This is a rich guide to understanding all there is to know about the Beneficiary of a Trust, Irrevocable Trust Beneficiary, What is a Trust Beneficiary, Trust Beneficiary Rights, and Irrevocable Trust Beneficiary Rights California.

What is the Beneficiary Of A Trust?

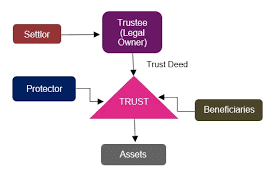

A beneficiary of a trust is an individual or set of individuals who need the trust. The creator of the trust or grantor assigns a trustee and beneficiaries. The trustee must be someone who is trustworthy. He should be someone who is able to manage the trust assets in the best possible way for the beneficiaries as stated in the trust agreement.

Also, individuals establish trusts for the efficient transfer of wealth to the beneficiaries. People also establish trusts for estate tax protection and to acquire certain gifts.

In addition, in estate planning, Trusts are a very important piece and are not there for just the wealthy and influential. There are several reasons for creating a trust. Some of them are;

- To have and to hold assets until you’re older.

- Strategies for Income and estate tax planning.

- Financial coverage

- To pass on a family legacy

Irrevocable Trust Beneficiary

Beneficiaries of an irrevocable trust have the right to information about the trust and to ensure the trustee is acting accordingly. The scope of those rights depends directly on the type of beneficiary or beneficiaries.

An irrevocable trust beneficiary is a person who is to receive the assets in a life insurance policy or an isolated fund contract.

An irrevocable trust is a type of trust that is rigid such that the terms cannot be amended, adjusted, or canceled without the immediate permission of the beneficiaries designated by the grantor.

The grantor effectively transfers all ownership of assets into the trust. He also removes all their rights of ownership to the assets and the trust legally.

Read Also: POUR-OVER WILL: Best US Practices and all you need (+Detailed Guide)

Consequently, this is in contradiction to the revocable trust. This is because the revocable trust allows the grantor to adjust and amend the trust. But, further loses some benefits like creditor protection.

An irrevocable trust is a type of trust that is indefinite. This is because it’s not flexible and it cannot be changed once created.

It is set up for giving the grantor the capacity to reduce their estate taxable rate. This should be while still giving to charity, heirs, etc.

The irrevocable trust is normally put up for tax and estate considerations.

Read Also: Debt Securities(D.S): Definition, types with examples

What are the benefit of the irrevocable trust?

- It effectively separating all ties of ownership by separating the assets of the trust from the grantor’s taxable estate.

- Also, it relieves the grantor of the liability of the tax on the income the assets generate.

The tax rule varies between authorities. In several cases, the grantor cannot receive these benefits when they are the trustee of the trust.

The assets held in the trust may include business to investment assets, life insurance policies, and cash.

Irrevocable trusts offer benefits of tax-shelter while revocable trusts do not offer those benefits.

Irrevocable trusts are mostly useful to persons or individuals who work in professions that can put them at risk of lawsuits. It is usually Professions like attorneys or doctors.

For instance, in the crypto world, Once any property is transferred to a trust wallet, it is said to be owned by the trust and for the benefit of the designated beneficiaries.

However, it is safe from creditors and legal judgments because the trust will not be a party to any lawsuit.

Irrevocable trusts today, come with so many provisions that weren’t commonly seen in old versions of these instruments.

These inclusions make room for greater flexibility in trust distribution and management of assets. Provisions like allowing the movement of a trust into a new trust which has more current provisions can ensure a lot. It can make sure that the trust assets will be effective now and in the future.

Those other features that can allow the trust to change its state of dwelling can provide additional benefits like tax savings.

What Is A Trust Beneficiary

A trust beneficiary is a person or company who is receiving their income from a trust. The said beneficiary receives a particular amount of money which is usually a percentage of the investment of the trust’s income starting at the agreed time.

It can be a trustee, the grantor, or some third party, depending on the type of trust in view.

Trust Beneficiary Rights

The State law highly governs the rights of beneficiaries to different trusts. Also, they totally have a general power to monitor the trust activities and the trustee.

Trustees usually send out annual trust reports to beneficiaries detailing everything. The gains, losses, and expenses such as commission fees of the trust asset.

However, If a trustee fails to send at least one annual report, the beneficiary or beneficiaries can make a request. A request for an accounting of trust investments from the court.

Also, If the beneficiaries suspect that the trustee has breached their trusted duty to wisely manage trust assets. Then, the beneficiaries can take up legal action to sue or replace the trustee.

These actions are totally handled by writing a petition to the local probate court.

In various cases, the trustee can be held accountable for the loss of the trust principal. They can also be held responsible for unrealized income due to misconduct.

Such violations may include poor investment decisions, bribery, and leeching off the trust.

Should all beneficiaries be adults who are wise and logical and unite to terminate a trust. Then, they can take legal action to do so.

In dominating cases, the court may have to rule in a certain way. In that, the objective of the grantor for creating the trust has been actualized.

Irrevocable Trust Beneficiary Rights California

In California, California Probate Code §16060 protects the Beneficiary’s rights on irrevocable trusts.

It states the trustee has a responsibility to keep the beneficiaries completely informed on the status of the process of probate, and the beneficiary or beneficiaries can reinforce their rights by writing a probate court petition.

California allows adjustment, amendment, or termination of the irrevocable trust without anyone compulsorily having to go to court.

In conclusion. Under California Probate Code section 15404(a), if all of the trust beneficiaries without opposition approve adjustment, amendment, or termination of the trust, they can do it without necessarily acquiring court approval.

What happens when a beneficiary of a trust dies?

When the beneficiary of a revocable trust dies before the settlor, all the settlor needs to do is simply rewrite his trust instrument to address the change of beneficiary. If the beneficiary dies after the settlor and the trust still holds the property on behalf of the beneficiary, the property often moves to the beneficiary’s estate.

What happens to money in a trust if the beneficiary dies?

If a beneficiary dies before the Settlor, the share of the Beneficiary’s Trust assets will be passed on to whoever is specified in the Trust. In a wide majority of Trust documents, when a Beneficiary survives the Settlor, then his or her share of the Trust is conferred and cannot be taken away.

What happens when one person in a trust dies?

when the death of one spouse occurs, automatically, the trust will be split into two trusts. Each trust will own half of the assets of the trust along with the separate property of the spouse. Then, the surviving spouse is the trustee over both trusts.