A mortgage calculator is one of the most commonly used online tools for home shoppers. Because it gives you an idea of whether you can afford the home loan or not. This value makes homeshoppers go for the best and most accurate – Zillow Mortgage Calculator.

The Zillow Mortgage calculator is preferred by lots of consumers because it includes the full PITI expenses and gives you a very close estimate to your actual monthly mortgage cost.

More so, it is very thorough as it includes all the cost you are likely to incur as a homeowner, though there is room for error if you use it incorrectly.

Find out more about Zillows Mortgage calculator and its effectiveness in helping you have an idea of the feasibility of your home loan.

Let’s begin with a general overview.

Zillow Mortgage Calculator Overview

Zillow is well known to have an easy to use mortgage calculator. It is important to understand how a mortgage payment will fit into your budget, hence this mortgage calculator helps you breakdown your payment in full.

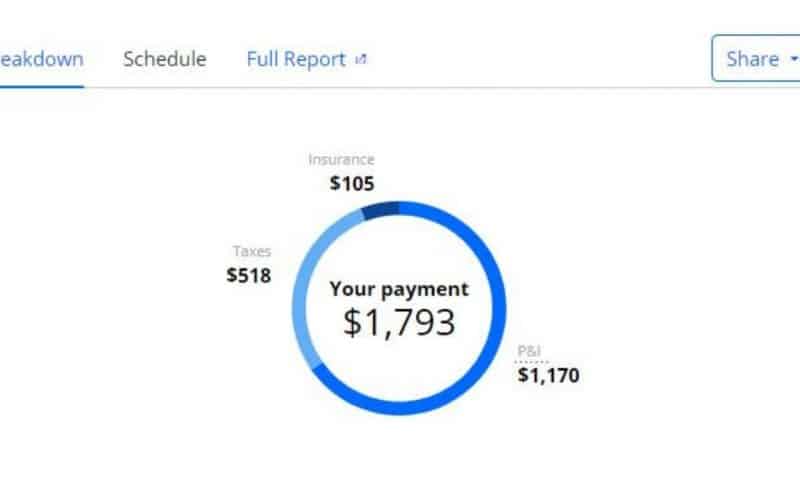

At first glance, you can see the principal, interest, taxes, and insurance it includes. However, you can opt to see the full breakdown for a complete amortization table and see the 1.2 percent property tax that is included.

Furthermore, the Zillow mortgage calculator has by default setting the full PITI (Principal, Intrest, Tax, Insurance) range of expenses. This means that because it includes taxes and insurance, consumers see it as a reliable and thorough mortgage calculator.

READ ALSO: Mortgage: Simple 2023 Guide for Beginners and all you need Updated!!!

How does Zillow Mortgage Calculator Work

You can use the Zillow home loan or mortgage calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees.

If you have an escrow account, you pay a particular amount towards these extra expenses as part of your monthly mortgage payment, which also includes your principal and interest.

Your mortgage lenders typically hold the money in your escrow account until your insurance and tax bills are due, and then pay them on your behalf.

In general, all you need to do is to enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. You can adjust the loan details to fit your scenario more accurately.

READ ALSO: BANK ACCOUNT BALANCE: 5 ways to spot Fake Account Balance Prank Easily (+ Quick Tips)

Parameters Involved When Using the Zillow Mortgage Calculator.

The following parameters are added by Zillow Mortgage calculator, to give you an accurate estimate of your mortgage payment.

#1. Home Price

This is the amount you paid for a home, or the amount you intend to pay for a future home purchase.

#2. Down Payment

Most home loans require at least a 3% down payment for the home. Although some loans like VA loans and some USDA loans allow zero down payment, its still important that you know that the higher your down payment, the lower your monthly payment will be.

#3. PMI

Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment.

In such a case where your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. This is a monthly cost that increases your mortgage payment.

#4. Interest Rate

Interest rate is the money you pay your lender yearly for borrowing their money, and is expressed in percentage rate. The calculator auto-populates the current average interest rate.

#5. Home Insurance

Homeowner’s insurance is based on the home price and is expressed as an annual premium. The calculator divides the total cost by 12 months to get your monthly mortgage payment.

