When we need to access some extra funds, it can be confusing to know what the best option is for you and what the pros and cons of each of the lending options are. Not to worry, we’ve created a helpful guide below to help you out when you’re considering taking out a personal loan or another avenue for lending. Here’s the guide to loans by CreditNinja!

Personal Loans

Personal loans are a way that you can borrow a large sum of money, and normally you’d agree to pay the amount that you owe back in monthly installments. This type of personal loan is known as an installment loan, and it’s a fantastic way to borrow an amount of money that you cannot afford to pay back in a short amount of time. Installment loans typically have a lower interest rate than most other loans, and you will agree to the terms prior to accepting the money, understanding the loan amount, the duration of the loan term, and the additional interest payments required on the loan.

It’s important to know the difference between personal loans, though. So, we’ve outlined the installment loan, which is generally the more popular option for loans. The other type of personal loan includes a short-term loan, which is a way to borrow money for a short period of time. Typically, these sorts of loans have fewer installments, if any, and are designed for a short-term solution to a financial issue. They typically have a higher interest rate than installment loans and are expected to be paid back quicker.

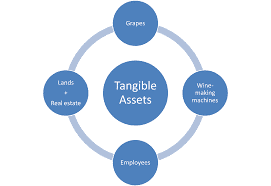

It’s important that you understand the difference between a secured loan and an unsecured loan. A secured loan refers to a loan that uses something as collateral, to protect the lender against the inability of the borrower to repay the loan. This often is your home if you’re a homeowner, or it could be against somebody else’s property if you used a co-signatory or guarantor for a secured personal loan.

An unsecured loan is your “normal” loan, which is simply the agreement to borrow money for a period of time and agree on the amount to be repaid. Whichever of these types of loans you decide to sign up for, remember that failure to repay can result in things like extreme debt, poor credit, bankruptcy, loss of your property, a civil judgment, or worse.

Personal loans are often used for things like debt consolidation, home repairs, medical bills, car costs, a wedding, or a vacation.

Credit Cards

Credit cards are among the best things you can have to build your credit score, particularly at a young age or with no previous lending history. They work by offering you a credit limit that you can spend on things, sometimes with rewards or points attached to them.

If you manage a credit card responsibly and correctly, you’ll spend under the credit limit, under the credit utilization ratio, and pay back what you owe in full when the payment is requested. Credit utilization refers to the amount you owe vs the amount you’re allowed to spend. Experts say you should try to keep this ratio as low as possible, preferably under 30%, in order to boost your credit score as high as possible.

Like with other lending options, credit cards often come with an interest rate, which comes into play if you do not pay off the full balance by the requested date. This can become really pricey if you owe a lot of money on one or multiple credit cards and cannot work the balance down.

At this point, you may consider looking at balance transfer credit cards at 0%. This allows you to move what you owe onto the credit card with 0% interest for a number of months, allowing you to repay the balance in chunks without paying additional interest fees. Bear in mind though, these offers are normally subject to variation – so after the time has elapsed, you may have to pay exorbitant interest fees after the 0% period has ended.

To put it briefly, unless you’re using a purchase card (long-term credit card), a credit card should only be used for a short-term solution and with a little amount spent on them, allowing for you to repay it in full at the end of the statement period. If you do this, your credit score will boom.

Overdrafts

An overdraft facility is normally offered by your bank. It’s usually a set amount of money to cover unexpected expenses, but it should not be used as a long-term financial solution. Often, banks will charge a monthly fee if you’re in your overdraft and often this can be extortionate.

To put it simply, if you have an overdraft facility, you should only use it for emergencies. Below, we’ve made it easy for you to see what the best options are for long and short-term borrowing.

Long-Term Borrowing: Personal loans, purchase cards

Short-Term Borrowing: Short-term loans, credit cards, overdrafts