If I sell groceries, should I use the net 30 modes of payment? You may, but then, is it appropriate? Will your cash flow survive the delayed payment? Will your business stay afloat and functional when several people have over a four-week interval to pay you? You need to provide answers to these questions and more before deciding to use net 30 as a mode of payment. Generally, it offers renowned businesses immense benefits, but it also comes with its disadvantages. Let’s see what net 30 payment terms are all about, its example, template, as well as some of the top companies in the US that offer this payment method.

Net 30 Payment Terms

If you reside within the United States or the United Kingdom, then net 30 payment terms aren’t something new because it’s one of the most common payment terms in these environments. It’s a form of credit service in which businesses give out goods or services and extend the payment over 30 days. Businesses that use accounting or invoicing software can effectively include these credit terms in generating invoices. When you see “net 30” on an invoice, it means the customer has 30 calendar days to make payment after being invoiced. You must, however, note that net 30 is strictly a thirty-day payment period, not thirty business days. This simply means the days include weekends.

In simpler terms, net 30 simply means that you are granting credit to your customer and expect them to pay the net, or the whole amount of the invoice, within 30 days of the invoice date. This indicates that the invoice must be paid in full by the end of the month after it is issued.

How Does Net 30 Payment Terms Work?

Every business has the right to choose its payment terms, and if you decide to use the net payment terms, 30 is a great option. Although there are businesses that opt for net 10, 14, 20, or even net 60 payment terms. In real terms, this is a credit term that is seen as an invoice. You will simply indicate net 30 as the payment terms on your invoice and then deliver the goods or service to your customer along with the invoice. The customer in question is expected to make payment on or before 30 days elapses. Generally, the net 30 payment grace starts to count immediately after the issuance of an invoice after a sale or delivery.

Can I Get Discounts With Net Payment?

Definitely. However, this depends on the business mode of payment.

For instance, an invoice can come with 2/10 terms. This simply means you will get a 2 percent discount if you pay within the first 10 days of your 30-day term. Businesses use discounts as a tool to boost early payment.

Net 30 Payment Terms: Benefits

Businesses that use this payment method enjoy the following benefits;

#1. More Clients

Using Net 30 payment terms serves as an added perk for customers to do business with you. Most customers will choose this over immediate payment. They know full well they have a grace period of 30 days. Additionally, a satisfied customer will always tell someone else. This simply means that your customer base will rapidly increase if you opt to use this payment method.

#2. Build Trust

It’s important to keep in mind that giving your customers credit shows that you trust them, which is likely to result in a positive connection and potential future business.

#3. Connects Small Businesses with Big Companies

Bureaucracy is common in large businesses. Considering the series of signatures that need to be signed before the money is released, a 30-payment term is perfect for them.

Net 30 Payment Terms: Drawbacks

Although using this payment method has great benefits for businesses, it also comes with certain drawbacks. Some of these are as follows;

#1. Negative Effect on Cash Flow

Credit facilities increase sales but have a reverse effect on cash flow. You need to restock your products or services, and waiting for 30 days to receive payment isn’t healthy for your business. It doesn’t just affect your cash flow, it equally affects your opportunity cost.

#2. Default Payment

Offering credit delivery or sales originally shouldn’t result in late payment because 30 days have already been given. Unfortunately, the reverse is also the case. Some customers will still default on their payment even though it comes with penalty fees.

#3. Chances of No Payment

Bad debts are also one of the drawbacks of net 30 payments. Aside from dealing with delayed payment, you will also face the problem of no payment.

#4. Not For Startups and Small Businesses

Startups and new businesses will have a hard time using this payment method.

Where Do Business Owners Include Net 30 on an Invoice?

Generally, you can include up to 30 terms in two different places. These are at your payment due date and your payment terms.

Net 30 EOM

EOM means the end of the month. So-net 30 EOM simply means the payment is due 30 days after the end of the month in which you sent the invoice.

Is Net 30 Payment Terms the Same as Net 30 EOM?

Not really. However, both are similar. Net 30 payment terms simply mean payment begins to count from the day the invoice is issued, while net 30 EOM means the payment deadline is at the end of the month. For instance, if you and your client agree to a net 30 EOM payment schedule, and you send them an invoice on October 19th, their payment is due on November 30th, or 30 days after October 31st. This is unlike the net 30 payment that will be due on the 18th of November.