Usually, average annual premiums cost less than 1% of the home price and protect your liability as the property owner.

READ ALSO: HOUSE POOR: Best Easy Guide to Buying a House Poor Credit (+ Free Tips)

#6. Property taxes

Your estimated annual property tax is based on the home purchase price. The total cost is divided by 12 months and added to each monthly mortgage payment.

#7. HOA dues

In some townhome or condos, some homeowners pay monthly Homeowner’s Association (HOA) fees to collectively pay for amenities, maintenance and some insurance.

When using the calculator, fill in the HOA dues if there’s any. And if there’s none, you can leave the field blank.

#8. Loan Program

Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5/1 ARM loan options in the calculator to see examples of how different loan terms result to different monthly payments.

Zillow Mortgage Calculator Equation

The traditional monthly mortgage payment calculation according to Zillows includes;

- Principal: The amount of money you borrowed.

- Interest: The cost of the loan.

- Mortgage insurance: The mandatory insurance to protect your lender’s investment of 80% or more of the home’s value.

- Escrow: The monthly cost of property taxes, HOA dues, and homeowner’s insurance.

- Payments: Multiply the years of your loan by 12 months to calculate the total number of payments. A 30-year term is 360 payments (30 years x 12 months = 360 payments).

READ ALSO: Credit Analyst: Job Description, Qualifications & Salary (US)

Is Zillow Mortgage Calculator Accurate?

This Zillow Mortgage Calculator review wouldn’t be complete if I don’t talk about its accuracy.

The truth is that the Zillow Mortgage Calculator is one of the best mortgage calculators available. And it didn’t get to this position by being inaccurate.

As a default setting, it includes the full PITI range of expenses and acknowledges private mortgage insurance. Although it can vary depending on your lender and the loan type that you sign on with.

In addition, it includes the private mortgage insurance at a rate of 0.5 percent. But this additional cost is required for borrowers who purchase a home with less than twenty percent down payment.

The Zillow mortgage calculator recognizes whether you have paid a full twenty percent down payment or not and calculates your mortgage accordingly.

If you intend to pay a down payment of twenty percent or more, the Zillow Mortgage calculator removes the private mortgage insurance from your estimated payment.

For the most part, experts say that the Zillow Mortgage calculator is fairly accurate. It allows consumers to put in their detailed information and receive estimates close to an actual monthly cost.

Alternative Ways to Use the Zillow Mortgage Calculator

Generally, mortgage calculators are used in calculating what mortgage payments will be like. But there are several other uses of a mortgage calculator which I’d highlight below.

#1. Know which loan type is suitable

The loan type you use to acquire a new home has a great influence on your monthly mortgage payment.

To see how much, choose your desired loan type from the “Loan program” drop-down on the mortgage calculator.

The payment will automatically change to incorporate the average interest rate and term for your selected loan type.

Seeing this impact on the monthly mortgage payment can help you decide which loan type is right for you.

The Zillow Mortgage Calculator has three types of loan type; 30-year fixed, 15-year fixed, and 5/1 ARM. If you’re looking for an FHA or VA loan, you can select any of the loan types from the drop-down.

You don’t need mortgage insurance for VA home loans, and in most cases, a down payment isn’t required either. However, for FHA loans, you’ll be required to put at least 3.5% down, and you’ll have to pay a monthly mortgage insurance premium.

READ ALSO: Best mortgage lenders: 2023 picks updated (+ detailed guide)

#2. Know the impact of several Interest rates

The interest rate you get for your home loan can affect your monthly mortgage amount. You can see this by entering different interest rates into the mortgage calculator and seeing the results.

Zillow mortgage calculator includes the average interest rates for the loan program and lets you see the differences.

#3. See your monthly mortgage payment

The total monthly mortgage payment you make doesn’t just go to repaying the principal amount. Some of it goes towards other different costs.

The Zillow mortgage calculator shows you the different areas it goes to. But just make sure the “include taxes/ins.”

According to Zillows, here’s a list of items you can see in your mortgage calculator.

- P&I: P&I represents the portion of your monthly payment that goes towards the principal and interest for your home loan.

- Insurance: Insurance is the estimated cost of homeowners insurance due every month. You can adjust this value in the mortgage calculator’s advanced options.

