Best dividend funds, what are they?

When it comes to investing, many factors play out: the economic condition of a country, the nature of the stock to be invested, your portfolio capital, risk appetite, and a whole lot more.

Talking about one’s risk appetite, most investment assets are a turn-off because of the high volatility this asset carries.

However, certain asset classes favor low-risk investors because of their low-cost entry and steady cash flow, among them, dividend funds stand out.

This article is geared towards providing in-depth information on the best dividend funds of 2023 and everything you need to know about this type of asset. Without further ado, we proceed.

Dividend Funds

Dividend Funds are a kind of stock that pays a dividend to holders of a such mutual fund, rather than banking on the sales of a stock when it appreciates, dividend stocks would pay at a stipulated time according to the company’s fiscal year.

The best dividend funds tend to be the most low-risk investors’ haven as they provide the opportunity for a steady income and avoid the contingencies arising from trading in ordinary stocks, high taxes, vo, volatility, and decline in stock value are among these contingencies.

While many investment assets are floating around the financial market, it is recommended to check in with a fund manager to know exactly what investment is a good one to try and to avoid the myriad of problems listed above.

In the next section, we would do well to uncover the myth around the authenticity of having a dividend fund as an investment option.

Is a Dividend Fund a Good Investment?

The answer depends on exactly your aim in investing, if you are after high yielding and volatile instrument fetching returns in a short space of time, having dividend funds as an investment may stall your financial goals.

On the other hand, if the slow and steady approach to Investment piques your interest, then testing the waters on dividends may be something worth trying. This alternative carries with it a positive portfolio build-up which could include:

- A Steady Source of Income

- Good performance during a downtrend market

- Favorable Tax rate etc.

#1. Steady Source of Income

The best dividend funds provide a stable income source, as this type of investment choice weathers the storm in investing, especially in stocks and other highly volatile instruments that respond to economic noise.

The payout of a dividend fund could be quarterly, monthly, yearly, or twice a month, whatever the time frame, this type of investment pays its holders its dividend, so it is advisable to choose a dividend fund known to pay monthly to fully enjoy the benefit of your investment.

#2. Good performance during a Downtrend Market.

Unlike traditional stocks and shares when for optimum profit, the market has to be bullish, a dividend fund investment is the direct opposite. A bear market is the best bet for a high ROI and here is why

When a dividend fund price goes down, this attracts newbies in investing to acquire such assets and while this happens, the company makes a profit from the sales of its new stock and in turn, would make available dividends to old and new subscribers. The reverse is the case with ordinary stock.

#3. Favorable Tax Rate

Since this type of mutual fund pools resources from different investors, the tax rate on an investor’s dividend is minimal when compared to the tax rate of an ordinary stock.

This is so because the IRS doesn’t treat mutual funds the same way as it does ordinary stocks and other equities that often stand alone in their outlook.

Dividend Funds are good investments to try if the thought of growing your financial portfolio in the long run appeals to you.

Another problem with dividend funds is finding stocks that are high paying in their dividend and how to take advantage of this listing. Below is a breakdown of the highest-paying dividend fund.

What is the Highest-paying Dividend Fund?

The best Dividend Funds aren’t plated in gold for you to know that they are the best, most low-yielding dividend funds over time perform better than high-yielding ones and this is dependent on many factors.

To assess a high-payment dividend fund the following considerations should be put in place:

- Allows for reinvestment (DRIPs)

- Good Dividend Growth

- Dividend Quality

- Tax rate

#1. Allows for Reinvestment

The best dividend fund makes it possible to pull back profit into a share to grow investors’ portfolios, while this is not much of a problem among dividend fund managers, some administrators still prohibit reinvestment for a reason.

This may be to avert a low dividend payment shortly or a probable winding up of the company, which tells us that

such fund managers are questionable and should be avoidable at all costs.

#2. Good Dividend Growth

A thorough analysis of whatever dividend fund one is willing to go for is highly recommended, this is to ascertain the growth of the stock over time, and also to determine which would yield more upon your investing.

The highest-paying dividend has good dividend growth, that is, the ability for the underlying stock to grow and yield more profit for the company and portfolio of investors in the long run. This should be considered when looking for the highest-paying dividend fund.

#3. Dividend Quality

A high-paying dividend fund has a good dividend quality and by that, it means that the stock in which the dividend is paid is worth investing in and can in the long run stand economic turbulence.

Most establishments during the first 2-5 years tend to show growth in their stock but as time goes by, competition, managerial policies, and sales decline plummet their stocks, this isn’t the same with the shares of large Corporations.

This goes to show that the highest-paying dividend fund has good dividend quality.

#4. Favorable Tax Rate

A good dividend fund’s growth and dividend fund quality aren’t enough when considering the highest-paying dividend fund, to enjoy the perks of a good-paying dividend fund, knowing the tax rate on the fund is also another to consider.

A low tax rate on a stock when it comes to the dividend to be paid is likely to make an investor plunge more into the asset given.

Retirees and the aged willing to improve their investment portfolio may be caught in a web of trying to find the best dividend fund to invest in, the next slide does justice to their worries.

Best Dividend Funds for Retirement.

Utility stocks, Tech stocks, Real Estate, Mutual funds, and a host of other portfolios are one of the best dividend funds to invest in.

Dividend Funds are one of the best assets to have as equity and if ever you doubt it, here are reasons why they are a good investment to try.

Is a Dividend Fund a Good Investment?

A dividend fund provides ease, good cash flow, an avenue to reinvest dividends earned plus the low risk Involved, assuming that this class isn’t a good investment deal would be a fallacy.