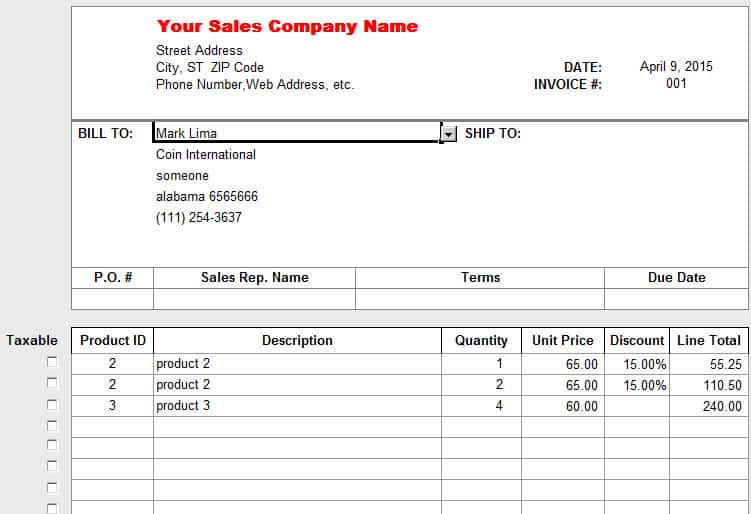

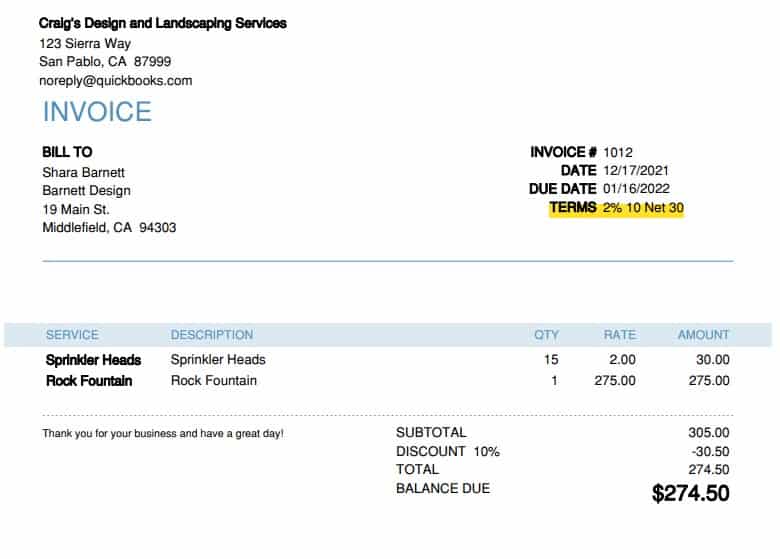

Net 30 Payment Terms Template

Businesses can get a net 30 payment terms template online. Every business can also customize its net 30 payment terms template to suit its business objectives. In reality, there is no specific set of rules or guidelines that indicate uniformity in business net 30 invoices.

Net 30 Payment Terms Template Example

Every net 30 payment terms template has something in common, irrespective of the business in question. Take a look at the following templates

Net 30 Payment Terms Example

Let’s check out this example of a net 30 payment term.

Cakesmith ordered stationery from Summa office supplies on the 5th of June and received a net 30 payment invoice. It simply means that Cakesmith is supposed to pay his clear his account on or before the 30 days term, which is the 4th day of July.

Let’s see another practical net 30 payment terms example with a discount offer. Smith hired Allison Lawn Care to mow his lawn. Allison’s Lawn Care, after completing the job, gave him an invoice on the 2nd of March with 3/10 on a net 30 payment. The 3/10 on the net 30 simply means, supposing Smith pays within the first 10 days, he will get a 3% discount on the total bill. Additionally, if Smith decides not to utilize the discount offer, he must clear his account on or before the 1st of April.

Net 30 Payment Terms Example: Companies That offer Net 30

The following are some of the businesses that offer customers a net 30 payment terms.

