You can give it a shot by asking your lender to change the terms.

Before you apply for a loan, it makes sense to have an understanding of who a lender is and what his agreements are. Knowing these aspects can prevent you from losing points unnecessarily by trusting somebody you are not handling responsibility for.