Most people are confused when they come across the phrase “Writing a covered call”. However, it does not necessarily mean ‘writing’ literally. In the financial market, writing a covered call means selling a covered call. Nevertheless, this article will discuss writing a covered call option for a living and its examples.

But before learning how to write a covered call, let’s first take a brief look at the meaning of a covered call.

Covered Call

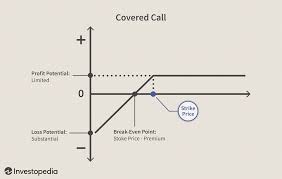

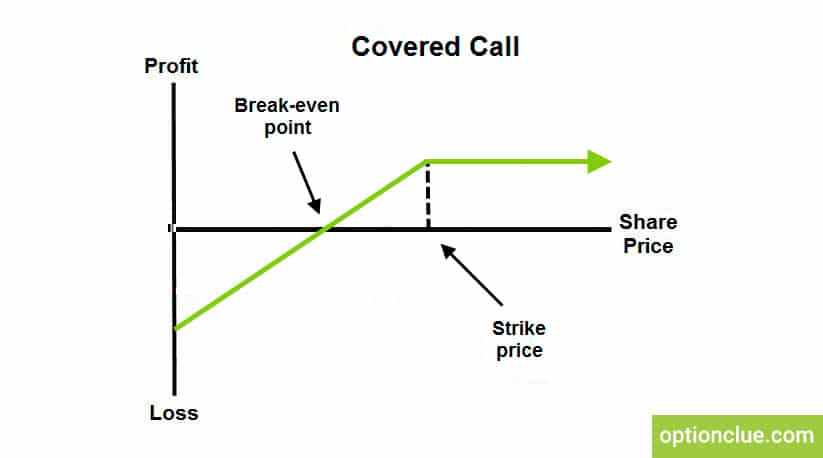

A covered call is a risk management and an options strategy. It includes holding a lasting position in the underlying asset, such as stock. It also sells a call option on the underlying asset. Investors commonly employ the strategy who believes that the underlying asset will undergo only insignificant price changes.

Additionally, A covered call relates to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To do this, an investor holding a long position in an asset will write (sell) call options on that same asset to produce an income stream.

However, the investor’s long position in the asset is the “cover”. It shows that the seller can deliver the shares if the call option buyer decides to operate.

Furthermore, if the investor simultaneously buys a stock and writes call options against that stock position, it is called a “buy-write” transaction.

Writing a Covered Call

The act of writing means to sell in a financial market. So writing a covered call option is about selling someone else the right to buy a stock that you already own, at a specific price. Indeed, one option contract usually denotes 100 shares. Hence, to run this strategy, an investor must own at least 100 shares for every call contract he/she plans to sell.

However, after selling/writing the call, you will pocket the premium right immediately. Nevertheless, the fact that you own the stock means you are covered if the stock price rises past the strike price. Hence, when the call options are assigned, you will deliver the stock you already own, reaping the additional benefit of the uptick on the stock.

Generally, the investor gets a premium for writing the call options. But if the price of the underlying security falls, the options only protect the investor in an amount equivalent to the premium received.

However, writing call options can be a good tactic for traders who are bullish enough to risk stock ownership. But must also not be so bullish that they anticipate a large price increase.

Writing a covered call for a living has some advantages and also some potential setbacks. Let us take a look at some of them.

Advantages

Income:

Investors receive the option premium by selling one call option for every 100 shares of stock owned. The money is for the investor, no matter what happens in the future.

Safety:

Any premium received by the investors offers the stockholder limited protection against a loss in a case where the stock price reduces.

Disadvantages

Capital gains:

Investors writing a covered call limits their profits. Their maximum selling price usually becomes the strike price of the option. Indeed, they get to add the premium received to the sale price. However, if the stock rises sharply, the covered call writer loses out on the possibility of a big profit.