While some of these mutual funds have a quarterly payment plan, they exist very good dividend funds that pay monthly. These stocks over time have recorded steady growth in their dividend yield and earnings per share.

The section below highlights the stocks as well as their dividend value

Which is the Best Monthly Dividend Mutual Fund?

The best mutual fund has been able to weather the hardship of the economic crunch and has applied sound growth principles that show the value of their stock and hence earned a profit for investors of these shares.

In no particular order, the stock listed below covers one of the best monthly donation-paying mutual funds, they include:

- EPR

- LTC Properties

- SL Green

#1. EPR

This real estate magnate, which is listed on the NYSE, has a high percentage dividend yield of 8.3% despite the turbulence of the covid-19 pandemic where they had to shut down operations.

Investors in the company have seen their dividends go up since the lockdown was lifted and the company was recently bought. The company offers rental and other recreational building services.

#2. LTC Properties

Another real estate company that provides medical and nursing homes to veterans and medical professionals has also had a fair bit of an economic crunch during the pandemic but has witnessed a significant bounce back and an increase in the earnings per share of their stock. This feat drove their dividend yield to a 6.1% benchmark.

#3. SL Green

Also trading on the New York Stock Exchange, SL Green provides offices and large cooperatives with state-of-the-art buildings and office facilities, and like their counterpart, they witnessed a slight drop in the share value during the covid-19 pandemic.

Thanks to the high profit and increased revenue from previous business activities, the firm maintains a positive dividend yield value of about 8.8%, giving investors a reason to reinvest their earnings.

There you have it, some of the best monthly paying dividend mutual funds, maybe you want a dividend fund that is likely to perform this year, then sit back as we bring to you the best dividend funds for 2023.

Best Dividend Funds For 2023.

From energy to consumer health and even telecommunication, the best dividend funds for 2023 are given below:

- Chevron

- Johnson and Johnson

- Verizon

- Coca-Cola

#1. Chevron

This energy giant saw their stock rise as a result of last year thanks to the Russia-Ukraine war. Only selling their petroleum to premium buyers, it is projected that Chevron stock would hit another high in 2023 according to Forbes’s list of best dividend funds for 2023.

#2. Johnson and Johnson

Passing the list of the best dividend funds for 2023, the consumer health product company recorded a 2.6% growth in dividend yield and an almost 63 percent growth in its earnings per share in 2022. The start of 2023 could mean another boost as they are set to launch another product when it comes to beauty and prosthetic products. A good bet for investors.

#3. Verizon

The US leading giant in telecommunication is set to make an impressive improvement this year in the value of their stock which could have investors eager to have a piece of the pie.

Despite the covid-19 slowdown and overall economic downturn, this telecommunication seems to escape unscathed as last year saw their dividend yield to investors rise to 6.3%. The forecast predicts that the year 2023 would be no different when it comes to the growth in their share. Another best dividend fund for 2023 to look out for.

#4. Coca-Cola

Talking about vintage and long-standing, this traditional household name is another stock to look at for 2023 largely due to the dividend yield percentage in 2022.

With a yield of 2.81%, this stable share is likely to outperform its current earnings, and no telling what awaits shareholders in terms of dividends this year.

What Funds Pay Monthly Dividends?

The following funds pay a monthly dividend and are likely to remain in the list of shares doing so for a long time:

- Procter and Gamble

- Lowe’s

- SL Green

- LTC Properties

- EPR real estate

Thanks to good market capitalization and high share sales, the above firms stick to paying dividends monthly.

How Do Dividends Get Taxed?

Dividends are classified as either qualified or ordinary dividends in terms of taxation. Ordinary dividends are taxed under standard income tax regulations, whereas qualified dividends are taxed under capital gains tax laws.

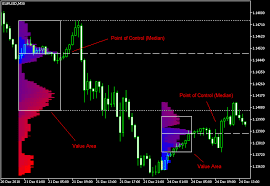

What is Dividend Yield?

A dividend yield is used by investors to determine the relative worth of a company’s dividend payments. Divide a stock’s annual dividend amount by its current share price to calculate dividend yield. The dividend yield is always expressed in percentage terms.

Dividend yield is a useful metric for comparing the value of dividends paid by different firms. A stock with higher quarterly dividends, for example, may appear appealing, but if the stock price is likewise high, it will reduce the overall dividend yield.

Are Dividend Index Funds Worth It?

Being the new kid off the block, questions about the dividend index fund spark a lot of controversies that if left unanswered could create a perception that isn’t factual. A quick look into what these funds are would help clear the doubts surrounding them.

Index funds are a kind of stock that Index specific shares within a sector and group them to rate their performance which is then valued and listed on the exchange floor.

The good thing about this type of instrument is that investors have the opportunity to buy an index that covers many stocks rather than having to buy just one stock. Unlike most popular shares and stocks where the cost of acquiring them could be over the roof, dividend index funds are the opposite.

This kind of fund also is known to record a high-performance propensity thanks to the list of many shares related to a specific index as against a particular stock that is likely to underperform due to market volatility.

If this benefit rings a bell then investing in them may be worth it.

What Does Ex-Dividend Date Mean?

The ex-dividend date is the deadline for owning a dividend stock in order to collect the payment. If you want to collect dividends from a stock as an investor, you should be aware of the ex-dividend date.

The ex-dividend date is normally one business day before the stockholder list is checked to see who is entitled to dividends. Purchasing stock on or after the ex-dividend date disqualifies you from receiving the dividend payout.

Conclusion

Nothing beats knowing that you could sit around and watch your investment portfolio grow as a result of a dividend fund you invested in. With the right knowledge, knowing how to select the best dividend fund would not only improve your equity but allow for the diversification of your portfolio should need to be. This article has covered everything to know about that.