- Taxes: Taxes show the estimated property taxes based on the home’s value and location. You can adjust this value (or opt to remove the taxes and insurance) in the advanced options.

- PMI: PMI is private mortgage insurance (or “mortgage insurance premium” for FHA loans), which is often required if the down payment is less than 20% of the home’s purchase price. You can remove this in the advanced options of our mortgage calculator.

#4. See the total amount of interest you’ll pay

The Zillow mortgage calculator shows you a monthly breakdown of the amount of interest you’ll pay each month. But you can also see the total amount of interest you’ll pay over the life of your loan.

Click the “Schedule” tab above your mortgage calculator results to see an interactive graph showing the principal and interest paid (as well as the remaining balance) for each month.

READ ALSO: Mortgage Underwriter: Process, Salary, Jobs & How To Become a M.U Guide.

#5. Figure out what you can pay to get a new home

A mortgage calculator can be used to know what you can offer on a new home. By entering different loan amounts you’re considering, you can see if its well within your budget or above it.

More so, if you’re adding an escalation clause, you can get an idea of how much your monthly mortgage payment will be if the escalation clause sets in.

If you’d like to use the Zillows Mortgage Calculator, click the button below.

Does Google Have a Mortgage Calculator?

On your phone, type “mortgage” into Google and scroll through the adverts to get the tools. Mortgage jargon, rates, and a calculator are all included in the information, which is provided by the Consumer Financial Protection Bureau.

What Is the 36 28 Rule?

A Crucial Count For Home Buyers. You can use the 28/36 method to determine how much of your salary should go toward your mortgage. This rule states that your mortgage payment should not be greater than 28% of your pre-tax monthly income and 36% of your total debt. The debt-to-income (DTI) ratio is another name for this.

How Much Are Closing Costs?

You must pay fees when applying for a loan, which are referred to as closing costs or settlement costs. Closing expenses are normally paid at closing and range from 3–5% of your loan balance.

What Happens If I Pay 2 Extra Mortgage Payments a Year?

Your mortgage term will be shortened and you will be able to accumulate equity more quickly if you make additional principal payments. You’ll make fewer total payments due to the faster balance reduction, which will result in greater savings.

Which App Has the Most Accurate Home Value?

Because it derives its home worth estimates from more variables than any other app, including city and county assessments, nearby comparable sales of similar houses, and price historical trends, Trulia is the best for home valuations.

What Is the 35-45 Rule?

The 35%/45% model states that your entire monthly debt, which includes your mortgage payment, shouldn’t be more than 35% of your pre-tax income or 45% of your after-tax income. Discover your gross income before taxes and multiply it by 35% to determine how much you can afford using this strategy.

Who Usually Pays Closing Costs?

The conditions of the purchase agreement between the buyer and seller govern how closing fees are paid. The majority of closing costs are typically covered by the buyer, however, on occasion, the seller may also be required to foot some of the bills.

Bottom Line

The Zillows mortgage calculator is a good tool to use if you want to know what your home mortgage can be.

However, its best to not just do estimates. Get the actual numbers from your source, and weigh your options to see where you stand. Because minor mistakes can make or mar your loan.

All the best.

FAQs

How much of your income should go to mortgage?

The 28% rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g. principal, interest, taxes and insurance). To determine how much you can afford using this rule, multiply your monthly gross income by 28%.

Is Zillow home loans a mortgage broker?

Zillow Home Loans is a direct mortgage lender affiliated with Zillow Group. The digital lender provides mortgages in most states but doesn’t generally operate from branch locations. To apply for a loan or refinance, you can call or fill out a form on the lender’s website.

What is considered house poor?

When someone is house poor, it means that an individual is spending a large portion of their total monthly income on homeownership expenses such as monthly mortgage payments, property taxes, maintenance, utilities, and insurance.

- Financial Instruments: Definition, Types and Examples

- Certified Financial Analyst: Definition, Requirements, Fees, Salary (+ quick tips)

- INCREMENTAL CASH FLOW: Meaning, Calculations, Importance, And Limitations

- Microfinance: Definition, Importance, History, Institutions (+ Loan details and Tips)

- What Are Hard Money Lenders & How to Find Them in the US