- Ohana Office Products

- Crown Office Supplies (and Shrtsy)

- Business T-Shirt Club

- Quill

- Amazon ( Pay by Invoice)

- Grainger

- Office Garner

- Creative Analytics

- Summa Office Supplies

- Walmart (Community Card)

Net 30 payment Terms Contract Language

Before using the net 30 payment method, make sure you assess your business’s financial strength, particularly for new businesses. If it will negatively affect your cash flow, avoid it at all costs. But if it wouldn’t, it’s a great way to increase the volume of sales. However, make sure you include net 30 in the column provided for payment terms using contract language. Also, ensure your client understands it before you start the project if net 30 sounds like the best option for your company. Every business can use net 30 payment terms if clients accept it and sign the contract language agreement.

What is a Contract Language?

According to IBM, the contract language consists of clauses, terms, lines, line definitions and formatting, and any pre-execution attachments. Whether these terms can be modified or not depends on the level at which the contract is at as well as the contract in question. There are just terms that can’t be replaced or modified in a contract.

Other Types of Invoice Payment

Aside from net 30 invoices, there are other forms of invoice payment that businesses can adopt. However, your payment terms must be clear to the public, so do well to specify them. Some of these are as follows;

#1. Payment in Advance (PIA)

PIA means “pay in advance.” These are invoicing systems that demand payment before the goods are delivered. It simply means that before obtaining the goods or services, the client must make payment. This is ideal for startups, but then, it depends on the kind of business in question.

#2. End of the Month (EOM)

A reference is made to the conclusion of a current or next calendar month. EOM is also possible with a net 30 payment term.

#3. Cash on Delivery

This form of invoice payment means a client must make payment for the goods or services as soon as they are received, whether it be by cash-on-delivery (COD), immediate payment, or payment upon receipt. This is mostly used by order to cash businesses.

What do terms 1/10 net 30 mean?

A method of offering cash discounts on purchases is the 1%/10 net 30 computation. It signifies that there is a 1% reduction if the bill is paid in full within 10 days. Otherwise, full payment is expected within 30 days.

What are 2% net 30 terms?

The seller gave the buyer a trade credit of 2/10 net 30. A buyer who pays the invoice in full within the first ten days of the invoice date will get a 2% reduction on the net amount. Otherwise, there is no discount, and the entire invoice amount is due within 30 days.

Can you pay net 30 with a credit card?

Payment can be made by check, ACH, or credit card from the customer. All invoices that are not paid within 30 days will be subject to an extra 1.75% per month interest penalty (21% annual percentage rate).

What does the term 5 15 net 30 mean?

A small firm may also provide a discount to encourage customers to make payments before the deadline.

What does net 3 mean?

If your customer pays within the first 10 days of receiving the invoice, you can offer them a 3% early payment discount known as a net 3/10 30 or 3/10 net 30. The “3” denotes the percentage off, while the “10” denotes the number of days the discount is valid.

What does net 45 payment terms mean?

Net 45: What is it? The term “Net 45” refers to the requirement that an invoice be paid within 45 days of receipt. An early payment discount may be made available by a seller occasionally.

Is Home Depot a net 30 account?

A Net 30 account provided by Home Depot in collaboration with Citibank is known as a commercial account. It includes itemized billing statements, online account management, and flexible payment methods and is only available to businesses.

Conclusion

Net 30 is great but not appropriate for every business. Therefore, it’s always advisable to use a payment method that’s in line with your business objective as well as one that will help build your business. So if 30 days payment method will affect your business, kindly shy away from it completely.

Net 30 Payment Terms FAQs

Can you make an early payment of on net 30 terms?

Of course, you can. In most cases, you’d be getting a discount when payments are made earlier. However, this depends on the vendor in question as well as the type of discount provided. For example, a vendor may include 3/10 on your net 30 payment invoice terms. This simply means that you will be getting a 3% discount if you make payment within the first 10 days of your thirty days terms.

Doesnet 30 include weekends and public holidays?

Yes, it does. Net 30 simply means 30 calendar days and not thirty business days that exclude weekends.

What is the penalty for defaulting my net 30 payment?

All invoices that are not paid within 30 days will be subject to an extra 1.75 percent per month interest penalty (21 percent annual percentage rate).

- Invoice Financing: Definition, Types, Pros & Cons

- Invoice Financing vs. Factoring: Overview, Differences & Similarities

- Invoice Factoring: All You Need to be Explained!! (+ Loan Options)

- Invoice Discounting: Explained!! (+ Quick tools & amp; all you need)

- Business NET 30 ACCOUNTS 2023: Top Picks & All You Need to Know