In the United States, biweekly is the most common pay cycle for a business. Biweekly pay means paying your workforce every two weeks on a fixed day. This gives a total of 26 paychecks per year. Furthermore, since paychecks are issued every two weeks, so certain months will have three. If the majority of the staff work on an hourly basis, biweekly payroll can be beneficial. For the most part, workers often appreciate being paid more often (as opposed to monthly or semimonthly).

Continue reading if you’re unsure which pay cycle choice is better for your business or just want to learn more about biweekly pay.

What is Biweekly Pay?

Biweekly compensation entails paying the workers every two weeks on a predetermined day.

For example, you could decide to pay your workers every two weeks on Friday.

However, it makes no difference when you pay your employees: you can pay them on the 4th one month and the 1st the next. It is only enough to make a payment every two weeks.

This might seem straightforward, but it means you’ll have three pay periods rather than two for two months out of the year.

Benefits of Biweekly Pay

- In contrast to weekly pay cycles, the HR team only has to process payroll once every two weeks, which can reduce the risk of payroll mistakes and time wasted on payroll processing.

- Employees earn more paychecks during the year than they will on a semimonthly basis, even though those paychecks are marginally smaller.

- Employees appreciate the consistency of a biweekly system; for example, an employee would expect to receive a paycheck every other Friday. The days of the week would vary for a semimonthly pay schedule, with an employee possibly getting a paycheck on Monday and then another on Wednesday.

- It is likely to make the workers happier than working on a monthly schedule, which forces them to prepare for a longer period of time.

Cons to Biweekly Pay

- If you use biweekly pay, the company must budget for the months of three paychecks and ensure that the payroll department has enough money to cover those additional expenses.

- Your payroll service provider can charge your company per payroll run, resulting in higher annual fees than if you choose semimonthly.

- Your workers may prefer to be paid every week so that their bank balances are more consistent.

- Employees can appreciate weekly pay for a sense of security if your industry operates on contract work, where projects can stall for long periods of time.

- When it comes to determining a pay period, it’s important to think about what your rivals are doing as well as what makes the most sense for your workers. The size of your HR staff, whether you can find a payroll provider with reasonable payroll fees, and whether your employees are salaried or hourly workers can all influence your decision.

How many Biweekly pay periods in 2023?

In 2023, there will be 26 biweekly pay dates. Since biweekly means once every two weeks, all you have to do is divide the number of weeks in 2023 (52 in total) by two.

Semimonthly vs. Biweekly: What’s the Difference?

At first glance, these two words seem to be interchangeable: once every two weeks or twice a month, aren’t they?

They aren’t, in reality. Your workers will be paid semimonthly on two separate days of the month, regardless of when they fall. You may, for example, pay your workers on the 15th and 30th of each month. Biweekly, on the other hand, guarantees workers a paycheck every two weeks, regardless of the day of the month.

Employees under the semimonthly category will earn 24 instead of 26 paychecks a year. Furthermore, depending on the month, the 15th and 30th of each month can fall on a holiday or weekend, so the HR team must stay on top of processing deadlines and pay dates to ensure that your workers receive a paycheck.

How to Work Out Your Biweekly Salary

- Calculate your annual gross pay.

- Divide the resultant figure by 26.

- That is the sum you will be paid biweekly.

- Take your biweekly paycheck and divide it by the number of hours worked every two weeks to get your hourly wage.

For example, a person earning 60,000 dollars per year would earn $2,307.69 biweekly or $28.84 per hour for a 40-hour workweek.

If you have money deducted from your paycheck for benefits like health care or a 401(k), you will need to consider those.

What Does Biweekly Payments Mean?

When you switch to biweekly payments, you’ll pay every two weeks. If you were paying $1,200 a month, you will now pay $600 every two weeks. Because some months are longer than others, you’ll end up making an extra mortgage payment every year.

Does Biweekly Mean You Get Paid for Two Weeks?

Employees are usually paid every two weeks, on Fridays. This is called a biweekly pay schedule. For example, if your employees got paid on October 8 and October 22 of 2023, that means you paid them every two weeks.

How Do I Calculate My Biweekly Salary?

In a year with 52 weeks, people get paid 26 times every two weeks. To figure out a salaried employee’s gross pay every two weeks, divide their annual pay by 26. For example, if they make $52,000 a year, their gross pay every two weeks is $2,000.

Why Do Companies Do Biweekly Pay?

When an employer pays employees every two weeks instead of every week, payroll only needs to be done once every two weeks. This cuts in half the amount of time it takes to do payroll processing. Payroll mistakes are also less likely when payroll is done every two weeks.

What Are the Disadvantages of Getting Paid Biweekly?

Cons of Paying Bi-Weekly:

- From the employee’s point of view, budgeting is hard because: When you get paid every two weeks, it can be harder to make a budget.

- Forced to Take a Vacation With Their Pay

- Likely to Make Less Money

- Harder Time Managing Expenses

- PAYMENT DATE: 2023 Dividend, SSI stimulus & SSA Stimulus Dates (Updated)

- BALANCE OF PAYMENTS: Definition and Components

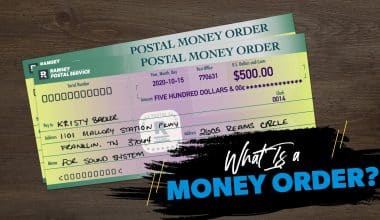

- How do Money Orders Work? (+How to Buy with Debit Cards)

- Check Fraud: Definition, Types, How to Avoid them (+ Quick Tools)

- Can you Buy a Money Order with a Credit Card? (Pros & Cons)