Flexibility:

As long as an investor sells the call, but it has neither expired nor been covered, he cannot sell his stock. Doing so would leave him “naked short” the call option.

Certain Misunderstandings About Writing A Covered Call Option

There are certain misconceptions people have about writing a covered call option.

Covered-call writing should only be done in flat markets

This strategy can be crafted to thrive in all market situations. However, you accomplish this by selecting the most appropriate underlying in bull (more volatile) and bear (less volatile) markets. Also by the best options in bull (out-of-the-money) and bear (in-the-money) markets.

Focus in on stocks & and options that generate returns

Indeed, an option premium is directly linked to the implied volatility of the stock or exchange-traded fund (ETF). However, covered-call option writing is a traditional approach with capital preservation a key condition. Furthermore, by selecting high-IV stocks, you are increasing the strategy to a risky one.

Sell winners and retain losers

Truly, when we sell a covered call option, we are accepting a duty to sell the stock. However, we can terminate that agreement by closing the short call option. Nevertheless, understanding the exit strategy skill will leave us in control.

Sell options before an earnings reports

Finally, never sell an option before an earnings release. There is too much risk connected with a disappointing report. However, allow the report to pass and then write the call if the underlying meets our system requirements. Again, covered-call writing is a traditional strategy where we can generate dependable modest returns that will surpass the market on a regular basis. Indeed, we can avoid the risk and not embrace it.

Writing Covered Call Example

There are certain examples when writing a covered call for a living. Let us take a look at some of the scenarios that can occur.

Scenario One: When the Stocks goes down

If the stock price is down when the option expires, the call will expire worthlessly, and you will have the whole premium earned for selling it. However, the bad news is that the value of the stock is down. Nevertheless, that’s the nature of a covered call. The risk arises from owning the stock. However, the profit from the sale of the call can help balance the loss on the stock slightly.

Scenario Two: If the stock goes up slightly, but not up to the Strike Price

In this case, there is really no bad news. Generally, the call option you sold will expire worthlessly, so you collect the complete premium from selling it. Perhaps you’ve seen some profits on the underlying stock, which you will still own. This also applies when the stock remains the same.

Scenario Three: When the Stock Rises Above the Strike Price

If the stock is above the strike price at closing, the call option will be distributed and you’ll have to sell 100 shares of the stock.

However, If the stock rise after you sell the shares, you might feel bad for missing out on any additional gains but don’t. Indeed, you made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy.

Now let us take an example when writing a covered call for a living.

Writing a Covered Call For a Living

Assuming we have been investing in Apple for quite some time and are sitting on tangible gains. We believe and think that the current valuation is slightly increased but moderate when compared to other big tech stocks.

We can shield ourselves somewhat by selling(writing) call options against our Apple stock position. When we do this, we are trading upside for protection. Hence, we receive some money for selling the call option but in return, we lose out on any money we would have made if Apple’s stock price moves above the strike price on our option.

Conclusion

In summary, If the stock rise after you sell the shares, you might feel bad for missing out on any additional gains but don’t. Indeed, you made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy.

WRITING A COVERED CALL FAQ

Is it worth writing covered calls?

Most of the time, covered calls work best when the investor doesn’t have a personal connection to the stock. It is usually easier to make rational decisions about selling a new stock than it is to make rational decisions about keeping stock for a long time.

What is a covered call example?

If the stock price is down when the option expires, the call will expire worthlessly, and you will have the whole premium earned for selling it. However, the bad news is that the value of the stock is down. Nevertheless, that’s the nature of a covered call. The risk arises from owning the stock. However, the profit from the sale of the call can help balance the loss on the stock slightly.

- COVERED CALL OPTION: How To Use Covered Call Option Strategy Effectively (+ Detailed Guide)

- SHORT PUT OPTION: Overview, Examples (+trading tips)

- COVERED CALL Explained: Understanding Covered call Formula With Examples

- Short Call vs Long Call Explained! Comparing risks and rewards

- PUT OPTIONS: How to trade put options in simple steps